MongoDB Q1 FY1/26

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Toast

I think that MDB might, in time, be toast. Sixteen years after the commercial launch of the database product, the company has just $2bn of TTM revenue and is maybe the 5th largest database provider by revenue (source - Wikipedia). It has very little in the way of deferred revenue, so if it stopped selling new stuff tomorrow, the revenue line’s time-to-live would be a lot shorter than it should be if they had an Oracle-like revenue model. And it still only makes 5% cashflow margins despite growing at just 19% pa. This is not what good looks like. 19% growth, how about 20%+ cashflow margins. 5% margins, how about 30-40% growth. 5 and 19, not good.

I think the company will be around a long time but I think it is going to be squeezed between a newly-resurgent Oracle (who finally relented on the cloud being a thing) and the next generation of database vendors that will come along to serve newer, more automated, less people-driven enterprise applications.

The stock has been in a downtrend since November 2021. Unlike the best of the tech sector, it didn’t make new highs in the 2023-4 bull market. There has been a bounce since the post-Liberation Day lows but I don’t see a redemption arc here, I see a bounce which at some point will run out of steam.

We move to Not Rated on the stock and this will be our last coverage note.

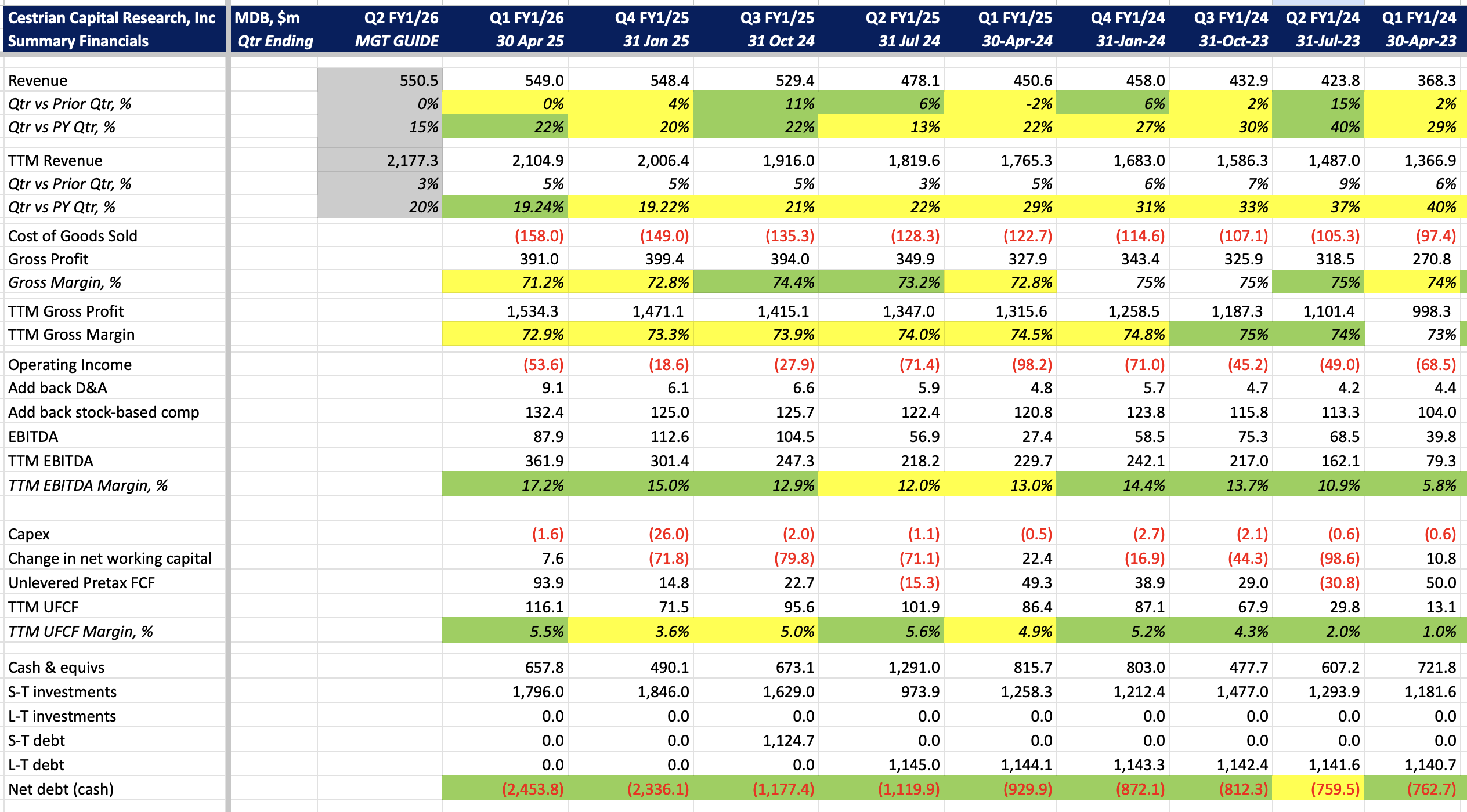

Numbers

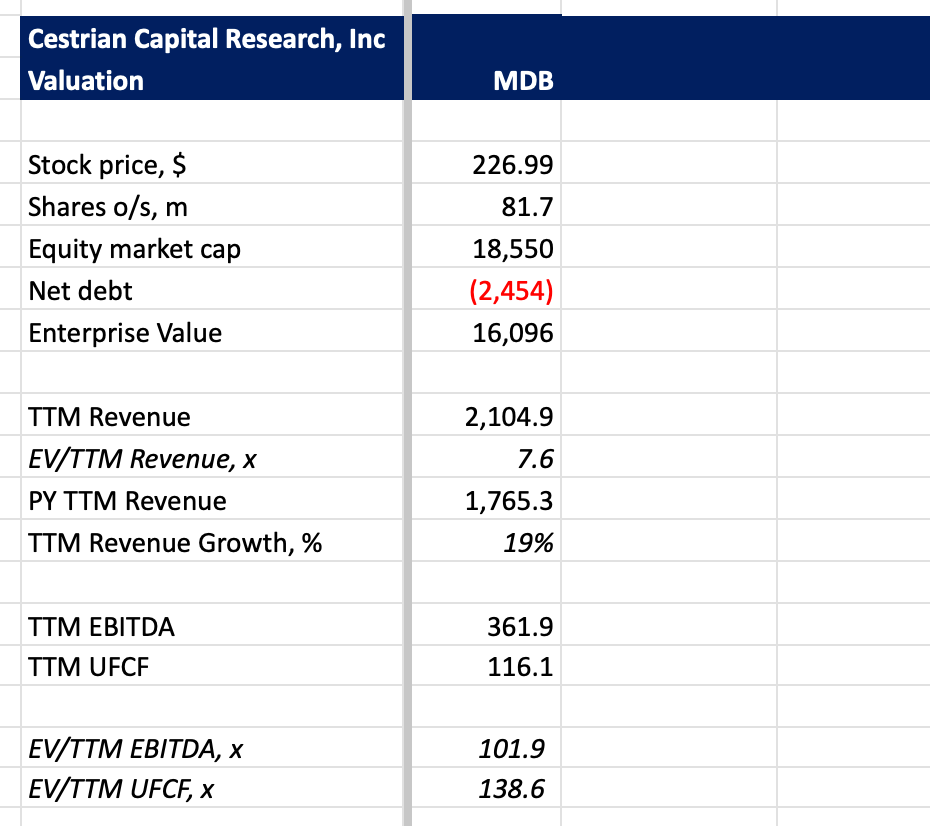

Valuation

Stock Chart

You can open a full page chart, here.

Cestrian Capital Research, Inc - 6 June 2025