NEW! Algorithmic Signals For Commodity ETFs

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Don’t Fear The Reaper

When the equity market turns from bull to bear, which of course it will at some point, your ability to keep making money anyway depends on your level of preparation. If all you know is “long Mag7” then you’re in for a painful run when the grizzly comes to town. If you know long/short S&P500 then you have a shot at success, albeit one requiring a great deal of effort each day to get your hedging ratios correct and to not panic when a big ole bear market countertrend rally threatens to rip the face off of your carefully-calculated short positions.

If you know another set of instruments entirely though, a set that beats to a different rhythm, and you’re already skilled at owning them, then the bear need hold no fear for you.

If, for instance, in 2022 you held the Nasdaq, you lost a third of your money. The S&P? A fifth of your money. The Dow? A tenth of your money. Better. But you were still down. If you held energy? You’d have been up more than 50% and, even better, you’d walk with confidence and cash into the renewed equity boom that began right at the end of 2022.

There is always a bull market somewhere, even when the equity indices are dumping. When this bull market in equities turns, and it will, it will turn hard; speculator-grade assets like quantum computing and the worst excesses of the AI narrative have been bid up so relentlessly that they cannot help but fall to earth when the time comes.

One area that is expected to prosper when equities turn is commodities. It has been a while since hard assets - outside of gold - have outshone equities; there’s a good chance that changes soon. Already, as you know, gold and silver have been bid up, uranium is starting to be on a tear and oil looks like it wants to move too.

There are two ways to invest in commodities.

One, become a subject matter expert and dive deep into your chosen field. This is great in principle but it often doesn’t work out consistently. One of the very best in the business is Pierre Andurand. Which didn’t stop this from happening:

Two, treat price and volume as price and volume, forget about second-guessing rig counts or whether the spot palladium market is likely be affected by elections across the districts where it is mined, etc, and let the machine take the strain.

Here at Cestrian we are enjoying tremendous success with our algorithmic signal services. And by success I mean (1) the algos are delivering very solid trading performances, outpacing their benchmarks, outpacing buy & hold, and (2) the algo services are selling very well as more and more people realize that NOT using algorithms to invest and trade because you prefer the old way - is like not using running water because you prefer to fetch it from down the street in a series of pails and bowsers.

Today we introduce our latest algo service, YX Insights Commodities Signals. This is a service offered by Yimin Xu, who is achieving great success here with his macro and single-stock research, together with his Mag7 and crypto algo services.

I am trading this service personally, religiously, with real money.

Why? Because I want exposure outside of equities, because I don’t want to spend 20 years becoming an expert in hard assets, and because above all else I have found Yimin’s algorithms to be high performers vs. buy and hold in equities and in cryptocurrencies - and I have no reason to suppose commodities will be different.

Launch pricing runs from today until 31 December - it’s deeply discounted. Prices will at least double on 1 January 2026 for anyone joining after 31 December. As with all our services, the price you join at is the price you keep, for as long as you remain a subscriber.

Launch Pricing

- Independent Investor: $249/mo or $1999/yr (33pc discount to monthly).

- Investment Professional: $499/mo or $3999/yr (33pc discount to monthly).

If you aren’t sure if you’re an Independent Investor or an Investment Professional, check 1.5 of our Terms & Conditions, here.

You can click here to sign up.

Service Description And Backtested Results.

Commodities Machine Learning Signals by YX Insights

YX Insights brings you institutional-grade machine learning signals for the global commodities market — now available to private investors through Cestrian Capital Research Slack channels.

Delivered daily before the New York market open, these signals provide a clear, actionable view of the risk regime across major commodity ETFs.

Each signal outputs a simple binary state:

1 → Risk On (constructive bias; buy / hold)

0 → Risk Off (defensive bias; sell / stay on sidelines)

Covered ETFs

- GLD — SPDR Gold Trust

- GDX — VanEck Gold Miners ETF

- SLV — iShares Silver Trust

- SIL — Global X Silver Miners ETF

- USO — United States Oil Fund

- PPLT — Aberdeen Standard Physical Platinum Shares ETF

- PALL — Aberdeen Standard Physical Palladium Shares ETF

- CPER — United States Copper Index Fund

Methodology

Each machine learning model applies a proprietary set of macro drivers and asset-specific technical features to determine the daily directional bias for each commodity ETF.

Signals are refreshed once per day and published to the Cestrian Slack channels before the U.S. session begins.

Backtests are conducted using buy/sell at market-open prices on the day the signal switches, reflecting a realistic execution environment.

Past performance and backtested results do not guarantee future returns. These signals are provided for research and educational purposes only.

Backtest Results

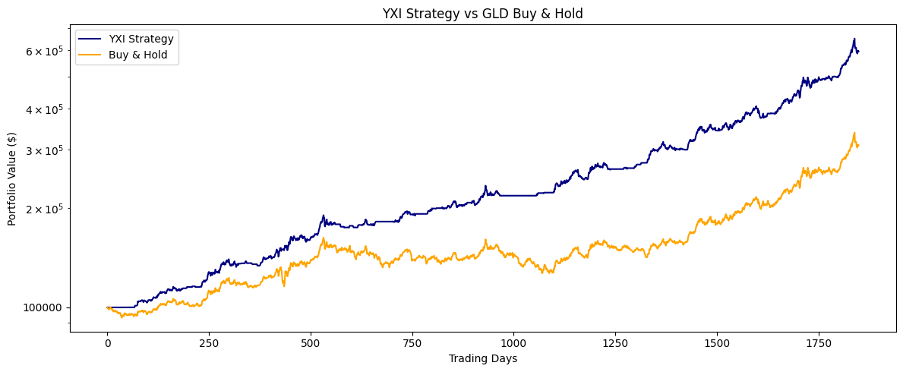

GLD

Trading days used in model backtest: 1892

Model Strategy Sharpe Ratio: 2.00

Model Strategy Maximum Drawdown: -9.96%

GLD Buy & Hold Sharpe Ratio: 1.08

GLD Buy & Hold Maximum Drawdown: -22.00%

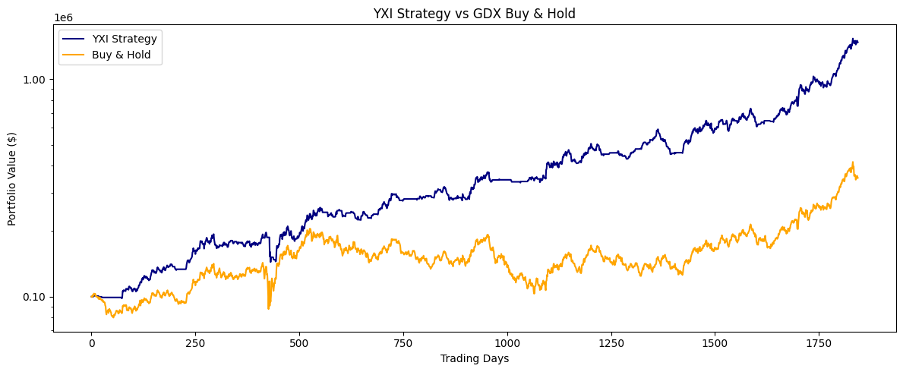

GDX

Trading days used in model backtest: 1887

Model Strategy Sharpe Ratio: 1.51

Model Strategy Maximum Drawdown: -26.94%

GDX Buy & Hold Sharpe Ratio: 0.65

GDX Buy & Hold Maximum Drawdown: -49.79%

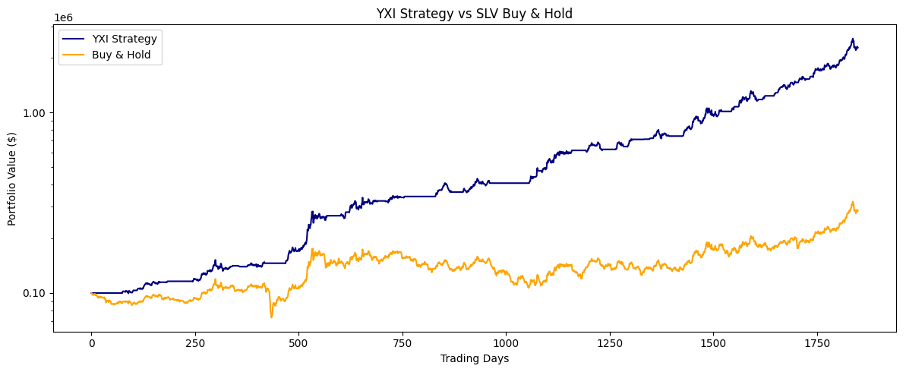

SLV

Trading days used in model backtest: 1892

Model Strategy Sharpe Ratio: 2.00

Model Strategy Maximum Drawdown: -13.77%

SLV Buy & Hold Sharpe Ratio: 0.64

SLV Buy & Hold Maximum Drawdown: -39.33%

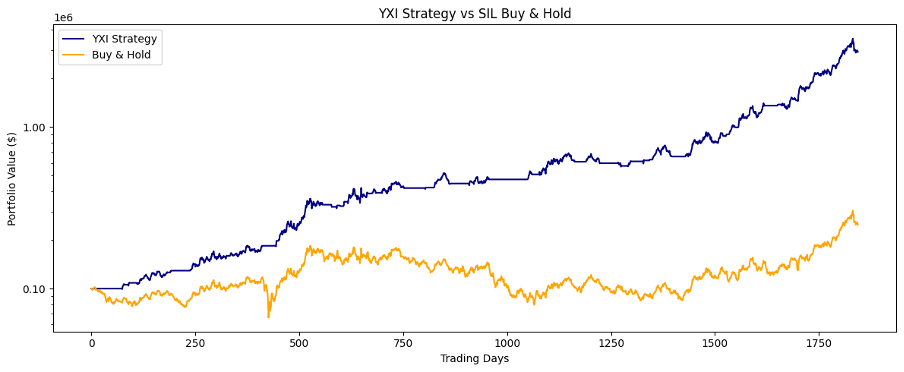

SIL

Trading days used in model backtest: 1887

Model Strategy Sharpe Ratio: 1.77

Model Strategy Maximum Drawdown: -18.47%

SIL Buy & Hold Sharpe Ratio: 0.51

SIL Buy & Hold Maximum Drawdown: -56.79%

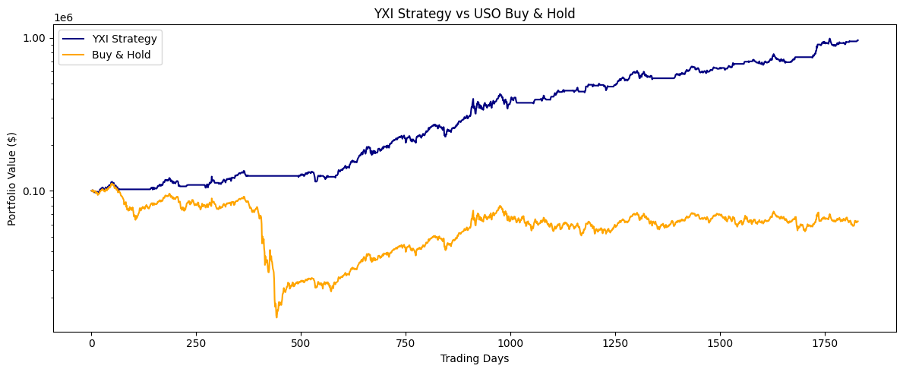

USO

Trading days used in model backtest: 1892

Model Strategy Sharpe Ratio: 1.43

Model Strategy Maximum Drawdown: -20.07%

USO Buy & Hold Sharpe Ratio: 0.05

USO Buy & Hold Maximum Drawdown: -86.75%

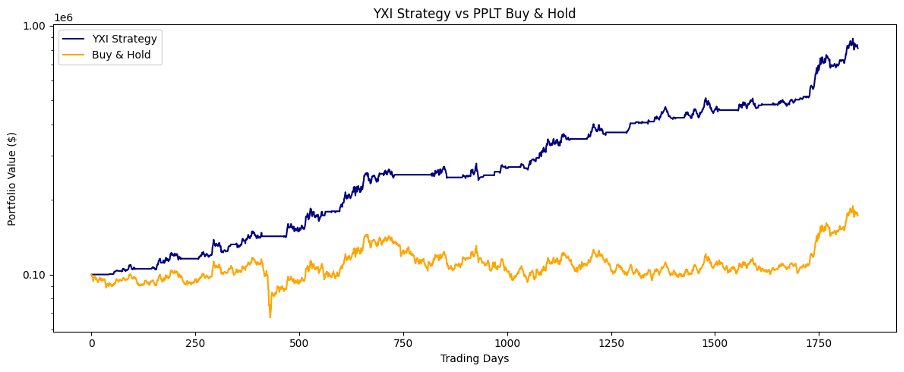

PPLT

Trading days used in model backtest: 1887

Model Strategy Sharpe Ratio: 1.47

Model Strategy Maximum Drawdown: -14.23%

PPLT Buy & Hold Sharpe Ratio: 0.41

PPLT Buy & Hold Maximum Drawdown: -42.51%

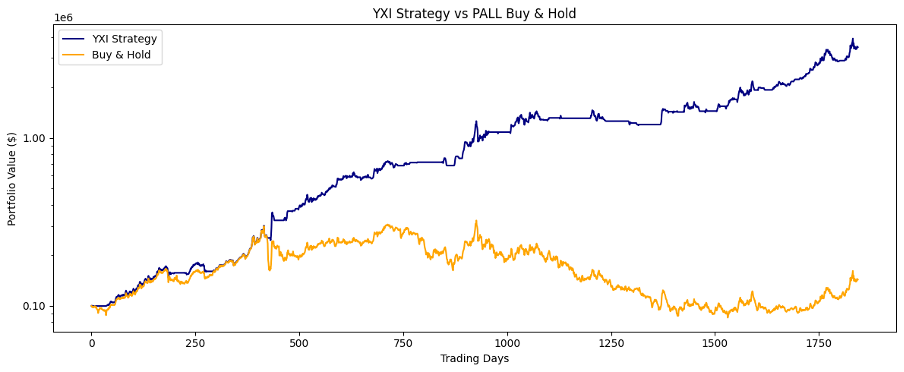

PALL

Trading days used in model backtest: 1887

Model Strategy Sharpe Ratio: 1.82

Model Strategy Maximum Drawdown: -24.60%

PALL Buy & Hold Sharpe Ratio: 0.32

PALL Buy & Hold Maximum Drawdown: -73.63%

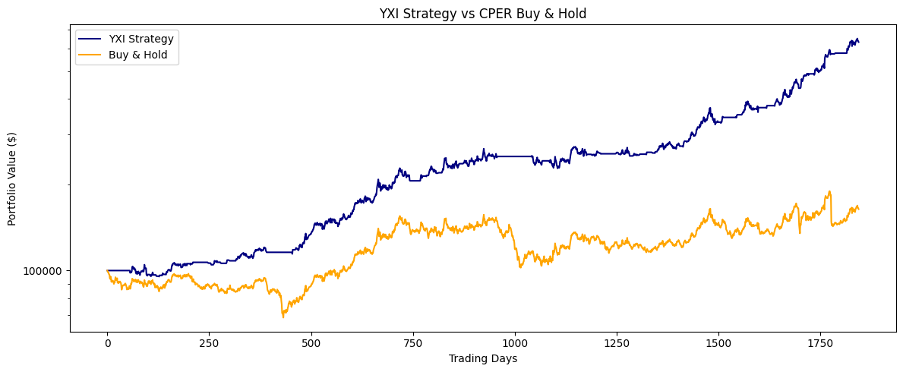

CPER

Trading days used in model backtest: 1887

Model Strategy Sharpe Ratio: 1.50

Model Strategy Maximum Drawdown: -14.68%

CPER Buy & Hold Sharpe Ratio: 0.40

CPER Buy & Hold Maximum Drawdown: -34.75%

Launch Pricing

- Independent Investor: $249/mo or $1999/yr (33pc discount to monthly).

- Investment Professional: $499/mo or $3999/yr (33pc discount to monthly).

If you aren’t sure if you’re an Independent Investor or an Investment Professional, check 1.5 of our Terms & Conditions, here.

You can click here to sign up.

Alex King & Yimin Xu, November 2025