No Paywall! Market On Open, Thursday 21 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Headfake Or Omen?

by Alex King, CEO, Cestrian Capital Research, Inc

Shots fired yesterday.

Time to be ready for a change in the weather.

We’ll take a look at equities, bonds, sectors and crypto as usual in a moment.

But first, this:

What People Say About Our Crypto Coverage

July 2025 - “The Tools, The Information, And The Confidence"

"Re. the Big Money Crypto service - I was a crypto hold out but now I am a crypto hodler. Alex & Yimin have given me the tools, the information, and the confidence to invest in crypto stocks and ETFs in a manner suitable for an adult who can't yolo it all away or try to follow the next meme stonk. Big Money is taking crypto seriously and where Big Money goes, I want to follow, and the Cestrian team knows the way".

If you’re not an Inner Circle member, and you want to use our work to help you win in the new world, can I suggest you either:

- Join Inner Circle to get our absolute best work all in one place, to join our wonderful community of investors and traders in our chat and alerts system, and to get access to our weekly live webinar - in short, to join the team, or:

- Join our Big Money Crypto service which is solely focused on the new world. You can sign up for the newsletter alone (get the paid version if you can), or the algos, or both.

This is where you go to learn about these services, and to sign up too:

If you’re already a subscriber to any of our other services, we’ll always provide a discounted price as a thankyou. Just drop us a line at minerva@cestriancapital.com and we can get you your best price.

Now let’s get to work. Here’s our daily subscriber-only take on the US equity indices, volatility, bonds, oil, crypto, and key sector moves.

This is a no-paywall version of this note - Inner Circle subscribers can read the full version, here:

US 10-Year Yield

Still trending down.

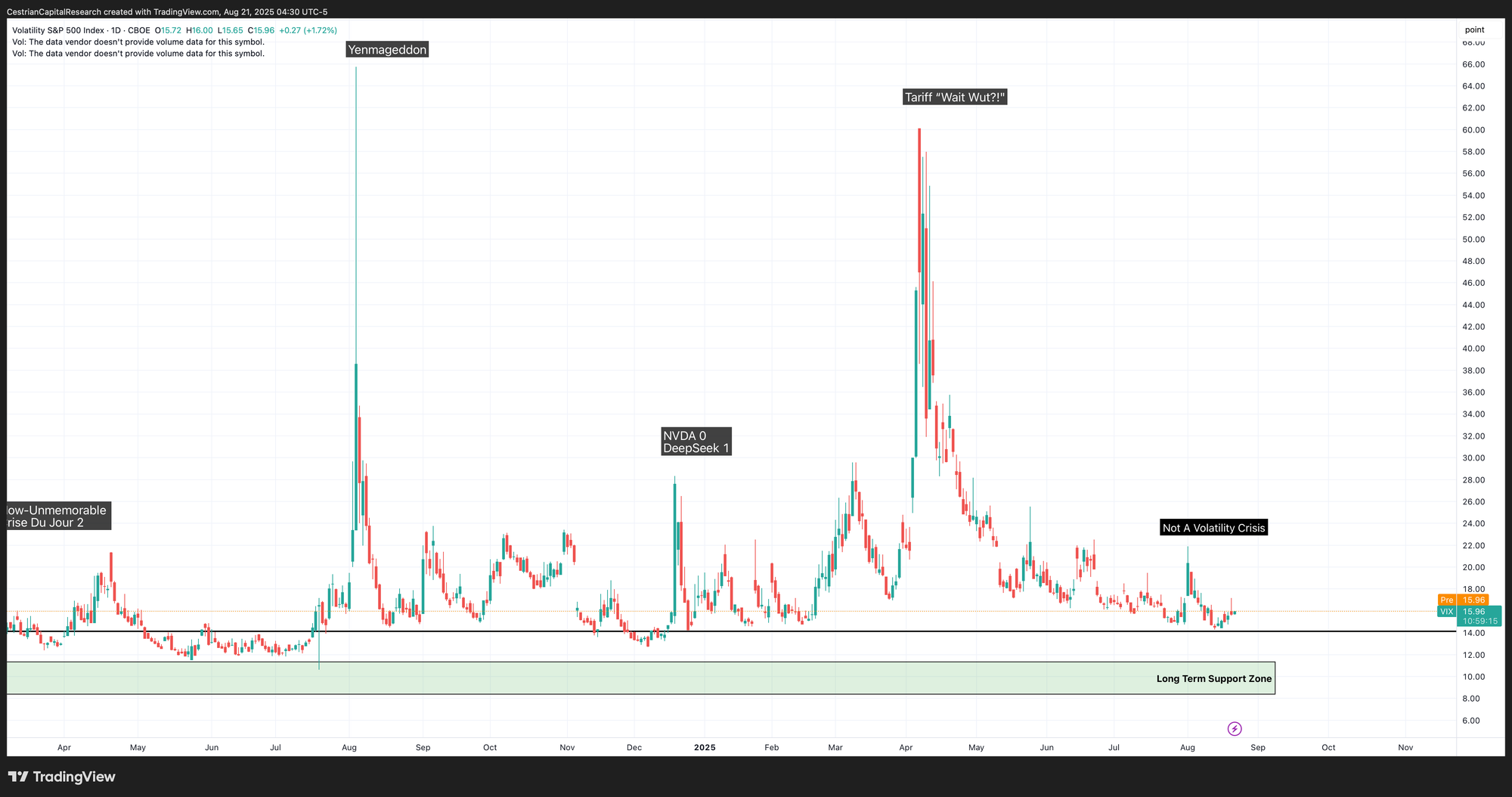

Equity Volatility

Volatility edging up a little - remains low, meaning puts remain cheap. If you are thinking about using puts for hedging purposes, consider using long-dated in-the-money or at-the-money strikes.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

As the penny had not really dropped amongst the majority of investors, Sec. Treasury has had to come out and say it.

I agree with him.

This is one of the reasons I am bullish on U.S. bonds.

No change.

The lower-order moving averages are clustering together; that won’t last - it means a price breakout coming. That alone just tells us it could be up or down; my view is up, driven by increased demand for bonds (per stablecoins, above), and by sustained policy choices guided by driving down yield.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Closed yesterday right underneath a converged set of three moving averages! I think at this point Jerome Powell turns into a glass slipper, or something.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

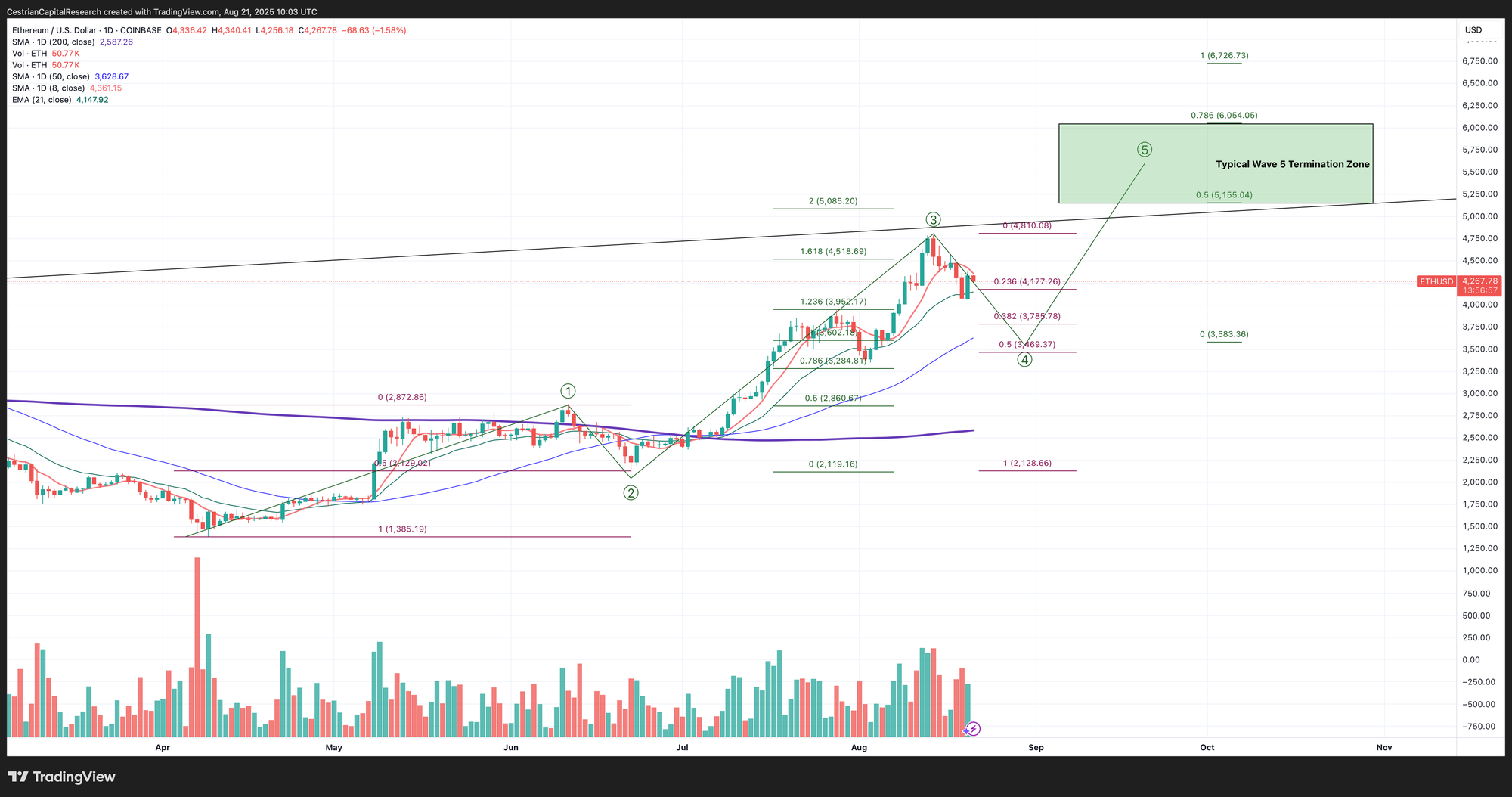

Ether

Well, Tom Lee said $4150 would be the Wave 4 low and since he is the biggest buyer of Ether in the market right now … perhaps he will be right. Potential further downside highlighted just in case. I remain bullish Ether.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

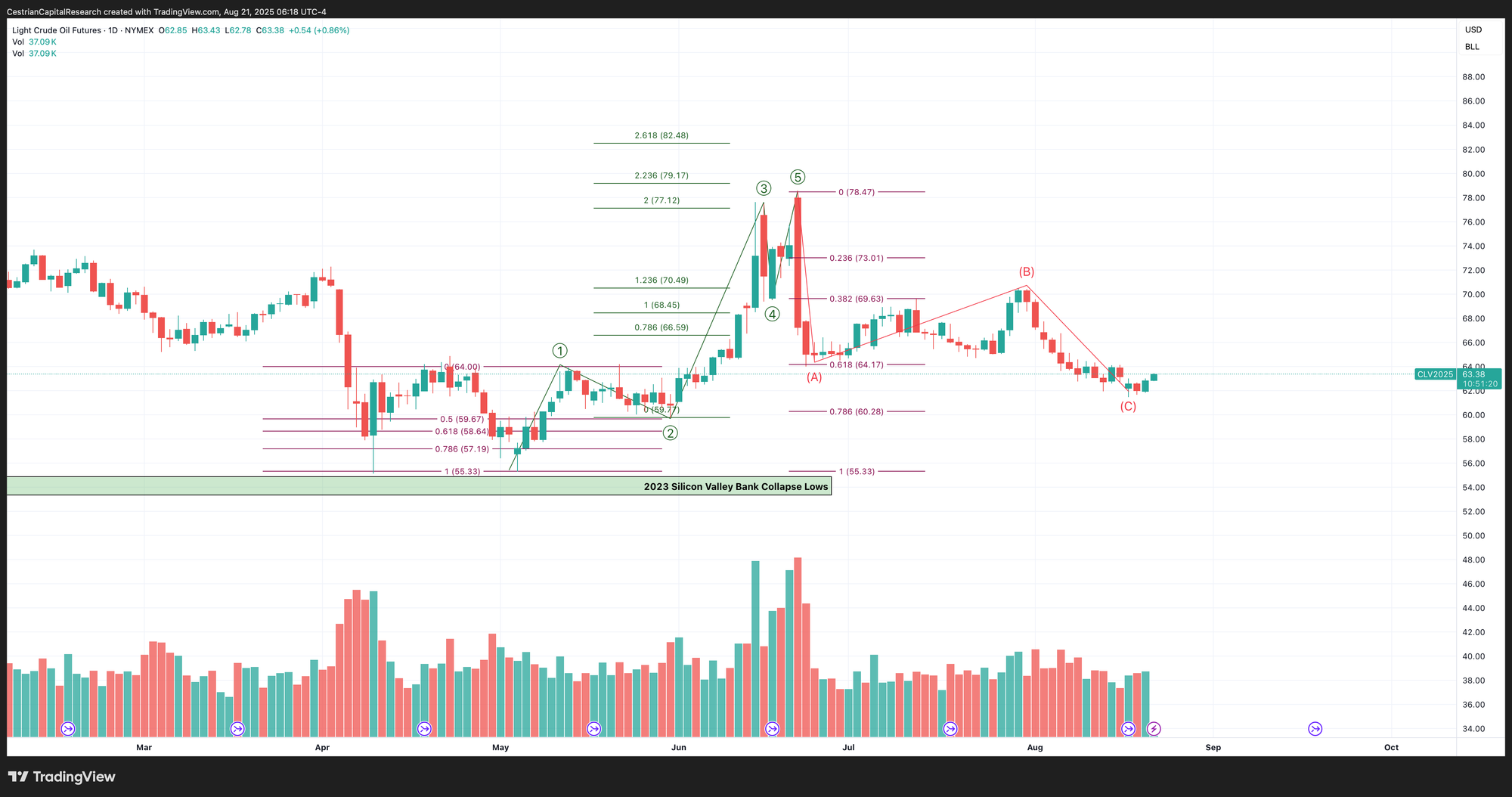

Oil (USO / WTI / UCO)

Consolidation continues.

If I had to guess, I would say oil is bottoming out here; an A=C correction would push oil all the way back down to the 2023 Silicon Valley Bank collapse lows, and I am not sure that would make any sense.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO also suggests oil may have bottomed - it is hugging that .618 retrace on the timeframe shown.

Disclosure: No position in oil.

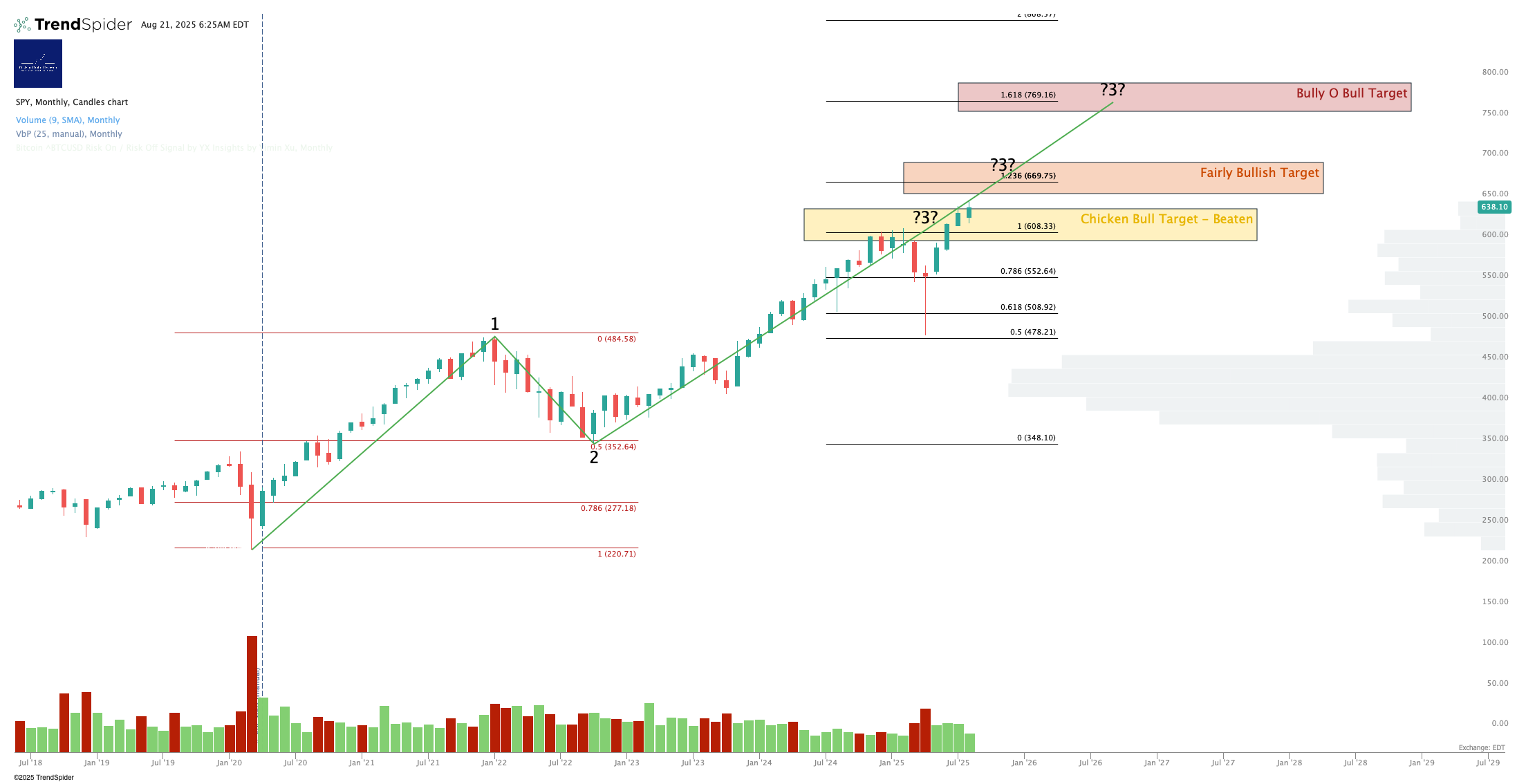

S&P500 / SPY / UPRO

Bears obtained some succour yesterday for at least 5 hours of the trading day. We’ll see if they can press any advantage during this on-average-seasonally-weak period.

I’ve placed the potential Wave 4 low just above the 200-day moving average as a kind of backstop. It’s important to note though that SPY held over the 21-day EMA yesterday despite a fairly sharp selloff in the morning. That’s bullish.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UPRO looks like SPY insofar as that 21-day EMA held at the close yesterday. SPXU (3x inverse daily S&P500) continues to show high volume accumulation down here at the lows. Thus far these hedging buys have little to show for it. We still have Q3 opex in September to think about on the downside.

Disclosure: I am long $IUSA, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / TQQQ

This thing really does have a shot at $650 I think! Remarkable.

Well, here’s something for bears (or those with underwater hedges … like a friend of mine … close friend!) to think about. Yesterday the QQQ did not hold the 21-day moving average, unlike the SPY. I have a hard time believing we are going to see a near-term rout in the Nasdaq but it’s possible there is downside to the 50-day moving average (around $550 right now) or further to the .236 retrace of the Wave 3 up on this timeframe (around $540 if I have that top of Wave 3 judged correctly).

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

TQQQ found support at its 50-day moving average yesterday. It could be that’s all the correction we get; accumulation in SQQQ suggests some folks think otherwise. So far this market just keeps surprising to the upside so it’s a tough one to call. Personally I have some SQQQ as a hedge for my long TQQQ position; the SQQQ position is somewhat underwater. I don’t feel much like bailing on it just yet.

Disclosure: I am hedged 1.1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for September expiry. Overall net long the Nasdaq.

For Dow Jones, Semiconductor And Tech Analysis - Join Our Inner Circle Service To Get This Full Note Every Trading Day.

Alex King, Cestrian Capital Research, Inc - 21 August 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, QQQ, IUSA, TLT, DTLA, ETHE, ETHA; long September TQQQ, QQQ and SPY puts.