NO PAYWALL VERSION: Market On Open, Friday 26 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

PCE Today

by Alex King, CEO, Cestrian Capital Research, Inc

Some selling yesterday, likely in advance of PCE inflation data which is due to be published today at 0830 Eastern. With GDP performance recently revised upwards, a non-scary PCE print would imply a Goldilocks economy of growth with inflation under control. This is something of a challenge for equity prices, strangely; to the extent that equity prices are driven by the actual economy (which at some level they are, of course) this would be a positive catalyst. However - since in the short term (meaning over say a 6-12 month period looking forward), stocks respond much more to the price and supply of money used to buy them - then growth up and inflation controlled could cause the Fed to back off of the planned rate cuts. Probably this resolves by the coming changing of the guard at the Fed - whomever is appointed as the next Chair, we can assume to be more dovish than Mr. Powell - so I think that whatever the near-term reaction, this is a good-news-is-good-news moment for the patient. A big PCE print is going to upset the apple cart in a big way however - this is the backdrop to some of yesterday’s selling, just folks de-risking ahead of the event risk.

If you’re trading short-term remember that the reaction to a big event like PCE comes in multiple moves. The initial move is theater designed to mess with investors’ heads; the next close (ie. today’s close) is important and the close the day after that (Monday, in this case) is probably the real story.

Now let’s get to work with our daily market analysis. This note is a cut-down version of that received daily by our Inner Circle members.

Please consider moving up to Inner Circle, our best work. You get direct access to our team of analysts, by way of real-time chat and live weekly webinars, plus trade disclosure alerts before Cestrian staff personal accounts place trades in any covered stocks, options or ETFs.

You can read about the Inner Circle service at the link below, but if you have any questions whatsoever, just message us using this contact form. We read every message and respond personally.

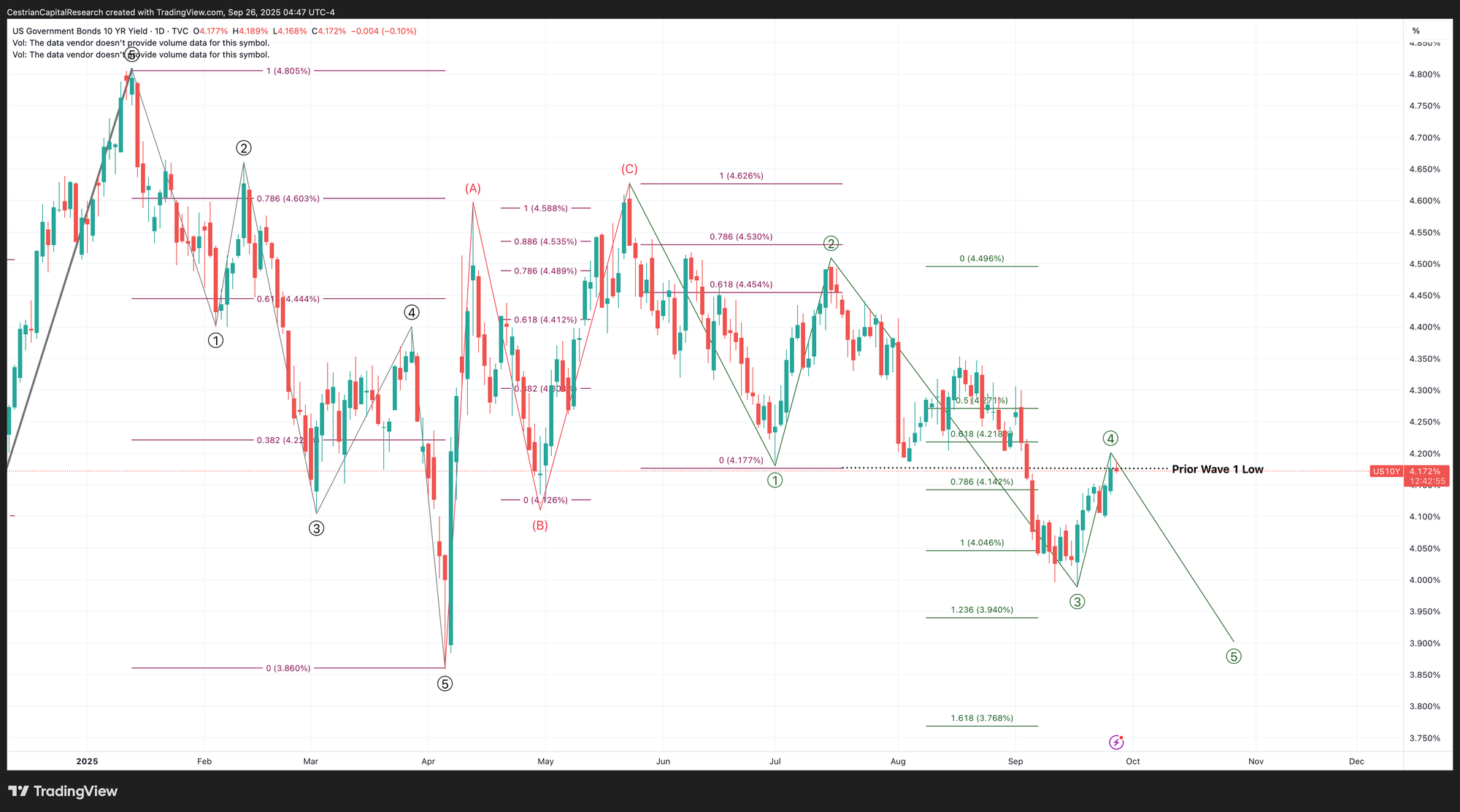

US 10-Year Yield

The inflation print will hit yields; low inflation, yields should fall, high inflation, yields up. That matters a lot more than this technical pattern right now.

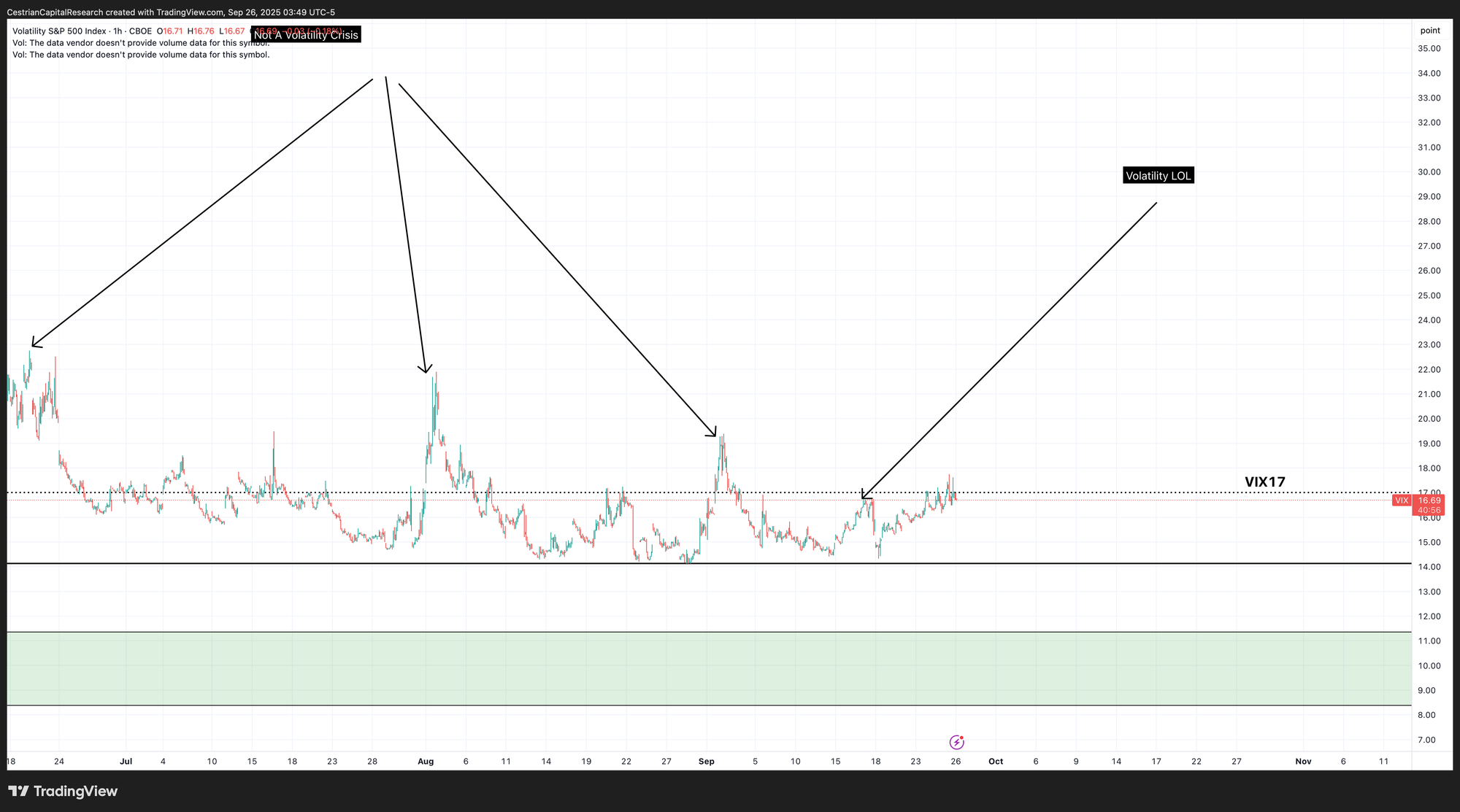

Equity Volatility

Zooming in - Vix is below 17, which seems an important level. Up and over 17 and turning 17 into support, we likely have some equity bearishness ahead.

Disclosure: No position in any Vix-based securities.

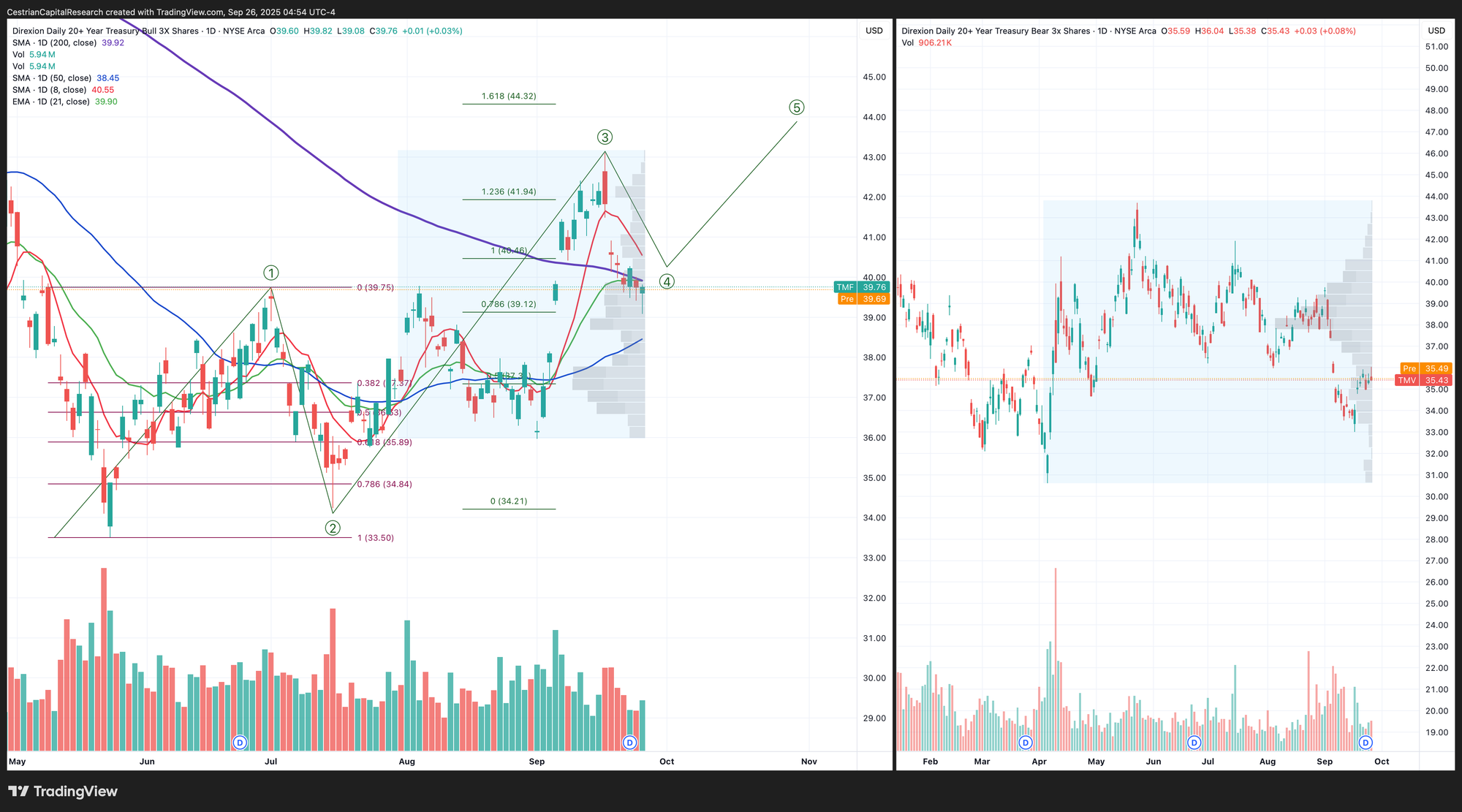

Longer-Term Treasury Bonds (TLT / TMF)

This is a bullish look. Up and over the 21-day EMA (green line) and holding there. PCE will determine the next move.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

TMF (levered long) and TMV (levered short) shown here.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Ether

Ether has a little work to do. Leveraged native Ether traders on the long side were blown out in recent days; to be bullish, Ether has to start to reclaim some of those short-term moving averages. Given the continuous bid from the treasury companies (Bitmine Immersion, SharpLink et al) I remain positive on Ether myself. Wave 5 target dragged down a little to reflect the lower Wave 4 so far.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

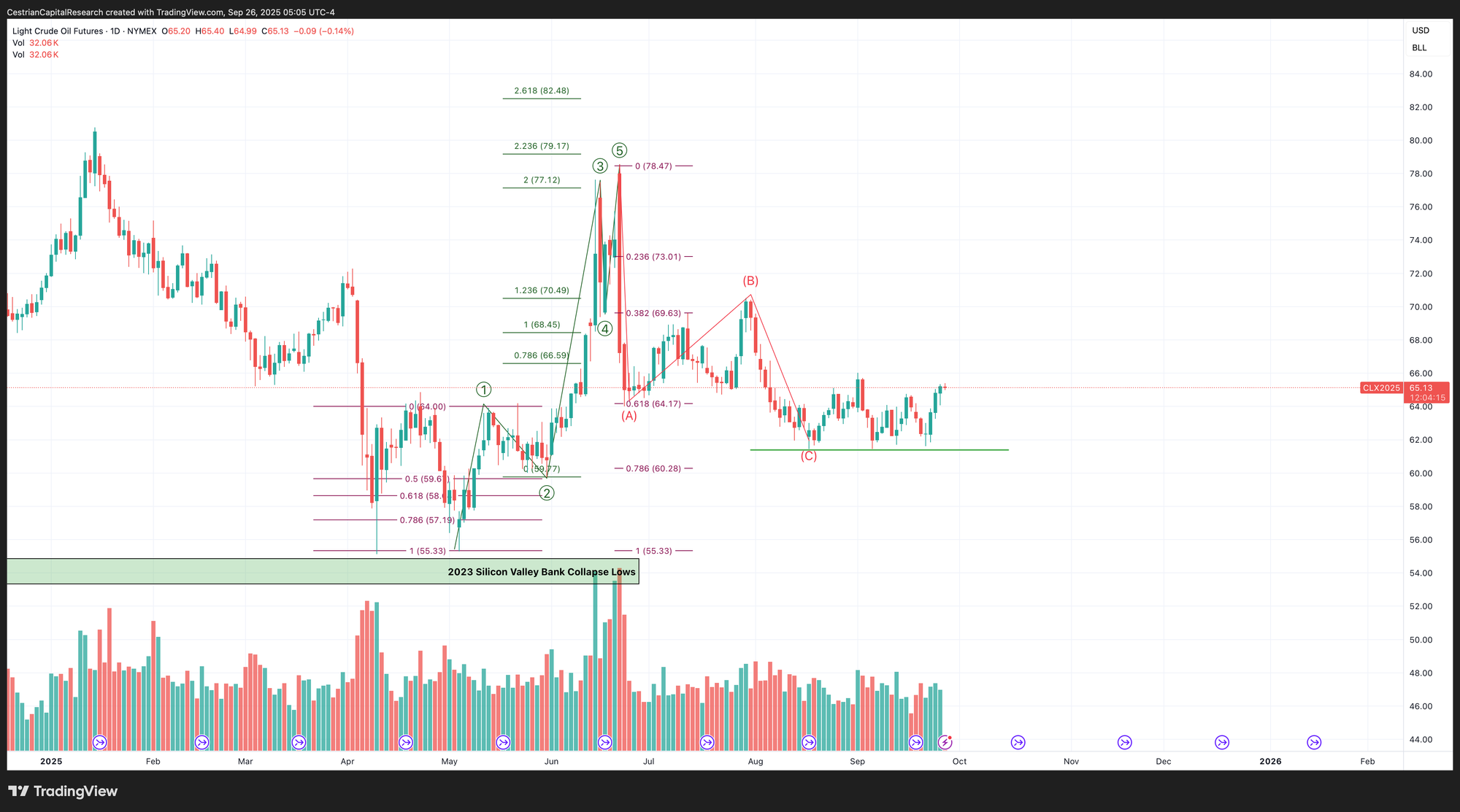

Oil (USO / WTI / UCO)

No change. Ongoing range compression within this wedge formation.

Up and over $66 and we can call it a breakout, until then, just rangebound sideways action.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO is approaching its 200-day, which is likely to act as resistance.

Disclosure: No position in oil.

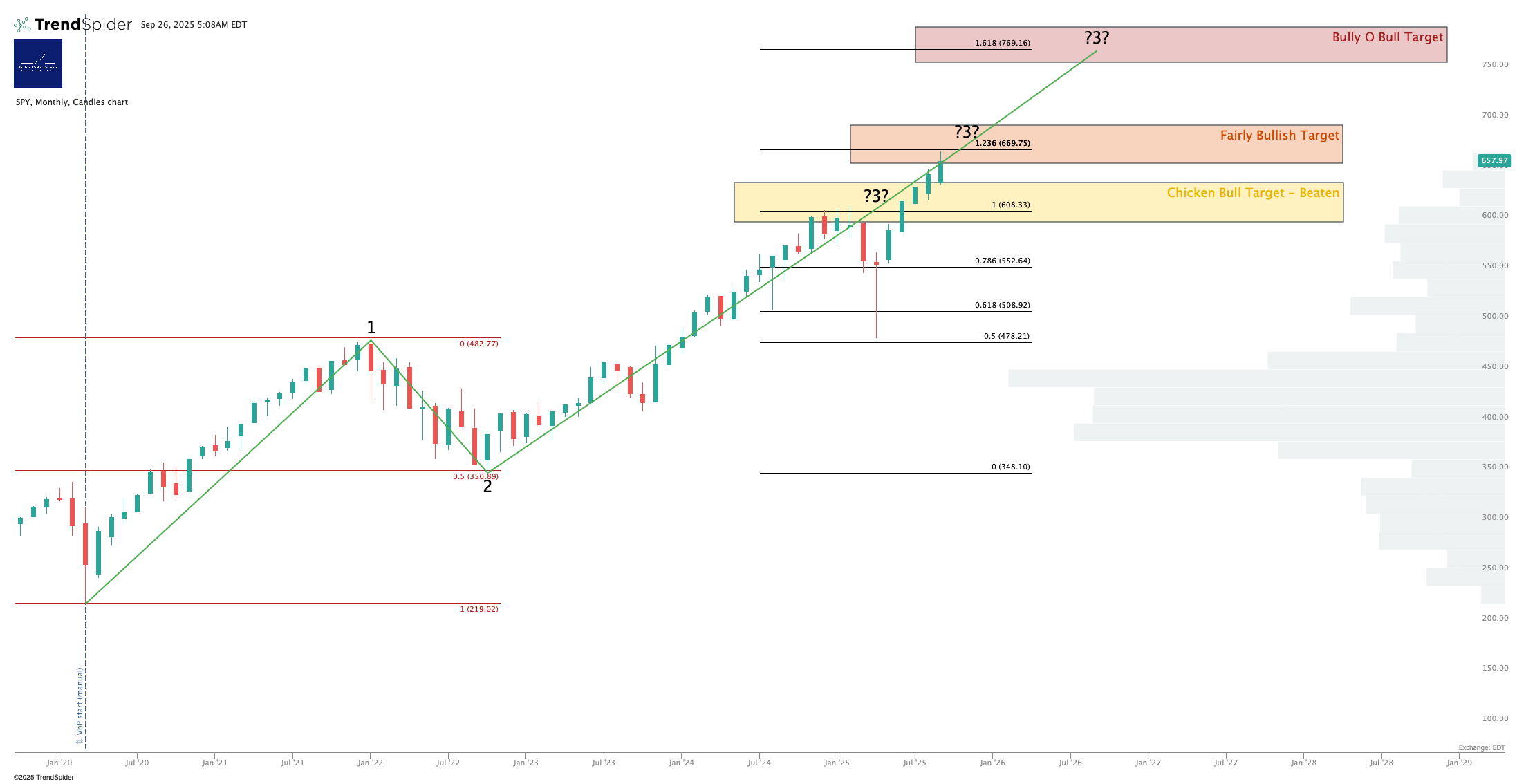

S&P500 / SPY / UPRO

Barring a dump on PCE, September has been remarkably peaceful.

Held over the 21-day EMA (green line) yesterday - that’s a bullish sign short term.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same story in UPRO as in SPY, bullish.

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / TQQQ

Remains a bullish look on this longer-term chart.

One daily close below the 8-day, but held up and over the 21-day. So a warning shot across the bows for now, nothing worse than that.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

TQQQ same look as QQQ.

Disclosure: I am hedged 1.3:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall net long the Nasdaq.

Alex King, Cestrian Capital Research, Inc - 26 September 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, TLT, DTLA, ETHE, ETHA; long December TQQQ, QQQ and SPY puts.