NO PAYWALL VERSION: Market On Open, Monday 25 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Hair Of The Dog, Anyone?

by Alex King, CEO, Cestrian Capital Research, Inc

I was working away quietly on Friday, a weather eye on the market, pretty much a nothingburger in the early session. Looked away to work on some stultifying administrative task or another, glanced back and what did I see?

Boomage!

Moonage!

A giant party in Jackson Hole!

And then a bunch of post-hoc justification about how the Fed had abandoned its inflation targets, there were going to be 25 rate cuts in September alone and by October the Federal Government would require you to pay it in Bitcoin whilst at the same time lending it your US Dollars. Or something.

Charts are what matter now, as always. If the S&P can stay up and over its 21-day EMA, if Ether can push on up and over $5000, if the Dow can keep making new highs - these are the signposts that tell us whether the market is in bull or bear mode, not endless pontification from experts.

In the pre-market session, participants are nursing a small hangover, a punishment from biology for chugging Grandpa’s 1982-vintage potato moonshine (in fairness the only thing left in the drinks cabinet by the end of Friday). That’s not signal. That’s just a fruit drink named Regret. Today’s close will be signal.

What People Say About Our Inner Circle Service

June 2024 - “Far Exceeded Expectations. Bravo!"

"At my 1 year mark of being with the Inner Circle service, it has far exceeded expectations. I am proud to recommend the service and will tell you why. But for a bit of context, a year ago I decided to actively prioritize investing in the market as a self manager. I set some well defined goals and am achieving them and revising them higher. Alex, who is behind Cestrian, is constantly improving the experience, as a result, I am learning more, faster, and enjoying it. It goes without saying that the scale of one's attention and focus is proportional to their results. What I've come to enjoy at Cestrian is that they have continued to grow with me and push me with their various services and community. Bravo."

Now let’s get to work. Here’s our take on the US equity indices, volatility, bonds, oil, crypto, and more. We publish these notes every day for our Inner Circle subscribers - and they include sector analysis in tech and semiconductor too.

This is today’s no-paywall version.

US 10-Year Yield

A big drop Friday; I would expect a retrace back up just as a correction to the overcorrection, if you see what I mean.

Equity Volatility

If you expected a spike on Friday - and honestly I did - we got a crush instead!

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

No change.

Closed Friday above all three shorter-term moving averages - just the 200-day overhead. Let’s see if TLT can hold such strength this week.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Very tight and coiled right now, nested amongst the shorter-run moving averages. Won’t stay that way for long; I suspect resolves to the upside.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Ether

Holding over the 8-day SMA at the time of writing. There is sustained demand for Ether from the new treasury companies (see our Big Money Crypto work for this) but that doesn’t mean we won’t see short term pullbacks. Any material pullback in Ether is a buying opportunity in my opinion.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

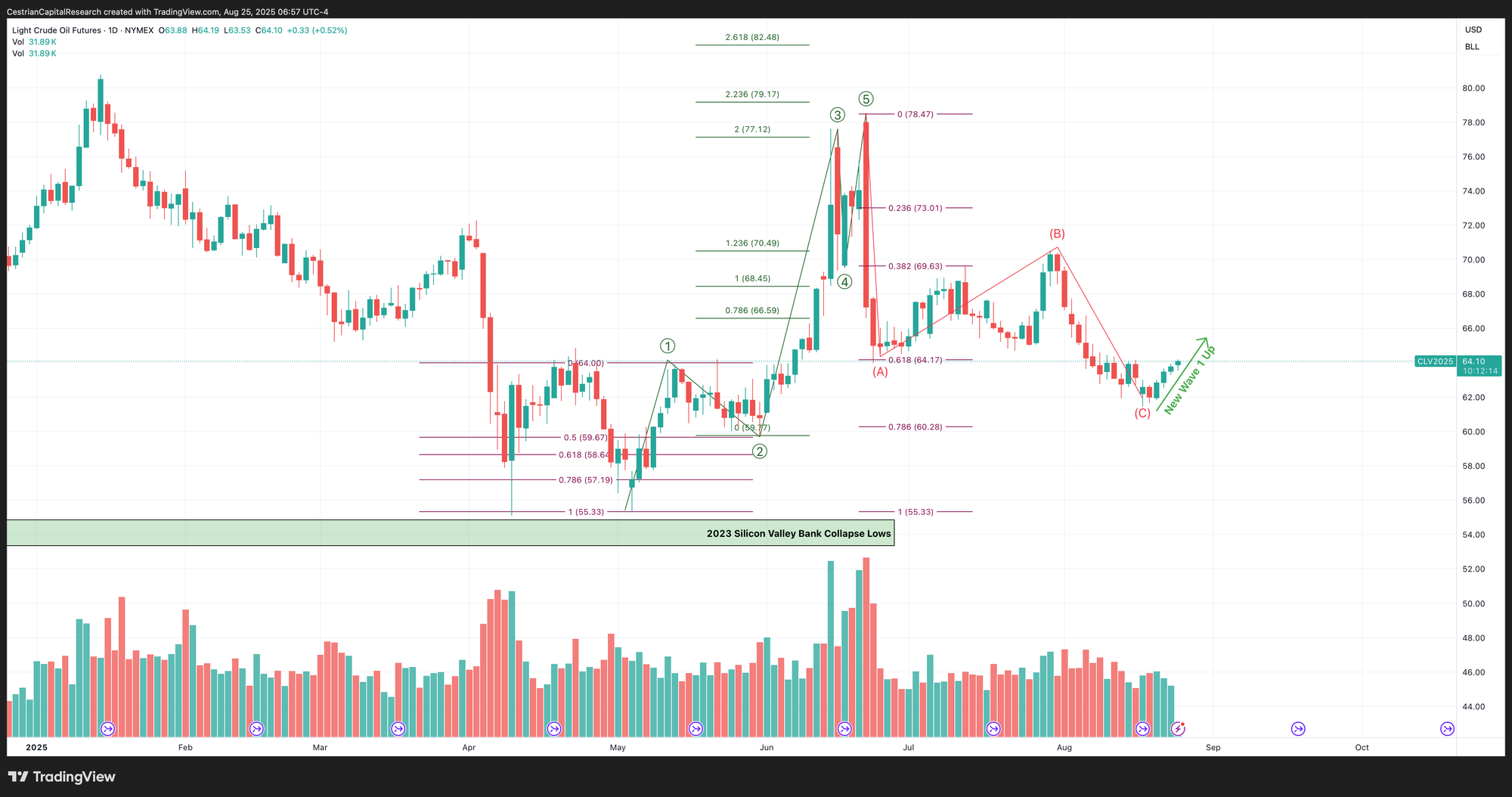

Oil (USO / WTI / UCO)

Consolidation continues.

Wave 1 up continues.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

A bullish trend in UCO continues.

Disclosure: No position in oil.

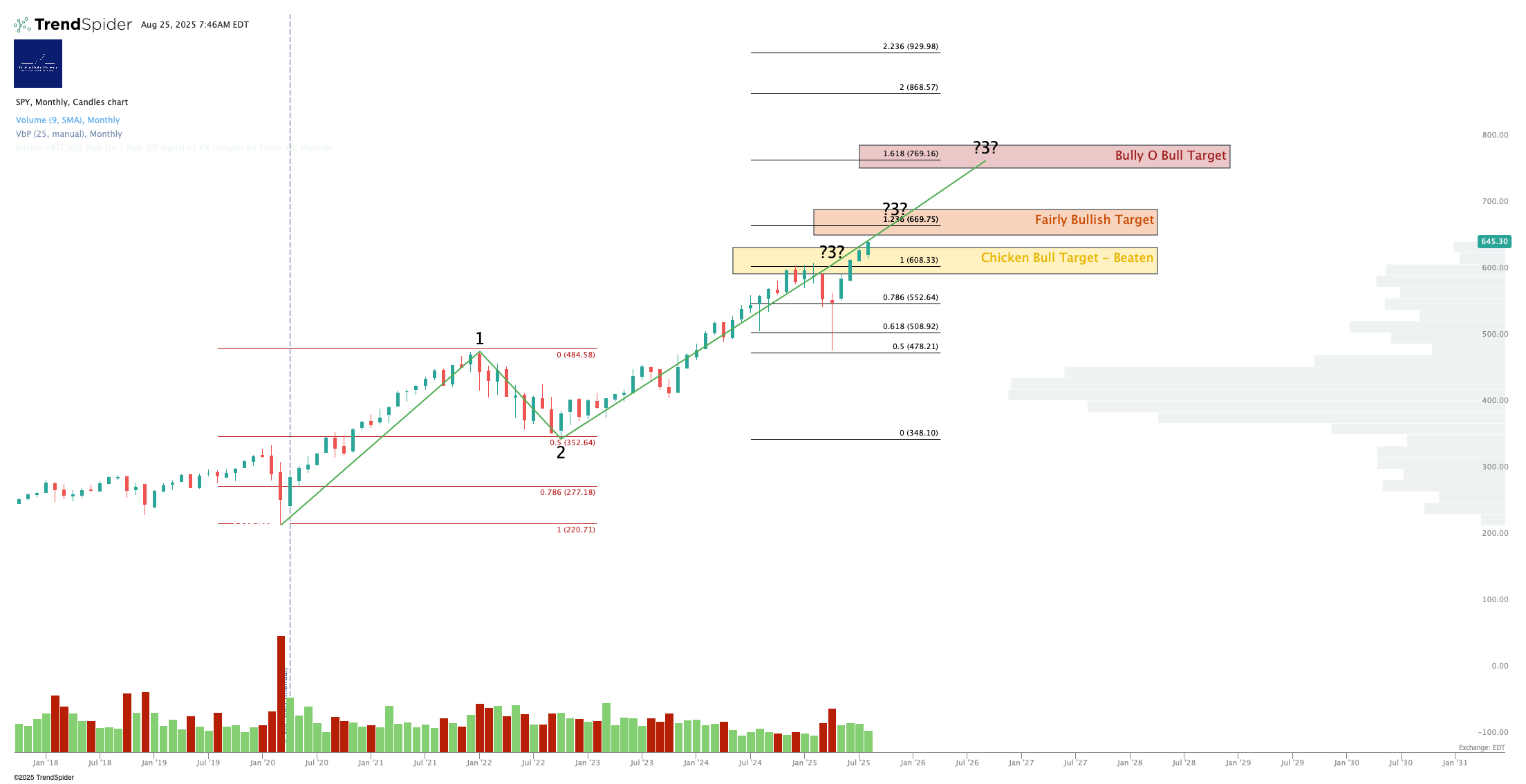

S&P500 / SPY / UPRO

Still moving up.

Friday saw the S&P put in a triple-top. Defeating it would be very bullish. For now, even with the pre-market dip, SPY remains over all short-term moving averages and the 200-day is quite some way away now.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same as for SPY - UPRO hitting its head on a resistance level. A break up and over, very bullish. A correction here, just a correction in my view, we’re not yet at the top.

Disclosure: I am long $IUSA, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / TQQQ

Still bullish on this timeframe.

This is a more interesting chart in my view. Friday everything mooned - right? Well, not according to this chart, it didn’t. The $QQQ couldn’t break up and over its 8-day moving average. That’s important as it may portend a short term correction here. Short term. Again - I do not think we are at the top.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same as for QQQ; Friday wasn’t as bullish as it felt. NVDA earnings this week likely resolves the near-term direction of the Nasdaq.

Disclosure: I am hedged 1.1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for September expiry. Overall net long the Nasdaq.

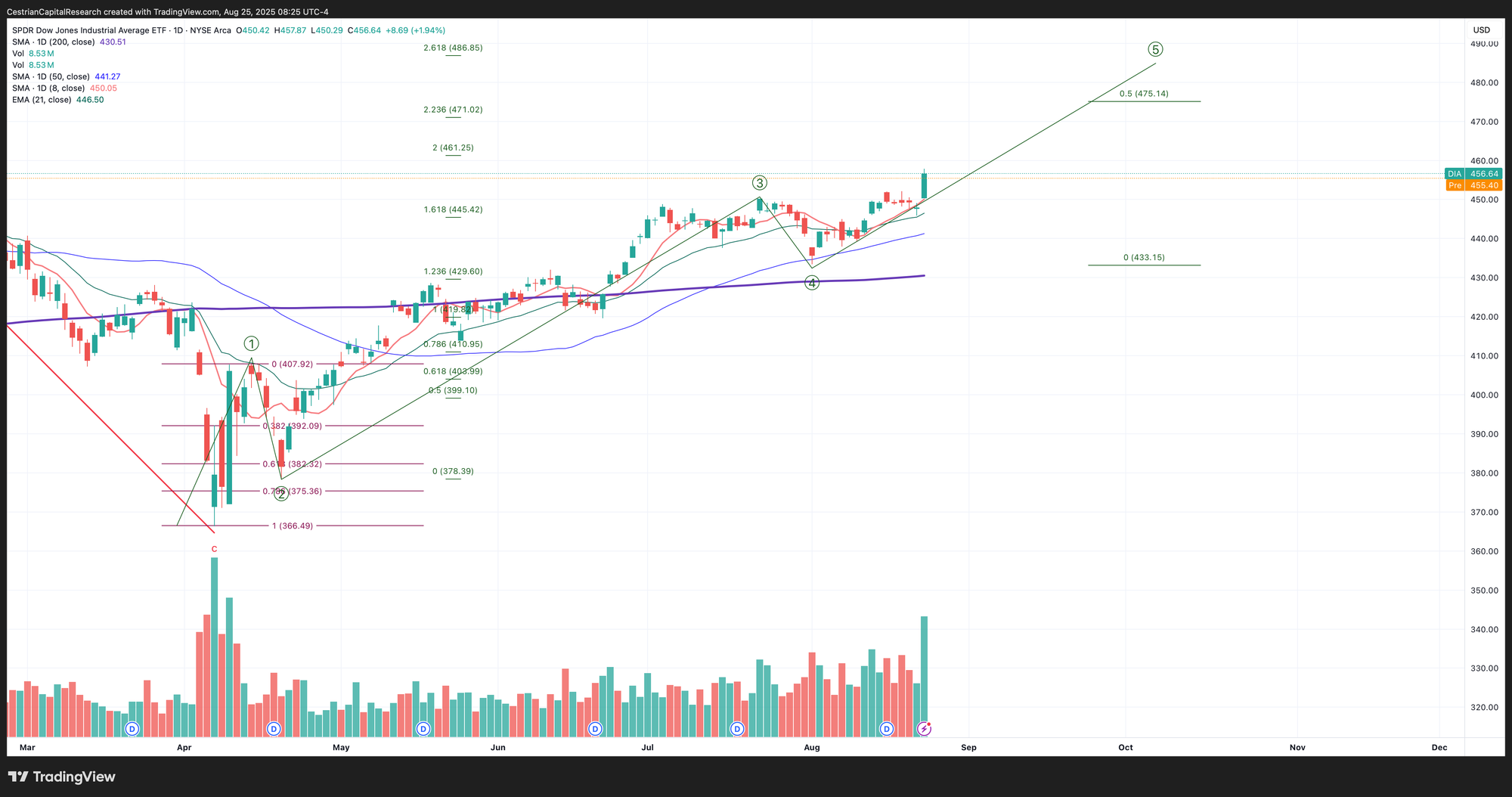

Dow Jones / DIA / UDOW

If the Dow holds its ATH, that’s bullish for the other indices in my view - even if we see a short term correction in the Nasdaq, a Dow shooting for the moon will, in time, drag the Nasdaq back upwards too.

Clear win from Jackson Hole at the Dow.

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Alex King, Cestrian Capital Research, Inc - 25 August 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHE, ETHA; long September TQQQ, QQQ and SPY puts.