NO PAYWALL VERSION: Market On Open, Sunday 7 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Another Week Begins

by Alex King, CEO, Cestrian Capital Research, Inc

Let’s take a look at where markets stand heading into this week.

This note is published each and every trading day.

We cover equities, bonds, oil, crypto, volatility and much more.

Want to get this direct to your inbox each day before the market opens?

Join the Cestrian Inner Circle service. You can read all about it here.

Here’s a recent comment by one of our subscribers:

"A Great Fan Of This Service".

I have become a great fan of Cestrian’s investment research service in a relatively short (less than a year) space of time. Alex King, who leads the team, comments by email everyday giving his views on the current state of US markets i.e. Dow Jones, S&P, Nasdaq and Russell 2000. The direction of the indices is forecast dependent, it seems, mainly on Cestrian’s interpretation of the respective charts using, amongst other tools, the Fibonacci wave theory. I have on occasion doubted their market direction conclusions but, I have to say, they have each time been proved correct. Cestrian also provides intensive fundamental research on companies in their US company universe and I have benefitted here from following a number of their selections. It is a personal service and Alex welcomes subscribers’ questions.

I have in the past subscribed to other US based investment services but not only were they much more expensive but also didn’t begin to compare in success terms.

I think what I like most about Cestrian is that, through their chart expertise, they will also call the big moves i.e. markets moving overall from a bullish to a bearish stance and vice versa. In other words a statement to consider becoming net short would, in the event of markets changing to a downward trend, be forthcoming.

I worked as a private client investment manager for over 40 years but have learned a considerable amount, predominantly using charts, since joining Alex a few months ago. Cestrian comes highly recommended.

Anyway, let’s get to work. This is a no-paywall version of our daily market note - it’s truncated vs. the pay version & doesn’t include the Dow, tech or semiconductor sector analyses. Join Inner Circle to get the full monty every day.

US 10-Year Yield

A very material drop in the 10yr yield Friday.

Equity Volatility

Since we are into September and so far there remains no sign of fear, I myself rolled my protective index puts out and up from the September quarterly expiry to December (as disclosed in real time in our Inner Circle service last week).

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Big move up on Friday but still within the overall accumulation range - no breakout yet on this timeframe.

Over the 200-day moving average; this test has failed since November 2024; let’s see if this time is different.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Still below its 200-day; that said, if trading TMF I personally find it easier to use the TLT chart as the basis for doing so.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

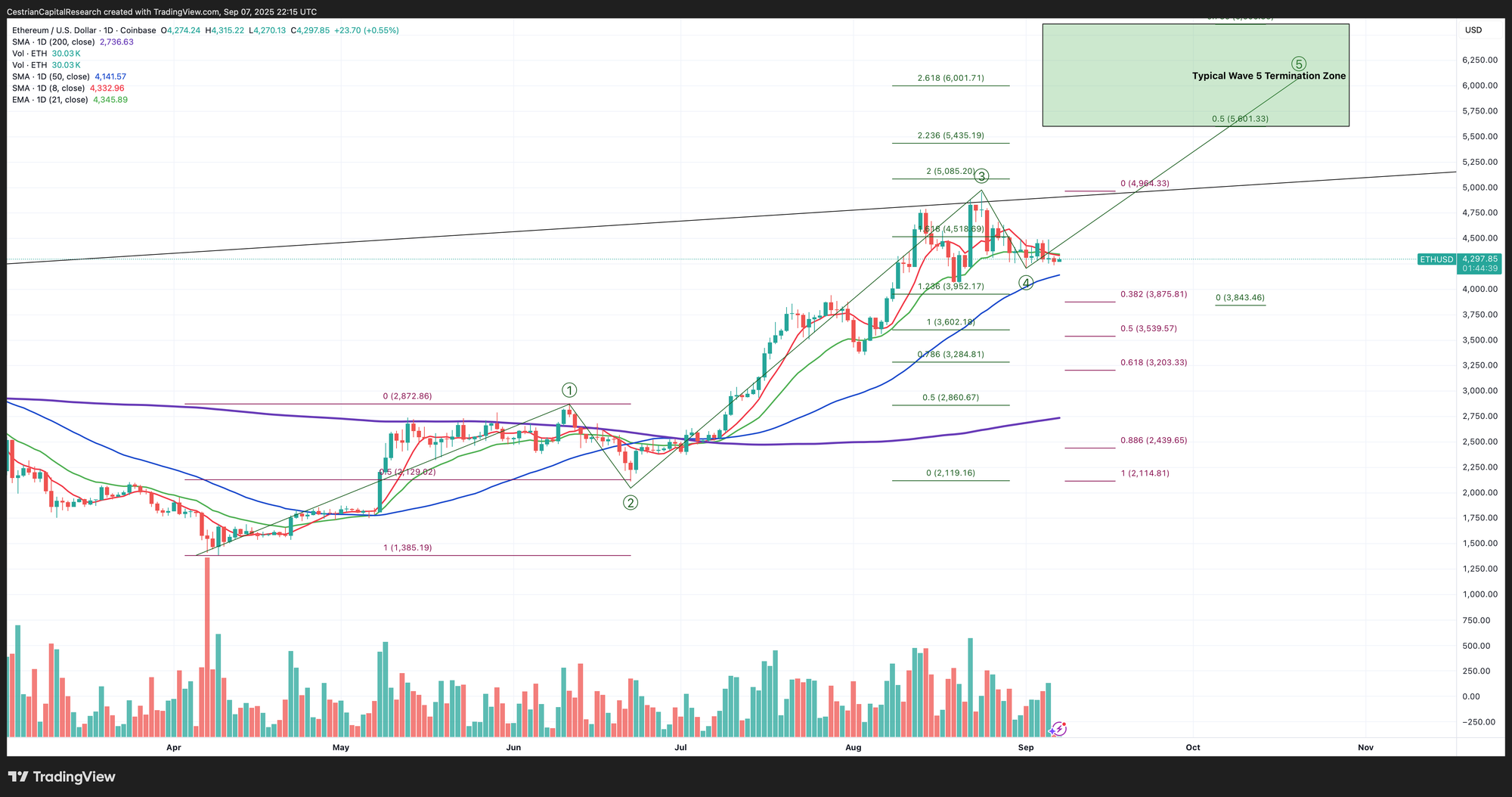

Ether

Bullish if over the 50-day at around $4135.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

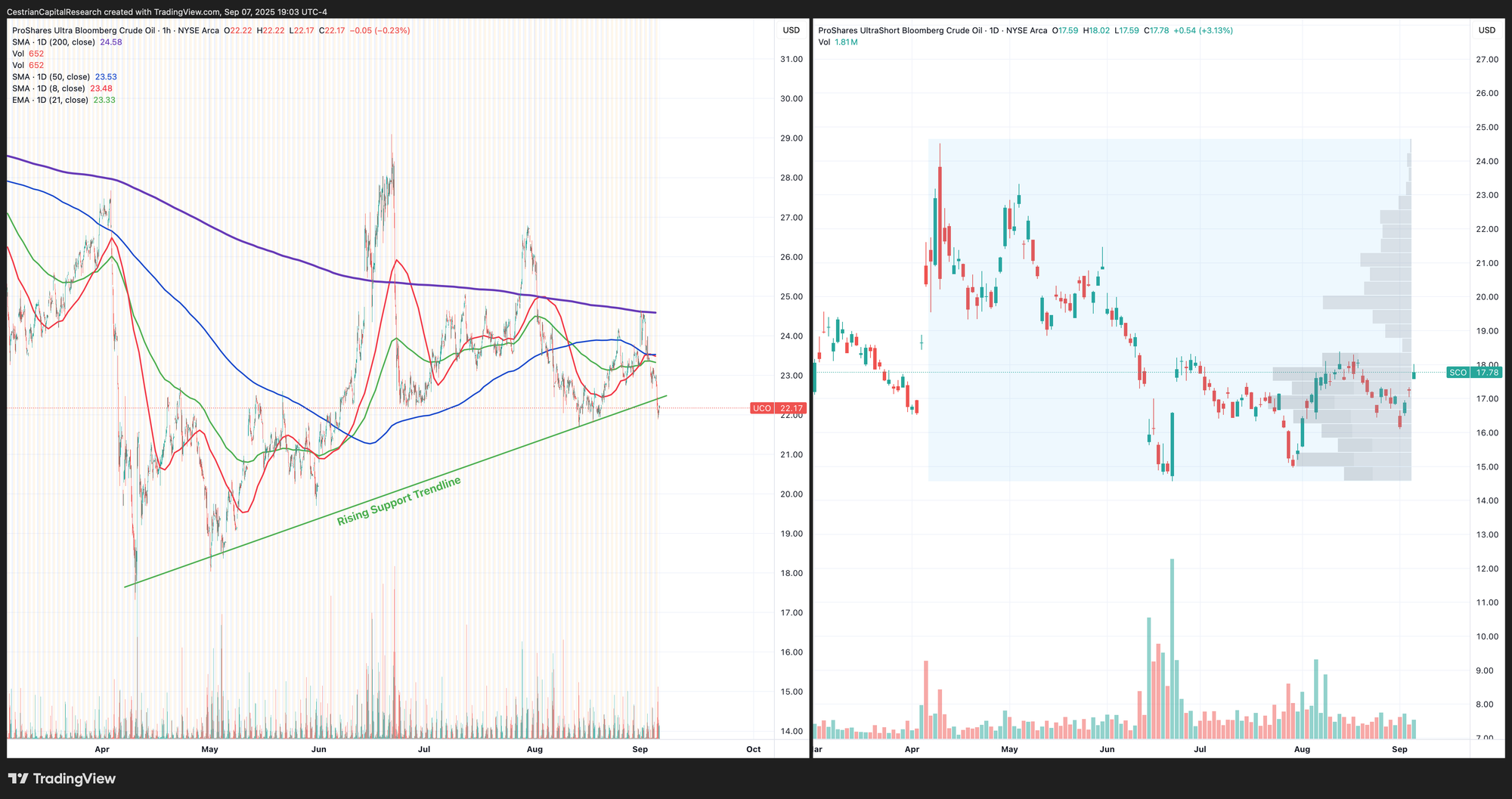

Oil (USO / WTI / UCO)

To repeat: remember that rangebound markets are designed to bore you to death before they break violently out of the range.

Breakout failed on this timeframe.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO broke the upward sloping support trendline Friday.

Disclosure: No position in oil.

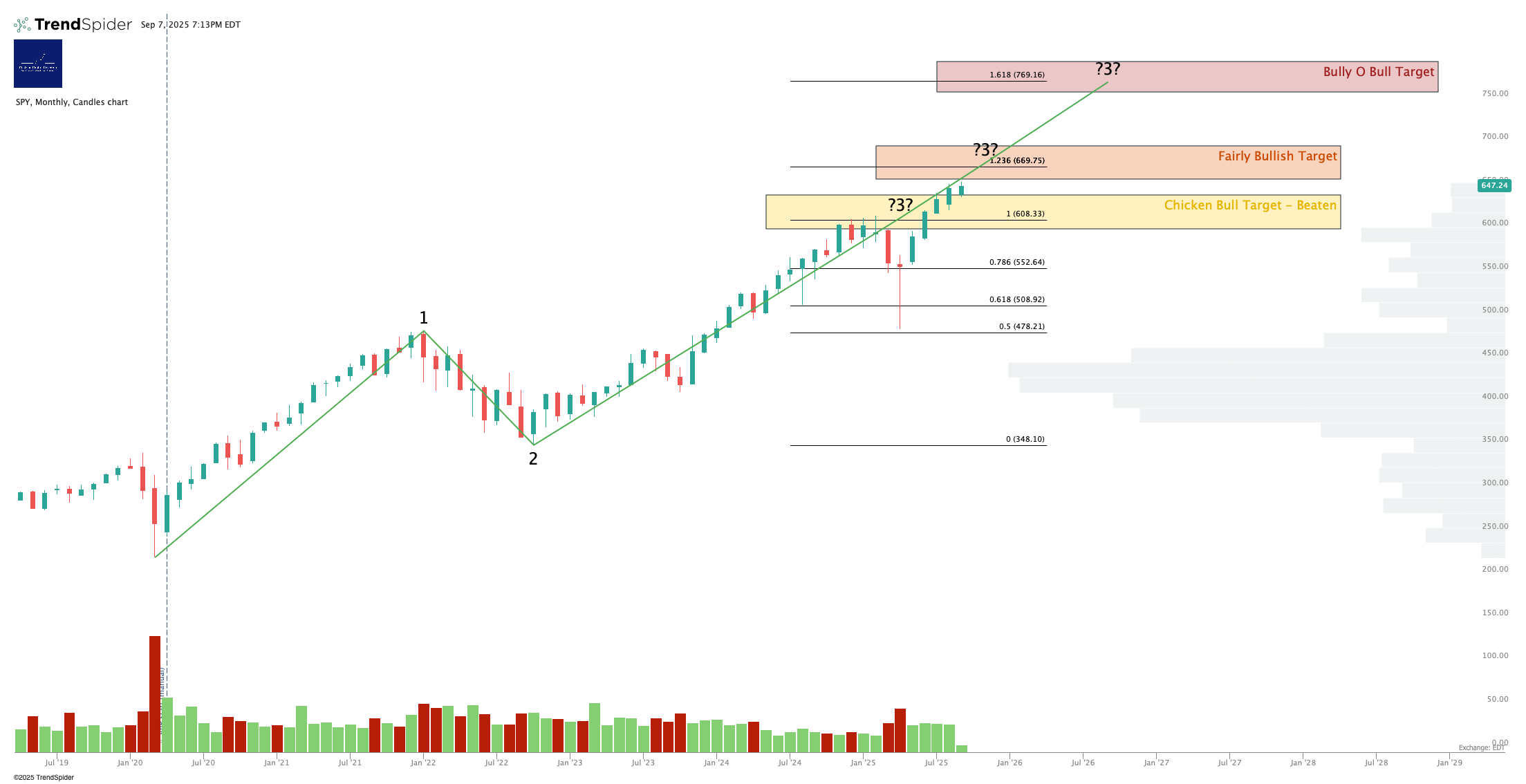

S&P500 / SPY / UPRO

Still in ‘nothing stops this train’ mode.

Potential corrective path and final Wave 5 high on this timeframe shown. Note that S&P500 futures are up slightly in overnight trading.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Left hand side, long-only degenerates. Right hand side, right-thinking risk-controlling hedgers. You can see who is winning the battle so far!

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / TQQQ

Nothing on this timeframe looks bearish right now.

Potential corrective path shown; for now, up. (Nasdaq futures are also up a little overnight).

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same story as the S&P500; the only mistake since April has been to not be long enough.

Disclosure: I am hedged 1.05:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall net long the Nasdaq.

Alex King, Cestrian Capital Research, Inc - 7 September 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, TLT, DTLA, ETHE, ETHA; long December TQQQ, QQQ and SPY puts.