NO PAYWALL VERSION: Market On Open, Tuesday 7 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Future’s So Bright

by Alex King, CEO, Cestrian Capital Research, Inc

Yesterday was one of those days which was so glorious that you just have to laugh. And also take profits. Three things in particular had me rolling in the aisles.

- OpenAI invests in AMD after having raised capital from Nvidia ↻, AMD +20-30% through the day. Good one! (I banked some gains in SOXL as a result, thankyou Mr. Altman).

- Opendoor Technologies ($OPEN) moons in the afternoon on heavy call flow. It was doing nothing unusual, up a little, I go do a Teams call, come back to party time with the stock +10-15% purely as a result of being dragged around by the options market. There is a lot of this at the moment - we talked about it during our Inner Circle webinar last night - if you understand options dealer hedging flows you can use options market activity to make solid gains in the underlying stocks. I remain long $OPEN personally (have already banked gains and my principal on this one, now just running with the house’s money - as always all disclosed ahead of time in trade alerts for our Inner Circle members).

- Biotech minnow $SPRB put in a modest +1300-1500% on the day as a result of (i) some positive FDA news and/or (ii) a tweet from the self-styled Pharma Bro, Martin Shkreli. I failed to capitalize on this one as I saw the tweet but was distracted by something for thirteen point four seconds, by which time the afterburner was lit up and the thing was headed to the center of the sun already. Dagnammit!

There were many more such cases. A perfect example day of, make sure you are positioned correctly to help yourself when the free money comes along. Just be sure to actually bank the free money because free money tends to be a short-term phenomenon that disappears just when everyone starts to believe it’s a permanent fixture!

We posted a hopefully-useful note on Seeking Alpha yesterday on the topic of How To Spot When The Market Tops. You can read it here.

On the subject of which:

Get Ready For The Turn

If you don’t know how to manage risk, don't worry, neither do the vast majority of investors. That’s why most people get destroyed by markets like this. The turn comes when people least expect it, when they’re in the riskiest assets, and then it all turns to dust. This is what happened as 2021 moved into 2022. It’s what happened when 2019 moved into 2020. And it’s what happened when 2007 moved into 2008. Oh, also when 1999 moved into 2000. So you can see that general destruction isn’t the exception, it’s the rule. The market needs destruction of unsuspecting investors’ accounts so that the grownups can then pick up stocks at exceptionally low prices. Because when folks’ accounts get trashed, not only have they lost money, they have lost all confidence and dare not step back into the market at the lows even if they do have cash on hand. This is when all the big money is made by Big Money.

We can teach you how to manage risk. We can show you how to enter a position at the lows and protect yourself against a further drop; we can show you how to know when a top is approaching and how to time your exit accordingly. We can teach you how to hedge using ETFs or put options. We can, in short, teach you to be a truly market-neutral investor, able to make money in bull, bear, and sideways markets. We do this in written notes, in live chat in our enterprise-grade Slack environment (no amateur-hour Discordia for us), in live, open-mic webinars.

If you’d like to become a truly market-neutral successful investor, join our Inner Circle service. Here’s a note from a member of the service which pretty much sums it up.

"Saved My Portfolio Bacon"

Cestrian Capital Research's Inner Circle services are exactly what I’ve been looking for and not been able to find until now. I’ve subscribed to several well known stock picking & research services over the years, but none of them match the combination of analysis, selection, process, monitoring and timely trading alerts which I need. The ability for me to accumulate, hold, & distribute selected stocks with confidence based on trading price points developed by Cestrian using a combination of Elliot Wave Theory/Fibonacci Retracements/Wyckoff cycle timing all informed by institutional trading volumes is what I really value, along with really good quarterly earnings reports, which further reinforce stock updates. Alex saved my portfolio bacon with his “Buckle Up” post in November 2021, which prompted me to sell 50% of my holdings across the board that day - how I wish I had sold 100%, but I was new to the service! Cestrian communications come with the added bonus of humour & self deprecation, they are fun to read. Chad no more!

You can learn more about Cestrian Inner Circle here.

OK, let’s get to work. Our daily market note for Inner Circle members covers yields, bonds, equities, volatility, oil, crypto, and key sectors. Here in this no-paywall version today we share our views on the 10-yr yield, the Vix, Ether, the S&P500 and the Nasdaq-100.

US 10-Year Yield

Still trending down.

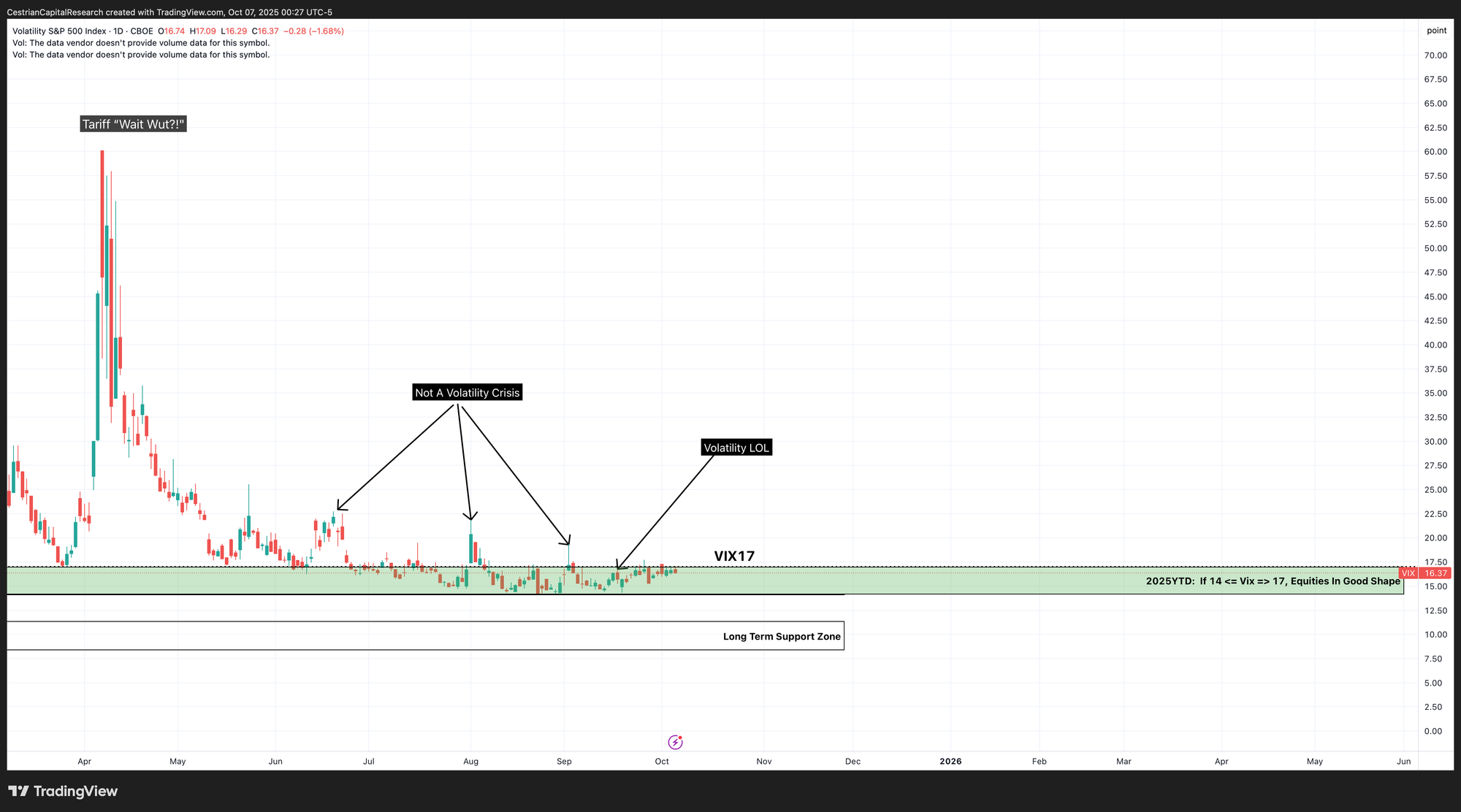

Equity Volatility

Still muted.

Disclosure: No position in any Vix-based securities.

Ether

Rip-A-Doodle-Do.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

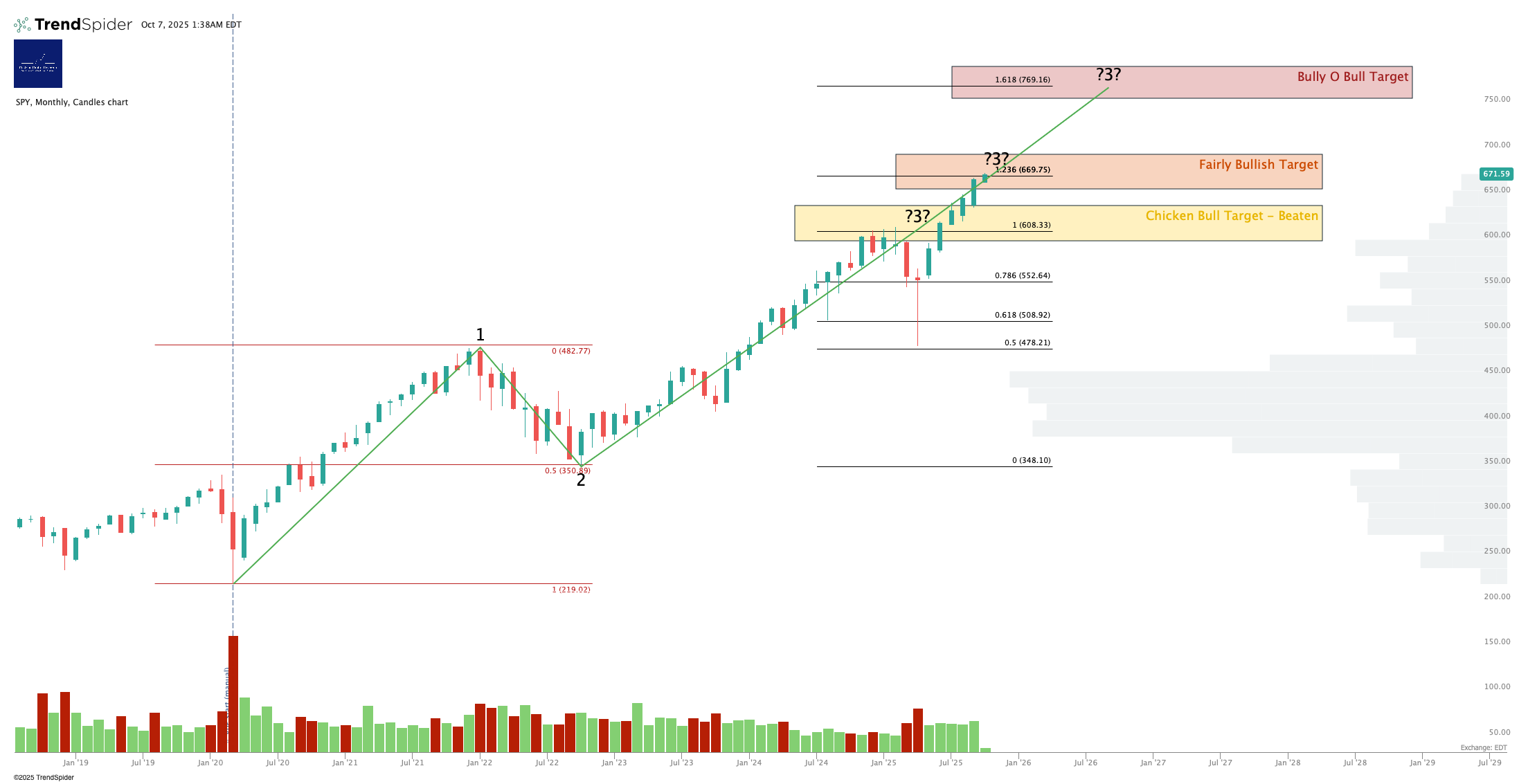

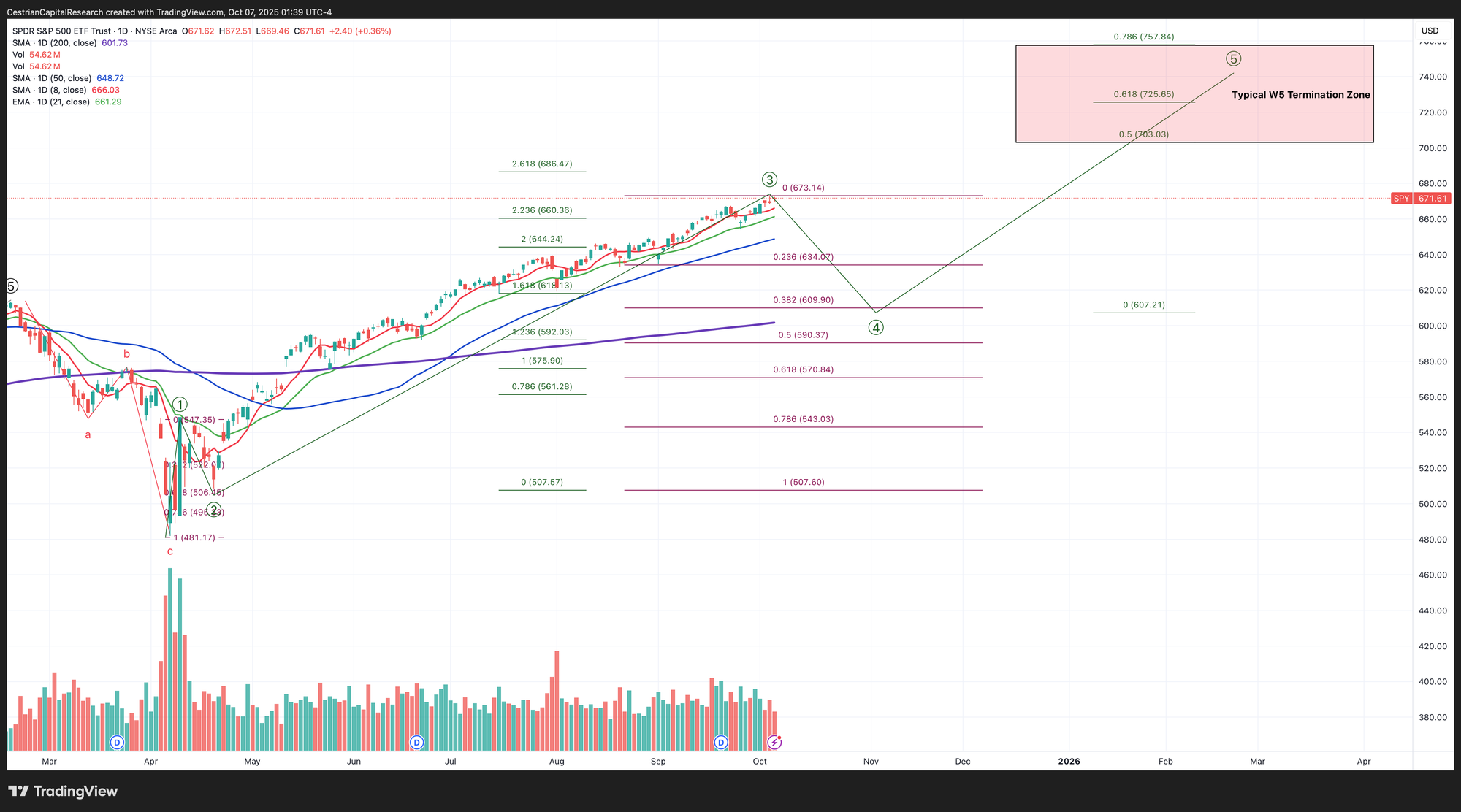

S&P500 / SPY / UPRO

Still moving up.

This chart is the single most important one in this daily Market On Open note right now.

To explain the logic again; for as long as the S&P moves up, I’ll continue to show the next move down (a Wave 4) as starting immediately, with a typical shallow retracement move (here shown as holding at the .382 Fibonacci level and over the 200-day moving average). The chart then projects a typical Wave 5 high based on those two pivots (Wave 3 high and Wave 4 low). Why do this? (i) so when a selloff happens we can have some context already and (ii) to keep eyes on the prize which is the final leg higher in this timeframe. For clarity it does not mean I think the S&P is about to dump into a Wave 4; the moving averages will show us when that happens, in near-real time. Unless and until the 8-day and then the 21-day trips, we’re in a bullish phase.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / TQQQ

Up.

Same logic as the smaller degree SPY chart above.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged 1.65:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall net long the Nasdaq.

Alex King, Cestrian Capital Research, Inc - 7 October 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHE, ETHA, XLK; long December TQQQ, QQQ and SPY puts.