NO PAYWALL VERSION: Market On Open, Wednesday 10 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Galactic Returns

by Alex King, CEO, Cestrian Capital Research, Inc

Oracle, once the Naysayer-In-Chief of cloud computing, just scored a galactic increase in its remaining performance obligations (RPO), the artist formerly known as the order book. The size of the orders means that, per Jim Cramer today, they could only have come from the US government AI project, Stargate. Now, orders are orders, they aren’t money and oftentimes, government orders are skewed to reflect the size of the customer vs. the supplier - just ask every US defense contractor. But still. This is another big capital vote of confidence in the future of AI.

AI will have its Trough Of Disillusionment moment before too long (that’s like a Wave 2 for technology!) when it will be deemed useless, oversold, lacking a killer app, no ROI, all that. These burblings have already started. That period may last for years. But in the end, do you really think that this latest generation of technology won’t prove capable of changing the economy in its favor? Me neither.

AI will sweep through all sectors just like the Internet did, and there are wins to be had in the most unlikely of places. Yesterday we wrote up how a once-toast CLEC, CenturyLink, is now all bulled up in its new Lumens Technology guise. What does it sell? Fiber capacity for datacenters. Yawn. But you can’t argue with the stock price peformance lately. You can read all about it, here:

Let’s now take a detailed look at where markets stand heading into this week. This note is published each and every trading day. We cover equities, bonds, oil, crypto, volatility and much more. Want to get this direct to your inbox each day before the market opens? Join the Cestrian Inner Circle service. You can read all about it here.

Here’s a recent comment by one of our subscribers:

"A Great Fan Of This Service".

I have become a great fan of Cestrian’s investment research service in a relatively short (less than a year) space of time. Alex King, who leads the team, comments by email everyday giving his views on the current state of US markets i.e. Dow Jones, S&P, Nasdaq and Russell 2000. The direction of the indices is forecast dependent, it seems, mainly on Cestrian’s interpretation of the respective charts using, amongst other tools, the Fibonacci wave theory. I have on occasion doubted their market direction conclusions but, I have to say, they have each time been proved correct. Cestrian also provides intensive fundamental research on companies in their US company universe and I have benefitted here from following a number of their selections. It is a personal service and Alex welcomes subscribers’ questions.

I have in the past subscribed to other US based investment services but not only were they much more expensive but also didn’t begin to compare in success terms.

I think what I like most about Cestrian is that, through their chart expertise, they will also call the big moves i.e. markets moving overall from a bullish to a bearish stance and vice versa. In other words a statement to consider becoming net short would, in the event of markets changing to a downward trend, be forthcoming.

I worked as a private client investment manager for over 40 years but have learned a considerable amount, predominantly using charts, since joining Alex a few months ago. Cestrian comes highly recommended.

Anyway, let’s get to work. This is the no-paywall version of this note. It’s a shortened version of the full monty, lacking sector ETFs amongst other stuff. If you’d like the note every day in full - then join our Inner Circle!

US 10-Year Yield

I would expect a retreat back upwards soon, before continuing the dominant downtrend.

Equity Volatility

Still no fear. At all.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

You guessed it. Still in the range.

If we truly have a bullish move in bonds now, TLT should stay up and over the 200-day (thick purple line).

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

As always - if you want to trade the levered ETFs I personally find it best to do so using the underlying charts (so use TLT to trade TMF or TMV).

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Ether

I think that’s the Wave 4 done at the .236 retracement. Shallow, true, but look at the buying action from the treasury companies. Raising target for Ether to $6k-$7k as shown.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

Zzzzzzzzzzzzzzzz.

Short-term bull move continues. If anything comes of the Russian drone invasion of Polish airspace and destruction of Polish property, we may see oil spike.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO now up and over its short-term moving averages - look for a daily close above those MAs for confirmation of a bull move.

Disclosure: No position in oil.

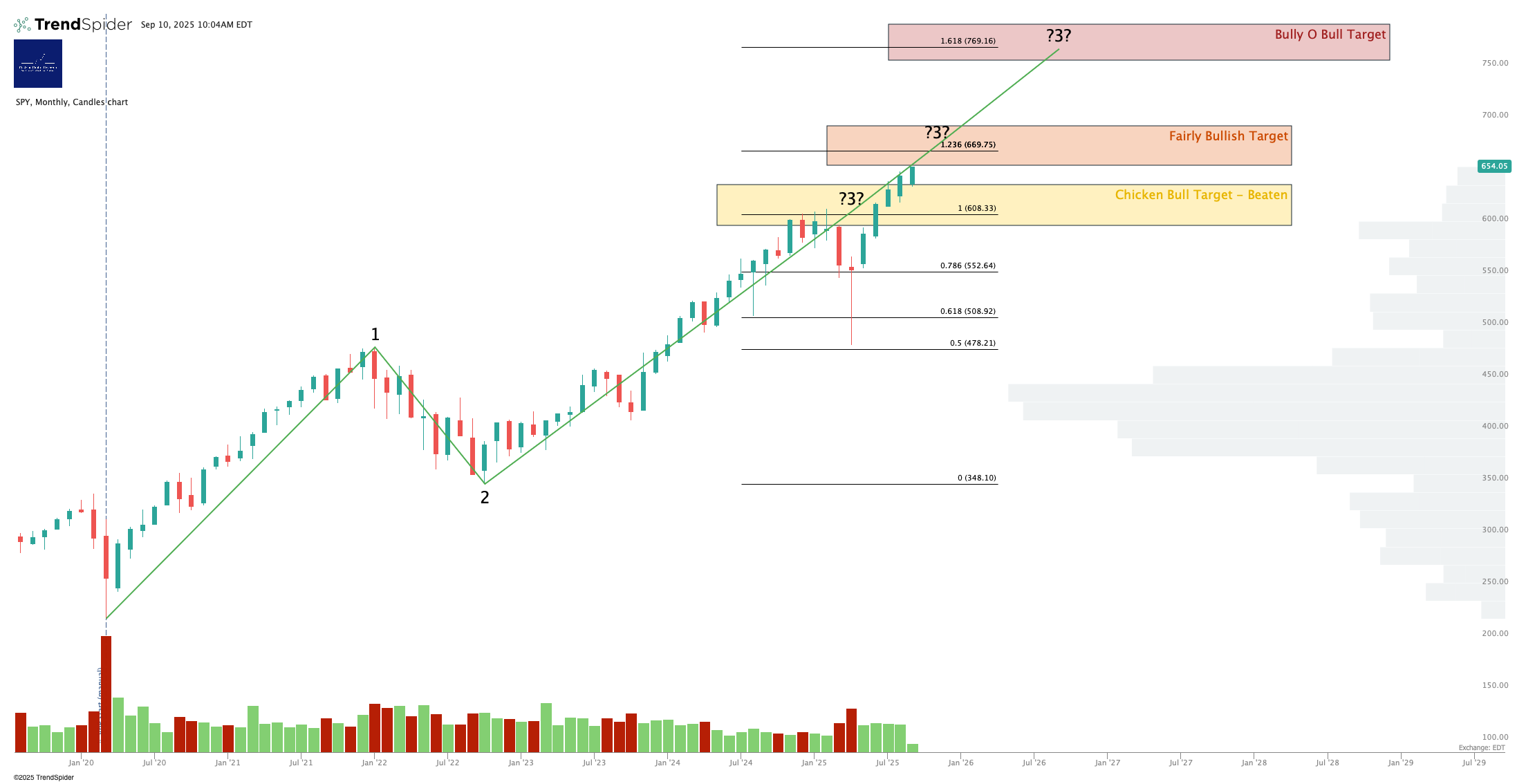

S&P500 / SPY / UPRO

Weak jobs and PPI, shrugged off.

Another new high today on the $ORCL blowout. The chart below assumes today is a top and we get a Wave 4 down, that holds at the 200-day then moves up to new highs once more. It’s just a schematic of course but having these sorts of parameters and likely guardrails at hand means being less surprised when big moves happen. Less suprised means calm, and calm means being set up to bank gains.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Following SPY. I have some hedges in place in the Nasdaq and the Philadelphia SOX and the S&P, nothing ruinous, which just get hit every day. This is in the “annoying” camp as I was expecting more of a pullback so that I could cash them out before another move up. I’m overhedged very long, so this bull market is fine by me - but when I look at those hedges I think that those positioned short must be screaming every day at the moment. Slow grind up markets are hard to take if you’re pointing the wrong way.

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

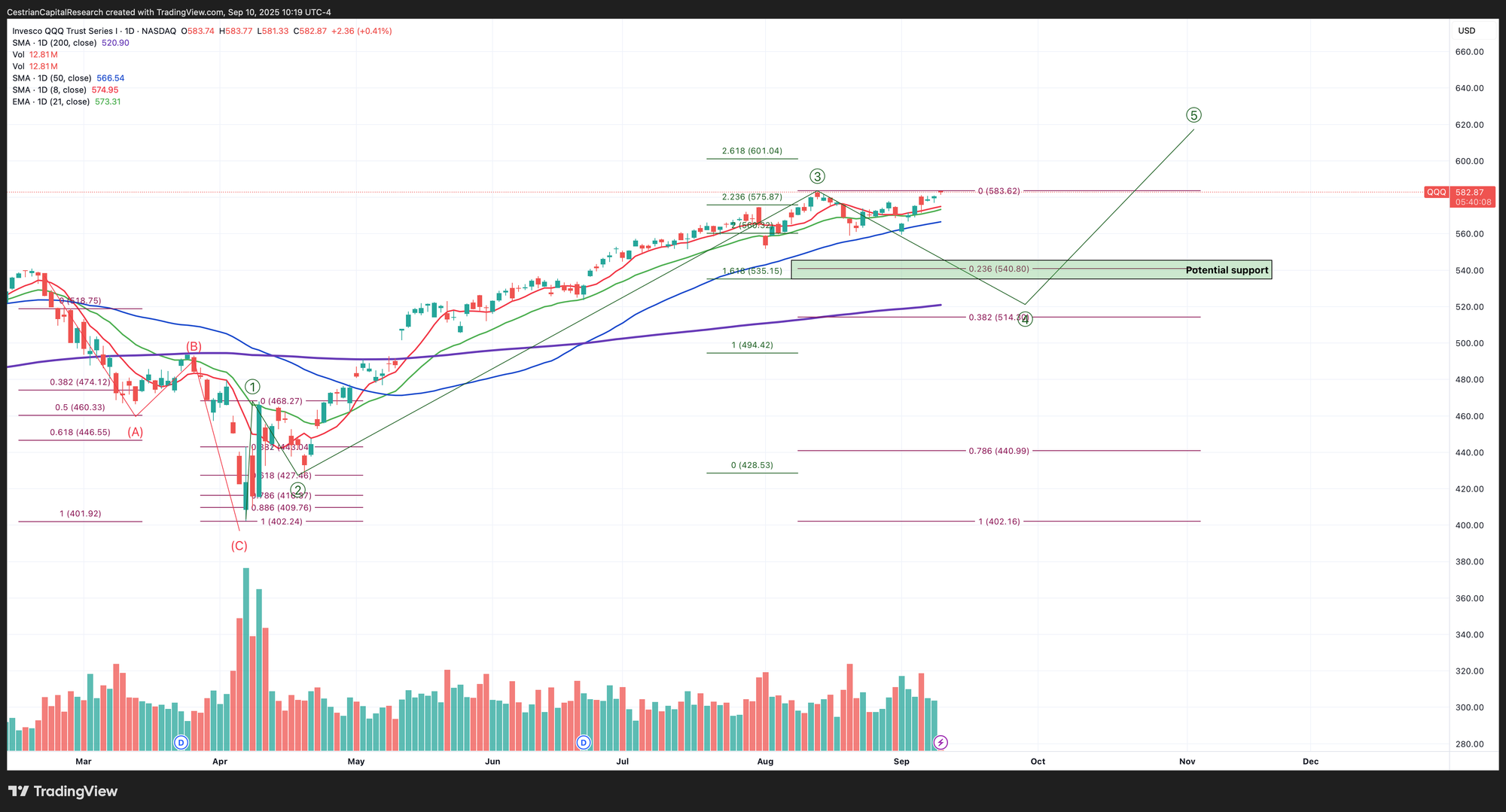

Nasdaq-100 / QQQ / TQQQ

Still bullish looking to year end.

Double top right now. Bullish to push through and up. Don’t be surprised if we see a Wave 4 down start soon though. Be prepared!

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged 1.05:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall net long the Nasdaq.

Alex King, Cestrian Capital Research, Inc - 10 September 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHE, ETHA; long December TQQQ, QQQ and SPY puts.