Nvidia Q2 FY1/26 Earnings Review.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Nothing Stops The J-Train

by Alex King, CEO, Cestrian Capital Research, Inc.

I’m on my third incarnation of datacenter architecture at least, meaning, this is not my first rodeo and I am not easily led up the garden path by CEOs with a bridge to sell me. I tend to ignore the hoopla and look at the numbers.

The hoopla about Nvidia is that it is the lynchpin of the Bubble Economy, the AI Mania, the South Sea Bubble of our time. Because it is “insanely valued” as every fule kno.

Monday morning armchair analysts simply point to this chart:

That must be a bubble. Right?

I say not.

I say this thing is just a juggernaut that cannot stop printing money for as long as it remains the monopoly supplier of premium GPU devices to hyperscalers.

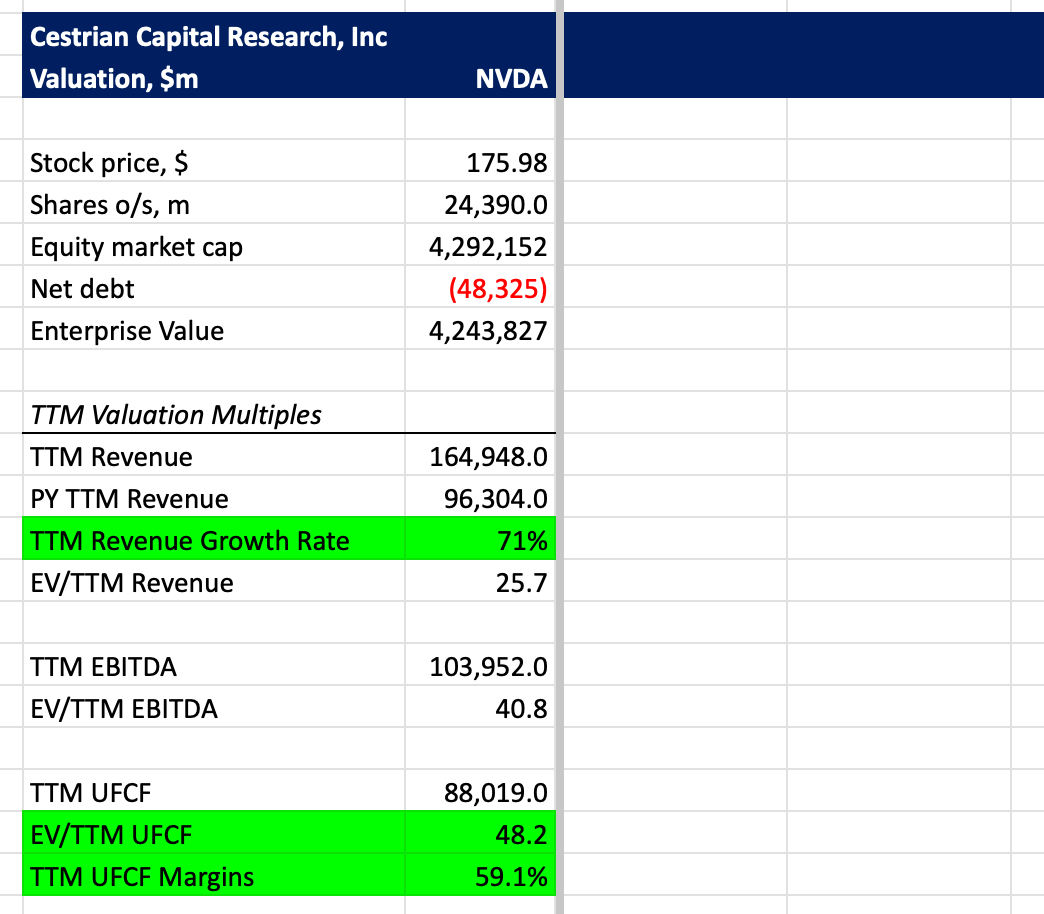

Yes, the price is up a lot; but the EV/TTM EBITDA multiple has oscillated between around 20 and around 80 for the best part of 8 years, and has spent much of that time in the 30-50x range. You’d say those are big multiples, but right now the company is growing its $165bn TTM revenue base at over 70% p.a., and it has 50% cashflow margins, and it has almost $50bn of net cash in the bank. So if you know any comparables for that kind of company, let me know, but from where I sit, that kind of company is going to be a little pricey some of the time.

I saw a piece from Beth Kindig on X today - she was speaking to CNBC or Fox, I forget which - and she said emphatically, “There has never been a company like Nvidia - no-one that has made a product like H20 with such a huge revenue impact”. That’s it - simples - the company just sells a lot of important stuff and operates at very high cashflow margins. And that explains the valuation.

Polemic over.

Now let’s do some numbers.

Financial Fundamentals

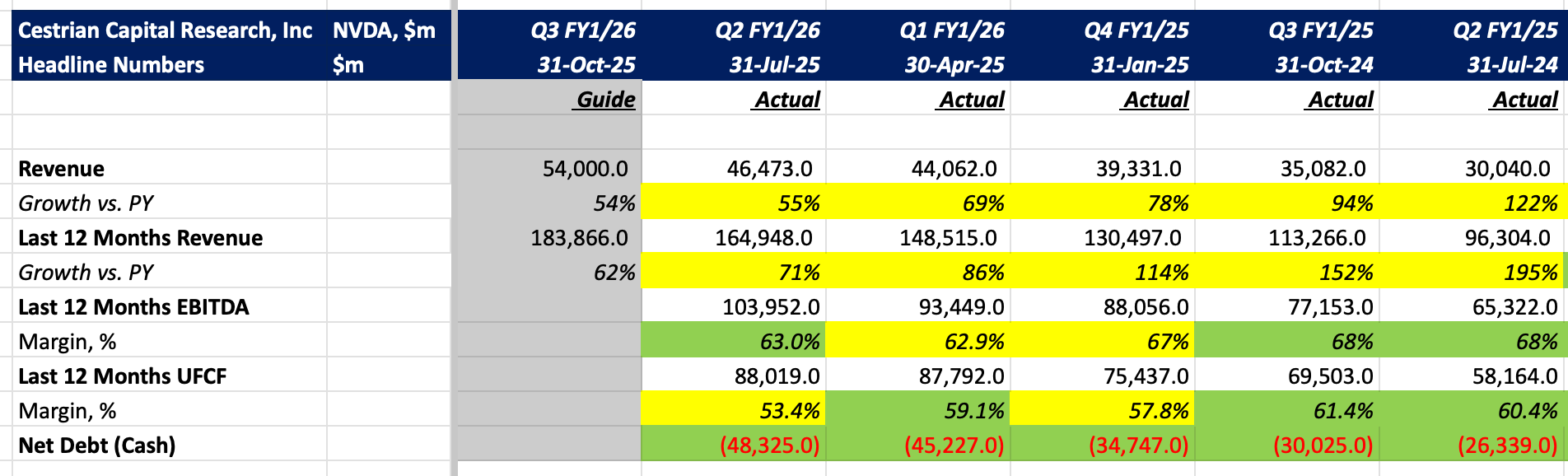

Here’s the headlines, which tell the story just fine. Growth slowing some from an enormous level, but still very strong. Margins remain extremely high and the cash balance colossal. There is nothing to not like here at this level of abstraction.

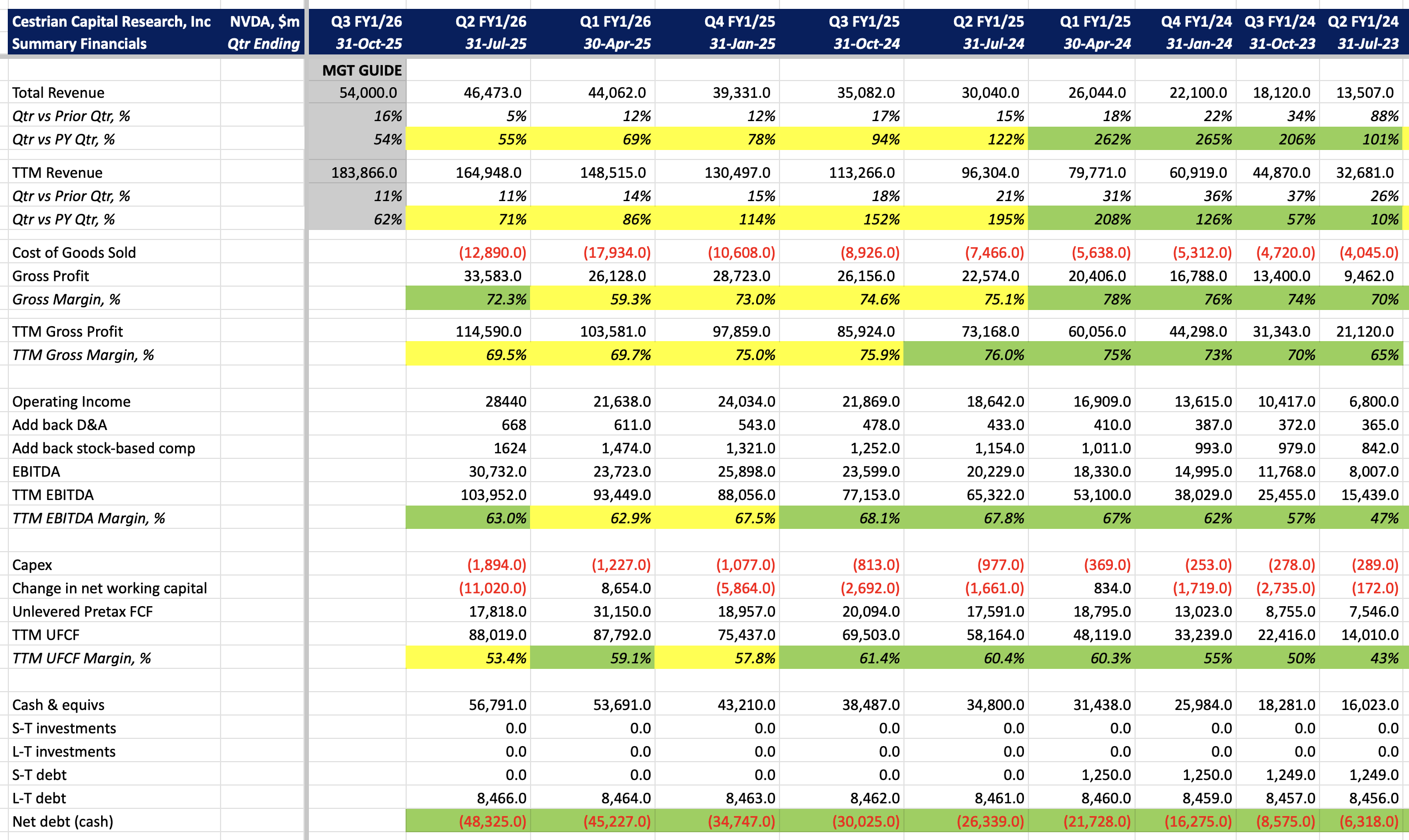

Digging a little deeper:

Just one nag, and that is the change in net working capital this quarter, an outflow of $11bn. In effect this means the company invoiced $11bn more than it collected in cash (I’m simplifying here but it illustrates the point). That’s fine as long as working capital swings back positive in the next 2 quarters or so. So it’s one to watch. If it stays negative it means the company isn’t getting paid as quickly as it should be.

Valuation Metrics

I really do not think this thing is overvalued given its financial performance.

Technical Analysis

We have to see the stock reaction tomorrow - a full day for large, price setting accounts to digest the news - but for now I think any downside is limited to $150 and the upside opportunity is to $210-250 (and I could argue for higher if pushed). You can open a full page version, here.

We rate NVDA at Hold.

Cestrian Capital Research, Inc - 27 August 2025.