Pinterest Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Mood Board = Sentiment Check

by Alex King, CEO, Cestrian Capital Research, Inc

Pinterest is not, of course, a market-critical stock. Nobody gets fired for not owning $PINS. And it wouldn’t really matter to anyone outside of its shareholders and employees - and maybe its hardcore customers - if the company simply ceased to exist. It’s a $20bn e-commerce business. There are a lot of those around.

However, I myself find $PINS earnings a useful sentiment check on the economy. Ultimately the market treats PINS as an adtech business. The stock waxes and wanes with META, TTD, GOOG and SNAP. Yes, SNAP. In fact the main and and as far as I can see only value proposition of SNAP is that whenever the company prints awful earnings and the stock tanks, it drags down PINS TTD and META with it, thus providing dip-buyers with an opportunity to pick up those three names at a discount before a move higher once the market realizes that the terrible numbers aren’t the ad market, they’re just SNAP’s terrible value proposition and worse execution.

But I digress. If PINS revenue is performing poorly then net-net it means brands aren’t spending money to promote, and if that’s the case then it means brands are worried about the economy, and as we know if there is one thing guaranteed to cause a recession it is when enough people are worried about a recession they stop spending money on stuff which causes a recession. Like that.

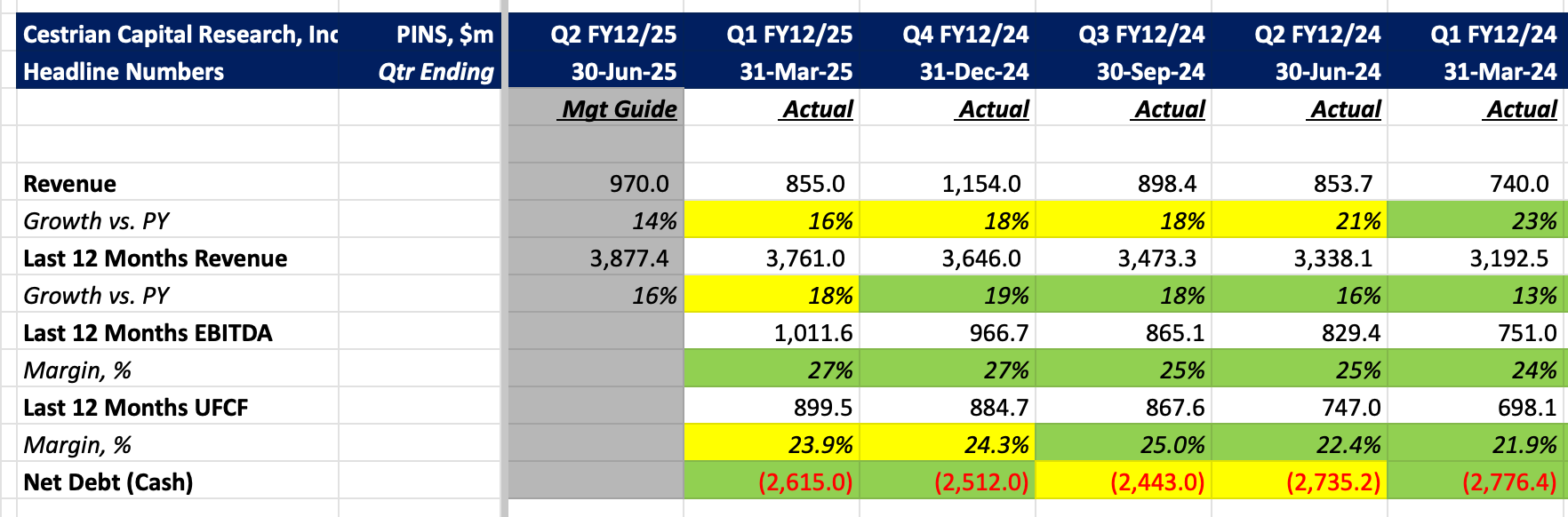

PINS revenue growth is in reasonable-not-wonderful shape.

Growth peaked in Q1 FY12/24 and has been on the wane since then. In part this is probably because a host of growth-enhancing methods (pricing, contract changes, one-time promotions etc), put in place as a result of extensive activist work at the company, are running out of steam. +16% growth is still many multiples of GDP growth, and 24% cashflow margin at that rate of growth is not to be sneezed at. So, not wonderful but not terrible either. Guidance is for a slight reduction in growth to +14%. So PINS, I think, confirms that right now, with the best data we can find - which is to say actual numbers to 31 March and CEO guidance for Q2 - the majority of companies we cover are all saying the economy is in good shape.

As we discussed during our Inner Circle webinar on Monday, there is a wall of narrative right now that says the economy “should be” or “will be” or “on an underlying basis” is weak; for now it is just narrative. It could turn out to be true by the time Q2 reports come in. But for now, narrative is bearish and data is bullish.

Let’s take a look at PINS fundamentals, valuation, the stock chart and potential price targets.