Qualcomm Q2 FY9/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Why Boomers Still Rule The World

Boomers, as everyone knows, just won’t move over and let anyone else get ahead of them. Despite several regional wars, a couple of financial crises, a global pandemic, rising temperatures and sea levels? These guys just won’t make room for the youngsters. Know why? Because they don’t want to. They keep on re-inventing themselves as the world changes and using their accumulated wealth to control their problems.

Qualcomm, although established in 1986 (a millennial!), was created a Boomer company by its cofounders Irwin Jacobs and Andrew Viterbi. Now 91 and 90 respectively, they may no longer drive the company but their mathematical and engineering brilliance remains the DNA at the core of $QCOM. The company, as you know, produces semiconductors on a fabless (outsourced manufacturing) basis and licenses the design of chips and parts-of-chips to other semiconductor companies. The Viterbi Algorithm is at the core of the CDMA technology that QCOM created and which is the standard upon which most modern cellular networks are based today. And Qualcomm, though it should have retired or died many times thus far, just keeps on pushing when the world changes.

If you read our work you will know that we are extremely bullish on the degree to which AI will continue to drive a capex refresh throughout the technology value chain. Stock prices will rise and fall, as they did during other tectonic shifts in the industry (mainframe to minicomputer to PC; offline to Internet; client-server to cloud; and so on), but unit volume of the devices and services required to build, operate and deliver AI applications to users? That, in my view, is going to moon.

If you use any of the major LLMs for more than half an hour you will know that they are extremely capacity constrained. A year ago it was kind of fun to see an LLM create an image or a video that you described at all. Now, when you can positively hear the network creaking as it tries to deliver your latest wouldn’t-it-be-funny-if-it-was-a-Labrador-in-the-picture-trading-stocks image, it is getting tiresome. Like loading what were once called “rich HTML” pages 25 years ago. Click the link, go make coffee, come back, still hasn’t loaded, go find something belonging to someone else in the office fridge to pilfer. Today, asking an LLM to do a research project for you is like, set it the question, go make coffee, come back and answer its sub-questions, then go for lunch outside the office, come back, maybe it’s finished, maybe it hasn’t. And maybe your IT folks are yelling at you for racking up their LLM bills, or maybe they aren’t.

Anyway to solve all this, the technology industry needs, inter alia:

- More computing resources in the datacenter

- Lower power consumption in those resources

- Faster local- and wide-area communications

- Faster client-side devices with more storage and more memory

- More understanding IT folks - what’s wrong with using company resources to make funny cat videos?

This starts at the smallest level - eg. chip to chip interconnect - and extends to the largest - eg. data throughput and latency in busy city center cellular zones.

Qualcomm just paid $2bn to help them solve a piece of this puzzle. Their pending acquisition of Alphawave Semi will help the old-timers from San Diego deliver multiple speed advantages in wireline and optical networks of all kinds. A small step on the way to unlocking the promise offered by LLMs. Notably, the QCOM stock actually moved up on the announcement; usually in such cases you’ll see the target stock benefit but the buyer’s stock get hit as investors sell first and then ask “wait, wut?” later. Personally I think the acquisition is likely to work out well. Alphawave has been exceptionally capital-efficient in its growth and even if (as is usually the case with earlier stage companies) their products and IP require some re-work before hitting the prime time, I believe QCOM is to be saluted for staying ahead of the curve.

Anyway, let’s take a look at numbers and charts and whatnot.

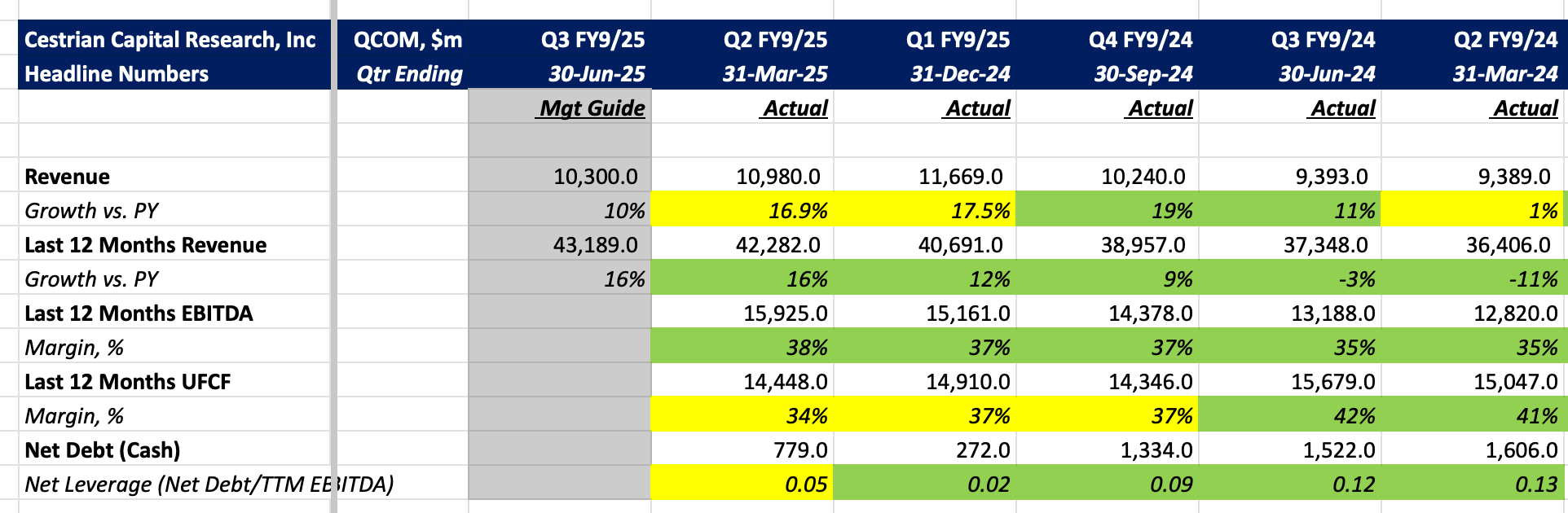

Financials - Headlines

Growth good, margins good, leverage barely-there. Now for the detail.