Resting Bull Or Busted Flush? SharpLink Gaming Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Let’s Keep It Simple

The bear case for SharpLink Gaming ($SBET) is really easy. If Ether is a bust from here, so too is SharpLink. This is a single-asset investment company and if that single asset is in a downtrend there’s not much the investment company can do about it save to diversify too late. The other bear case by the way is that Ether moves up from here but SharpLink stock does not; either because investors believe SBET owns less Ether than it claims, or because there just isn’t enough demand to own SBET as there is another indirect claim on owning Ether, such as the BlackRock ETF $ETHA.

Let’s look at the Ether chart with this bear case in mind. You can open a full page version of this chart, here.

That's clearly a volatile chart but it remains in a bullish pattern since the April lows. Should ETHUSD break below say $2870, the Wave 1 high set back in June, then probably this chart is broken and we have to re-visit. But until such time, I think the chart holds up. In which case ETHUSD has a shot at a run from here to $5k-$6k.

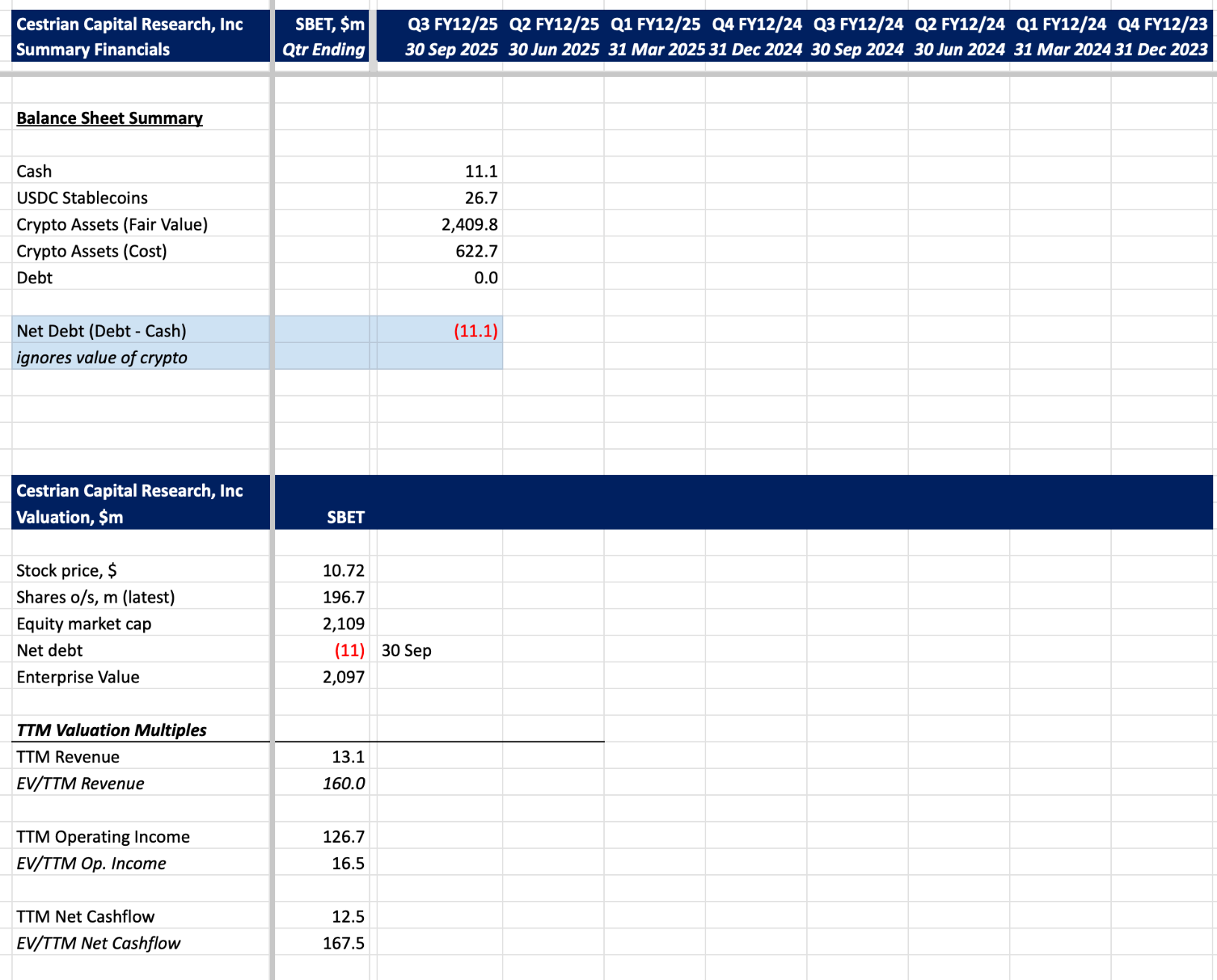

Next, let’s look at SBET financials. There is pretty much one quarter’s worth of financial history for the current business model, so identifying trends is impossible. The key points to make are:

- Revenue for this business is in essence the staking yield on the Ether it owns.

- Gains or losses on the Ether held show up in ‘Other Operating Income’ which as of 30 September was showing a substantial gain.

- Cashflow comes down to, how much money did the company raise in financing and how much of that did it use to purchase additional Ether.

In short this is more like an investment fund than a company which makes things and then sells them. Success or otherwise will be dictated by (i) can the company raise money at attractive (ie. high) prices for their equity and, perhaps, future debt and (ii) can the company use that money to invest in Ether or future target assets at attractive (ie. low) prices.

Valuation as follows; it ignores the value of the Ether on the balance sheet. If you treat the Ether as a liquid investment (which it kind of is but then again if SBET suddenly started selling a lot of Ether to raise cash, it would probably affect the price of Ether) then the EV goes negative, another way of saying that the stock is trading at a discount to NAV.

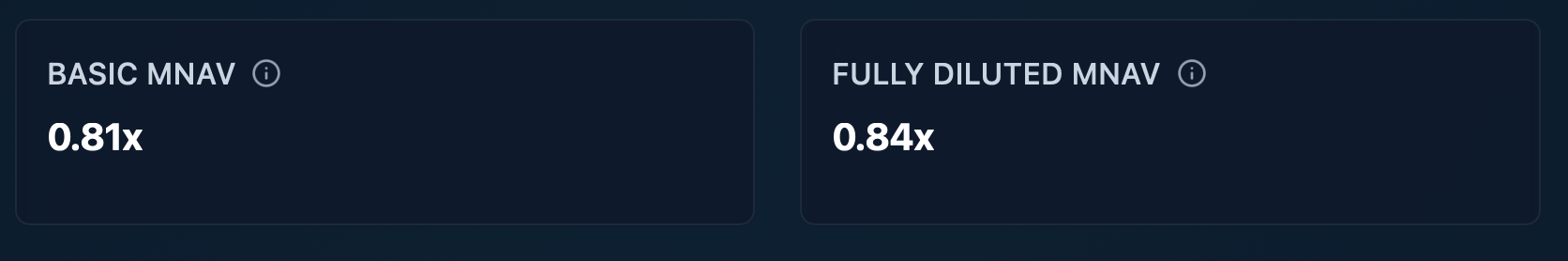

Based on the amount of ETH they owned on 9 November the company states the stock is trading at a discount to NAV of around 15-20% depending on whether you count only currently issued shares or you add shares that would be issued if all options etc were exercised.

If you think Ether is going up - and I do - this is an attractive place to start to build a position in SBET. If you think Ether is toast, this is one to avoid entirely.

The stock chart is also simple. If Ether starts rising, this should rise more quickly. Falling, fall more quickly. Full page chart (log scale), here.

Rating: Accumulate

Alex King, Cestrian Capital Research, Inc - 17 Nov 2025

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in $SBET.