SentinelOne Q1 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Weighed Down

By Hermit Warrior, a.k.a. Richard Iacuelli

By all accounts, SentinelOne ($S) should be flying. It has a strong product story, backed up by industry group and customer rankings; it was an early adopter and promoter of AI-powered cybersecurity and, by its own reckoning, boasts a $100 billion addressable market to go after. And yet, given the underwhelming revenue performance of recent quarters, something is dragging it down.

We'll dig into this a little later - for now here are the headlines.

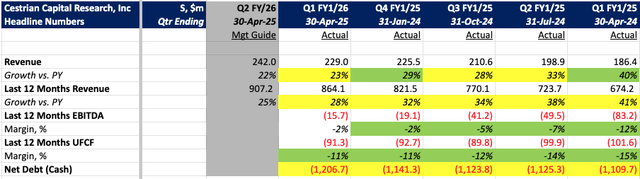

Q1 year on year revenue growth of 23% came in a touch over the 22% guide, but notably below last quarter's 29% - disappointing those that had hoped the guide was 'conservative'. The guide for Q2, as well as for the full year, is also for 22% revenue growth, a far cry from the heady days of 40% growth last year (not to mention 90% the year before that).

EBITDA and unlevered free cashflow margins (UFCF) remain negative and show only incremental progress towards flipping positive - despite revenue growth slowing. All in all, not a good look.