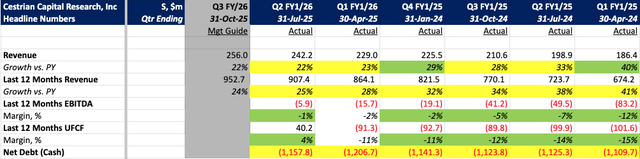

SentinelOne Q2 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Slow Progress

By Hermit Warrior

Let's get straight to the point. In most instances, 22% revenue growth, with a $1B ARR run rate is nothing to sniff at but - like in everything - context matters.

Context in this case is:

- An overall cybersecurity market growing at around 12.5%-14.4% per annum (Gartner for the lower figure, Fortune Business Insights for the higher) - meaning that 22% growth is less than 10% over and above what the market is already growing at; not a great indicator of growing market share.

- Competitors with far bigger businesses that are seeing accelerating revenue growth which is also outpacing the market ($PANW), or indeed revenue growth exceeding 22% ($ZS).

In short, SentinelOne ($S) - at around a third the size of ZS and a tenth that of PANW - should be the small nimble player with superior technology running rings around their larger, less agile competitors - and growing much faster as a result. It isn't.

This, I think, is the challenge facing SentinelOne management as they look to stay relevant in an increasingly competitive market where scale (both financial and access to AI-ingestable data) matters. We'll explore this further later, for now let's get to the headlines.

Revenue growth matched the 22% guide with Q3 guidance also set at 22%. Full year revenue growth was increased by a token $2M, to $1B at the midpoint (which by the way is also 22% growth yoy) although this represents a pretty meagre 0.02% increase from the previous full year guide. EBITDA margin was incrementally better, though still negative, however unlevered free cashflow (UFCF) margins did turn positive for the first time.

It's helpful perhaps to look at where SentinelOne came from - securing endpoints (desktops, laptops, etc.) - as this also helps to explain, in part at least, why it may be struggling to grow at a faster clip.