Micron Earnings - Snatching Defeat From The Jaws Of Victory

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Spoiler Alert: Memory Is Still Cyclical

In the olden days, grownup investors, hardened, cynical folks with weary faces and lived-in looks, happy to hold the grubbiest mining stock or querulous municipal bond, quaked at the prospect of owning very much at all in semiconductor. And with good reason, which is that for much of its short history the semiconductor business has been a fairly awful industry in which to operate. Colossal capital expenditure bills, exorbitant product development costs, continuous downward pressure on pricing, nausea-inducing customer concentration, you name it. Oh and that’s before you get to the capital equipment players who suffer all of the above with bells on.

Sometime in the last decade, the capex refresh cycle in tech has rendered everyone a chip sector expert. Hoards of people now pretend to understand nanometer engineering concepts, which they don’t, and those same crowds think that because semiconductor unit demand will rise inexorably - which I think it will - so too must chip stocks.

D’oh!

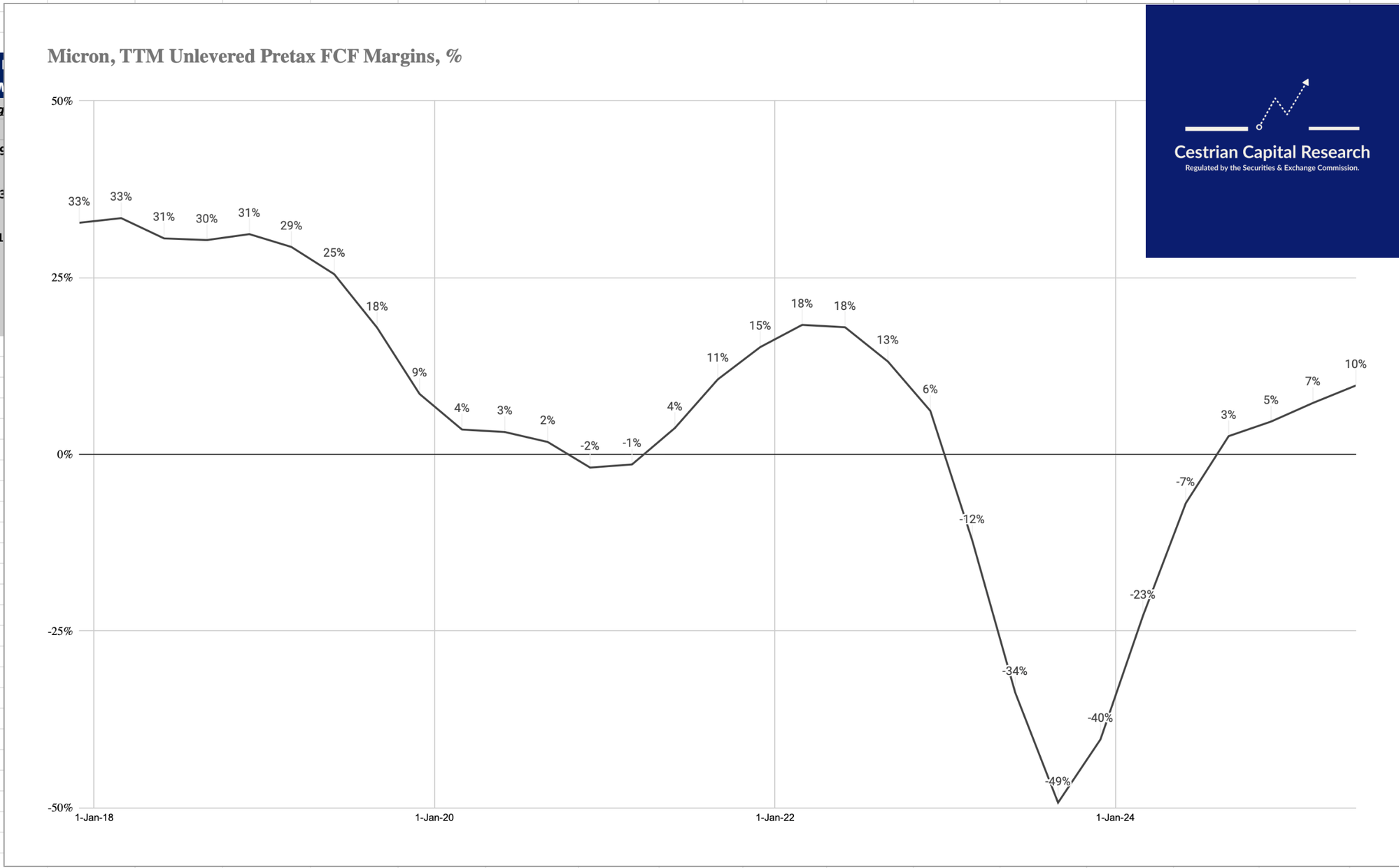

The problem with memory is that you have to spend ever-more-dizzying-sums to make DRAM and NAND chips faster, cheaper, better, and when you do, your customer still wants to pay a lot less for this year’s model than last year’s. The fact that there are only three at-scale DRAM vendors (Micron, Samsung, SKHynix) ought to make this a cosy high-margin market, but reality is not working that way. Worse, as memory technology and feature/function demands become ever more intensive, Micron is finding itself able to achieve lower and lower cycle-high cashflow margins.

Memory is still cyclical, and at or near the peak of a cycle, life isn’t as good for Micron as it was at the peak of the last cycle. It’s true that if you want AI to fufill its promise, you need a lot of DRAM, but that’s just a volume-shipment call. It tells you nothing about where the stocks are going.

Personally I find Micron un-tradeable. The fundamentals make me seasick and the chart doesn’t really run to any technical analysis playbook I have found. This quarter’s earnings, printed today after the close, don’t change my view. And nor does management’s lack of ability to sweet-talk the market!

Let’s take a look.

Financial Headlines

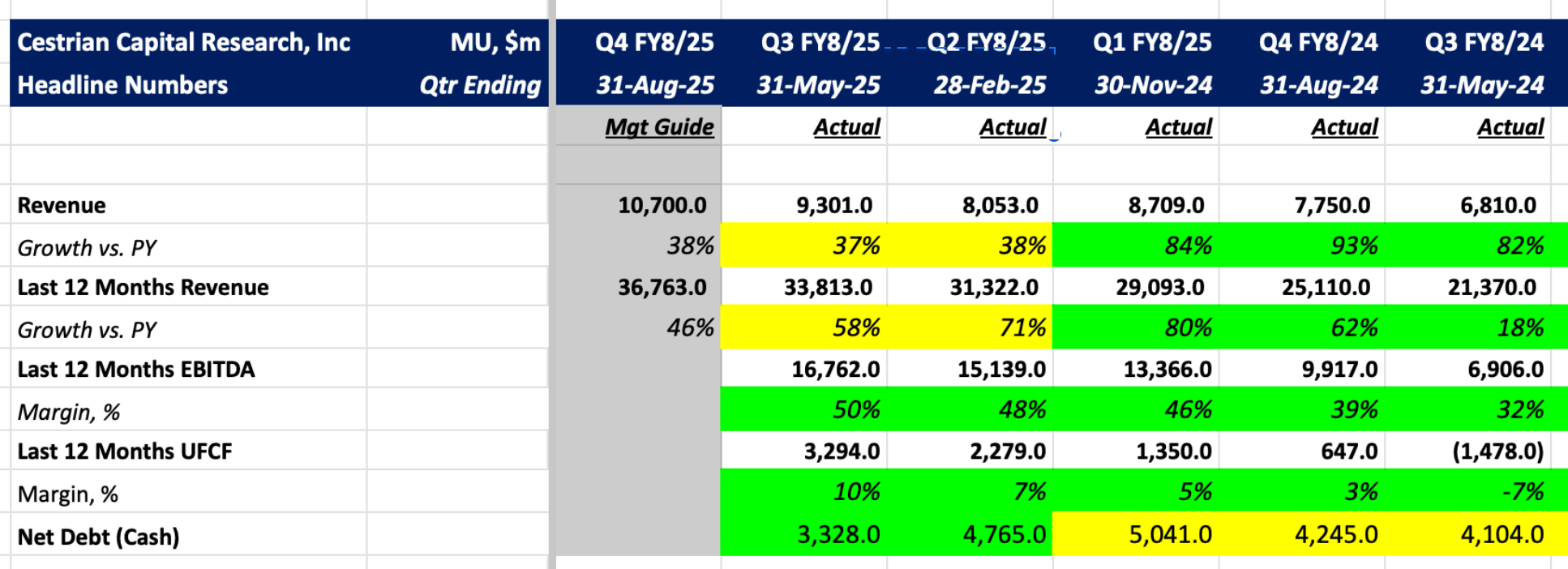

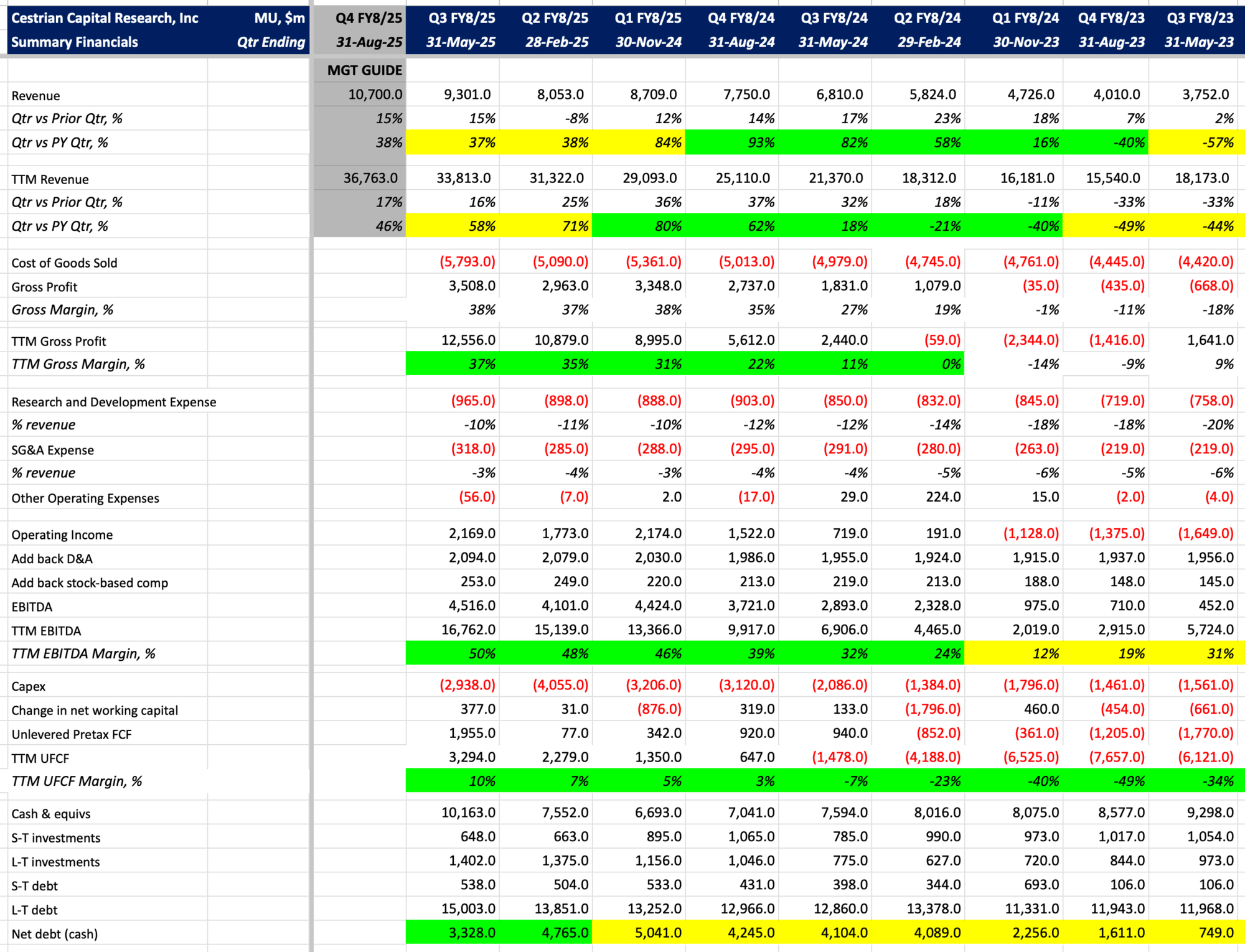

Growth is decelerating and margins are approaching cycle highs. The balance sheet continues to improve.

Financial Fundamentals, Valuation, Stock Charts And Rating

Valuation Multiples

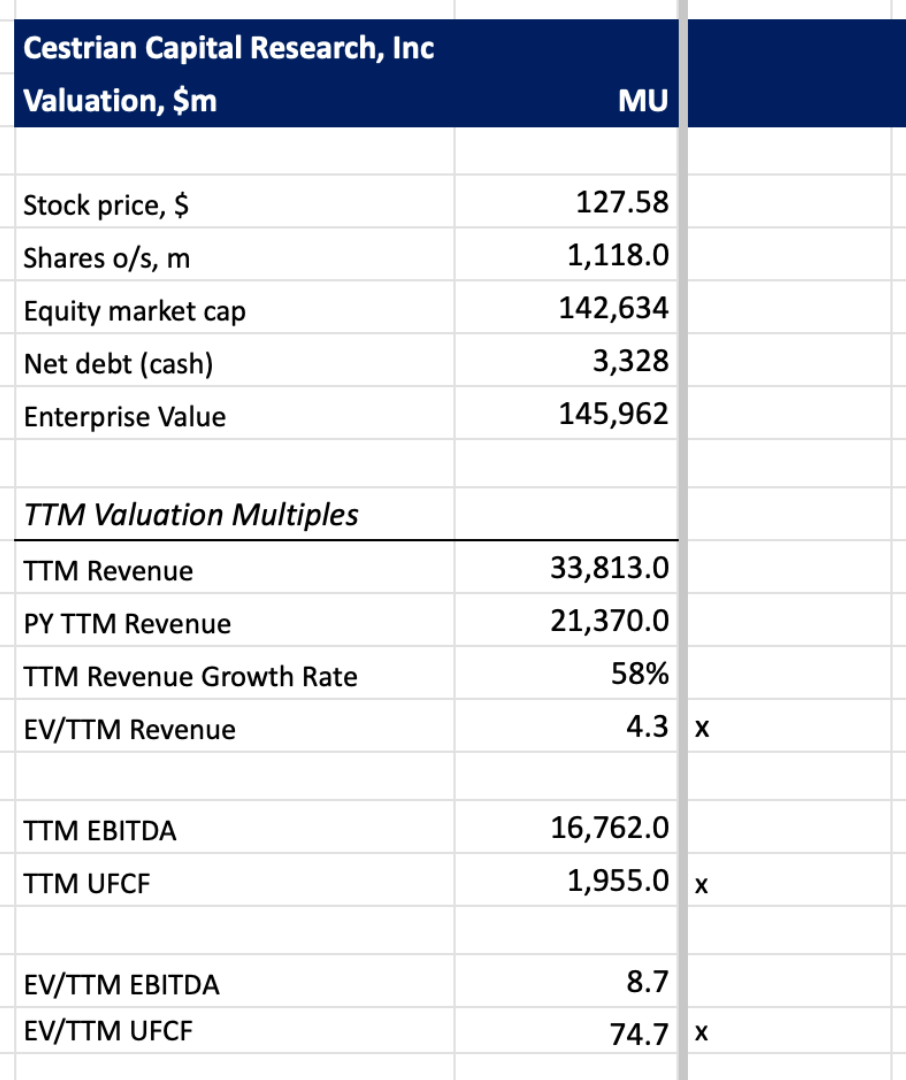

75x cashflow whilst nearing peak margins at relatively muted rates of revenue growth. That looks punchy to me.

Stock Chart

Look, formally we rate MU at Hold but I can tell you that if I owned it, which I do not, I would be selling around now, because that moonshot move up off of the April lows is unlikely to continue at the same angle of attack. Be careful out there folks (you can reach the full page chart here).

Cestrian Capital Research, Inc - 25 June 2025