Solving The AI Bottleneck

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Credit Where Credit Is Due

The writeup that follows is due entirely to our longtime member “FredFrog” who in addition to being able to hold entire large-scale computer systems in his head, and to reverse-engineer LLM-based securities trading models in the same head at the same time, knows a good single-stock prospect when he sees one. “Fred” has been telling me about this company for a while now; I think he has a live one here.

Read on!

How To Win At Telco

by Alex King, CEO, Cestrian Capital Research, Inc

The reason most telcos are terrible companies is because most of the people that work there in senior roles have been brought up in telco. Child psychologists will tell you that if you show them the child at 7, they’ll tell you a lot about what kind of adult they will become. Well, capital allocators will tell you that if you show them the manager who has worked in telco for the first seven years of their career, they’ll tell you …. all the reasons not to allocate capital to that person.

At its heart, old-line telco - your AT&Ts, Verizons and whatnot - still think of themselves as a kind of national utility. Yes, the FCC did its best in 1984 to break up the AT&T monopoly, and for a while that worked - culminating in scores of altnet carriers springing up in cities small medium and large in the 1990s. But, telco executives being long-game types, in the end the FCC was end-run by a combination of (1) the complete unviability of city-ring fiber models (2) the subsequent ‘Escape From Telco’ capital flight in bond and growth equity capital markets (3) the delayed start to the Internet Revolution - the 2000s were a lost decade really - and (4) the general ineffectiveness of telecom regulation in the US and most everywhere else in the world but more than anything (5) the resting "Computer Says No” face of your average telco lifer senior executive.

- High-capacity interconnect at multiple peering points across major metros? Computer says no.

- Rollout of fiber in the last mile? Computer says no.

- Growth mentality to capture the ever-increasing value available from the digital revolution? Computer says no.

For a while it looked like the big long-distance powerhouses, Qwest, Level3, WorldCom (yes!) might transform their industries, but that soon ended in tears. Bondholder tears, shareholder tears, and family tears as executives did the perp walk.

Surely, you ask, 25 years after the Bondfire of the WANities, it has changed? Surely, given everyone’s complete reliance on comm in the smallest aspect of our daily lives, someone is doing telco right?

Well, the answer is, yes, I think probably there is. It’s a company now called

Lumen Technologies ($LUMN), formed in Phoenix-like fashion from the ashes and scorched earth that was once CenturyLink; some combustion products arising from the flameout of Level3; and some pixie dust from the stock-as-its-main-service Qwest.

What’s different this time? Easy. The CEO never worked in telco before.

I've never met Kate Johnson so I can’t vouch for her managerial skill personally. But I can say that Oracle, GE and Microsoft are tough old places to work. Oracle in particular has a reputation for eating the weak.

Lumen Technologies is a telco insofar as it has large-scale network assets to manage, but it really doesn’t look like telecom as we know it. It doesn’t sell cellphone plans, doesn't know what a family calling bundle is, and probably doesn’t have a circuit switch (which interestingly my autocorrect tried to change to ‘cirrhosis’ which is about right) anywhere in its network.

The business is focused on providing low-level services - meaning low-level in the OSI Network Layer Model - to customers who need high speed, low latency networking to operate their AI services. This means that customers are going to be low-churn (since many services will be bespoke), highly creditworthy, have a growing volume and value of business to put Lumen’s way and, further, that if Lumen does it right, customers will pull in partners to Lumen. Right now, if you want to buy SASE network services from Lumen, you can do so using Fortinet services re-sold by Lumen. If a large Lumen customer said, well, we want you to offer Cloudflare or ZScaler SASE services, you can bet it would happen. And working with leading security vendors like these will keep Lumen out there, on the edge, where it’s gotta be.

I own a small position in LUMN which I aim to build up over time.

Let’s take a look at the fundamentals, then valuation and the stock chart.

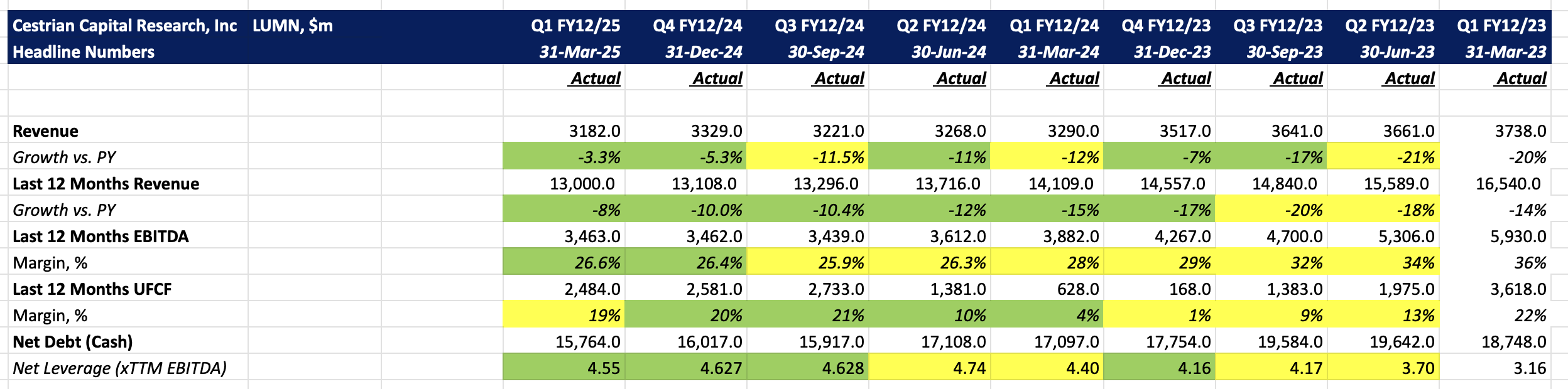

Financial Headlines

Revenue decline is slowing; EBITDA and cashflow margins generally rising; leverage just starting to decline. Good.

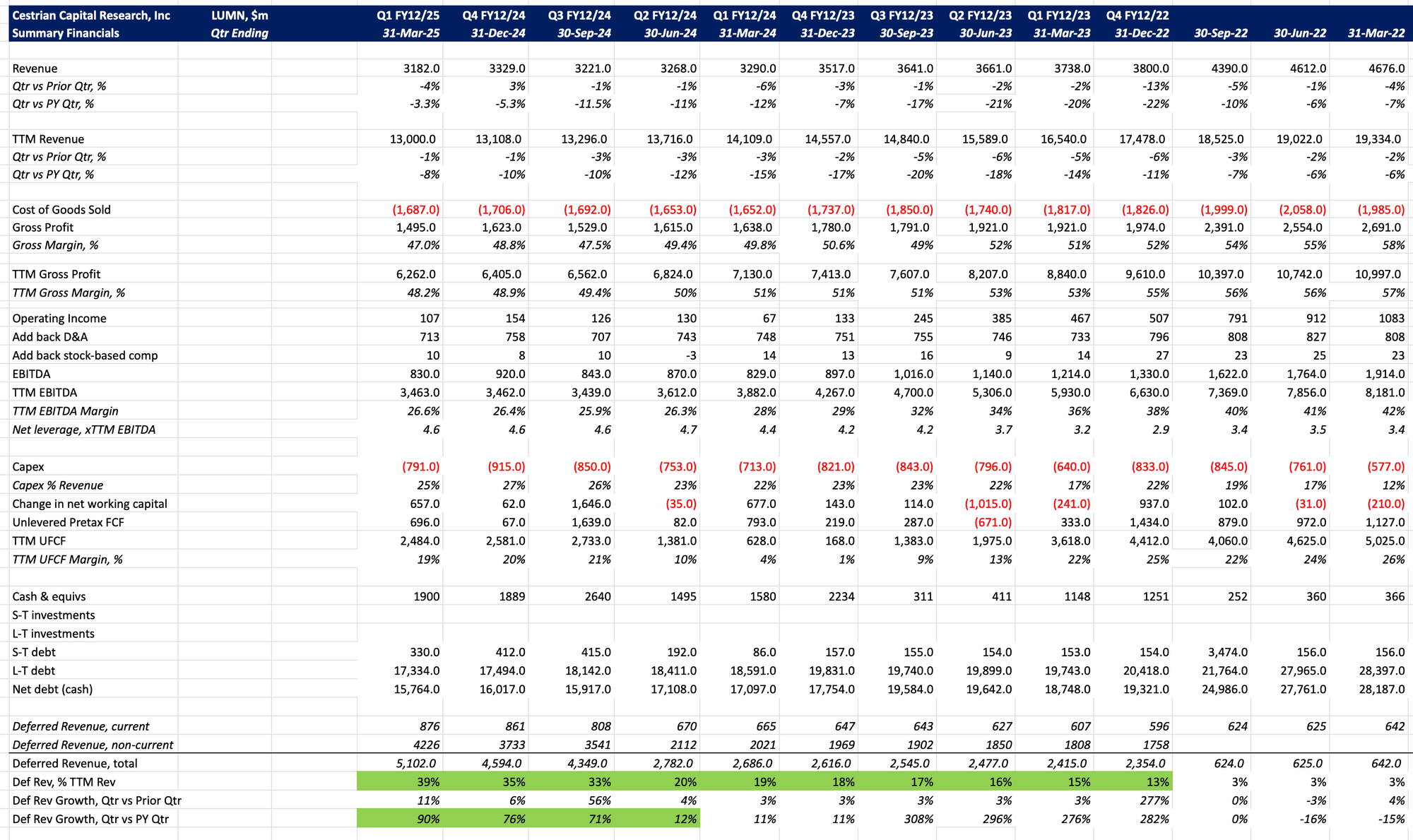

Financial Fundamentals

I would draw you attention to the deferred revenue line. This is too boring a thing for most people to care about, but it matters. It shows that the CEO is driving pre-paid sales pretty hard (I don’t mean burner phones. I mean pre-paid long running fiber services contracts). Most un-carrier like. More like … Oracle and Microsoft! Doubleplusgood.

Valuation

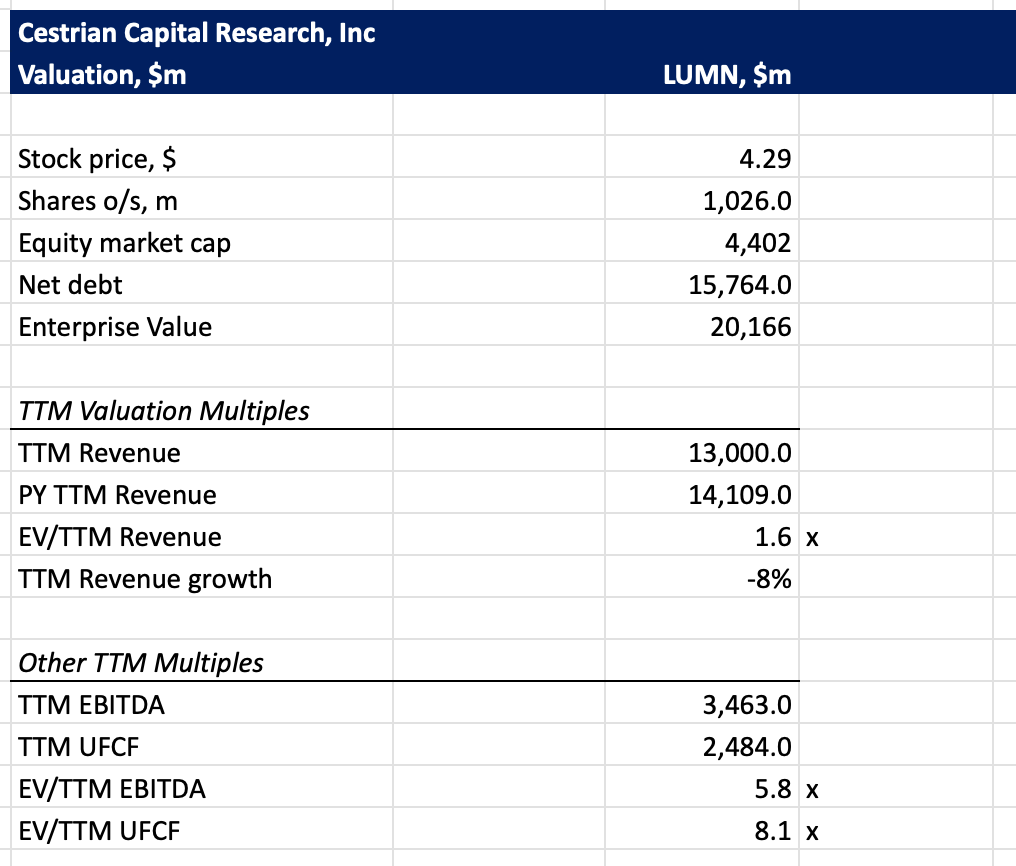

I think the stock is cheap on fundamentals. 8x TTM unlevered pretax free cashflow is absolutely unchallenging as an entry multiple.

These multiples will move around as the divestiture of a unit to AT&T completes so I would not treat them as a religious text but … I still think the stock is cheap.

Stock Chart

It’s not the same company so this is a facetious think to say but for kicks … you can buy this thing at 1988 prices right now!

The interesting part of that chart is the ginormo accumulation volume between 2022-date down here at the lows. That, I think, is a very bullish indicator albeit one that may not pay off for some time.

Let’s look shorter term. How has $LUMN performed up off of its lows?

Well, I think the stock is early in a Wave 3 up on this timeframe. Minimum target, $10.35 (up and over the prior W1 high); support should hold at a tad below $3 if this thesis is correct. The stock is currently $4.30, so about 4.5:1ish risk/reward from here through that lens. Full page chart, here.

Resistance at $5.50ish if the stock hits the 200-day; support at $3.85ish at the 50-day.

Rating

We rate $LUMN at Accumulate.

Cestrian Capital Research, Inc - 24 June 2025

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in, inter alia, $LUMN