The Great Crypto Wipeout Of 2025

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Time To Make Like The Phoenix

by Alex King, CEO, Cestrian Capital Research, Inc

If you’re reading this, you don’t need me to re-hash the events of Friday, but for the sake of form we can summarize it.

After the equity market closed - on a down day, some long-overdue selling which will of course be attributed to a POTUS social post but in truth would have happened anyway - the crypto market blew up, and not in a good way. The long list of altcoins dumped to close-to-zero as a result of an initial price drop followed by forced liquidations which led to more selling which led to more liquidations. History can determine why the initial selling of crypto happened but the reason that the crypto market chose violence was twofold; turbo leverage, and thin markets with no deep pools of liquidity in most all these altcoins.

Inevitably, several traders seem to have positioned themselves just-so a few moments before the selling, and have made bank as a result. Some of these people will have been skilful and others will have had inexplicably good foresight vs. their usual trading patterns. If you’re griping about the latter, don’t worry, any ill-gotten gains are frequently temporary in nature and cannot be spent, lest one day the long arm of the law taps said miscreants on the shoulder.

The two coins with real institutional adoption, Bitcoin and Ether, suffered some selling too, but nothing material in the context of volatile securities. Bitcoin dropped but held firm at the 200-day moving average; Ether dropped but has yet to trouble its own 200-day. If you own these coins via the grownup ETFs - $IBIT and $ETHA respectively, both BlackRock entities - then the structural market problems faced by native crytpo has not affected you.

When we started this Big Money Crypto coverage earlier this year, we did so because we observed that Wall Street had taken over Bitcoin and Ether - and perhaps Solana though I think it will become clear that SOL lies more with the long list of altcoins than it does with the Big Dogs. Since Wall Street now ran Bitcoin and Ether, we concluded, we could probably bring to bear our research methods - liquidity analysis, price and volume analysis, quantitative signal development - to the Bitcoin and Ether markets. That thesis has proven correct - we’ve done well with our judgment calls in the top names and we avoided anything below Solana from day one.

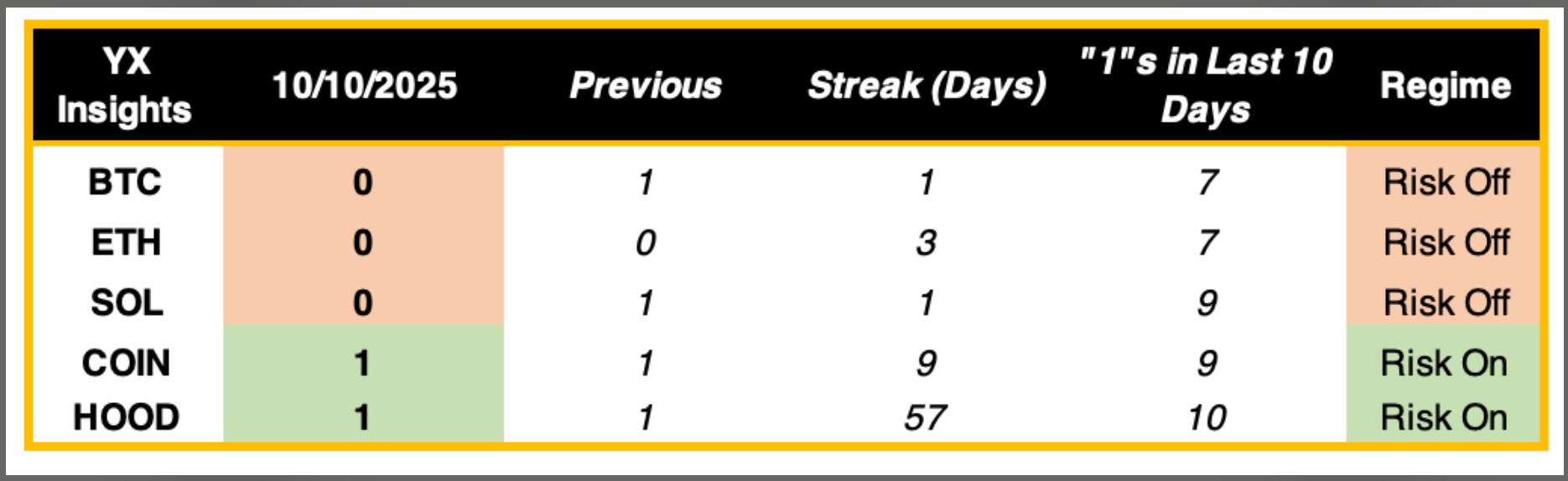

Going into Friday, before the equity open, here’s what our AI-driven crypto signals were saying:

Risk off for BTC, ETH, SOL, meaning, our AI model thought it better to hold cash than to own Bitcoin, Ether, or Solana. Anyone following those signals will have likely missed a big drop.

I am appalled and horrified to see the stories of crypto traders and investors taking their own lives after yesterday’s dump. The truth is that investing and trading, there is always another day if you just get up in the morning to face it. Many traders of futures have seen their accounts wiped out before now, for the same reason as crypto yesterday, which is to say leverage. You can let this finish you, or you can get back to business and keep going.

Might I suggest that if you trade or invest in crypto, you read our Big Money Crypto coverage. It can be had with its own low-cost subscription (here) or within our Inner Circle service at no additional cost.

We teach how to invest and trade in crypto like a professional, not like a gambler. None of the ideas featured in that service were much hurt yesterday. A little selldown, sure, but nothing you don’t see on the Nasdaq from time to time.

If you’d like to get a sample of our approach and method, I’d like to invite everyone to join our weekly, live, open-mic Inner Circle webinar tomorrow, Monday 13 October, at 4.15pm Eastern time. You can register here. We’ll be talking about the Great Crypto Crash of 2005 and how to profit from it.

If you have any questions at all, you can reach out to us at minerva@cestriancapital.com .

Stay safe.

Cestrian Capital Research, Inc - 11 October 2025.