Toxic Balance Sheet Alert: CoreWeave Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Let’s Keep It Simple

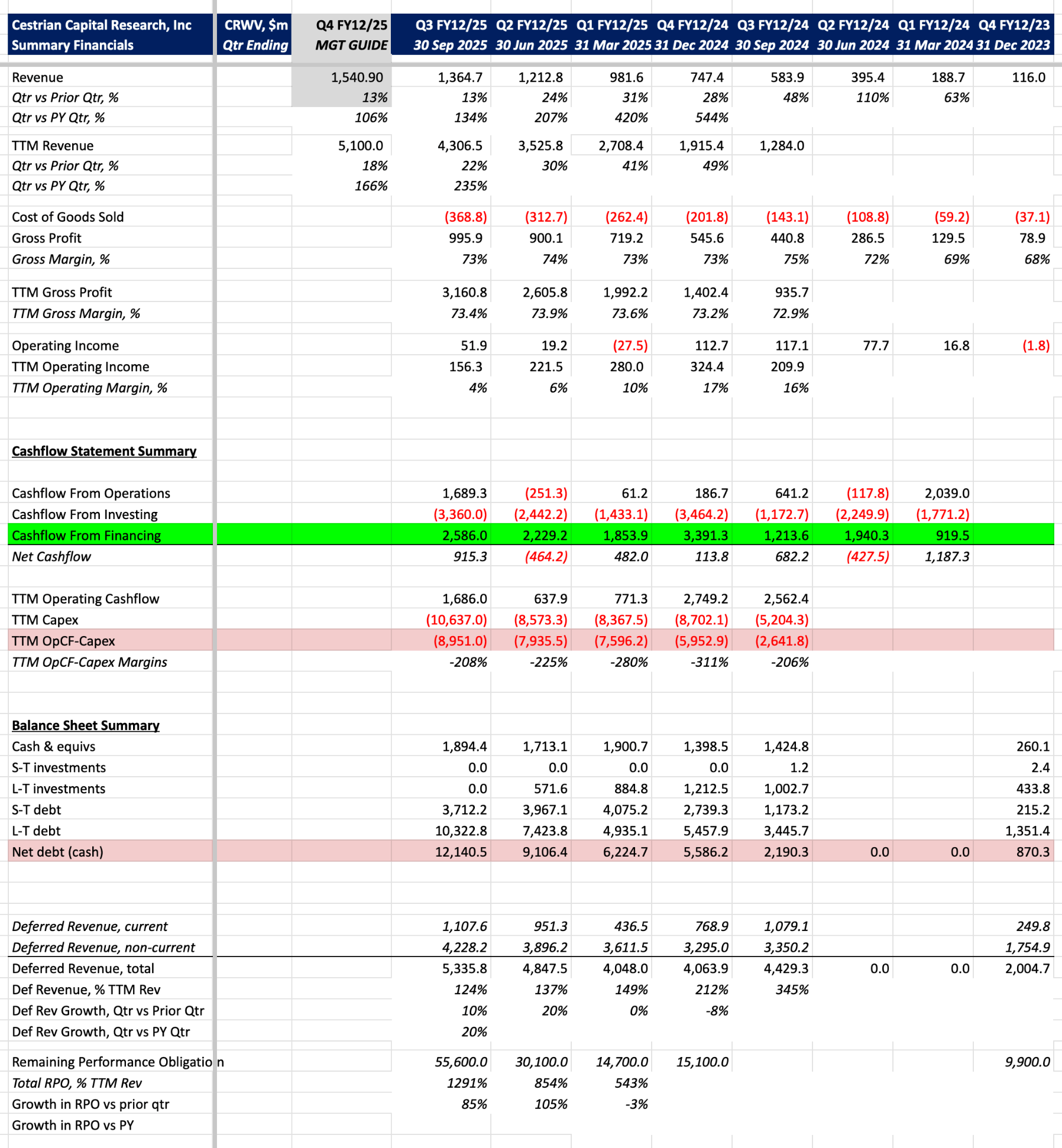

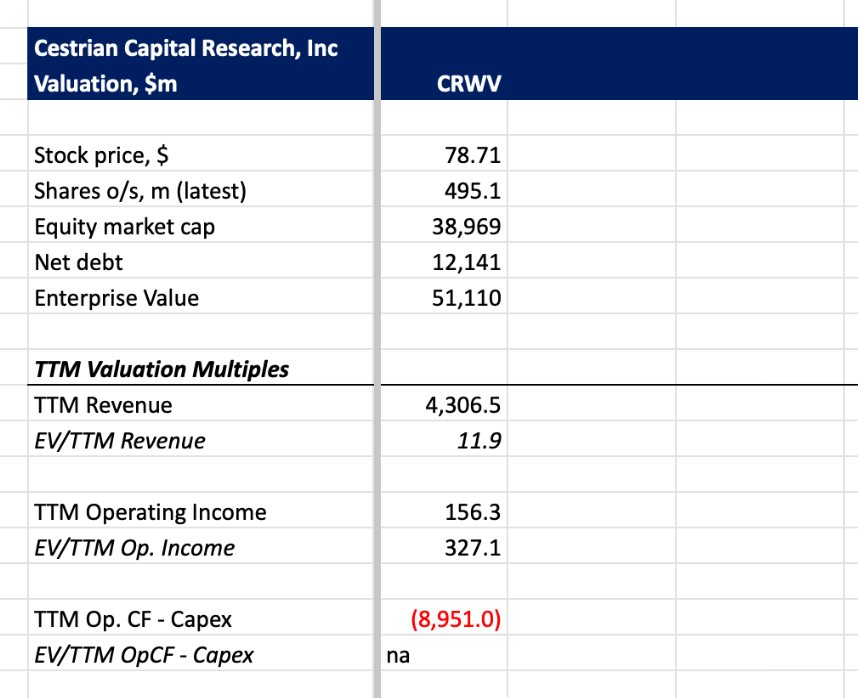

CoreWeave isn’t going to make it in my view. I believe it will be one of the first casualties when the market turns down for real. The company has $12bn of net debt being (not) serviced by negative TTM cashflows of $9bn. Which by the way get more negative each quarter. The only thing keeping this company alive is regular cash infusions from debt and/or equity issuance.

It remains valued very highly in my view.

In my view, the game is up for these small, non-mission-critical, undercapitalized asset-intensive names.

From our resident credit nerd (note, when equity markets go bad, the credit nerds are king):

The credit market in the end will call time on these infinite money-eaters like $CRWV in my opinion. I personally would not short this because anything can happen, folks can step in to save any such loser, but I would not own a long position either.

Rating: Do Nothing.

Alex King, Cestrian Capital Research, Inc - 13 Nov 2025