Will AI Destroy Adobe?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Second-Order Deflation

by Alex King, CEO, Cestrian Capital Research, Inc

I think ADBE is one of the companies most at risk from the onslaught of AI development. Since most all enterprise software is mainly the automation of (usually simple) business processes, I think it is true that most all enterprise software developer jobs are under threat in the coming years. At some point a machine can observe the worker-ants at Acme Megacorp and draw its own Microsoft Visio type flowchart of what the workflows look like; and the same machine can then send coder-bots to write code to replicate those flows. Integrating the code with the spaghetti soup that lives in most large companies and claims to be a unified software stack, well, that will be harder job but, in the end, the dreams of those early-2000s microservices companies, your Grand Centrals and whatnot, will be automated. Self-discovery of integration connectors and self-coding of APIs, self-provisioning of monitoring tools etc etc.

Now, all this is likely bad news for the developers that work for software companies, and it’s likely bad news for developers working in customer environments, and the same for developers in consulting shops that make bank making heavy weather of design, implementation, integration and so forth. So in case I am not being clear I think AI, bad for the current crop of developers. But AI could be great for those software companies that embrace it, because … they will need less developers. Yes, GPUs are expensive to buy and run, but they aren’t as expensive as Larry, who only works 3-day weeks, who requires a particular kind of chair and desk setup, a kind of vegan milk only available from a store 10 miles away that doesn’t deliver, and, worst of all, who cannot be fired because only he wrote all the COBOL integration points in 2012 and won’t document them because he knows that … you will then fire him.

This is how I think life plays out at CRM, NOW, SAP, MSFT, MDB, WDAY, you name it. 1980s/1990s-era enterprise software vendor? Toast unless they automate the developer- and integration function. So it’s a choice for them.

But ADBE?

ADBE doesn’t really automate business processes in the way that enterprise application providers do. It provides tools to creative professionals who don’t mind spending the big bucks so that their work looks, well, professional. So is it immune? I think not. I think that the problem ADBE has is that AI is deflating what it means to be a creative professional - accelerating a trend that is already in motion. Today the creative guilds are already on the back foot. Anyone can be a journalist, a photographer, an author, an illustrator, a producer, a movie-maker. Semiconductor makes the production possible and YouTube and other platforms make the distribution possible. And when guilds are on the back foot, put there by technology, they never recover. Can you think of one that has? ADBE’s end market is under threat in my view; the number of professionals to whom the company can sell will decline and the budget available to them will also decline. And if you are a newcomer to creative-land, your software budget is going to be Figma-sized, not Adobe-sized.

I am not sure that this opinion shows up in the numbers yet. I can point to slowing revenue growth and in particular to slowing order book growth (RPO dropped vs. the prior quarter for the first time in three years - that’s not a good look). But this is just one quarter, so let’s see how this plays out. Want to know the bull case for Adobe surviving this existential threat? It’s that Adobe has been under serial existential threat for, oh, about 40 years since its establishment in 1982 as a printer software business. And whilst CEOs have come and gone, the commitment to re-invention has remained. This is why, of course, the company tried to buy Figma for some $20bn (or about 1 Zillion Times Revenues) last year - only to be nixed by the FTC/DOJ. The deal may not have progressed but what it tells you is that the company is well aware of its challenges and is happy to use a capital-bazooka to fix the problems. (The exact opposite of the proposed $CRM / $INFA deal which in my opinion is more like the Grandpas’ Get-Together At The Old Folks Club).

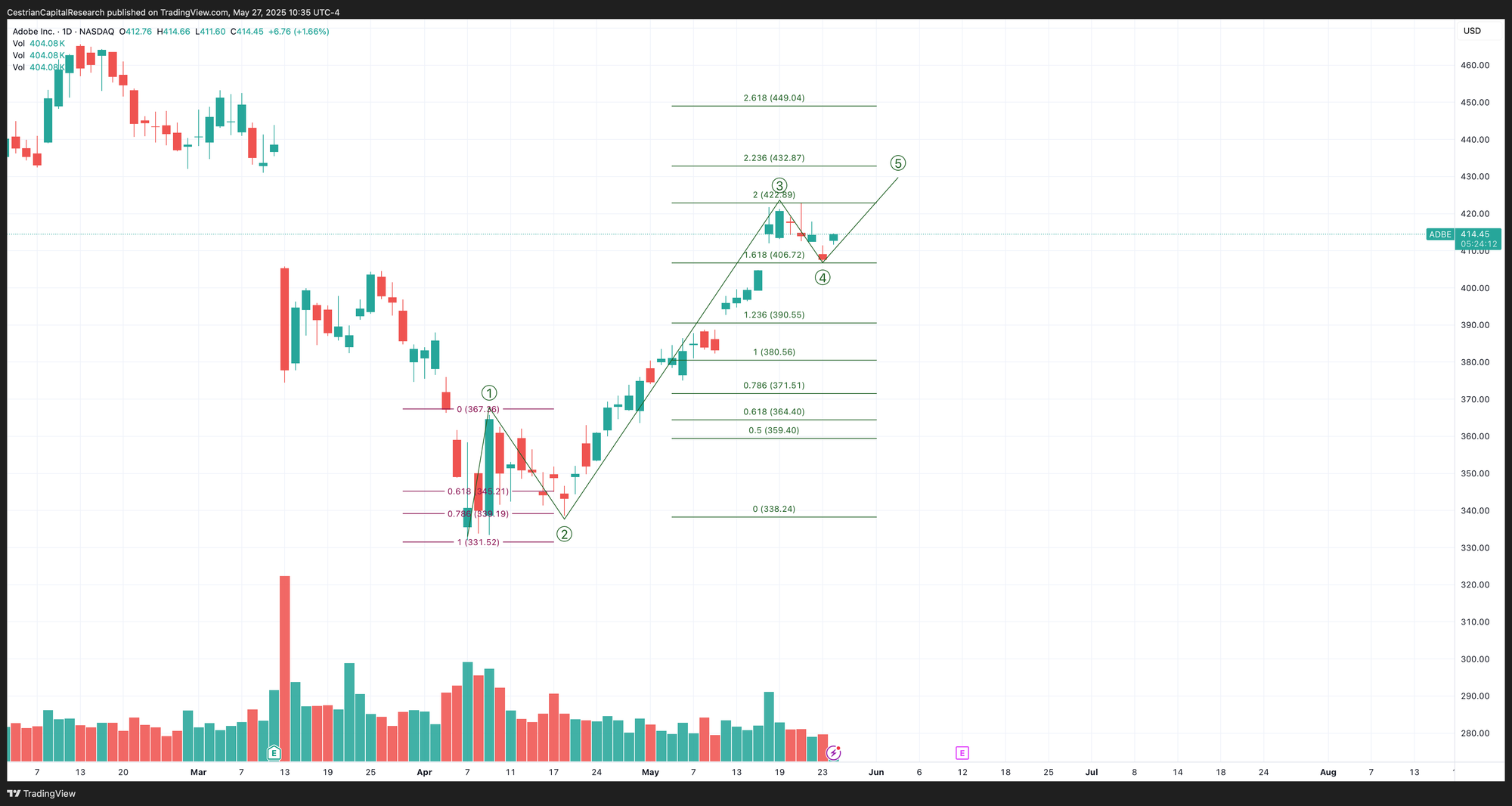

Anyway. Personally I don’t own ADBE stock and I don’t plan to - why take the risk? But if you want to place your faith in history and bet that the good people at ADBE can pull the company back from the abyss once more? Then the stock chart will give you succor. You can open a full page version, here.

The move up from the post-Liberation Day lows looks to me like a possible new, impulsive Wave 1 up. If so, we will see a partial retrace of that move in a Wave 2 down at some point. And if that Wave 2 low were to hold somewhere between the .5-.786 Fib retrace of the Wave 1 up - that would be a buy signal in my view. (If you’re a subscriber of ours, keep watching the updated charts to see if this happens). For now we rate ADBE at Do Nothing; if we got that Wave 2 retrace that held in that zone, we would likely move to Accumulate. Until then, plenty of stocks that one can buy that don’t have existential threats hanging over them.

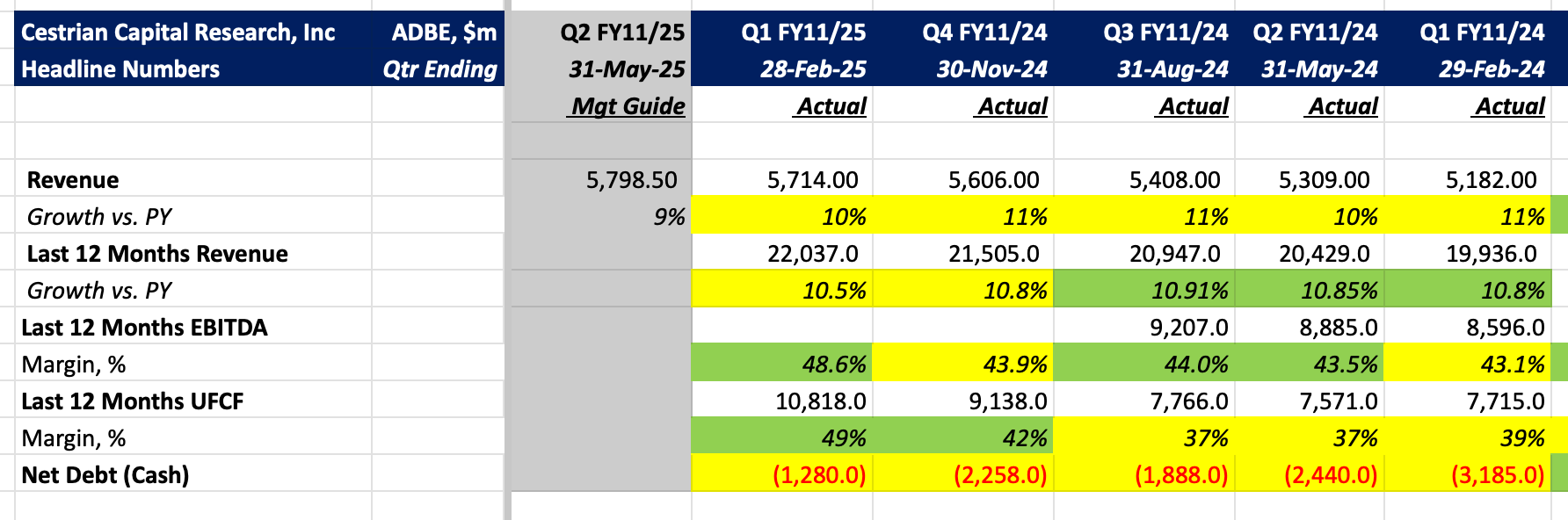

Here’s the headline numbers:

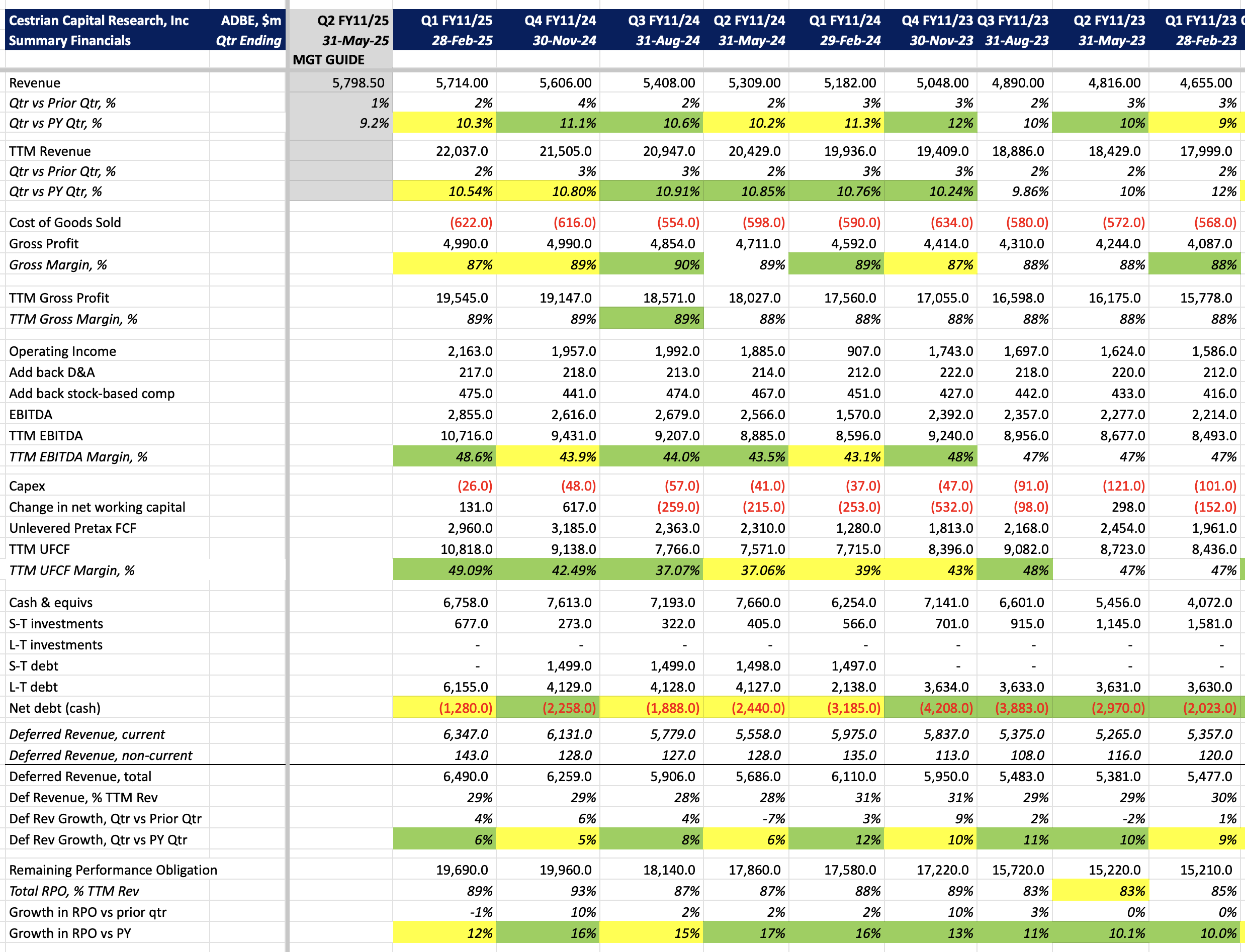

Now the details:

Like this note? Get more as a member.

Note that the guide is for further deceleration of revenue growth.

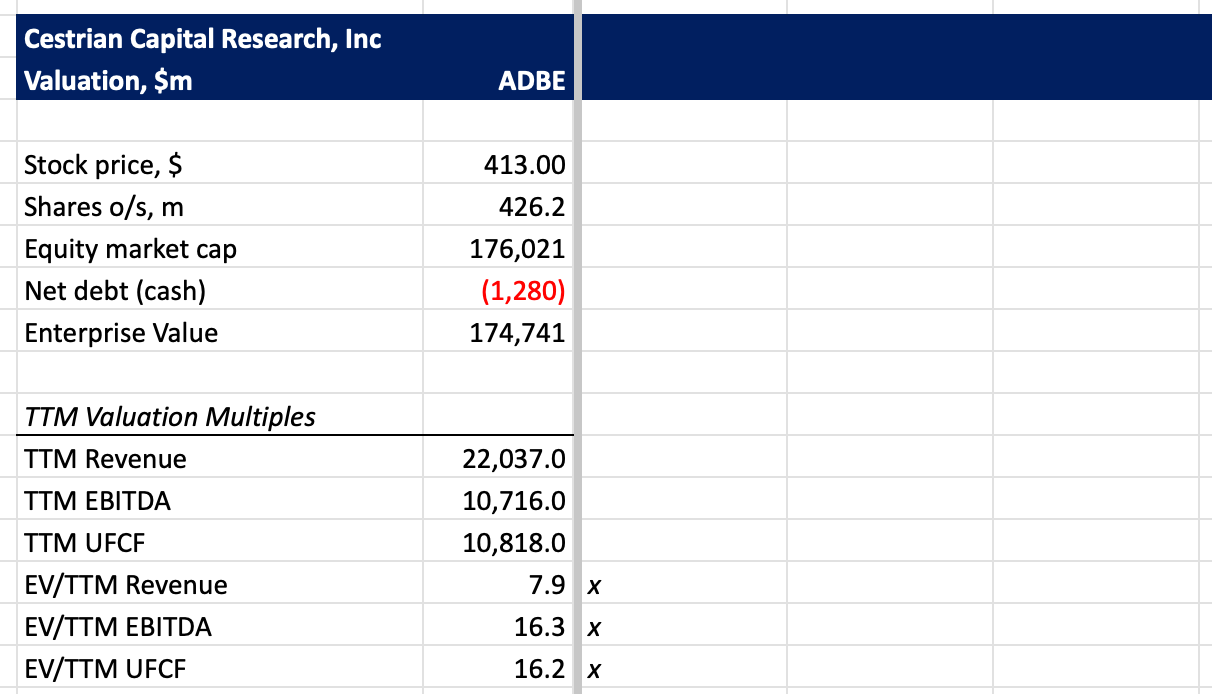

Valuation:

Not a screaming buy and not a screaming sell. More of a buy than a sell on valuation probably.

And finally, a very short-term chart. A break up and over $422 may see a new, smaller degree Wave 5 high - to be followed by a potential material decline corresponding to the larger Wave 2 discussed above. Ask us in Slack Chat if this is unclear.

You can open a full page version of this chart, here.

Thanks for reading our work!

Cestrian Capital Research, Inc - 27 May 2025