Zscaler Q4 FY7/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Agentic AI - The New Star of the Show

By Hermit Warrior a.k.a. Richard Iacuelli

I think its fair to say that the pivot from traditional cybersecurity (if there ever was such a thing) to AI-enabled cybersecurity is well underway, taking it's lead no doubt from the explosive growth in the use of AI tools, including OpenAI's ChatGPT, Google's Gemini and others. Zscaler ($ZS) is no exception, with CEO Jay Chaudhry illustrating the point in his Q4FY25 earnings prepared remarks:

Our ThreatLabz report revealed that AI/ML transactions on our cloud increased 3,500% in the past year.

Not quite as impressive, but still a significant indicator, mentions of 'AI' within cybersecurity vendors' earnings calls are up between 60% and 120% in the last 3 quarters (PANW, ZS and FTNT, just within the prepared remarks).

Putting their shareholders money where their mouth is, acquisitions of niche AI security providers have picked up markedly in recent months as the larger players look to fill gaps in their capabilities, and give credence to their rush to lock in customers to their specific platforms. Niche 'telemetry pipeline' acquisitions by Crowdstrike ($CRWD) and SentinelOne ($S) join bolder acquisitions by Zscaler, with Red Canary ($675M), and Palo Alto Networks ($PANW) with Cyberark (a whopping $25B).

Let's take a look at the headlines, then we'll explore how Zscaler intends to leverage the ongoing growth of AI to drive future revenue growth.

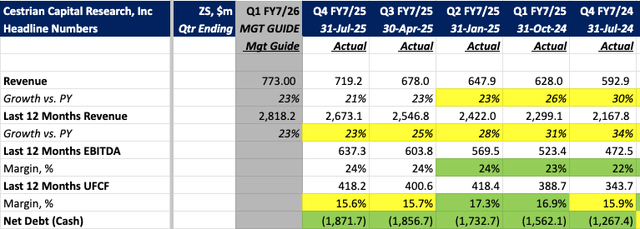

Q4 revenues grew by 21% year-over-year, beating the 19% guide by 2% - a little less than the 3% beat in Q3. The forecast for Q1 is for growth to re-accelerate to 23% - with a similar guide for FY2026 - which is notable because, assuming they beat the forecast (in line with our assertion that they are becoming more capital-markets-savvy by under-promising and over-delivering) we may see growth in the ballpark of 25%, a marked improvement from recent quarters.