ASML Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Will The Dam Hold?

$ASML is, as everyone knows, one of two pillars upon which the entire future of the world depends. If you don’t have ASML machinery, you don’t have extreme ultraviolet lithography, and if you don’t have EUV, you don’t have fancy semiconductor chips, and if you don’t have fancy chips, you can’t have nice things. Like that. (The other pillar is Taiwan Semiconductor $TSM, which we will be talking about soon enough as it’s now earnings season).

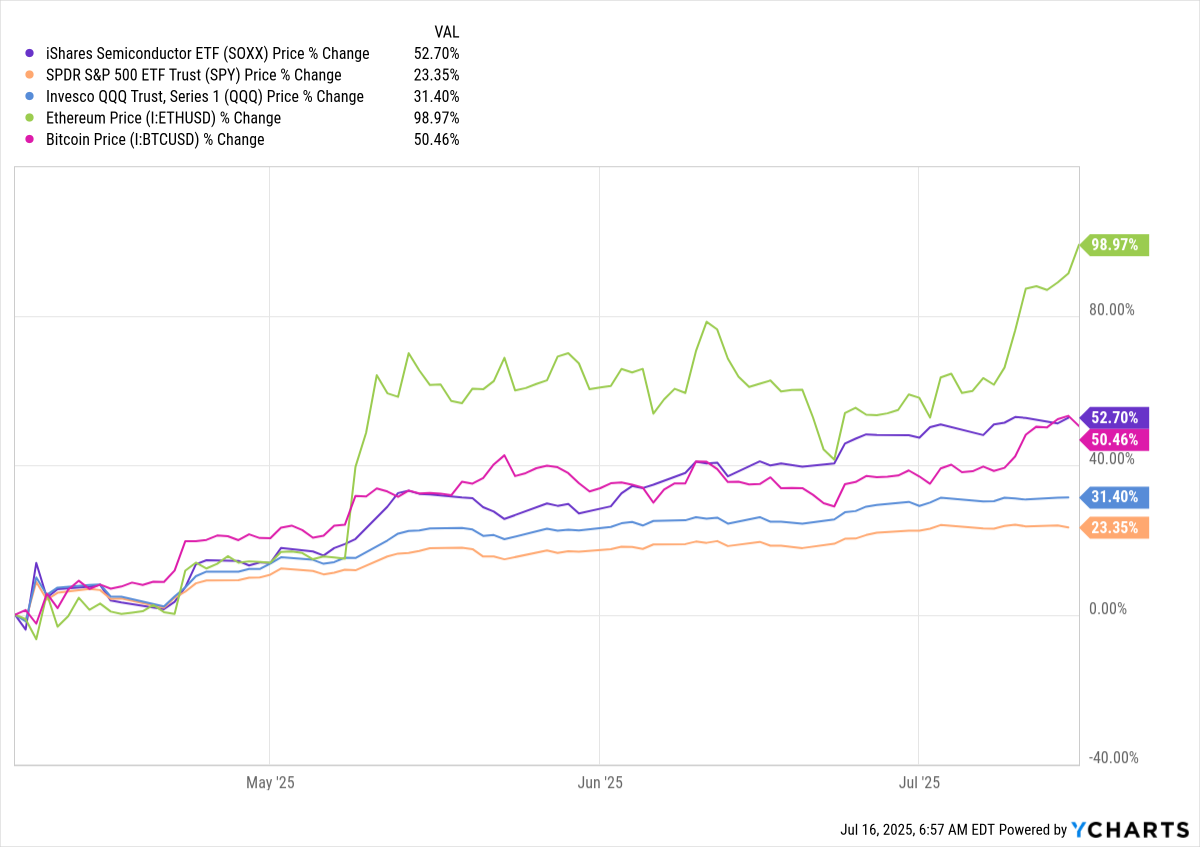

Semiconductor has had an extraordinary run up since the April 7 market lows. The $SOXX ETF achieved a trough-to-peak run of almost 70% in less than four months, as you can see here.

Semiconductor has, in fact, hogged money since those April lows, easily outpacing the S&P and the Nasdaq and even just about eclipsing Bitcoin. Only Ethereum has performed better amongst Big Money-friendly asset classes.

(“Ethereum? Big Money friendly?” you say. It is now. And bigly. Read this.)

Here's the comparison since April 7th.

So, against that backdrop you can imagine that chip stocks have to really impress with earnings, because any weakness is likely to see large investors take gains and rotate out of the sector, taking gains at these highs, and rotating into other sectors currently bumbling along un-noticed at the lows.

Well, ASML’s numbers today were good, but not blowout good, and you could say the same for the guide. This is a stock which in any kind of secular bull market will go up over time, so if you take a Buffett approach to buy and hold, this is no particular time to dump ASML and run for the hills. But if you like to swing trade, and you got in early in this run up from April, you might consider protecting those wins, be that by taking some or all profits or perhaps using a single-stock hedging strategy.

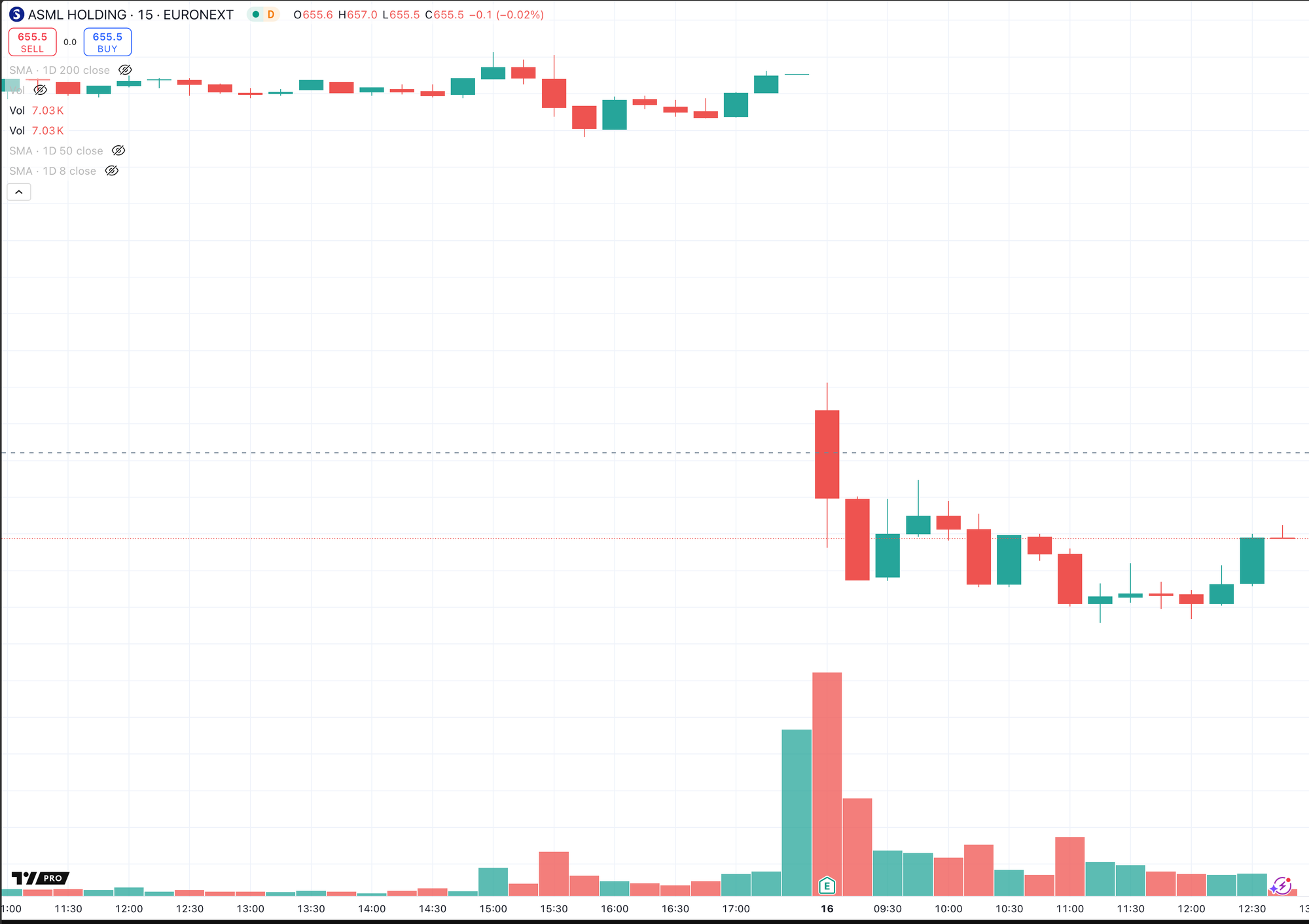

First, the stock reaction. Here’s ASML since those April lows. You can open a full page version of this chart, here.

The name is down 7-8% in pre-market trading; it remains to be seen what happens at the New York open but the early read does reflect trading of the stock in its native European market.

The reason for the drop? Well, the huge run-up in the sector and this stock itself is going to lead to a selloff at some point, for no reason other than that rotation logic. The ex post facto justification will include the phrases “slowing revenue growth” gross margin pressure” and, perhaps “reduced unlevered pretax free cashflow margins”. (Just joking. Nobody cares about pretax UFCF margins in a bull market).

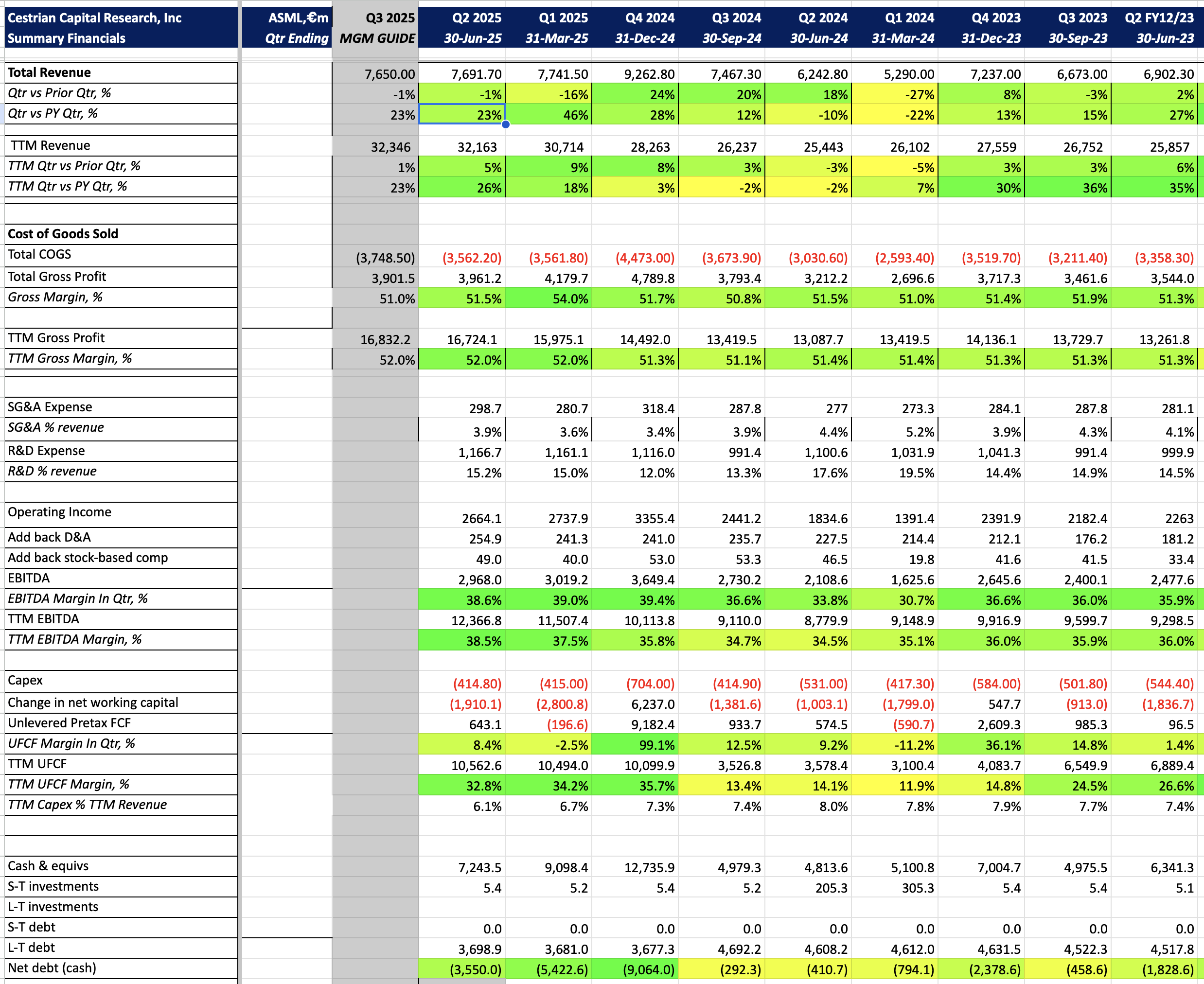

Here’s the numbers anyway so you can tick the issues off on your bingo card when CNBC et al cover the story later today. The color-coding, by the way, is on a heatmap basis. Something very good = deep green. Good but less good than it was = lighter green. Ungood, yellow. Doubleplusungood, deep yellow.

Valuation? Remains punchy but then it is one of the two pillars of the free world, so it’s going to be punchy isn't it? Around 8x TTM revenue, 20x TTM EBITDA, 24x TTM UFCF.

Buy it now? That’s a question of, do you feel lucky, punk. We’ll be talking about ASML a lot in our Inner Circle chat today.

Cestrian Capital Research, Inc - 16 July 2025