Crypto 2.0 - This Time It Means Business

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

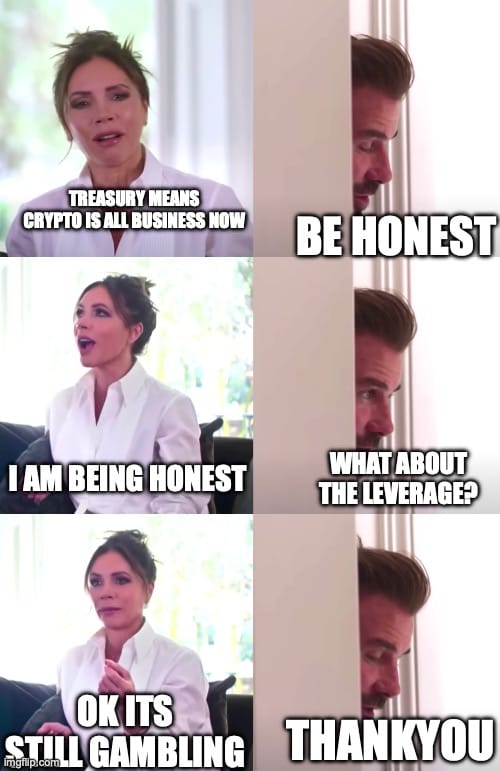

If It Has A Use Case, It’s Not Gambling. Right?

Crypto has grown up.

Bitcoin first surfaced in around 2009 following its apparent creation a year earlier. If this is new to you, it’s worth reading a basic history on Wikipedia and then, if you want to get really into the detail and the arguments as to why Bitcoin has real utility, take a look at Broken Money by Lyn Alden.

In essence, however, aside from the obvious advantages for the unbanked (because they are poor) and the won’t-bank (because they are criminals), the utility of Bitcoin has been not obvious. More obvious has been its gambling benefit. It is a limited-supply commodity that trades just like a commodity except with greater momentum and much better memes. The whole “get rich quick” theme that surrounded crypto in general and Bitcoin in particular during the Gamble-From-Home era in 2020-21 left a few people very wealthy but a lot more people very rekt (that’s crypto for poor).

Two things have happened in crypto which mean we now include coverage in best work.

- The Administration changed, and with it the generally skeptical view of crypto has given way to a generally positive view. As always everyone will have their own political opinion on this change; as always we don’t care in this service. We are just looking for Number Go Up, or Number Go Down. If Number is likely to be banned and can no longer be traded, that’s no good for us. This Administration is pro-crypto which means the policy backdrop is supportive of the proliferation of crypto. That’s good for liquidity and that means our tools can start to work.

- The coming tokenization of assets. The asset management industry is very excited about the opportunity to re-issue, re-package, re-package a world of assets, from the already-liquid (single name stocks) to the utterly illiquid (major artworks or real estate) as well as, crucially, the stuff in between (esp. private funds where current sources of liquidity are a little thin on the ground). “Tokenization” just means the creation of a digital record of shares. The creation of the joint-stock company was tokenization. Being able to own a property between multiple parties was tokenization. Everything is token. What’s new is that the standard upon which the asset register is held is the Ethereum blockchain, which uses the Ether cryptocurrency to pay the gas bills. (Literally).

This means that crypto is, or is becoming, all-business.

Kind of.

Today we add crypto coverage into our Inner Circle service, for no additional charge. If you’re already an Inner Circle subscriber, you can just do nothing and you’ll start to receive the content, which will be:

- A long-form newsletter published a couple times a week when there is something to say.

- Technical analysis of the top cryptocurrencies that actually have use cases - specifically the Bitcoin, Ether and Solana complexes, including the associated Crypto Treasury Companies like Strategy, SharpLink, BitMiner Immersive and so on.

- Trade disclosure alerts whenever Cestrian staff personal accounts place trades in covered instruments.

If you’d like to join our Inner Circle service, you can do so here.

Cestrian Capital Research, Inc - 14 July 2025

DISCLOSURE - Cestrian Capital Research, Inc holds positions in, inter alia, $IBIT $ETHE $SBET $BMNR $BTCS $SSK.