Market On Open, Friday 21 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

But Is It All Over Tho

by Alex King, CEO, Cestrian Capital Research, Inc

Although everyone has now flipped Fearful Bear, the facts of yesterday remain.

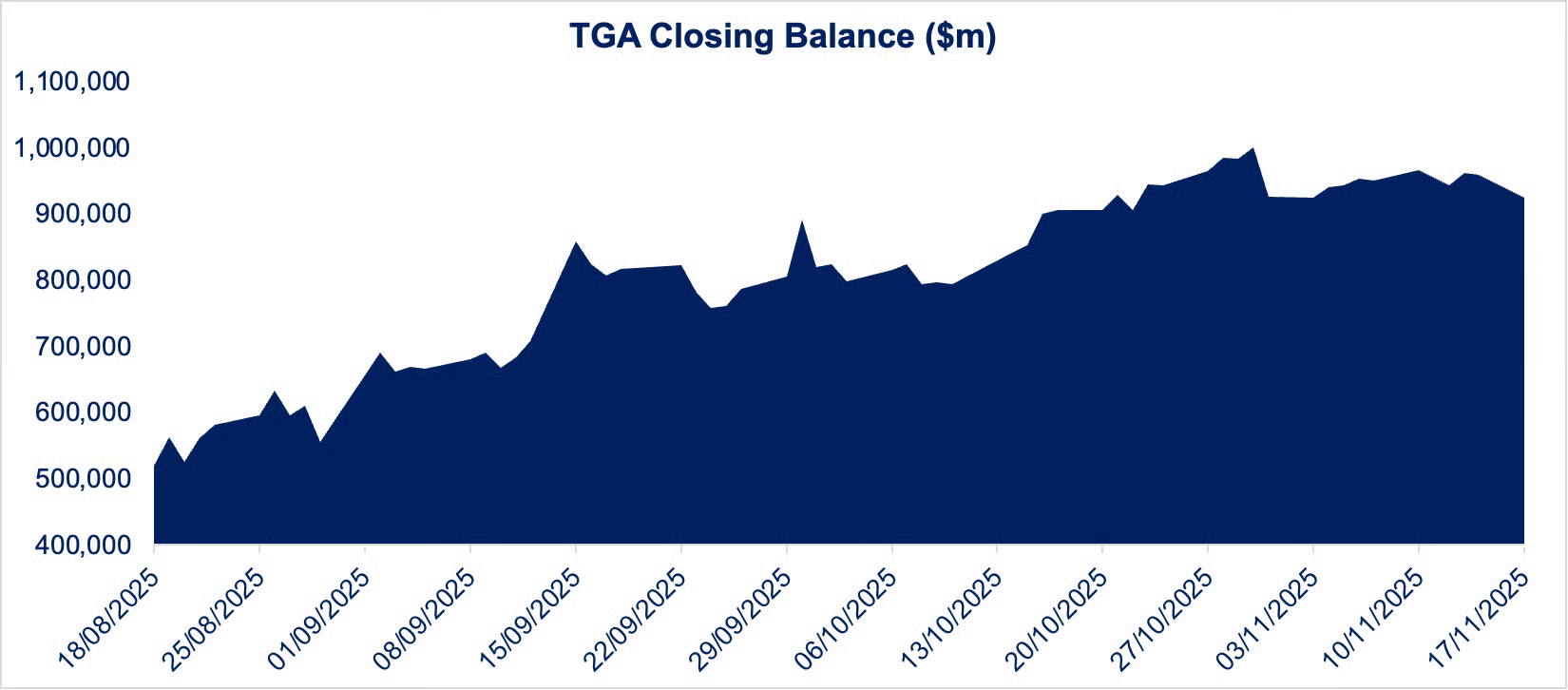

Federal liquidity is rolling back into the banking and brokerage system. To repeat as noted by Yimin on Wednesday this week:

“The good news is that TGA is now starting to move lower, meaning the government is spending cash on its reopening.On Monday, TGA moved from $959 billion to $925 billion, a notable one-day spend. If continued, which it should, we could see liquidity flowing back into the markets soon.”

And I am going to ask you once more to read another take on this macro picture, from Alan Longbon, who is low-key one of the best macro commentators around.

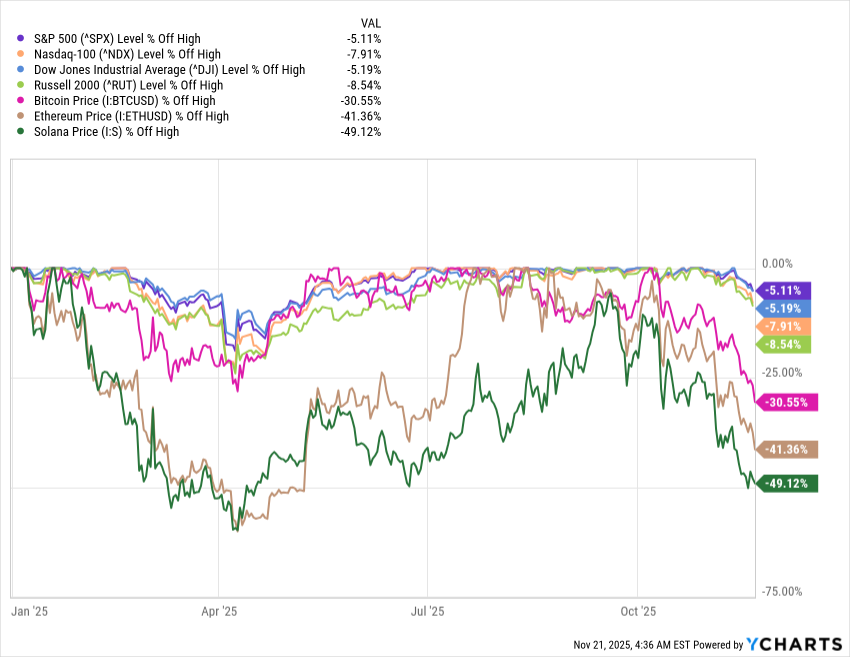

These are the facts - money coming into the system. In addition, whilst crypto is hurting, the indices have barely a flesh wound.

If you are finding market volatility difficult to navigate - and if you aren’t, I salute you - then I suggest you sign up to one or more of our algorithmic signal services. We offer two families of algos; the SignalFlow AI family, developed by Jay Urbain (a computer scientist and statistician by background) and the YX Insight s family, developed by Yimin Xu (a rates market maker by background). You can learn more here:

SignalFlow AI Algorithmic Trading

YX Insights Algorithmic Trading

Join The Cestrian Inner Circle

As a member of our Inner Circle service you’ll receive a full market analysis note every day in your inbox, earnings reviews on 50-60 stocks through the year, you’ll join a real-time grownup, all-business chat community of investors and traders (it’s a Chad-free zone by the way), a weekly live open-mic webinar and of course trade alerts whenever Cestrian staff personal accounts place trades in covered stocks & ETFs. Doubt me? Check our reviews.

OK. Let’s get to work - our daily Market On Open note below covers yields, bonds, equity indices, sectors, oil, gold, Ether, Bitcoin and more, as always.