Market On Open, Monday 14 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Trade Wars: The Next Chapter

by Alex King, CEO, Cestrian Capital Research, Inc

First of all, happy quatorze Juillet for those who celebrate.

And on the subject of Europe, the news on Saturday was this:

And, naturally, this:

Usually after a big rally, some sort of catalyst is needed to post-hoc justify the profit-taking that was going to happen anyway. I don’t know if this will prove to be the post-hoc explanation or not, but I do know that if equities correct a little, they had already started to do so, and I also know that since it’s the 14th of July it is not the 1st of August and so to quote the most bullish of bull fraternities, the “Nothing Ever Happens Bros”, er, nothing has happened yet. It might happen, and that’s what commentators will claim to be worried about, but nothing has happened yet.

I don’t think that any such tariff back-and-forth is likely to affect the underlying strength of the equities market, meaning the outlook to year end remains bullish for the S&P500, the Nasdaq and the Dow for me. But I would not be surprised to see a lot of talking heads now come out to say such bullishness was now in jeopardy, etc. If so, one has to be prepared and have a plan for what to do if a near term correction comes.

In 2025 to date, the optimal reward to stomach lining ratio has been achieved by, er, doing nothing. Just hold your stuff and play golf, or go to work, or whatever it is you have to, need to and/or want to do all day. As long as you owned the S&P or the Nasdaq, this has worked out fine. (Single name stocks may be up or down of course, and as a 30-stock index the Dow is suffering in comparison due to blows inflicted by United Health and Apple).

If a correction comes, you have a number of choices:

- Ignore it and hope the bull has further to run - that can be fine if you are unlevered, own the indices, and own them via common stocks or ETFs not options or futures.

- Avail yourself of some downside protection by way of index puts, which are cheap relative to their own pricing system at the moment due to the very low Vix.

- Hedge your holdings in full or in part with inverse ETFs.

- SELL EVERYTHING AND HEAD FOR THE HILLS. IT’S THE BIG ONE. BRING CANNED WATER!!!!

You will decide which of those apply to you. I hope our analysis helps you to make the right decision.

Before we get to our market analysis, please do take a moment to read about what is happening in crypto. It affects all investors, whether they invest in crypto or not. In short, blockchain technology finally found a use case beyond gambling, and it’s a big use case: tokenization. Read on. (Really. Don’t skip it, even if you think crypto is for degenerates. Because I have news. The degenerates are about to deflate the asylum).

The New Belief System: Everything Is Token

Larry Fink, the CEO at BlackRock, thinks he is about to get rich on tokens. Not a little bit rich like he has on stocks. But really rich this time. Here’s why:

US 10-Year Yield

This pattern is holding up, despite a big move up in the yield at the end of last week.

Equity Volatility

We can all come up with arguments as to why the Vix should pop, but so far it has not done so in any meaningul way for 2-3 months. So it would need a catalyst and so far (considering Vix futures which are up a couple points only this morning) it doesn’t seem like the EU / Mexico / US tariff story is enough to cause that. As always - one should trade the market that actually exists, not the market in one’s own head.

Disclosure: No position in any Vix-based securities. Long some puts because no-one is worrying so … it’s probably a good time to start worrying.

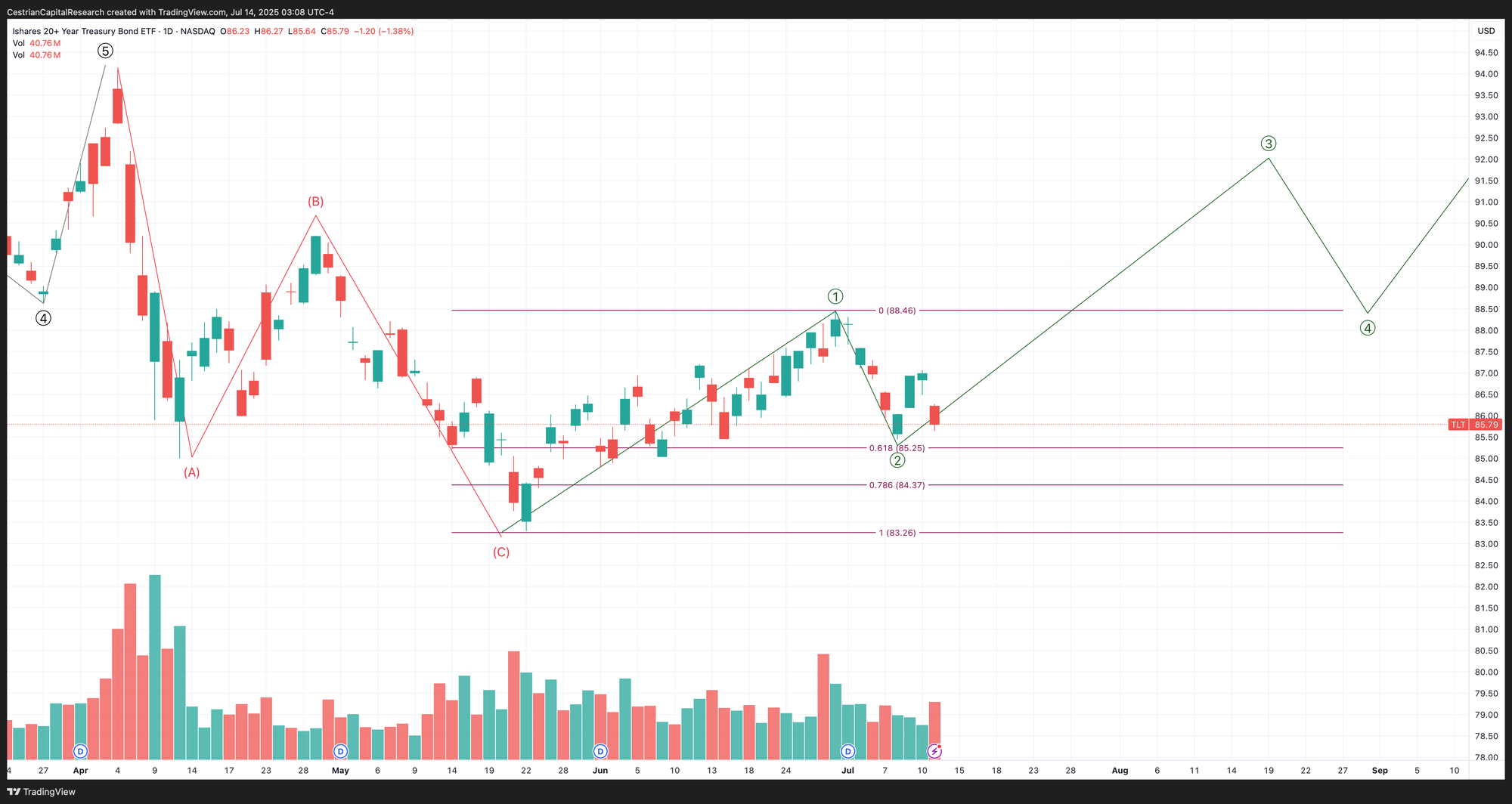

Longer-Term Treasury Bonds (TLT / TMF)

Took a beating on Friday but the long-term outlook remains strong in my view. (There was some noise in the EU recently about something that could one day become a pan-EU bond. Should that ever become a reality, and it is a long way away today, then I might start to have some concerns about US treasuries, because that would be a credible alternative home for some capital currently allocated to USTs.)

Remains bullish on the daily too. Below $84 is a concern for the bull case; above $89 is supportive for the bull case.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Below $34, bearish; above $40, bullish.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

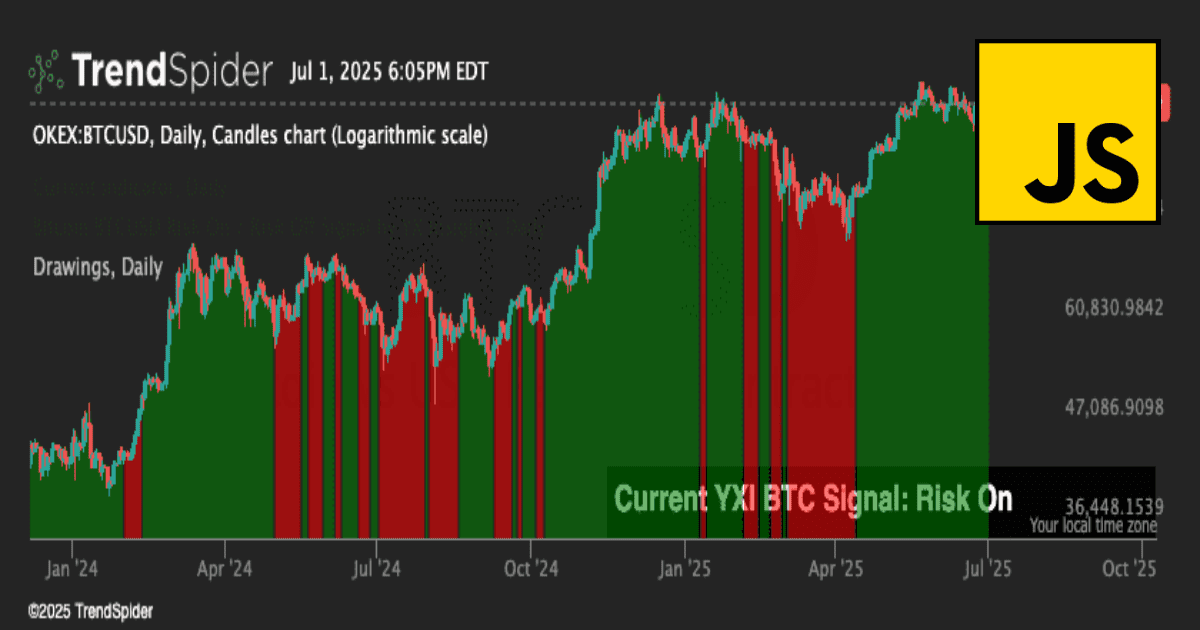

Bitcoin

Up, and going more up in my view.

NEW! We now offer Bitcoin risk signals. Risk on means the algo thinks better to buy (or hold if you already bought). Risk off means the algo thinks better to sell (or stay in cash if you already sold).

You can access our Bitcoin risk signals in two ways

- As Slack alerts - learn more here

- As an indicator within your TrendSpider environment.

You can view the Cestrian Algo Store on TrendSpider by clicking below or here.

Disclosure - I am long $IBIT.

Oil (USO / WTI / UCO)

Still rangebound in this wedge. Wedges often resolve with some violence and it is hard to predict in which direction, so, if you own oil, be ready.

Continues to look bullish on this timeframe.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Ditto.

Disclosure: No position in oil.

S&P500 / SPY / ES / UPRO

I don’t think the bull train stops in this Chicken Bull zone. I think it pushes higher to at least the Fairly Bullish zone. That doesn’t mean in a straight line so, as always, know your timeframe.

ATH last Thursday, a modest down day Friday, let’s see if Trade Wars II does give air cover for a selldown.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same as for SPY.

Disclosure: I am long $IUSA and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / NQ / TQQQ

Still bullish looking to year end. I think the question is whether the QQQ puts in the final move up to complete a Wave 3 on this timeframe at the 1.618 extension (a ‘natural’ place for the bull move to end) or not. My guess is that it can do so.

If momentum picks up, ie. if the MACD climbs back up and over the level struck at the May highs, we’re likely in for another push higher. Until then, short term risk is to the downside I would say.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Let’s take a look at both the levered-long (TQQQ) and levered-short (SQQQ) takes on the Nasdaq. Here’s TQQQ as usual; it follows QQQ with extra volatility of course.

And now the short side, SQQQ.

The volume ramp, MACD and RSI turning up, is all indicative of either nervous traders hedging out, or institutions preparing for a Q3 correction which can be used to protect gains then sold at the lows to release funds to roll back into long positions.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ and have $TQQQ and $QQQ puts for September expiry. Overall broadly neutral the Nasdaq but significantly net long growth equities.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.

Alex King, Cestrian Capital Research, Inc - 14 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, XLK, IBIT, TLT, TMF, DTLA; also long SOXS calls and September TQQQ, QQQ and SPY puts.