Market On Open, Monday 28 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Largest Deal Ever Made

by Alex King, CEO, Cestrian Capital Research, Inc

All news is good news right now, or in other words, we’re in a bully-o-bull market. Nothing stops this train.

At the weekend a trade deal was agreed between the US and the EU, which will be cited as the reason why equity futures are on a tear at the time of writing. In truth though, I think we are in an unusual kind of FOMO rally at present. If the data circulating is correct, retail investors have front-run institutions and funds insofar as bigs were fearful at the April lows, but retail jumped in, bought, and held. Normally when this happens, retail is humiliated and impoverished when the inevitable giant rug is pulled from under them. This will happen this time around too - it always does - but so far the rally from the April lows has extended so far that it seems to be professionals who are suffering FOMO and jumping in.

This is odd. So let’s think through why it might be, and what may happen.

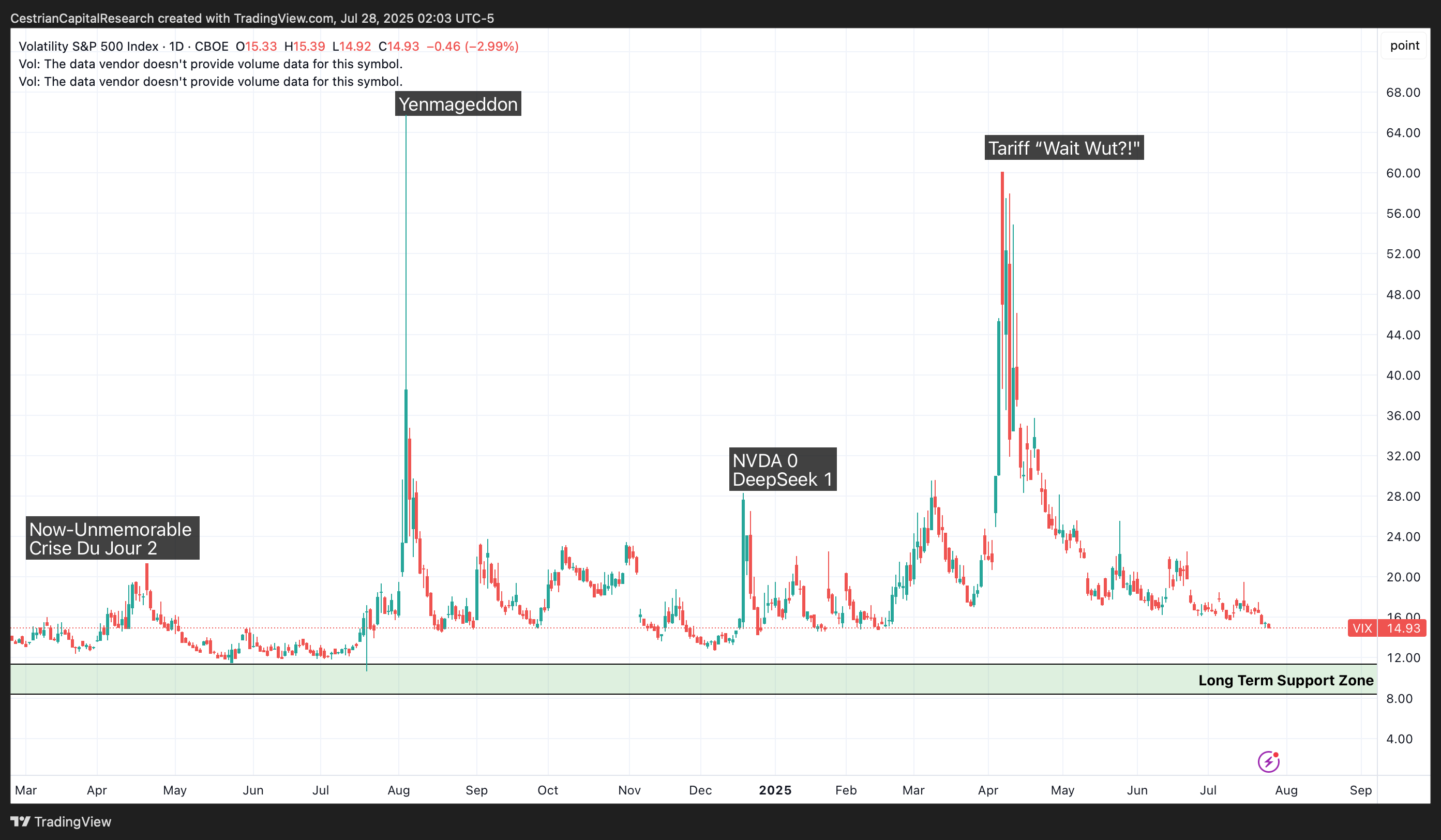

I suspect that the investing public, educated by the Yenmageddon Crash That Never Was in August last year, further emboldened by the subsequent DeepSeek Death Knell For Nvidia That Wasn’t, decided that the equity dump following Liberation Day was just another big ole dip to buy. And they did. Buy it. Whereas investing professionals, schooled with the finest degrees from the toniest schools, had no framework within which to analyze the changing global trade environment; they decided that this was Very Scary Indeed because of being The Great Unknown, and sat on their hands with their money stuffed in locked boxes beneath their feet. They then disbelieved the ensuing rally, either have not joined in or have done so halfheartedly, and are now staring down the barrel of a Very Bad Performance Review come the end of Q3.

I have a couple things to say about that.

Firstly, global free trade is the exception in history, not the rule. You can be a pro-free-trader, you can be pro-protectionism, doesn’t matter, the facts are that until GATT was remodeled as the WTO and China ushered in, world trade was defined by endless tariff- and non-tariff barriers. And even after the implementation of the WTO methods, tariffs were still the rule not the exception. So to freak out about the imposition of new tariffs is to fall for the shock and awe not the reality. Which you would think is behavior that retail would exhibit, not professionals. So why was that?

I think the answer might be age of decisionmakers at Big Money. I would wager (and have wagered!) that anyone who was running money - sizable money - before the late 1990s was not wrongfooted by the April lows. But if you joined the party later and all you knew was a unidirectional history of liberalization, a sort of teleological interpretation of history wherein everything in world trade was progress towards a glorious finale of truly free trade, then, zoweee, your world just got rocked and you still don’t really know which way is up.

Sometimes in trading and investing, brains and imagination can work against you. This is the famous “don’t be mid-curve” meme of course. If you have brains and imagination, the best thing that you can do is be aware of how much this opens you up to biases of the mind and therefore investing mistakes. And you have to develop methods to solve for this.

If you assume that you are probably wrong in your interpretation of what effect on prices will be caused by something in the real world, then you are more than halfway there. Then you need an actual execution method to deal with it.

There are at least two good methods that I have found. The first involves consciously overriding your own opinions, and the other involves machine logic.

Manual Override

If you choose to run money according to your own analysis, you are going to be wrong, a lot. So you have to learn to change direction quickly when necessary. You can use hedging to always maintain two shots on goal, a rod on either side of the boat to pick up the fish whichever way they swim. I’ll give you a worked example. I personally was wrongfooted some by Liberation Day in a different way to the above. I watched the market put in a bullish setup into the event and when the Administration first announced a blanket 10pc tariff, the Nasdaq promptly jumped 1% in post-market trading. Wonderful, thinks me, I caught that right. Then out comes the Reciprocal Tariff Board. I, like much of the market, looked at it for half an hour or so and decided that, well, of course that wasn’t going to happen, that it was positioning ahead of negotiations, and it could be ignored. And I was right, if you zoom out; the lows are waaaay in the rearview. But I was wrong in the very short term and so, having missed the dump, I had to massively over-hedge long to escape the gravity well of my own making. And that worked just fine. Lately I have also been wrong; all normal technical charts of any method you choose tell you that a short-term pullback is about to happen in equities. So I wound on some short hedges to catch that drop. Reader, there has been no drop. So do you stick with being wrong, or do you course-correct? You course-correct if your mind is free. So I have been over-hedging long to catch the upside; the short hedges blunt the upside some, but it’s working fine for me overall. I’ve been taking some gains on the way up too, so that when the turn comes, those short hedges will have some power. All this is logical and not psychologically painful if you know you’re going to be wrong a lot. But if you think you’re mostly right? Yikes. You’re going to lose a lot of money.

Machines

Want to know a lower-stress way to handle weird price behavior? A well-oiled machine, that’s what. Compare and contrast the above labor-intensive process with the following in our AI-driven signal services. (1) In February our SignalFlow service flipped risk-off in the S&P and the Nasdaq, and missed almost all the dump. Remember the market was already in a correction before Liberation Day. (2) Early on in the recovery, all our signal services flipped risk-on and have mostly stayed that way, with the occasional “hmm” from the machines seeing them take a breather for a couple days here or there. Yimin will tell you that his Bitcoin signal service has stayed bullish - correctly - for way longer than his own technical- and macro- analysis would have.

Machines remove the I-have-too-many-degrees-and-too-much-pride-and-imagination error category from trading and investing. They make some other errors of course, but since that “I’m RIGHT Dagnammit” is the biggest error most people make, and since most people are emotionally incapable of turning their positioning on a dime, machines are a wonderful tool to have at one’s side.

Choose Your Fighter

We teach the manual hedging method all day long in our Inner Circle service which comes with Cestrian staff trade disclosure alerts (before the trades are placed of course) too.

We offer machine signals now across a slew of assets - the S&P500, Nasdaq-100, sector ETFs, Bitcoin, Ether, Solana, and key crypto sector stocks. We have two families of algorithm on offer. Take a look. Sign up if you like what you see, but don’t sleep on this stuff, for it is the future which has already arrived.

OK.

Let's get to work.

US 10-Year Yield

Still tracking down. Between the hinted-at “yield curve control” (ie more targeted QE) and the likely rising demand for Treasuries as collateral for stablecoins, I think the demand for US government bonds is going to remain robust, contrary to the “America Is Finished” narrative.

Equity Volatility

The Vix will spike, it always does, but as you can see, in between spikes there are often long periods of calm when the “Nothing Ever Happens” bros are running the narrative. As now.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Wake me up when the EU issues a pan-European Treasury bond. Until then I continue to believe that US Treasuries will act as the preferred store of value, and for that reason I am long $TLT and other such names.

W3 ongoing. As of Friday’s close, TLT is over the 8-day SMA, the 21-day EMA, the 50-day SMA, and just has the 200-day SMA to go. Lot of people asleep on this one in my view.(*)

(*) and if I’m wrong … see above for methods to course-correct!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Sat right beneath the 21-day EMA. Has to break up and over it to be bullish but if it does, we may see a Wave 3 up in a leveraged name here.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

Ether

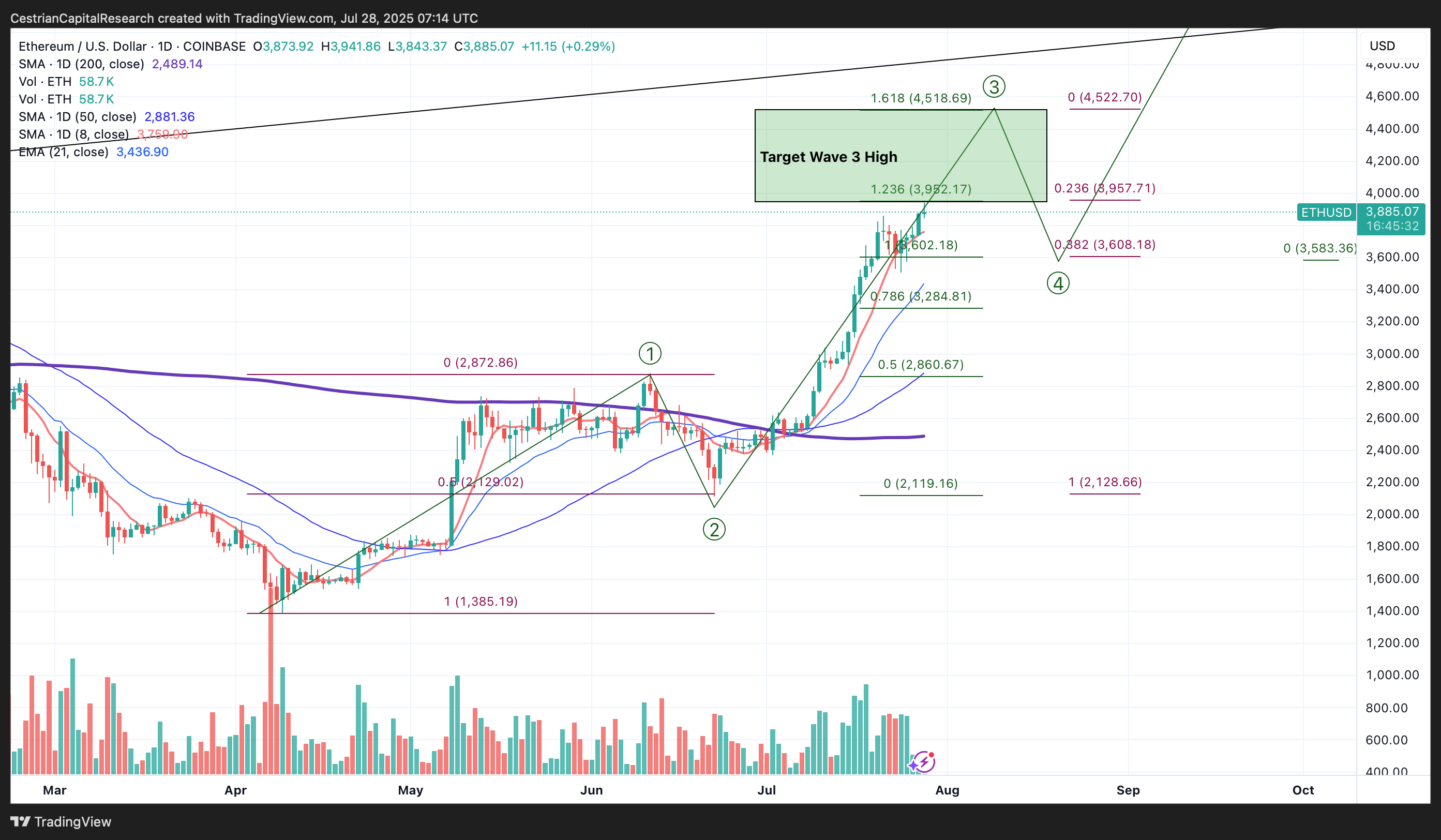

Just entering a potential Wave 3 topping zone. Most likely it carries on higher from here but if you own Ether, and I do, you might start to watch price a little more closely than normal right now.

Get Big Money Crypto.

Disclosure - Long $ETHE and others in the Ether complex.

Oil (USO / WTI / UCO)

Still within the wedge.

A break of $64 from above invalidates this bull case.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

I personally would watch CL_F futures in order to trade UCO; easier to study the underlying than it is the levered name itself.

Disclosure: No position in oil.

S&P500 / SPY / ES / UPRO

Nothing stops this train.

Above all moving averages shown, and still climbing in a slow grind up since May. Shorts are in pain.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UPRO is now up more than 2x from the April lows. There is some accumulation on the short side (SPXU) now for sure - let’s see if that proves prescient or just another failure of genius.

Disclosure: I am long $IUSA, long $UPRO, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / NQ / TQQQ

Insert runaway train comment here.

Exam Question: does declining momentum mean anything anymore?

We will know in a month or two, I suspect.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

On the left: the YOLO trade.

On the right: a couple goes now at accumluation on the short side. Spiking quite a bit now down here at the lows in SQQQ.

In the end, Big Money always wins. ALWAYS wins. So that runaway train? Look out for the creaky ole bridge a little way down the track.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, long and have $TQQQ and $QQQ puts for September expiry. Overall broadly neutral the Nasdaq but significantly net long growth equities via sector ETFs.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.

Alex King, Cestrian Capital Research, Inc - 28 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, UPRO, IUSA, SOXL, SOXS, SMH, XLK, TLT, TMF, DTLA, SDOW, ETHE; also long SOXS calls and September TQQQ, QQQ and SPY puts.