Market On Open, Thursday 26 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Plain Sailing, Until It Isn't

by Alex King, CEO, Cestrian Capital Research, Inc

Sailors, on the whole, are hard working sorts of people. And here I am not even talking about the brave folks who spend all night and all day on trawlers or freighters or tankers. And I am not talking about the performative types who land on a yacht bobbing around in the Med for couple days before heading back to land. I am talking about folks who for reasons best known to themselves decide to spend relatively large sums of money on a bathtub with a couple diesel engines and a big ole sheet tied to a pole and then use this to battle one of the most unpredictable and dangerous things on this Earth, being the ocean.

Oh wait.

Investors and traders … spend relatively large sums of money on a bucket of money connected to the Internet and then more money to draw some lines and then use this to battle one of the most unpredictable and dangerous things on this Earth, being securities markets.

The ocean will humiliate and destroy you if you don’t respect it.

The market will do the same.

When the going is good, as it is right now, and has been for as long as anyone can remember (since March/April this year was, like, hundreds of years ago!), most capital market participants forget that like anyone actually sailing a boat (as opposed to driving it), you can never stop watching the horizon, nor the sky above you, nor the water beneath you, nor the land off to the side of you, nor the boat itself, nor food and water supplies … you get the picture. You can never, ever relax. If at the end of a trading week you feel like nothing happened all week - then even if you didn’t place a single trade, you aren’t doing it right. Because even if you didn’t move from the spot, you weren’t concentrating enough. When the sun is shining, it’s going to whip up a storm soon. When the storm is lashing you so badly that you wondered why on earth you ever set sail, all you have to do is make it through and the sun will shine once more.

That’s if you are sailing solo.

If you have help, it’s different.

In our work here at Cestrian our goal is to ease some of the workload and emotional stress that comes with investing and trading. We try to help you see the conditions ahead and teach you how to react when the weather changes. We have a truly skilled group of analysts - all of whom invest their own capital into their own work - working together across multiple time zones, day and night, to help you perform better. We get things wrong all the time, of course; but we get things right a lot more often.

If you aren’t reading our work, try it. Start with our free content, which you can find right here:

And if you want to know more about what we do, just reach out here.

By the way - if you’re positioned incorrectly in the market, do something about it. Hedge; reduce a losing position; open a new position in something pointing the right way; something. Being wrong is an everyday fact of life in capital markets, it’s inevitable. The biggest winners in the market are wrong a lot - not being wrong a lot isn’t a differentiator, it’s not an edge. Changing your positioning when you are wrong - that is the edge.

Back to the weather for a moment. A great way to read what is coming down the pike for stocks and ETFs is to learn how options work. This I learned a few years back and I confess at first I was like Wait Wut? But as is often the case, one of our skilled community members (thankyou Karan1 !) suggested I go down this rabbithole to see what it held. And yea verily has it paid back. Rather than start from scratch, I would point you to the folks below as a way to read the weather better than most in the market. Which is another genuine edge!

Why Stocks Are Derivatives Of Options

A reminder: If you haven’t started to understand the options market, in order to become a better investor and/or trader of common stocks, you’re missing a major piece of the puzzle. Here’s three places to go to get smarter.

- Free - read Robert P. Balan’s work on X and if you like it you can pay him for the good stuff.

- Almost Free - our own Prof. Jay Urbain, Ph.D - learn about his options analysis here.

- Less Free - SpotGamma, whose founder Brent Kochuba opened my eyes to this structure beneath.

OK. Let’s get to work!

US 10-Year Yield

I don’t know what is going to happen in an hour or a day or a week in bonds or anything else. But I do know that the whole “US government debt is toxic waste” crowd might want to cast an eye at the changes to US bank capital requirements this week and its impact on their ability to buy US government bonds (spoiler alert, they can buy more). The 10yr yield continues to fall.

Equity Volatility

With the Vix bumping along at the lows (it can always go lower - but this is fairly low vs. recent history) I started to accumulate some index puts for September expiry yesterday. Baby steps to begin with. Options do have a nasty habit of going to zero so I tend to be pretty cautious with these things. As always such trades are disclosed ahead of time for our Inner Circle members.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Snorage. Literally the world’s most boring chart. Nothing ever happens. Right?

Well, something is happening in the shorter timeframe in TLT at least. Up and over the 50-day now, for three consecutive daily closes.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Also starting to put the 50-day in the rear-view.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Bitcoin

Whilst we’re on the subject of reading the weather. Bitcoin is now a pretty good proxy for general market risk. If you want a weather vane at your side to help you work out market direction, try our AI-driven Bitcoin signal service. This is not a crazy tool for crypto bros. It is a professionally developed market risk indicator that speaking personally I use every single day to help me judge market risk levels.

Bitcoin risk signals, here (independent investors) or here (investment professionals).

Disclosure - No position in Bitcoin.

Oil (USO / WTI / UCO)

That for all the world looks like it is going to resolve to the upside. Why would oil move up and out of that wedge? No idea. I don’t make the rules. I am long $USO though, buying after the Iran/Israel price drop; small potatoes for now, let’s see what happens.

That .618 retrace is holding nicely - also a bullish indicator.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am unhedged long $USO.

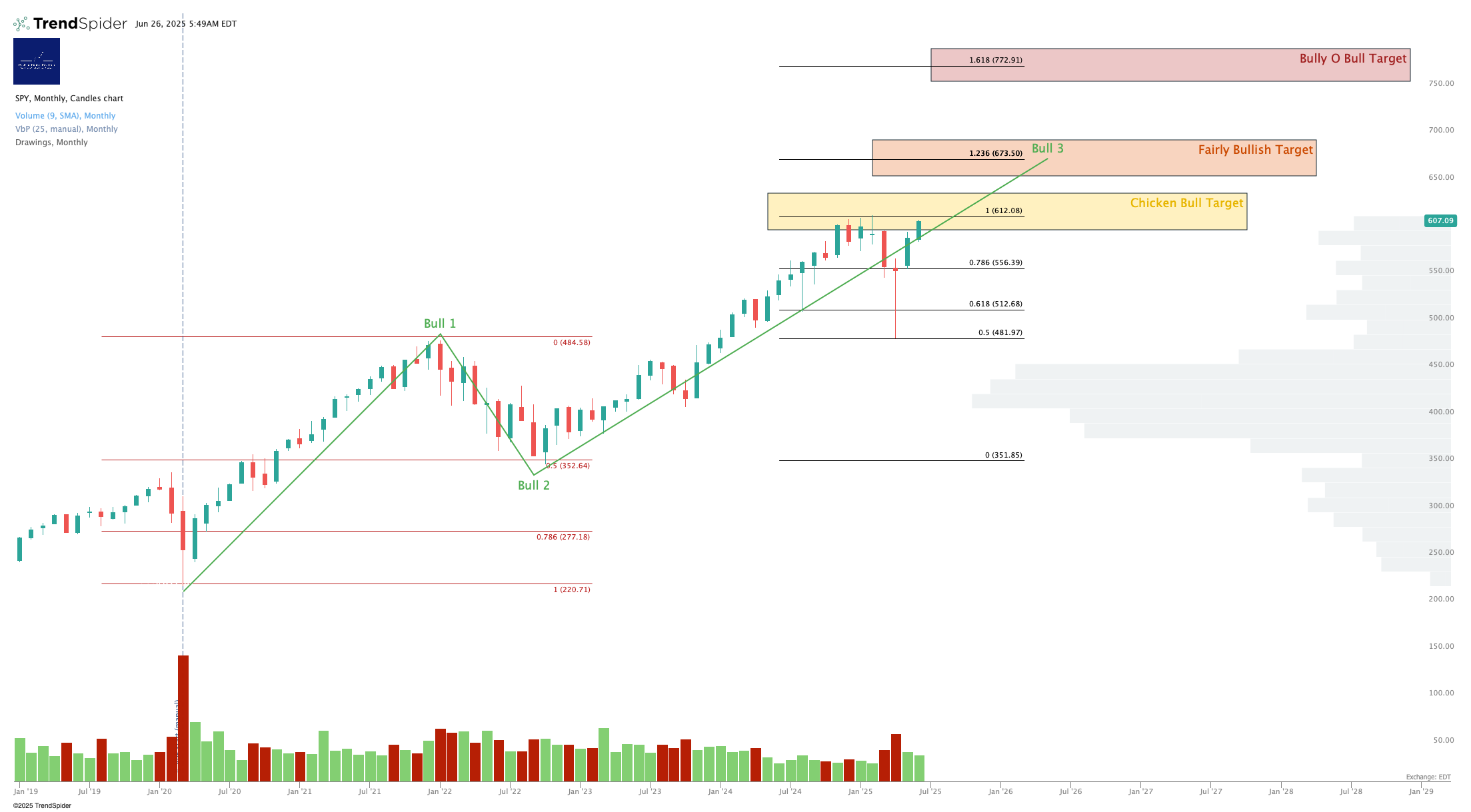

S&P500 / SPY / ES / UPRO

World’s second most boring chart.

Shows every element of a local top (price rising but momentum declining) except … it hasn’t topped yet!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same setup as SPY.

Disclosure: I am unhedged long $IUSA (EU UCITS S&P500 ETF)

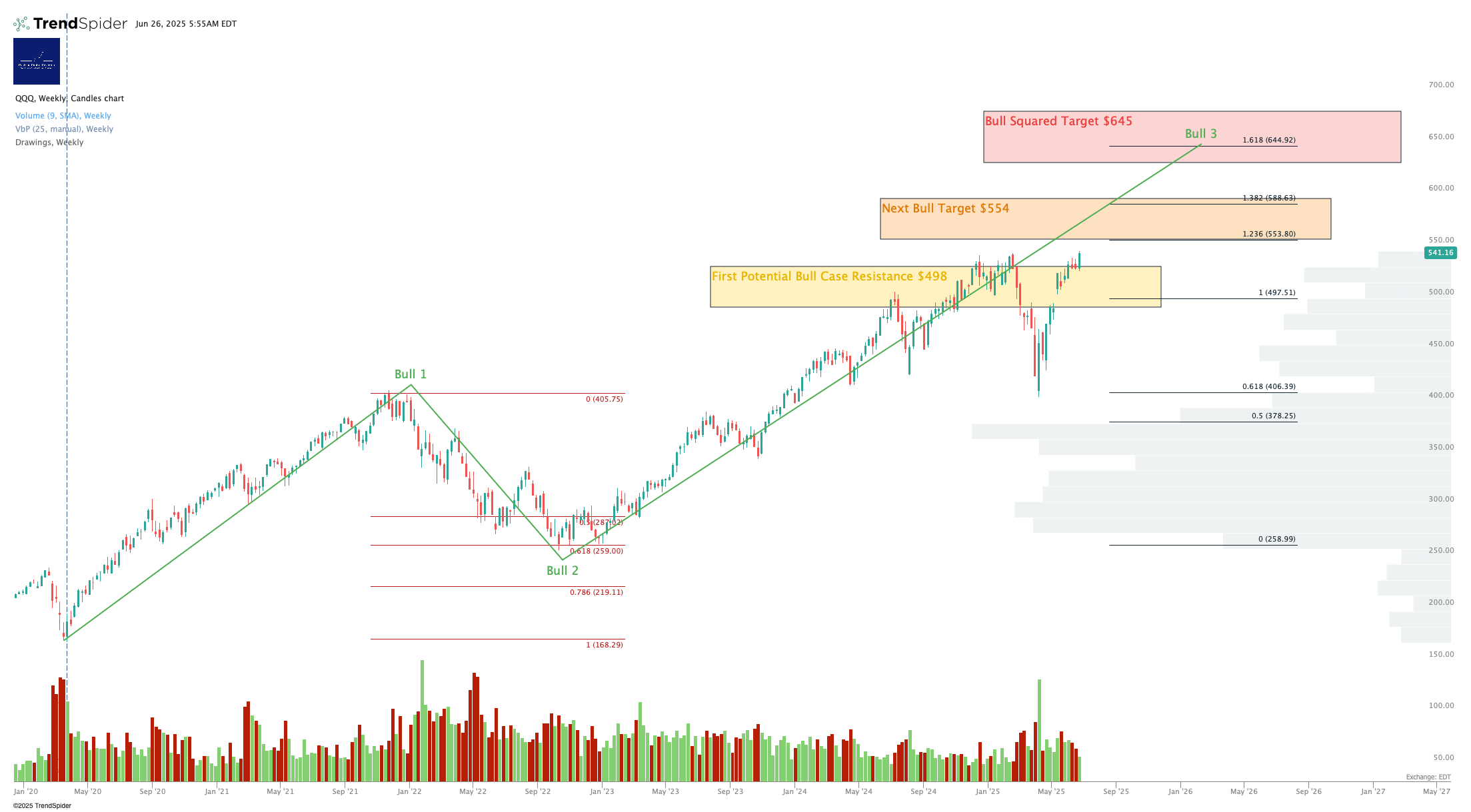

Nasdaq-100 / QQQ / NQ / TQQQ

Third most boring chart.

When we get a correction in the QQQ, my take is that the golden cross (50 day up and over the 200 day from below) means a correction will be shallow. I will be looking for the 50-day to hold on any selloff.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Again thinking about the next correction - the 200-day may not hold in TQQQ; but if the 50-day holds in QQQ all will be well longer term in TQQQ.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ

Alex King, Cestrian Capital Research, Inc - 26 June 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, USO, XLK, SOXL, SOXS, SMH, TLT, DTLA; also long September QQQ and SPY puts.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.