Market On Open, Thursday 3 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Sale, Extended

by Alex King, CEO, Cestrian Capital Research, Inc

Due to unprecedented demand (ie. people happy about saving money!!!) - we are extending our Independence Day sale until the close of Monday 7 July.

Remember, Inner Circle is our very best work - our highest-quality single-stock and ETF coverage, broadest set of trade alerts, professional-grade webinar presentations and discussions and more. Better yet, the investor & trader community in our enterprise-grade Slack workspace is superb - a wealth of experience and insight working together to help everyone raise their game.

Whether you manage your own capital, advise client capital, or invest limited partner capital, Inner Circle is for you.

We’re offering 30% off Annual and 6-Year Extended memberships. If you’ve been thinking about signing up, or you currently pay monthly and you’d like to reduce your total cost of membership, this offer is for you.

Pricing with the Independence Day discount:

- Annual Independent - falls from $4999/yr to $3499/yr (here)

- Annual Investment Professional - falls from $9999/yr to $6999/yr (here)

- 6-Year Extended Independent - falls from $19,999 to $13,999, equivalent to just $233/mo (here)

- 6-Year Extended Investment Professional - falls from $39,999 to $27,999 (here).

As always, if you have unused subscription amounts - say you just signed up for an annual and want to move to Extended, or you’re a Market Insight subscriber and want to move up to these Inner Circle tiers - we’ll roll in that amount too, so you won’t be out of pocket.

Please note, for those of you who signed up for any of these Inner Circle membership tiers in the month of June, we’ll offer you a store credit equal to the discounts above, which you can use against any Cestrian purchases within the next 6 months.

Holiday Spirits

After a brief feint to the downside, equities have re-commenced their upward march. Reasons why they should not do so are as manifold as they are moribund and include (1) risk around passing the budget (2) ongoing uncertainty around trade policy (3) the tug-of-war between the Fed which won’t cut until they know what trade policy is and the Administration which wants rates down - each side has some good logic to its argument by the way (4) most importantly - stocks are up a lot already.

Fundamental and technical analysis are pretty useful tools but in the end one has to respect price behavior as more important that what one thinks price should be doing.

Personally whilst I wait for the next correction in equities, which will come as it always does, when seeing a market moving up, my answer is, position accordingly. If not long enough (I have some hedges which were taken out in haste!) the answer is, don’t hope things go your way, just get longer and follow the market. Then when the market turns you can bank those gains and wait to catch the downside. The only error one can make in the market is not following the market. It’s good to have an opinion and it’s good when that opinion proves correct and even better when the opinion is correct, you acted on it, and the market goes your way. But if it doesn’t? The market was right, and you were wrong - act accordingly! Bull markets over-react to the upside; bear markets to the downside. We’re in a bull market.

I hope the charts below can help you set your course.

In our Inner Circle service we discuss the above all day long in chat and help one another take advantage of every given market situation. If you’d like to be a part of it, sign up before the close of Monday using those links above.

US 10-Year Yield

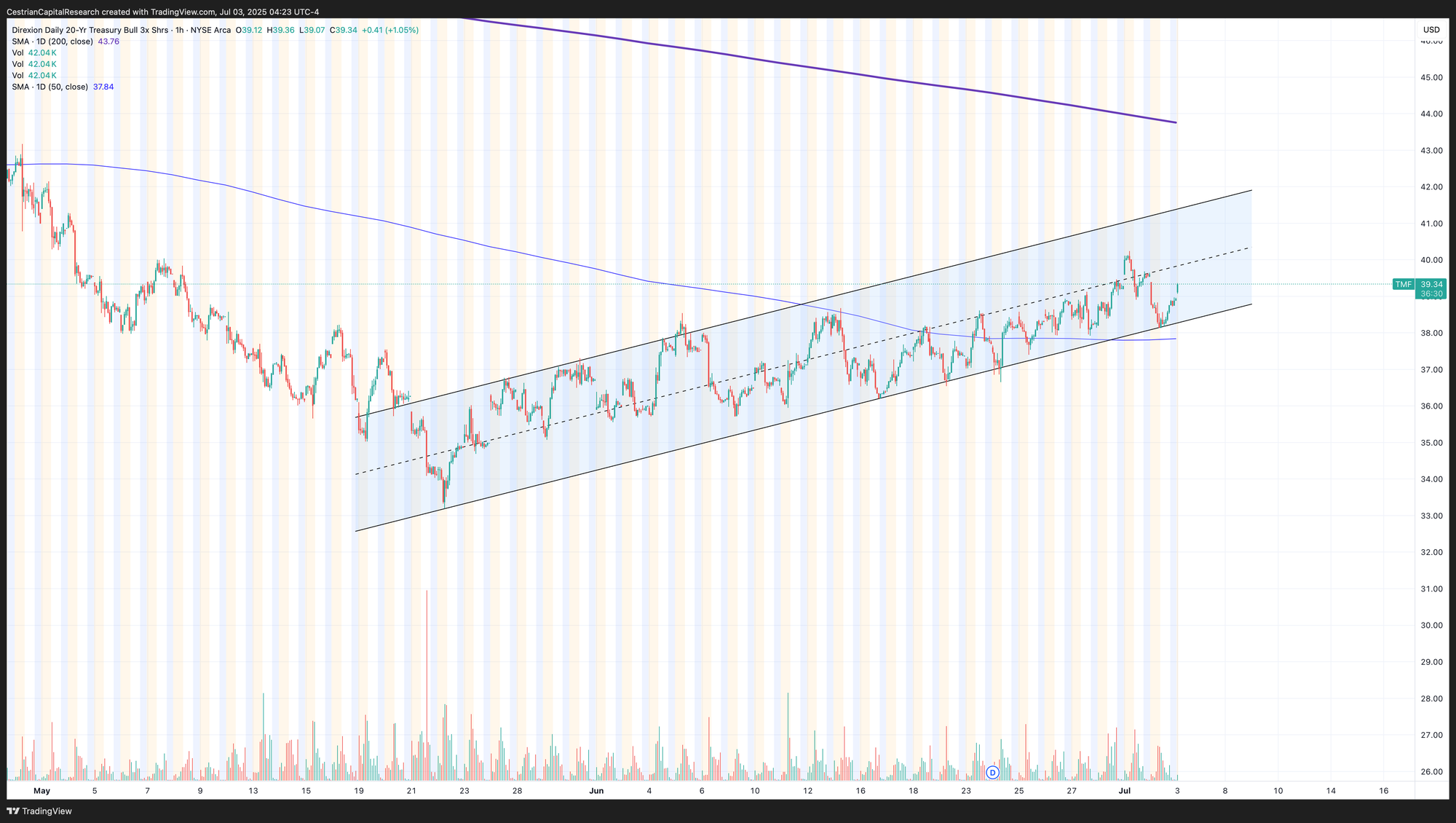

A sharper rise than I expected yesterday, ostensibly due a sympathy move with UK gilt yields. Personally I used this to get out of a TMV position at cost (it was underwater) and then went long TMF which is now nicely in the money. All disclosed in real time in our Inner Circle service, of course.

(Here’s yesterday’s trade disclosure alerts).

Equity Volatility

Continues to trundle along at the lows.

Disclosure: No position in any Vix-based securities.

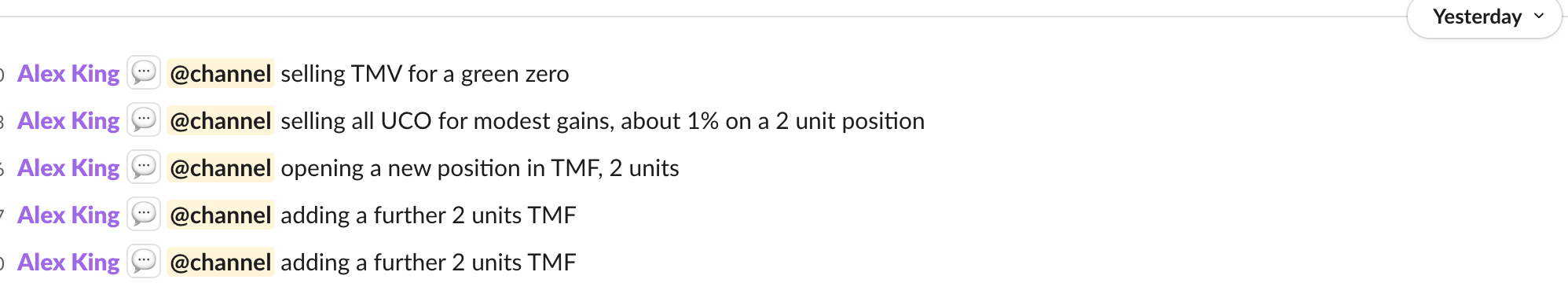

Longer-Term Treasury Bonds (TLT / TMF)

No change. The jobs report yesterday is underlying bullish for TLT I believe.

The 50-day moving average is turning up; I wonder if that drop yesterday is all the Wave 4 we are going to get. I’ve re-drawn the chart on that basis; I think the W5 high in this cycle probably coincides with the 200-day moving average acting as resistance.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

TMF on the hourly shows the support at the bottom of this channel and the bounce towards the midline. Best guess it continues to pinball its way up like that.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

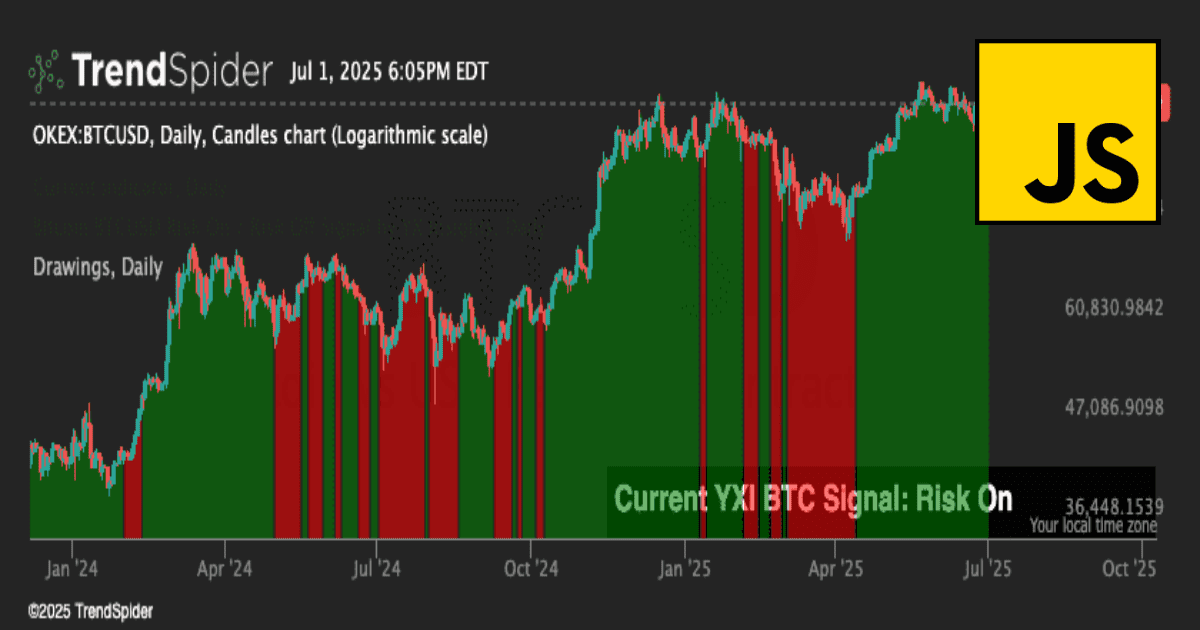

Bitcoin

A ripper up and away from the 50-day!

We now offer Bitcoin risk signals embedded in TrendSpider charts. Click below or here to learn more.

Disclosure - No position in Bitcoin (I bought and sold for modest gains yesterday).

Oil (USO / WTI / UCO)

No change on the monthly timeframe.

As long as $64 holds I think the next major move is up.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

To repeat - starting to break out, perhaps.

Disclosure: No position in oil.

S&P500 / SPY / ES / UPRO

It’s always good to zoom out. Is that a bullish looking chart? It is.

Case in point. “Should” have rolled over. Hasn’t. So what do you do if you were positioned for it to roll over? You change your positioning. Keep a short hedge if you like but be sure to be net long whilst the market is rising.

By the way the next “it should roll over” argument is that SPY is at the 1.618 extension of the Wave 1 shown, placed at the Wave 2 low. So maybe this has been a Wave 3 all along and is about to roll over into a Wave 4 down.

But so far, up. Act accordingly!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Momentum divergence remains, but now MACD is turning … up. So the bear argument is weakened. You know the drill.

Disclosure: I am long $IUSA and long $SPY puts for September expiry; heavily net long the S&P500 in the aggregate.

Nasdaq-100 / QQQ / NQ / TQQQ

Down on where June closed, but still looking bullish on this timeframe.

Not as strong as SPY on this timeframe, it has to be said.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Not at new highs; weaker than the S&P. Remains to be seen if the onward march up continues.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ and have $QQQ puts for September expiry. Overall neutral the Nasdaq.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.

Alex King, Cestrian Capital Research, Inc - 3 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, SOXL, SOXS, TLT, DTLA, XLK; also long August SOXS calls and September QQQ and SPY puts.