Market On Open, Thursday 31 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Moon Now.

by Alex King, CEO, Cestrian Capital Research, Inc

A rollercoaster yesterday as markets first ran up into FOMC, then sold off on what were perceived to be bearish commentary from Chairman Powell, and then - in the case of the Nasdaq - exploded to the upside on strong prints from Microsoft and Meta Platforms.

No matter how controlled you think you are, how ice-cold you think the blood runs in your veins, volatility of this nature is very difficult to ignore and wrong-foots even the best investors.

Want to know what doesn’t get wrong-footed by newsflow or people screeching on social media? Machine-learning trading algorithms, that’s who.

Throughout this melt-up of late, I think you can characterize broadly three categories of successful investor.

- Experienced investor: trying to grab as much upside as they can whilst knowing that at some point markets will dump and when they do it is likely to take money off of a lot of people. The experienced investor is spending as much time protecting their gains as they are chasing new ones right now.

- Inexperienced investor: trying to grab as much upside as they can, somewhat oblivious to the potential risks of this (but since these risks have not yet materialized, the inexperienced investor may well have outperformed the grownups. And no that does not give the grownups the right to take the moral high ground. Because since April 7 the only error to make has been to be not long enough and/or not levered enough. That could change in a minute, an hour, a day, a week, a month, I don’t know. But so far it’s a true statement.)

- Algorithm: runs calculations each day. Spits out a 1 or a 0. Goes back to sleep.

I’ll say this again and again, and you can say “ah yes but you are selling these things” and I will say “correct, because they are good things and I believe they are very helpful to investors” … if you don’t use successful machine-learning algorithms in your investing and trading then you are being left behind. It is as simple as that. The biggest challenge any of us face in successful investing and trading is ourselves. We are all our own worst enemy. Too greedy, too fearful, too impetuous, too indecisive, too quick to change our minds, too stubborn, the list goes on. All of us are capable of being extremely successful investors and traders by simply using the skills we have - and all of us shoot ourselves in the foot over and over by second-guessing ourselves. This simple reason is why having a robot work with you is such a successful move.

If you don’t believe me, try one of our algo services out and then tell me in a couple months whether it helped you or not.

The simplest algo we offer is for the S&P500. “SignalFlow For $SPY” spits out a 1 or a 0 every day after the market close. If it prints a 1, it means the model thinks the S&P500 is not likely to hit a material correction the next day. If it prints a 0, it means the model thinks a material correction is likely the next day. Nothing is perfect in this world but this very simple algorithm has demonstrated an ability to beat buy-and-hold-the-S&P by a very considerable margin - and it is extremely easy to use. I use it myself for my own S&P ETF positions in retirement accounts.

We offer a similarly simple set of algos for crypto, that most emotional of asset classes. Covering Bitcoin, Ether, Solana, plus Robinhood and Coinbase stocks, this algo again just prints a 1 or a 0, same logic.

You can read more about these algo services at the links below.

I hope you sign up and not just because we get money if you do so - but because with all my being I believe that this is the way forward. Just another step in automation. The Internet destroys every guild it touches - now it is destroying the hallowed ground of quantitative fund management.

This, as they say, really is my quant:

Big Money Crypto Algorithmic Signals

Any questions on any of the above, reach out using the contact form here or email us at minerva@cestriancapital.com .

Now, let’s get to work!

US 10-Year Yield

Continues to drop.

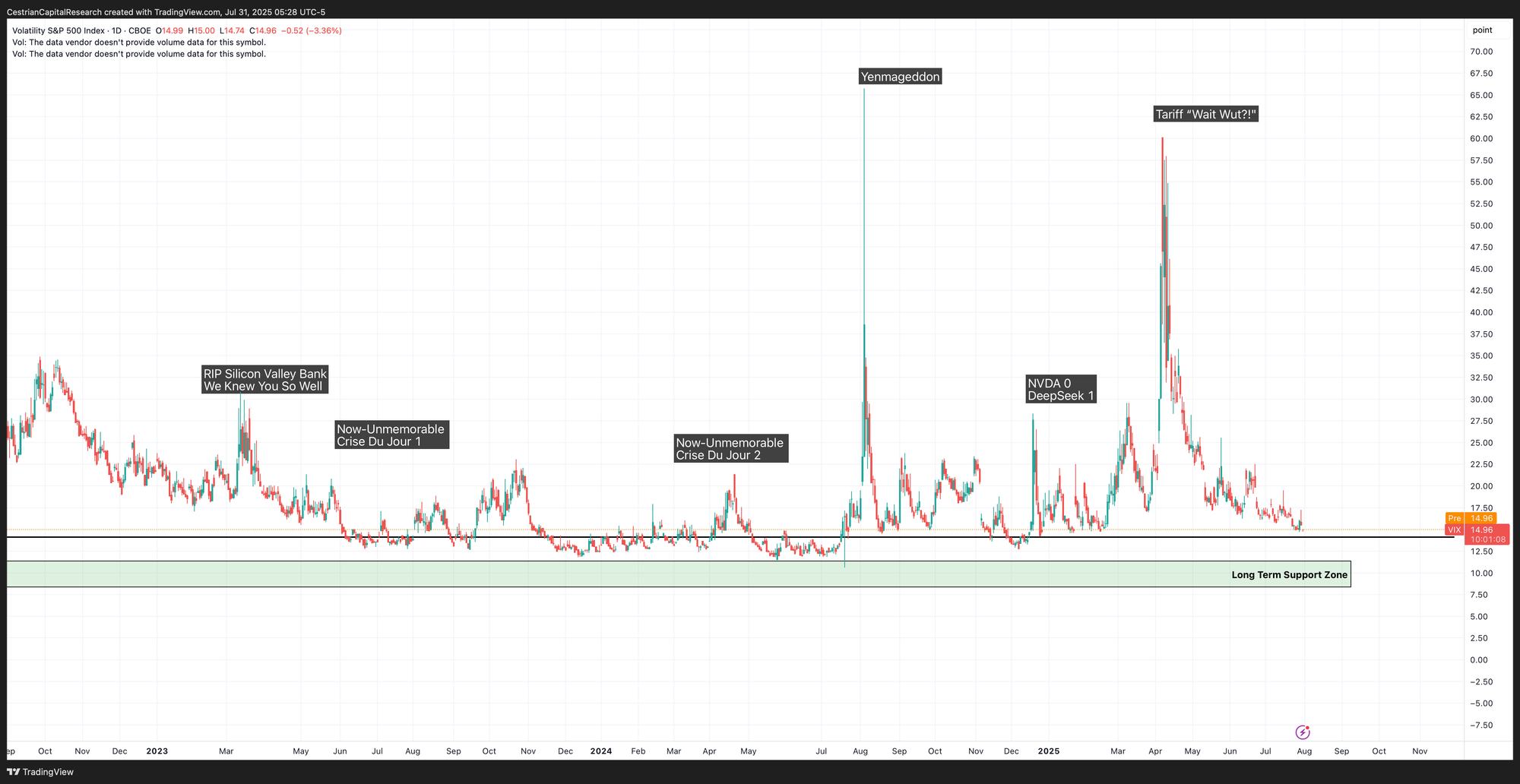

Equity Volatility

Remains at the lows. Translated: S&P500 puts are cheap. Because nobody thinks the S&P500 is going to drop much. Choose your own ending.

To repeat - it's worth keeping a weather eye on the MOVE index by the way, which is a sort of Vix for bond options. It seems to be finding support around here. I don’t think that’s a “yikes sell stocks and bonds” moment; I think it’s an interesting factoid as we watch the Vix continue to have the air let out of it.

The MOVE is at the lows last seen in February and before that December.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Something that bond mavens seem to have missed: the GENIUS Act. This enshrines and legitimizes stablecoins as an on- and off-ramp to cryptocurrencies. Stablecoins require collateral in dollar-denominated securities, the most obvious of which is US government debt. The genius of the GENIUS Act is that it’s likely to ramp demand for that debt. Thank me later.

By the way - if you want to trade bond ETFs but you don’t want to spend time analyzing bonds - we have an algo for that. See SignalFlow For Bonds, here.

Bullish. Look for possible resistance at the 200-day (purple line overhead).

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same story.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

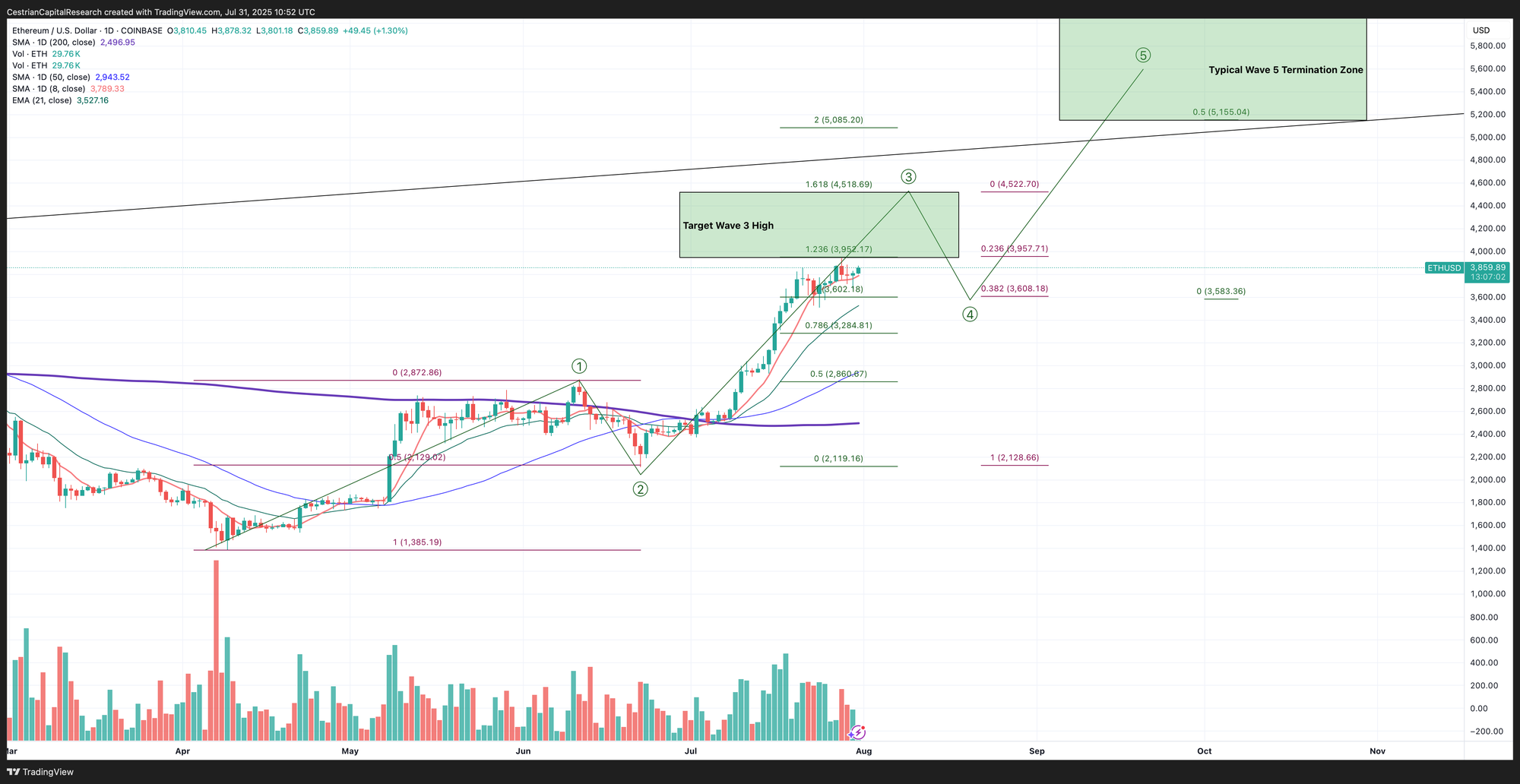

Ether

Looks bullish to me.

Get Big Money Crypto at launch prices until midnight Eastern on Sunday.

Disclosure - Long $ETHE and others in the Ether complex.

Oil (USO / WTI / UCO)

Price predates the news, again. Oil prices rising yesterday are not unrelated to the US pressure on the India-Russia relationship which was applied overnight.

A break of $64 from above invalidates this bull case. For now still bullish.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Continues to look bullish.

Disclosure: No position in oil.

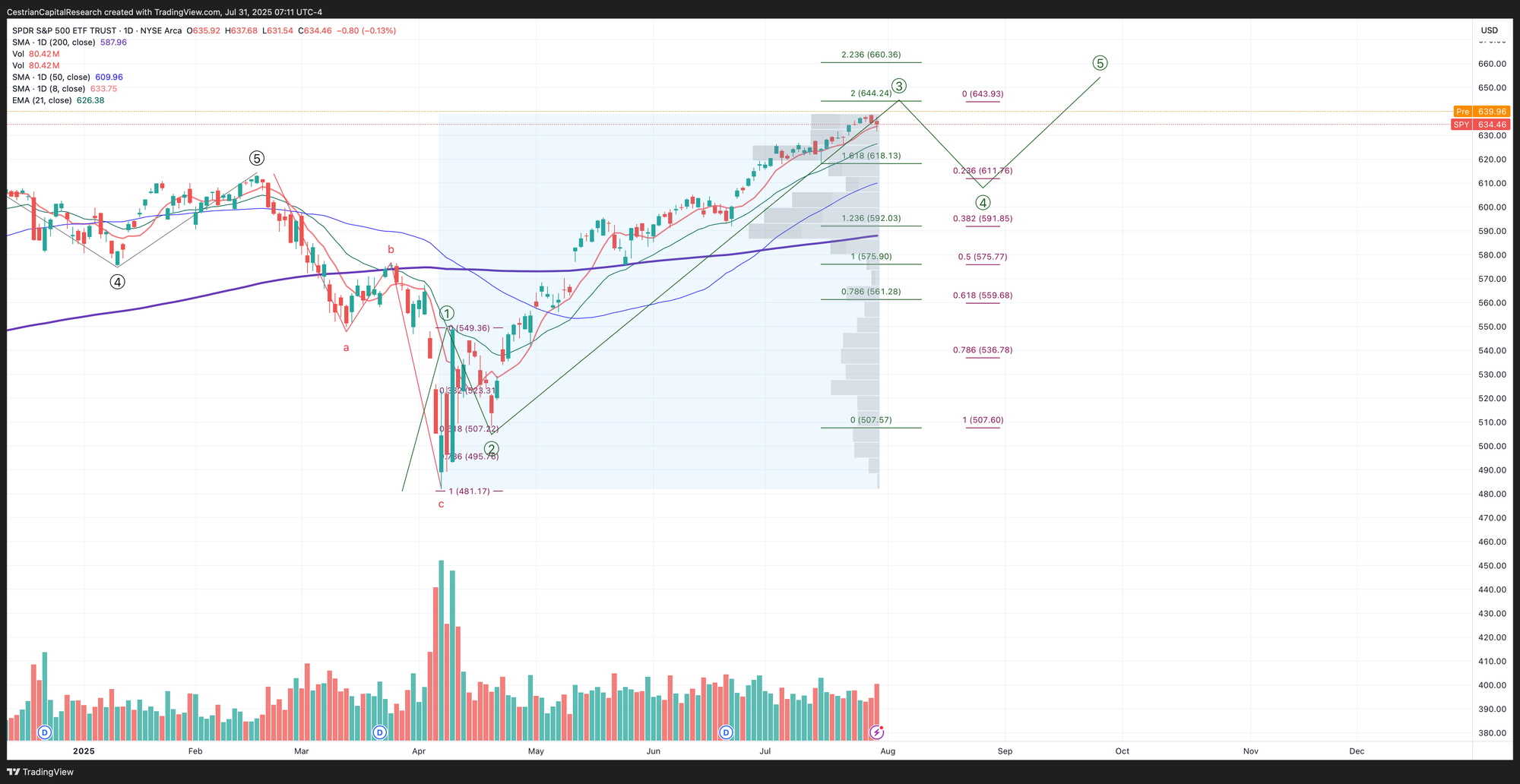

S&P500 / SPY / ES / UPRO

I know nobody wants to hear this, but if you zoom all the way out you might conclude that the S&P had yet to return to trend growth after the April scare. Which means up may be the new, er, up.

Let’s see if SPY can make that 200% extension at $644.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Accumulation on the short side continues.

Disclosure: I am long $IUSA, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / NQ / TQQQ

Blowout move up following Big Tech earnings yesterday.

The 2.618 extension at $601 is in play.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

$95 in play for $TQQQ; growing accumulation in $SQQQ.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for September expiry. Slightly net short the Nasdaq in aggregate; but overhedged long via Bitcoin and Ether complexes.

Want More?

The full morning note, available daily to Inner Circle members, also includes coverage of: DIA, UDOW/SDOW, XLK, TECL/TECS, SOXX, and SOXL/SOXS.

Alex King, Cestrian Capital Research, Inc - 31 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, TLT, TMF, DTLA, SDOW, ETHE; also long SOXS calls and September TQQQ, QQQ and SPY puts.