Market On Open, Thursday 5 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

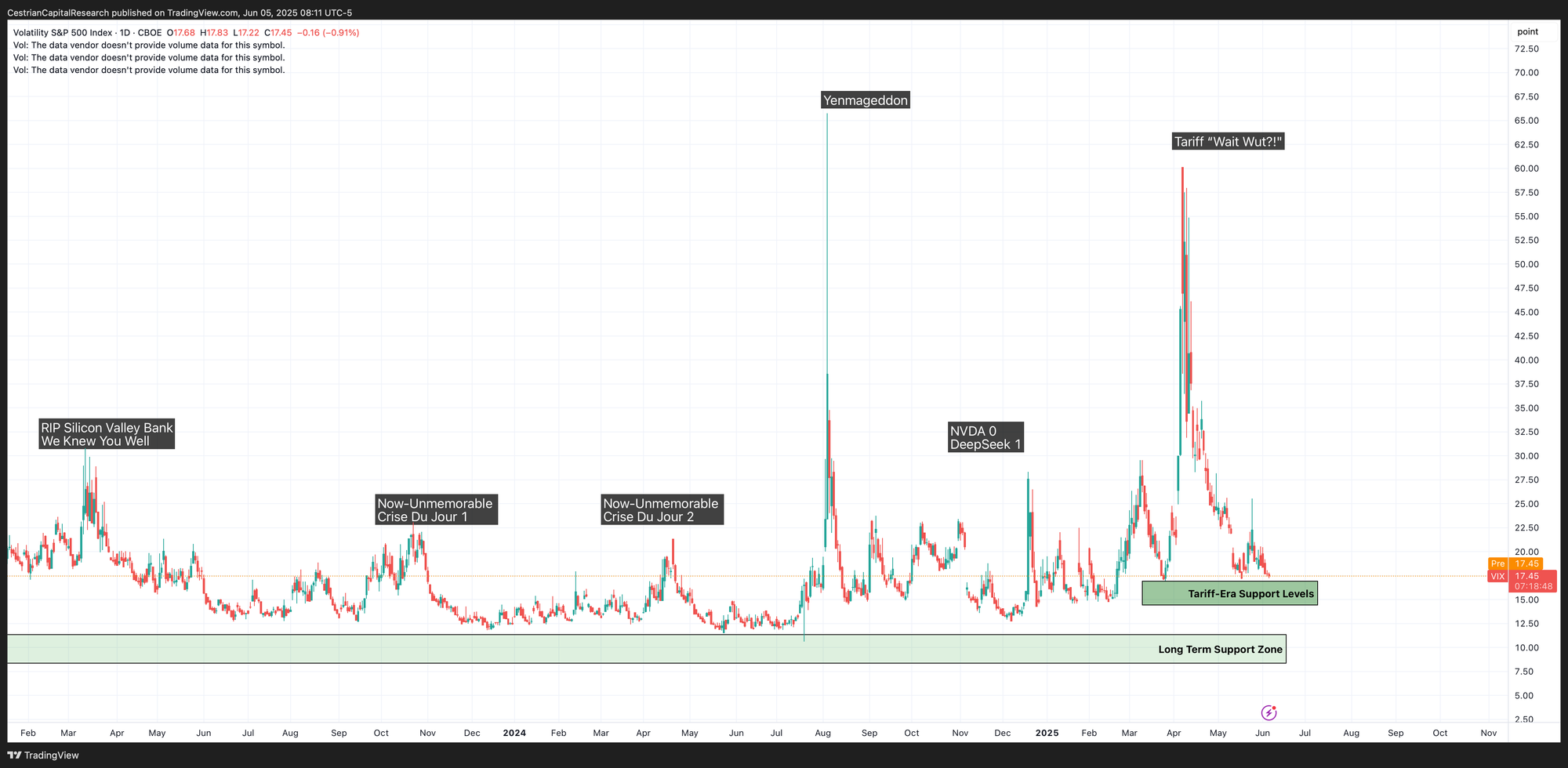

The Vix

by Alex King, CEO, Cestrian Capital Research, Inc

The Vix is a completely misunderstood thing, in my view. It is treated by many folks as a sort of fancy Fear And Greed Index and people worry when it spikes and relax when it is running along the floor. This makes no sense to me whatsoever.

First, let’s remind ourselves what the Vix actually measures. Our resident Prof, that would be Jay Urbain Ph.D., tells us that the Vix is a measure of demand for S&P500 puts with greater than 30 days to expiry. This means that whilst it doesn’t cover options trading by your common-or-garden dopamine-addled options tradooor, who will naturally favor the high-stakes zero-or-hero 0DTE strategy, it does measure the demand for portfolio protection arising from grownups of various kinds. Meaning funds, advisors and the more serene kind of investor in general.

Now we know that investors in general fall into two camps as regards market corrections.

- Folks that call 7 out of every 3 selloffs and therefore never make any money because they are too worried about losing it, and;

- Folks that happily sail right over the Niagara Falls because dips always get bought.

If you were going to be in one of these two camps then as long as you are only playing with say the S&P500, as opposed to this week’s Hot Stonk, and if you don’t need the money you have in it, and you don’t have leverage at work, then it’s better to be in the latter category. Because so far history tells us that if you zoom far enough out, Portnoy’s Law (Stonks Only Go Up) is actually a thing.

But what if … there were some way to try to work out when a selloff was more likely? And I don’t mean hoping CNBC tells you the answer. And what if…. you could actually make money from the selloff without having to do all crazy stuff with options and shorting and whatnot?

Well, there is. And it requires a little concentration and a little skill; and more than that it requires you to recognize when you got it wrong and then to change course without becoming anchored to your original thesis. This is the hedged trading model - we talk about it a lot, we teach it in our Inner Circle service, and we disclose Cestrian staff personal account trades made within this strategy in that self-same Inner Circle service.

But for me, it starts with the Vix. How can you estimate when a correction may come along? When the Vix is on the floor. Low demand for >30DTE S&P500 puts, investors asleep at the wheel. And when might a royal dump find its footing and turn into a buyable dip? When the Vix is on the moon. All anyone wants to buy is puts. You still have to do all the other work but for me? The analysis starts with the Vix.

Right now, the Vix is running along the suspended floorboards. This is a new level of floor that has established itself during 2025, when the degree of relaxation isn’t as extensive as the pre- tariffs-as-trade-policy era. Notably though it isn’t much higher than beforehand. As time goes by more investors are realizing that the market can suck up a modest level of tariffs without too much harm. Poor people may be harmed by the tariffs, since prices will rise, but stocks - which are bought by rich people - not so much.

Here’s where the Vix lies right now. You can open a full page version of this chart, here.

The time to buy - again we are only talking about the S&P500 and maybe the Nasdaq-100 here, we aren’t talking about $HIMS or $CELH or $CRWV or $MSTR or any other social media favorite - the time to buy is obviously when the Vix has spiked, preferably spiked big. Because that means that everyone is scurrying around to buy puts, at a huge price because of the elevated implied volatility. Whereas you, because you understand this stuff, will have been buying puts when the Vix is on the floor, or selling them when the Vix has mooned. And you will therefore be completely calm and when all around you are losing their minds and decrying the End Of Capitalism As We Know it (for the fourth time in the last twelve months) - you will be buying.

Anyway - right now? Folks are asleep at the wheel as the Vix tells us. What we cannot be sure of is whether they have FSD, which version, and is it working. Or whether they should be paying more attention. Usually when the Vix is down here and nobody is worrying … it’s time to start thinking about worrying.

And that is how you use the Vix, in my humble opinion. Vol-control managers, hedged-equity managers, and Cem Karsan, you can lob rocks at me all day long if you want, but that’s how I think you use the Vix. To help you with Opposite Day.

And with that … a short note from the Pointyhead Department.

The self-same Prof. Urbain to whom I refer above operates a wonderful options service here at Cestrian. It’s nothing at all like your regular Options Furu nonsense. You can learn about it here:

OK. Let’s get into it.