Market On Open, Tuesday 25 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Manhattan 2.0

by Alex King, CEO, Cestrian Capital Research, Inc

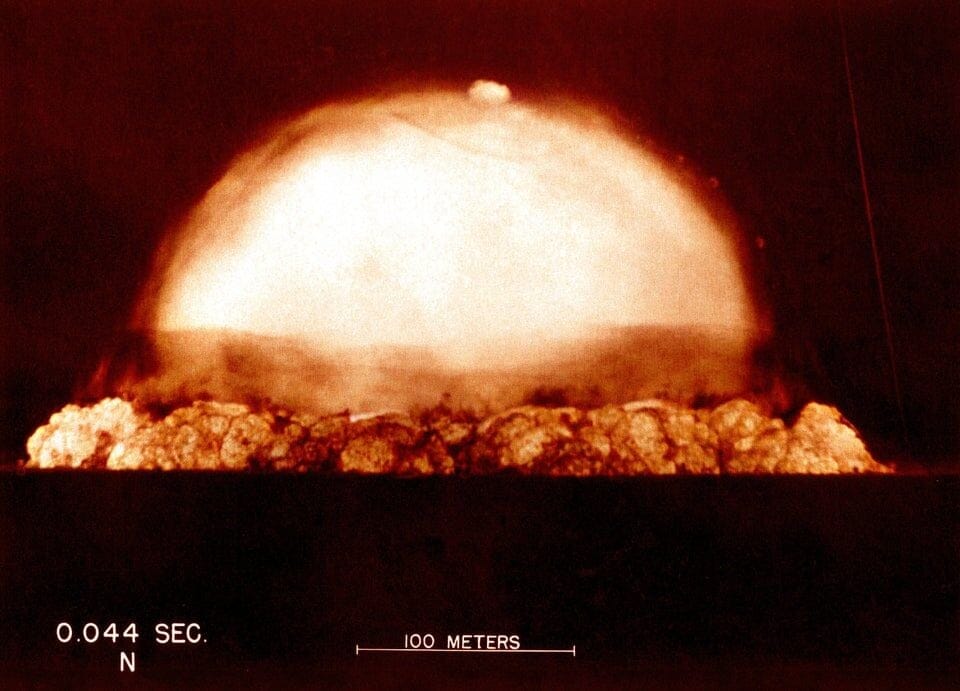

Want to know what that image above represents? Is it the triumph of humanity over the rest of nature? The victory of good vs. evil, or evil vs. good depending on whether you’re a peacenik or not? The crowning glory of applied mathematics?

Well, yes, all of the above and more. But want to know what it really represents?

The creation of American world leadership and hegemony. That’s what.

Plenty of countries had developed plenty of the parts required to build an atomic bomb. The success of the Manhattan Project required contributory science, materials and mathematics from that developed in Italy, Denmark, Germany, Norway, the UK and others. But what clinched it for the US was the combination of (1) the sheer commitment of the federal Government to get it done, requisitioning vast areas of land and people in a complete volte-face to the limited-government motif embraced by the Founding Fathers; (2) vast quantities of money available only in a country with enough wealth to begin with and not already impoverished by a long war; (3) process engineering. For what really cracked the code to get the bomb working was the ability to refine uranium into the correct isotopes in the correct ratios, at scale.

Yesterday the White House published this:

The responses I have seen to this so far regard it as an admixture of fiscal stimulus, selective privilege for particular constituencies, risk asset pricing support, a whole host of things. And of course like any government action since the invention of government, it is no doubt all those things in some degree.

But the other thing it is, the core of what it is, is an actual commitment to American leadership of AI and consequent industries. At a time when the hegemony established by Nvidia is under threat from ASIC and other non-GPU alternatives, the initial leadership by OpenAI under threat from DeepSeek and other less resource-intensive LLMs, and the required growth in photonics, interconnect, power management, memory and much more all have non-US vendors in leadership positions - this is a commitment to use the might of the federal Government to overcome all that.

For a long time I have admired David Tepper and not only for his financial success, but for two aspects of his investing. Firstly, he is unafraid of risk; he once stated that since he started out working on oil rigs, if it all went wrong and he had to go back to that, he wouldn’t mind all that much. And secondly because much of his investment strategy has at times been based on listening to what key governments say they are going to do, assuming they will actually do those things, and then positioning capital accordingly.

The market right now has more than a dose of fin-de-siecle sentiment (or, better perhaps given the dot-com-echo narrative, a dash of pre-millenium tension) about it, shared expectation that the top is close at hand or may already be in. And maybe so. The charts will tell us if that’s true and along the way the algos will keep us safe from harm. But I would note two things. Firstly, leadership in AI, biotech and the other real-world industries cited in the ‘Genesis Mission’ will actually deliver hegemonic power to the winner; and secondly the government spending that may flow from this will one way or the other provide a significant inflow of funds from the public to the private sector; that can be bad news for inflation and anyone affected by it but it is likely great news for risk asset pricing in anything but a deep bear market.

There are many ways to run it hot; this is one of them. The top’s in when the top’s in, and not before. And for the 1000th time … AI is real, it’s here, there are valuable use cases, it’s early and in 20 years we will look back at chatbots and the like and laugh at their simplicity, just as What’s New / What’s Cool looked great in 1995 but already cringe by 2000.

I think the US is going to pull further ahead.

How To Make Life Easier

If you are finding market volatility difficult to navigate - and if you aren’t, I salute you - then I suggest you sign up to one or more of our algorithmic signal services. We offer two families of algos; the SignalFlow AI family, developed by Jay Urbain (a computer scientist and statistician by background) and the YX Insights family, developed by Yimin Xu (a rates market maker by background). You can learn more here:

SignalFlow AI Algorithmic Trading

YX Insights Algorithmic Trading

Join The Cestrian Inner Circle

As a member of our Inner Circle service you’ll receive a full market analysis note every day in your inbox, earnings reviews on 50-60 stocks through the year, you’ll join a real-time grownup, all-business chat community of investors and traders (it’s a Chad-free zone by the way), a weekly live open-mic webinar and of course trade alerts whenever Cestrian staff personal accounts place trades in covered stocks & ETFs. Doubt me? Check our reviews.

OK. Let’s get to work - our daily Market On Open note below covers yields, bonds, equity indices, sectors, oil, gold, Ether, Bitcoin and more, as always.