Market When Open, Friday 18 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Run It Hot.

by Alex King, CEO, Cestrian Capital Research, Inc

As of before the market open today, here’s the state of play.

- Equities are on fire

- Crypto is on fire

- Bonds are cold as ice

Will these trends continue? This is what I think.

- Equities: I expect a modest Q3 pullback in stocks before a final push higher in Q4 to finish the year. I think the drawdown in the S&P and Nasdaq will be sub 10pc but because so many people have piled into high-beta stocks in recent weeks, the impression given will be that some kind of terrible market has befallen investors. Any such dip is likely an opportunity to buy with a timeframe looking out to year end. I have something like the Q3 2020 dip in mind.

- Crypto: I expect Bitcoin to climb higher. I think there is a very specific opportunity in the Ethereum complex which in my view has plenty of room to run and will surprise to the upside. We talk about it here:

- Bonds. People are sleeping on bonds in my view. I think the 10yr US treasury yield is going to drop, a function of both (i) rate cuts from the Fed and (ii) should the economy cool off, a rotation out of equities and into bonds. I do not believe that US Treasuries are done as the world’s reserve store of value.

For disclosure I am long the Ethereum complex, long US government bonds, and net long equities (ie long, with some hedges in place).

HEADS UP - we launch the premium version of our Big Money Crypto service very soon. Look out for the announcement. We’ll be running deeply discounted launch pricing until end July. If you want to pre-register for this service just drop us a line using this contact form.

US 10-Year Yield

If the yield is going to fall meaningfully in the coming weeks, it should roll over around now for the next leg down.

Equity Volatility

Volatility is on maybe the mezzanine level, meaning, it can continue to drop to the ground floor if the current run-it-hot conditions prevail. It won’t stay down here, it never does, but trying to predict exactly when it spikes is impossible. All one can do is be ready and be sure to not believe that the on-fire market will remain on fire forever. The longer this hot streak lasts, the more late money is sucked in at the top. That is not to say I think the market rolls over tomorrow, and nor do I think that one cannot make money by taking on new long positions today. It is simply that when the rug is pulled, as it always is, it is the last money in that is most badly hurt. One has to be ready.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

No change on this timeframe.

Holding at this Wave 2 low nicely I think.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Again, holding over the Wave 2 low nicely.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

Ether

Ether is the best risk/reward opportunity in crypto in my view.

Read why I think that, here.

Disclosure - Long $ETHE and various other members of the Ether complex.

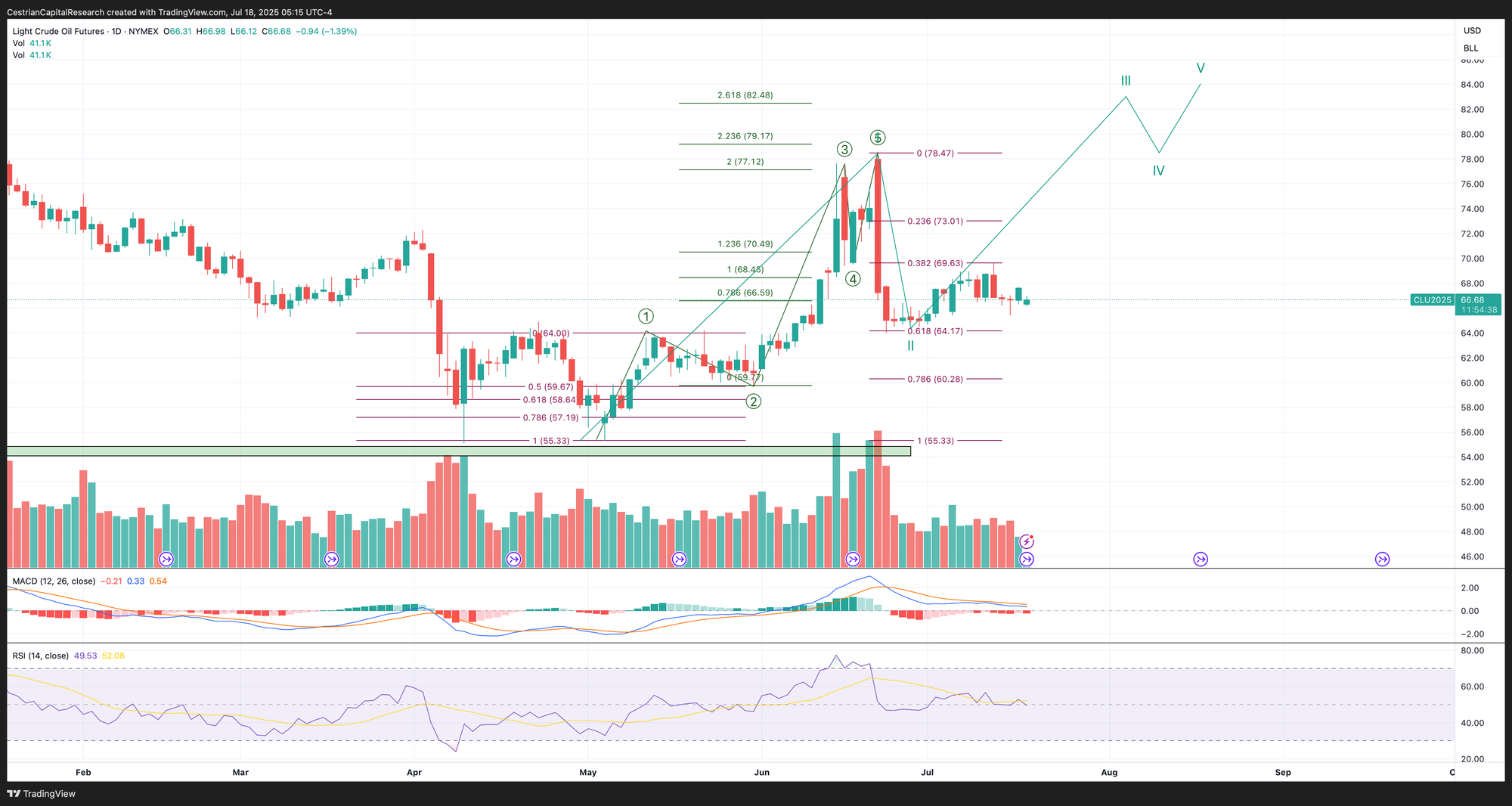

Oil (USO / WTI / UCO)

The wedge pattern continues to consolidate on the monthly.

Bonds and oil are holding over Wave 2 lows right now and look set to run up in Wave 3s. That is surprising if you think about it - for that to be the case suggests that price-setting market participants are accumulating oil and bonds ahead of some change in the market. We’ll see whether that proves to be the case or not.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Also looks like it is getting ready to move up.

Disclosure: No position in oil.

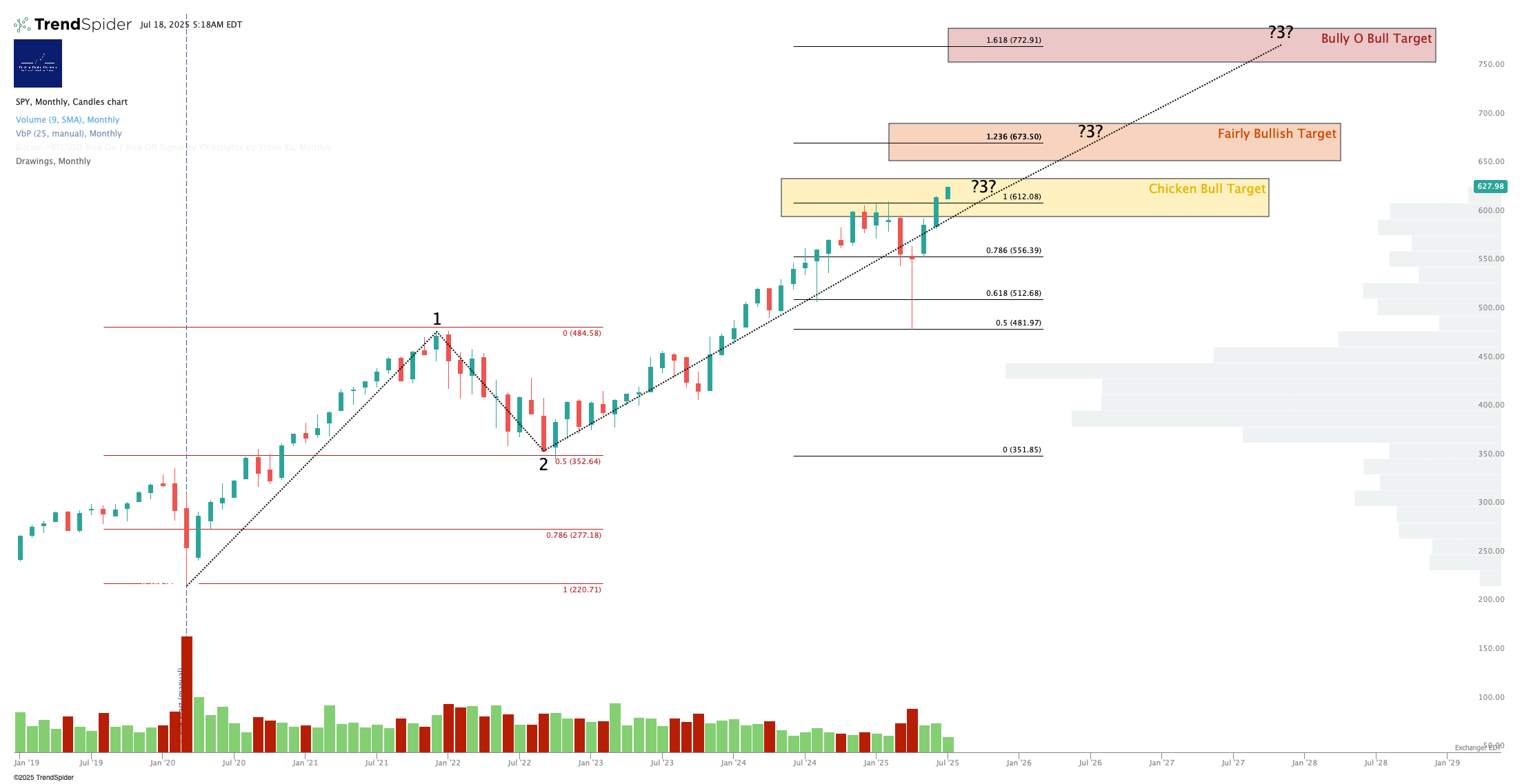

S&P500 / SPY / ES / UPRO

Even if we get what people think is a brutal Q3 pullback I will remain bullish on the S&P into year end. Why? Because this chart. It’s been on the money for several years now.

Every indication of a topping pattern, except, er, it hasn’t topped!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am long $IUSA, long $UPRO, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / NQ / TQQQ

Bullish through year end.

Up until not-up, and the momentum divergence (MACD declining whilst price rises) is marked at this point. We have to be ready.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Compare and contrast. Folks are getting ready with the SQQQ; doesn’t mean they are right.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, long $QQQ, and have $TQQQ and $QQQ puts for September expiry. Overall broadly neutral the Nasdaq but significantly net long growth equities.

Dow Jones / DIA / YM / UDOW

Just will not make new highs! Blame Tim Cook.

Closed over the 8-day and maybe the golden cross (50 day moving up and over the 200 day from below) says bullishness ahead. I am not sure. I think the Dow is leading the other indices into a modest correction.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Again with the accumulation in the short ETF (SDOW). Again doesn’t mean these people are correct. I opened a trial balloon sized position in SDOW yesterday to play along without risking the farm.

Disclosure: I am long $SDOW (so short the Dow). Tiny allocation. Net short in a bull market is rarely wise.

Sector ETFs

No change - $296 by year end in my view. There will be bumps in the road.

Disclosure: I am unhedged long $XLK.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

All these long/short index ETF pairs have the same charts. Accumulation on the short leg + topping pattern on the long leg. Charts can lie, whatever anyone tells you, because they rely on the wetware for interpretation. But this is a consistent lie at any rate. It says “potential correction incoming”.

Disclosure: No position in TECL or TECS

SOXX (Semiconductor)

May have peaked Tuesday. TSMC results were good yesterday (see here) but this failed to push SOXX to new cycle highs.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

That long/short pair chart, again. Same story. Notice momentum picking up in SOXS.

Disclosure: I am hedged 1:1 $SOXL:$SOXS, long $SMH, and long $SOXS calls; overall net long semiconductor.

Alex King, Cestrian Capital Research, Inc - 18 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, QQQ, UPRO, IUSA, SOXL, SOXS, SMH, XLK, TLT, TMF, DTLA, SDOW; also long SOXS calls and September TQQQ, QQQ and SPY puts.