NO PAYWALL VERSION: Market On Open, Thursday 9 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Bubble, Not-Bubble, Doesn’t Matter If You Do It Right

by Alex King, CEO, Cestrian Capital Research, Inc

Is the market in a bubblicious euphoric state? A little bit, yep. When everything is going up and your only error is to be cautious every now and then, you’re in a full on bull market which tend to end in untrammelled optimism about prices which tends to end in tears for those late to the party.

Is there anything wrong with a bubble? Nope. Just a function of human nature. Humans, it seems, are naturally crowd-driven animals and if three people over there are running in that direction then pretty soon 50, 100, 1000 people will be doing the same. So much for apex predator. A bit above bison maybe.

Should you stay out of the stampede? Only if (i) you dislike money or (ii) you don’t trust yourself to get out before the thing rolls over and breaks hearts, wallets and lives, which is an inevitablity at some point.

Should you short the bull run? Lol. Have fun with that. An even better way to break hearts wallets minds and more and that’s without even the joy of making the money on the way up.

So what to do? Well, like most things in life, the way to start is to calm down and don’t get sucked into the TO THE MOON or the THIS IS CRAZY AND WILL END BADLY narratives, for in each case these are stories architected by people who just want to take your money and keep it for themselves. The next thing to do is … just invest and trade normally. Learn to measure price and volume moves and patterns and understand what they are likely to represent.

Stocks trending sideways at the lows at high volume? Probably institutional accumulation ahead of a move up. Stocks mooning upwards on low volume? Probably retail buying stocks that institutions already accumulated, thus providing free markups to said institutions. Stocks trending sideways at the highs at reasonable volume? That’s probably Big Money selling quietly and carefully so as Joe P. Retail doesn’t notice. Stocks in freefall? Bigs already sold and now Joe is panic selling and cursing his own idiocy for ever getting into stocks in the first place.

That, dear reader, is the folksy version of the Wyckoff Rotation Cycle, which is another way of describing crowd psychology and how to beat it. We use this daily in our work in our Inner Circle service. The method is as old as time itself, just ask Isaac Newton, and will last for evermore, or unless and until LLMs do all the trading using independently generated pseudo-emotion patterns. That may yet come to pass. But it’s not today. Today we just have to deal with the bison herd instinct.

Now, before we get to work, a nice note from one of our subscribers this week.

“Really Helped Me Get Significant Returns In This Market"

"With your Inner Circle charts and research plus the insights from the super smart community of Inner Circle members, I feel much more confident about my investments and trades. As a result I worry less and I'm comfortable holding longer than I normally would, which really helped me get significant returns in this market - I even went on 3 weeks vacation, just checking the SignalFlow and YX Insights AI signals and your trade alerts, not the charts themselves."

You can learn more about Cestrian Inner Circle here.

OK, let’s do it. Our daily market note for Inner Circle members covers yields, bonds, equities, volatility, oil, crypto, and key sectors. Here in this no-paywall version today we share our views on the S&P500 and the Nasdaq-100 together with the semiconductor sector and Ether.

Ether

Ew. Ether is a mess this morning. Below all the short term moving averages we use (bearish) but still looks like it is moving up in this Wave 5 towards $5500-6500 (bullish).

Note, if you are trading Ether then you might note that our Big Money Crypto algorithmic signals flipped bearish on Ether yesterday morning, thus far missing about a 2-3% drop since then. If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at those self-same Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

S&P500 / SPY / UPRO

Still has the look of “Nothing Stops This Train”, (tm. Lyn Alden).

SPY has spent four days now butting up against $673 from underneath. That tells you that $673 is resistance. And in the end if it can’t break up through that, we’ll get a correction. Simple.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

If SPY corrects so will UPRO, to the benefit of SPXU.

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

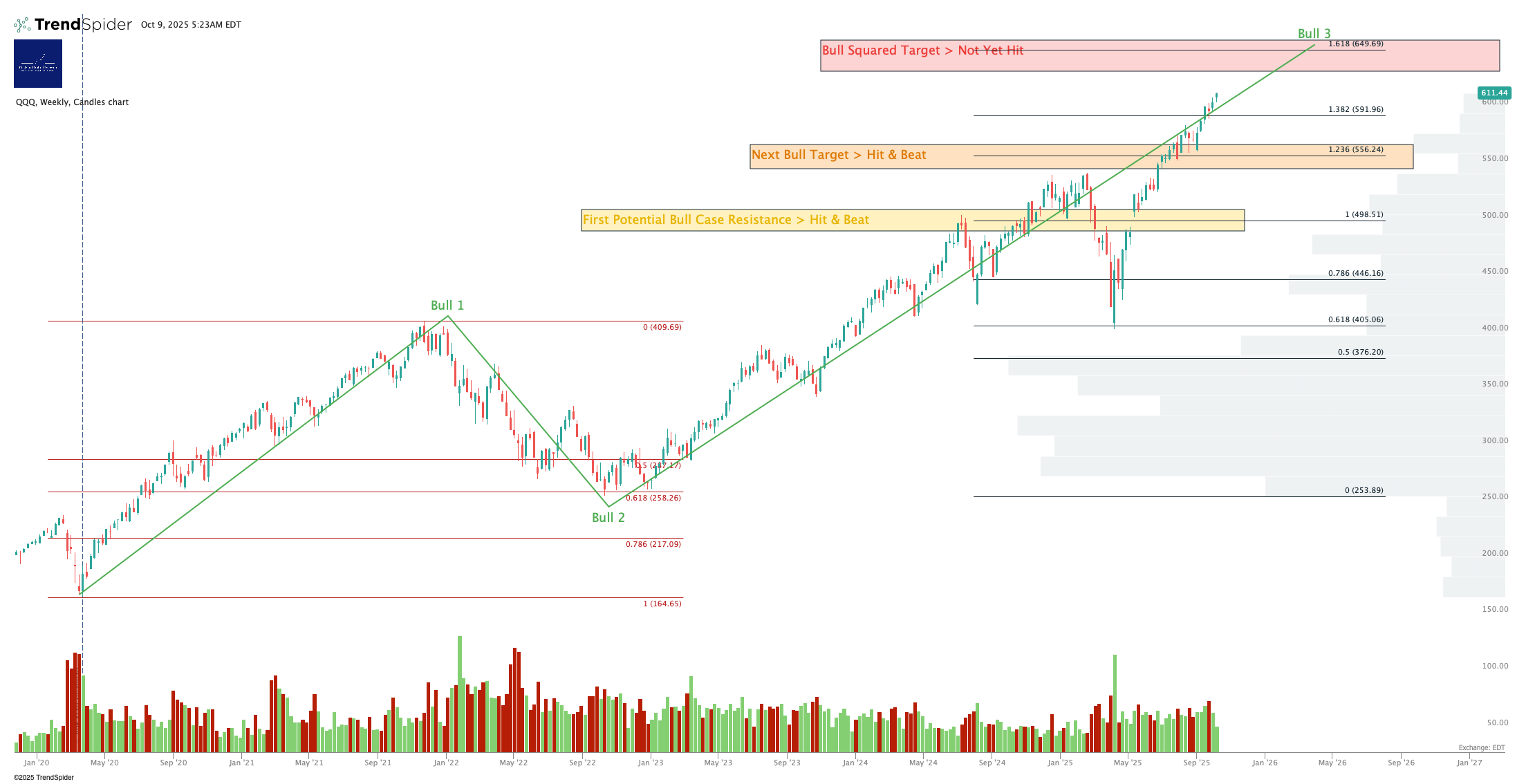

Nasdaq-100 / QQQ / TQQQ

More bullish than the SPY, with continuing higher highs. Let’s see which of those prevails over the other.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall slightly net short the Nasdaq.

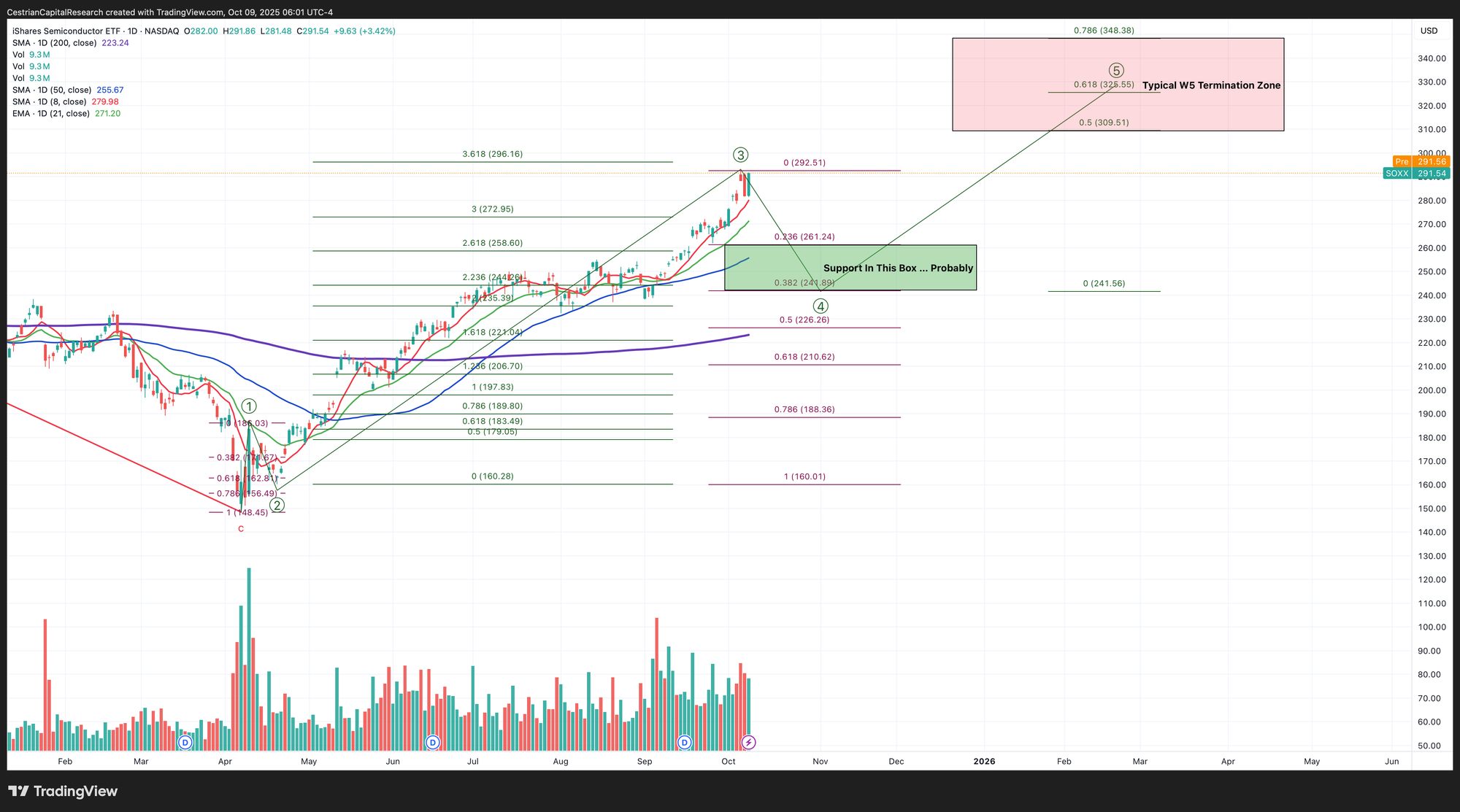

SOXX (Semiconductor)

Can’t get up and over $292-293 in the last three days. Again, if it can’t break that resistance, it’s time for a modest correction most likely. The chart below shows what such a correction might look like. The first tripwire is the 8-day simple moving average (the red line).

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

SOXX leads the way for the levered names.

Disclosure: I am hedged 1:1 $SOXL:$SOXS and also long $SMH - overall net long semiconductor.

Alex King, Cestrian Capital Research, Inc - 9 October 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHA, XLK; long December TQQQ, QQQ and SPY puts.