Spire Global Q4 FY12/23 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No-One Cares About This Stock. Yet.

by Alex King

A lot of microcaps go to zero. If you are going to play with microcaps, you have to know this. If you assume that the money you have in microcaps is going to zero, and you allocate accordingly, then you have already provided for any disappointment that may follow. Which means you can be at ease to enjoy any upside.

In the Inner Circle Defense Portfolio we have two microcaps, being Spire Global ($SPIR) and Rocket Lab ($RKLB). Either or both might go to zero, which is why we have them in half the allocation size assigned to the defense primes in that portfolio. Either or both may also deliver multiples-of-money return, which is why they are in the model portfolio. And speaking personally the reason I own each of these names is because the upside potential is huge whereas the downside is … all that can happen is I lose all the money I have in them. Given the risks otherwise sensible people seem prepared to take with short positions, leveraged short positions, futures, options and all manner of complex instruments wherein you can lose more than all your money, 100% downside risk vs. many-hundreds-of-percent upside risk doesn’t seem that bad to me.

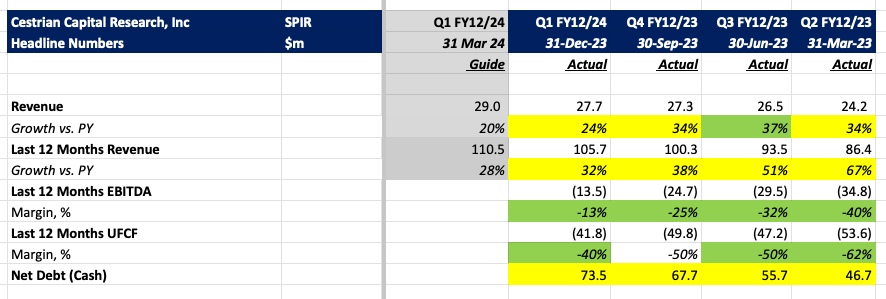

$SPIR reported its Q4 of FY12/23 yesterday after the close. It was a good quarter. A slight miss on revenue vs. their guide; personally I can live with that, small companies are less predictable than large companies and the revenue line is always going to wobble around some. As long as it is trending up at a decent pace, that’s OK in my book. The company clocked up a very important milestone, which is to say positive EBITDA this quarter. EBITDA is not a thing, really; it’s not cashflow (the company was still cashflow negative this quarter), it’s just an accounting measure and one which is extraordinarily pro-management-friendly, particularly in companies with a degree of capex intensity which of course is the case here. But it is a milestone of sorts for previously heavily-lossmaking companies to turn EBITDA positive, because it indicates that positive cashflow generation may not be too far away. And to be cashflow positive at this scale is quite a feat. Spire isn’t there yet, but the management team seem committed to get there. That’s not as common as you might think; it’s a big plus as far as management team mindset goes. (It’s often the case that microcap management teams think cashflow is something they get from shareholders).

Here’s the headline numbers.

Now let’s look at the valuation, our stock chart analysis, rating, valuation, and the impact of the recent equity raise (which doesn’t feature in the 31 December balance sheet).

Read on!