Taiwan Semiconductor Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

$100B

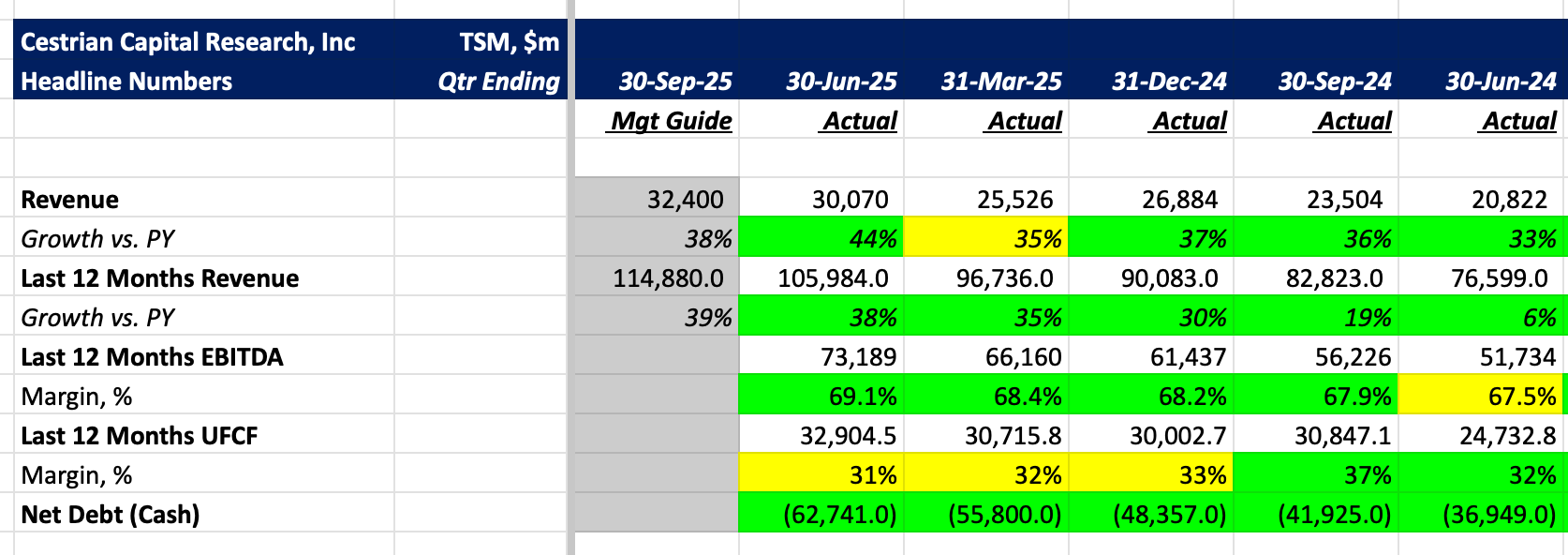

Taiwan Semiconductor just cleared $100B of trailing twelve month revenues.

It is growing that TTM revenue at +38% pa, and that rate of growth is accelerating.

Also, its TTM unlevered pretax free cashflow margins are 31%.

And finally, it has a little shy of $63bn net cash in the bank. Yes net cash, after the bond liabilities are taken into account.

It is, in short, a freight train which will be slowed down by nothing short of (i) a global downturn and/or (ii) a Chinese physical or political annexation of Taiwan.

Now, since gravity applies to all revenue growth and stock price trajectories, TSMC will fall off the tracks at some point, and whether that is due to (i) or (ii) I do not know. But for now the trend is strong, the company’s grip on global chip fabrication (at small feature sizes - that’s the high margin stuff - we aren’t talking about the thing that times your toaster here) remains very tight, and the company is also playing the MAGA re-shoring theme very well by building plant in the US with gusto. The company’s origins are as a JV between Taiwanese interests and Philips of the Netherlands; it is no stranger to spanning two continents.

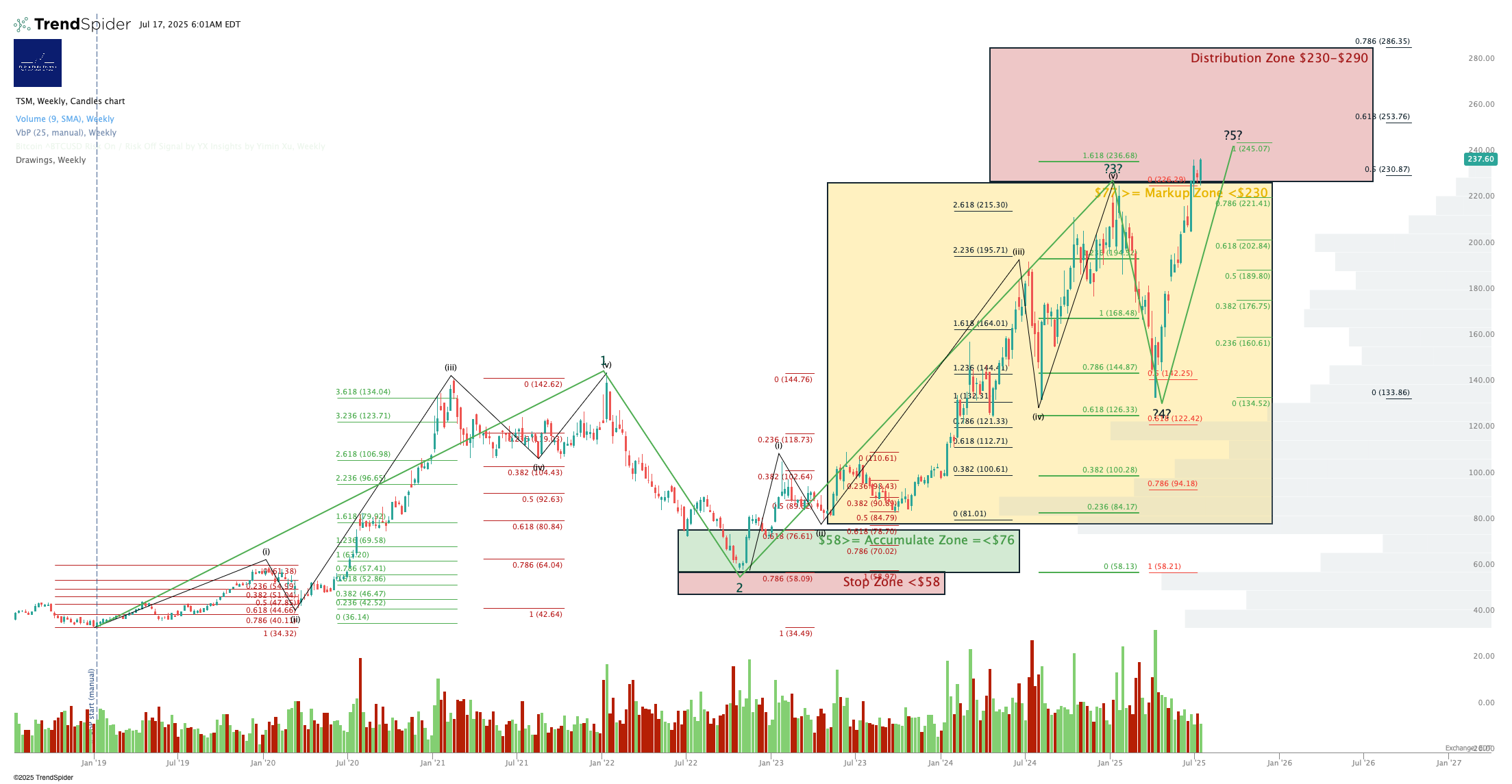

The stock has had a tremendous run-up from the April 7 lows, and anyone who bought in around that time may be sitting on gains of up to 85% at this point. On a longer-term chart the stock is also in a price range where a cautious professional asset manager would think about taking gains. I believe that the $230-290/share range is likely to see some distribution by such large asset managers. The stock is sat at $247 in pre-market trading.

Could there be more upside? Absolutely. Would a cautious, professional asset manager YOLO into the stock today? Probably not. If you own TSM, or are thinking of doing so, consider the risk-reward at this point from the perspective of those price-setting investors - then you can decide what to do for your own investment plan.

Personally I am net long the semiconductor sector, with some hedges in place to try to catch any weakness in Q3 (before what I think may be another run-up in Q4.)

Headline Numbers

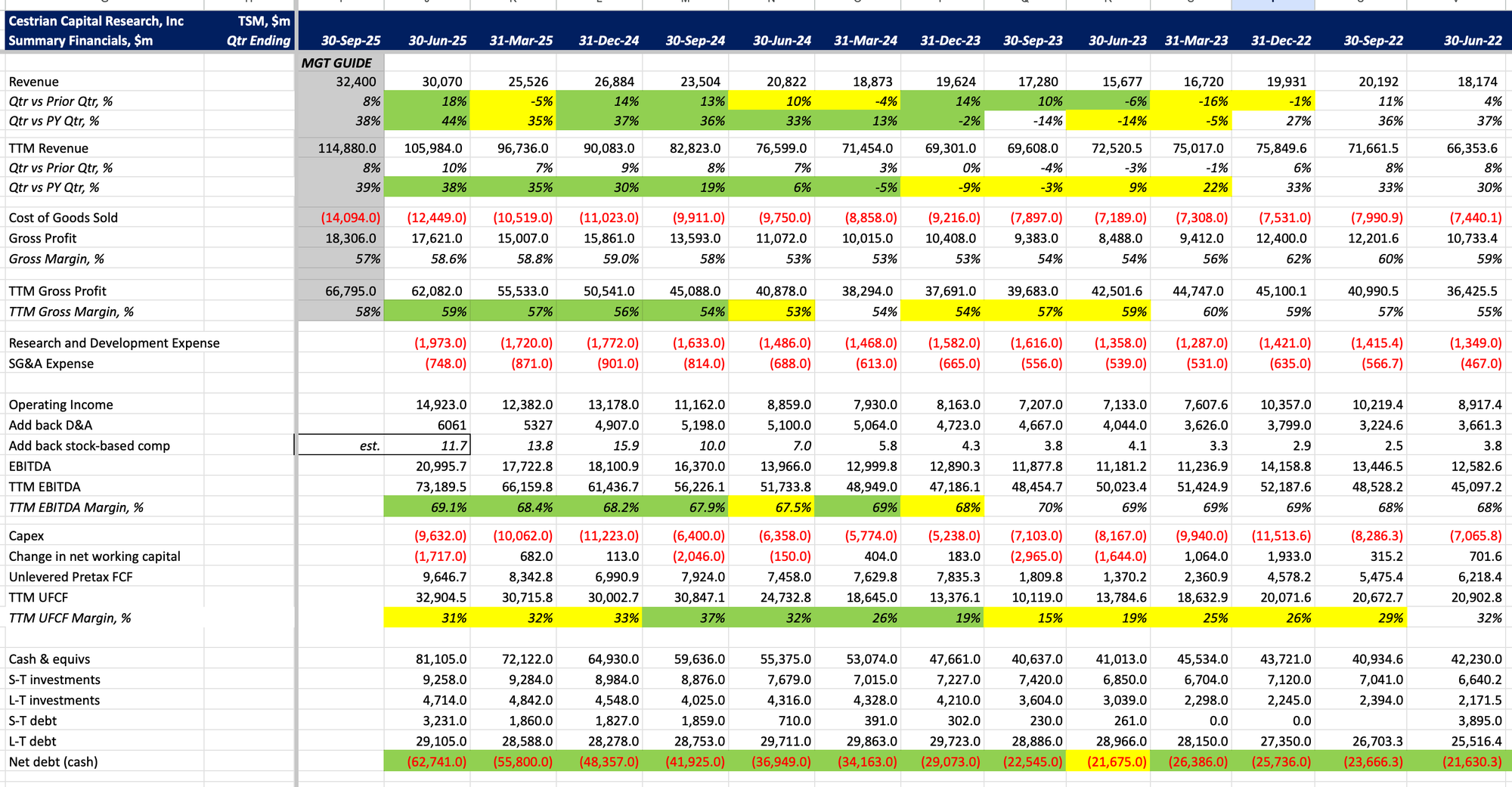

Keep an eye on cashflow margins. Most people don’t, but they matter, particularly in a capex-intensive business like this one. Cashflow margins have likely peaked for this cycle (going back 8-10yrs, peak is around the high 30s / low 40s and the company hit that in Q4 2024), which means some intensive capital expenditure is probably coming along even as revenue growth slows going into the next cyclical downturn. (Yes, semiconductor is still cyclical. Yes it is. No really).

Stock Chart

We rated the stock at Accumulate between $63-74/share; if you bought in that range, you would be up somewhere between 3-4x in less than three years in a simple, unlevered common stock. That is what good - nay, great - looks like, so if you played this, congratulations! (This is why bigs who accumulated $TSM in 2022-23 will be thinking of lightening up now).

We rate at “Distribute” between $230-290 - that doesn’t mean we think “YIKES RUN FOR THE HILLS” it means we think that large asset managers will be lightening up, and if so, why not follow them? The volume profile will start to tell the story if this is true - it’s too soon to know for sure yet - but a cautious investor would certainly protect profits up here even if they didn’t yet start to sell.

You can open a full page version of this chart, here.

Financial Fundamentals

If you love numbers, and I do, here are some more of them.

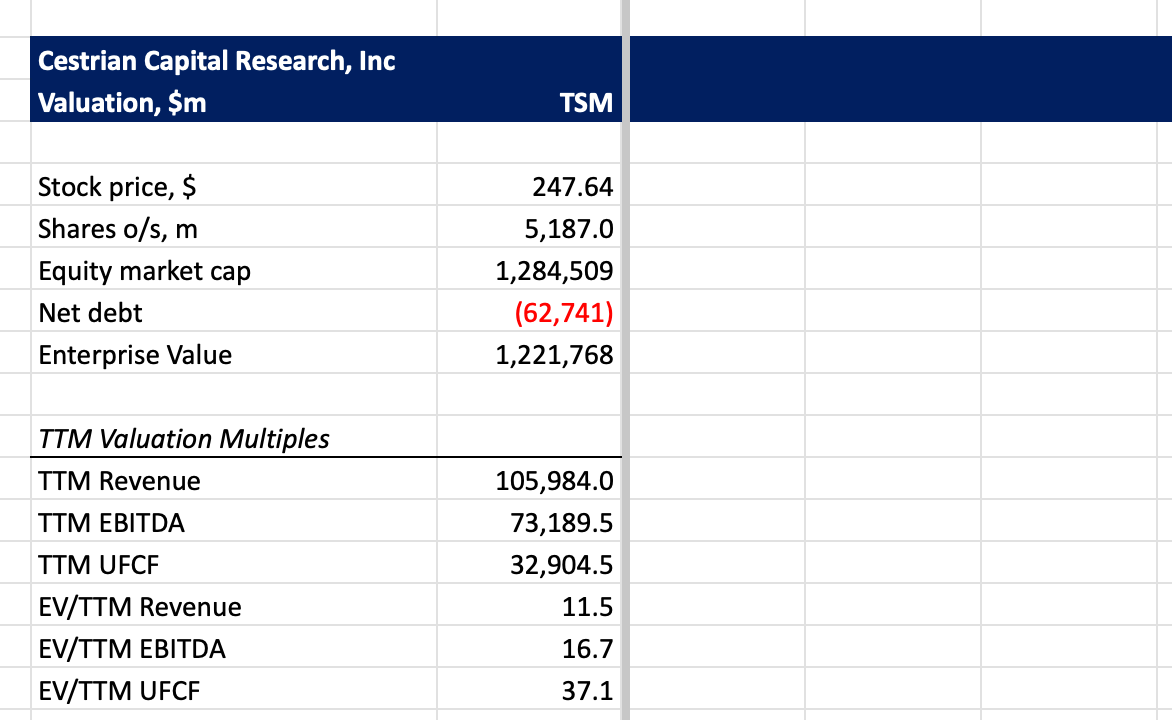

Valuation Multiples

Multiples on TSM are neither so elevated as to drive selling, nor so depressed as to drive buying.

Questions?

If you have any questions about our TSM analysis, here’s what to do.

- If you are an Inner Circle subscriber, reach out in Slack Chat.

- If you aren’t an Inner Circle subscriber, head to our almost 24/7 presence on X and hit us there. We’re at CestrianInc.

Thanks as always for reading our stuff!

Cestrian Capital Research, Inc - 17 July 2025