The Trade Desk Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Everything Is Broken?

by Alex King, CEO, Cestrian Capital Research, Inc.

TTD printed its Q2 Thursday and the stock promptly bled out. It could go lower of course, anything can happen, but I think support is not too far away from here (and the lows may already be in).

The company cited some weakness in its end market and pinned that on tariffs; and the longtime CFO announced they were stepping down. At the same time a number of senior appointments were announced, a clear effort to assuage the market of any CFO concerns.

Personally I think $TTD has the value it does because of founder Jeff Green, who is a silent-killer CEO in my view. It’s possible the company proves to have underlying financial problems or some other murky reason for the CFO departing, or it could be the normal reasons that CFOs leave. Either (1) got offered a better job or (2) a difference of opinion with the CEO that was resolved by one of them leaving, and it was never going to be the CEO. I’ve followed TTD for a long time and nothing in the cashflows or balance sheets have ever looked fishy to me, but I am not their auditor, go off of the SEC prints and only dig deep if something does look fishy. So again - anything can happen, I’m not saying it won't. But since maybe 2018 the numbers have always looked fairly clean to me. Until proven otherwise then, I’m not concerned about the CFO departure.

We rate TTD at Accumulate. Read on to see why.

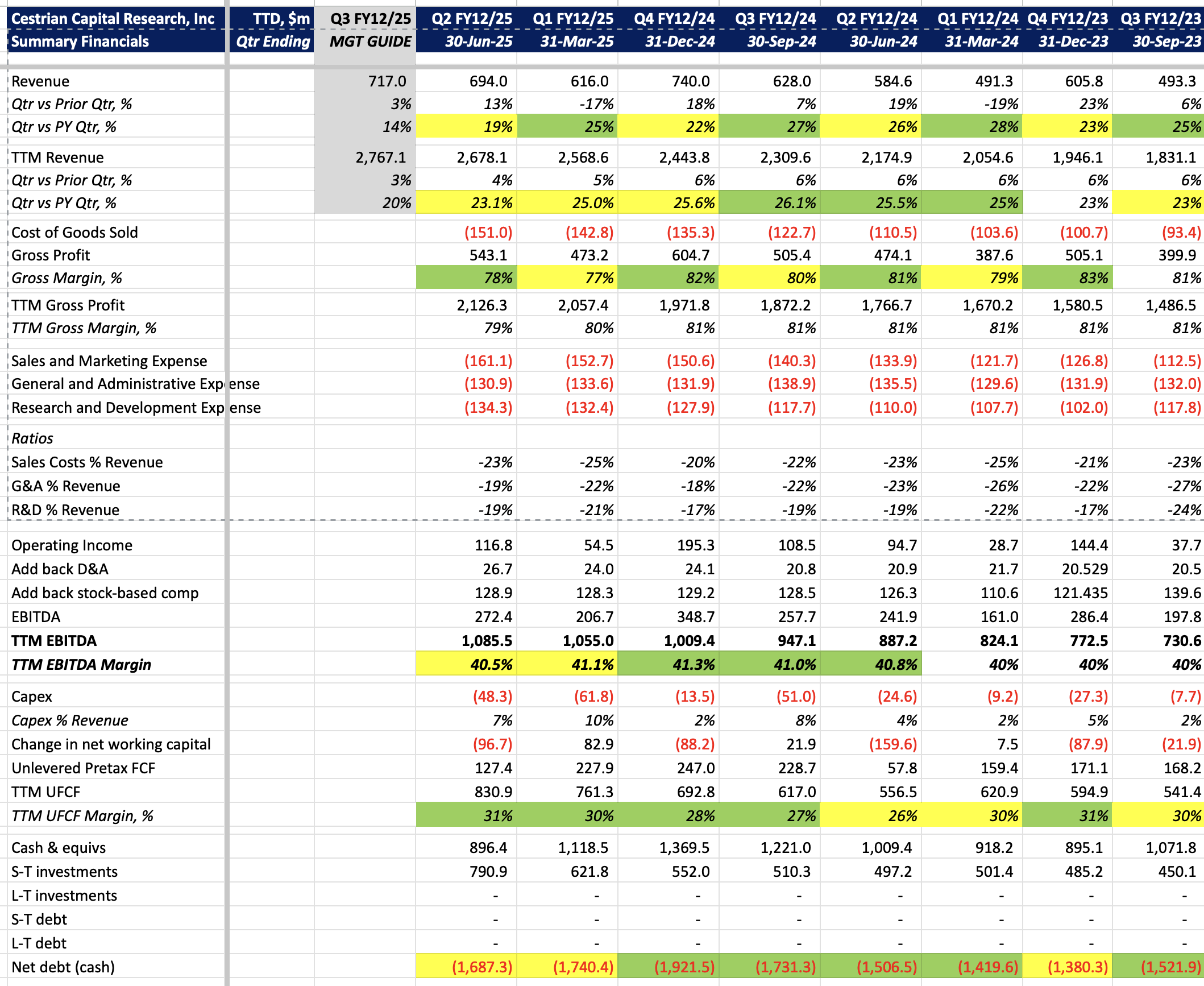

Financial Fundamentals

Revenue beat this quarter, a drop to +19% growth vs. Q2 last year; the guide is for a further slowdown to +14% - this was partly why the stock reacted as it did, I suspect.

Cashflow margins moved up a tick to 31% on a TTM UFCF basis, and the balance sheet has $1.7bn of cash & short-term investments with no debt whatsoever.

Valuation

I don’t think that 9x TTM revenue and 30x TTM UFCF is too bad - this is the post-dump valuation analysis of course. This isn’t a screaming buy on fundamental valuation, but it’s not overvalued either in my view.

Stock Chart

This is where the action is I think.

Long-run support for $TTD stock sits in the $40 zip code.

If the stock drops below there, you know there is real trouble at hand. Since it’s at $54 right now, that means a 25% ish drop from here to hard support. A prudent investor might place a stop a few points below that $40 zone - let’s say $35. (I would suggest picking a number that isn’t a round number; make it a little harder for stop runs to take your money).

This is how I think the moves since the April lows look:

Stock Rating

I don’t think TTD will magically reach for the stars tomorrow, but I do think it will start to put in an accumulation pattern down here at the lows. If so we may see a new Wave 3 up on this timeframe (months) before too long.

I opened new long positions in the name on Friday when I saw the .786 retrace holding.

We rate at Accumulate. Below $40 is a bad place and losses could be cut without looking back I think. We’ll look at upside targets as the stock progresses.

Cestrian Capital Research, Inc - 10 August 2025.