AMD Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s Almost As If We Aren’t Doomed

If you spend any time reading or thinking about the macro picture it’s easy to think the market must be heading down sometime soon. For good measure, this week India commenced bombing Pakistan. Probably Pakistan will retaliate. Both are nuclear powers. The news just keeps getting worse.

But if you look at the financial fundamentals and guidance getting printed by the top US companies, the gloom is hard to discern. We’ve seen this throughout earnings season so far, and AMD is no exception.

Let’s take a look.

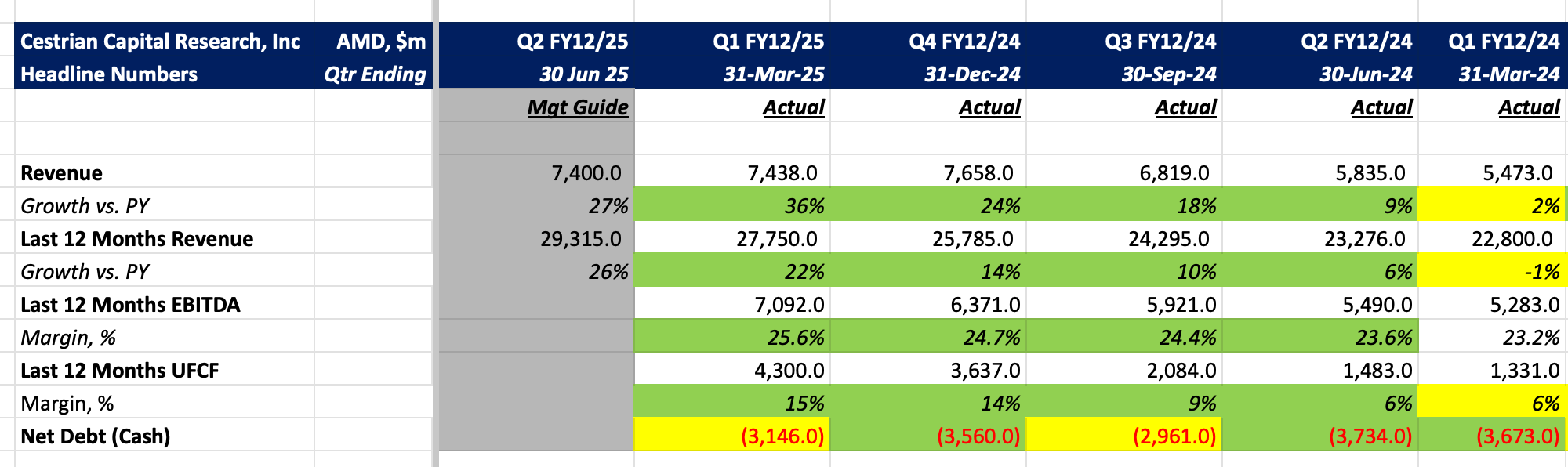

Growth accelerated and margins rose. Net cash was a little lower than last quarter but nothing at a level to worry about. It’s certainly possible that some of the acceleration in AMD growth is due to pull-forward orders; many participants in the semiconductor supply chain are scrambling to get ahead of any possible future tariffs. But growth has been accelerating for each of the last four quarters, so perhaps this is just a continuation of the trend. (You could say the same for margins. Pull-forward orders are likely to be at premium prices, which will push up margins - but the margin trend has been up for four quarters now anyway).

For our paying subscribers we now move on to valuation analysis, our stock chart view, and our stock rating.