Animal Spirits

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Just Another Stock

Trupanion is one of those companies with the capacity to irritate people beyond compare. This goes with the territory unfortunately. If your business is the provision of healthcare or insurance to wetware furry or otherwise, then you stand at fundamental odds to your customers. Because your customers want to get and stay healthy and want to pay as little as possible for that, and you want your customers to get the minimum service you can defend in public (aka. the maximum mortality rate you can look the regulator in the eye and declare it OK), and to pay you handsomely for that. This is true for every healthcare sector business in the land. We don’t cover healthcare stocks because we prefer to deal with nobody-got-hurt-in-the-making-of-this-profit stocks in tech and defense. OK not in defense. But, you know, in defense stocks, bad guys get hurt, not, you know, Bonzo.

We got interested in Trupanion because a group of whip-smart short sellers have ahold of it. We refer you to Marc Cohodes and Parrot Capital, amongst others. We don’t claim their insights into this thing but we’re very happy to bring our usually-pretty-sharp fundamental analysis to the table here.

Thank you for reading Cestrian Market Insight. This post is public so feel free to share it.

So here goes with Q4 of FY12/23. As always, no paywall on our short work.

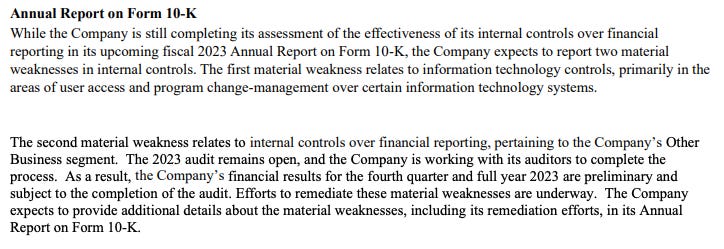

The first thing to say is that the company is saying that the earnings are only, you know, in draft. Sure, sure, they published them and all but really you should consider these a placeholder until the real numbers arrive. “Directionally Correct” as an ex-boss of one of our number would put it. (His other slide labels were, “Interesting If True” and “Probably Wrong”, but we don’t need to go there at this stage).

This is what the company printed on page 2 of the release today.

This isn’t a disaster in itself, it happens, but it’s not a good look. Microsoft doesn’t do this. Lockheed Martin doesn’t do this. And so on.

Let’s look at the headline numbers anyway, assuming they are more or less correct.

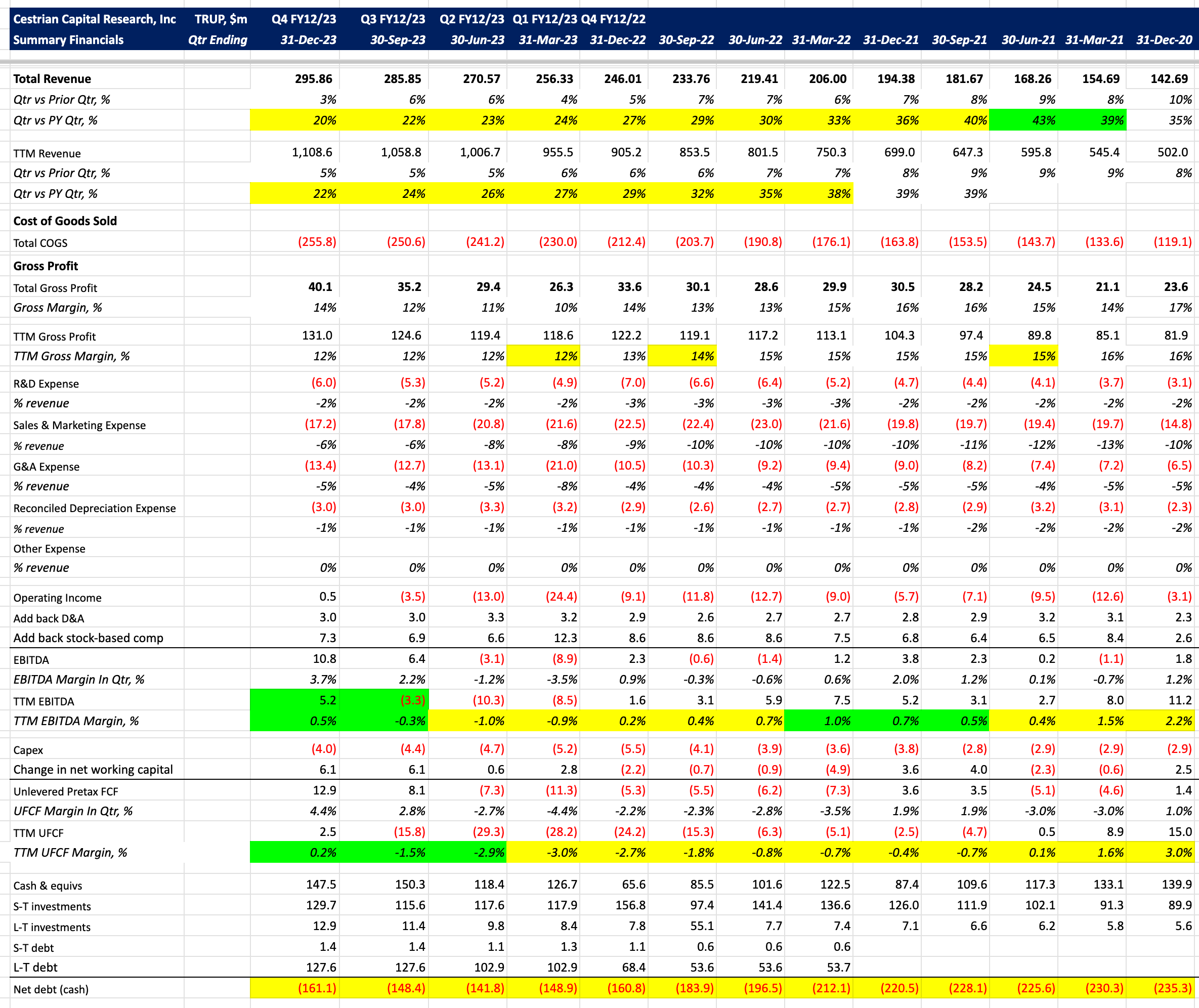

This quarter saw the tenth sequential quarter of declining revenue growth - 20% in the quarter vs. 36% two years ago, and 22% on a TTM basis vs. 39% two years ago.

TTM gross margins remain at 12% - that’s not very much, it tells you that fully 88% of the value captured as recognized revenue is paid away to third parties before Trupanion can charge a single dollar of its own expenses.

EBITDA, adding back stock-based comp, was positive in the quarter and just about positive on a TTM basis too.

Cashflow turned positive on a TTM unlevered pretax free cashflow basis for the first time in a year. And net cash ticked up a little.

So, declining growth and margins not really picking up. Also that “these numbers aren’t really the numbers” thing. Hm.

It may be that there is a smoking gun in there somewhere but if there is, we haven’t found it.

What we would say is that this is just not a very good business and none of its trends look very healthy.

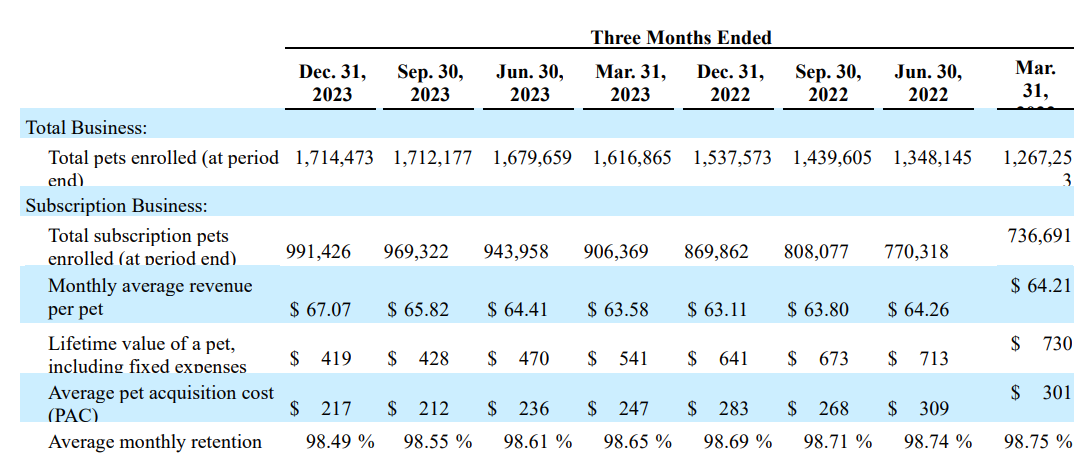

This is the key table that leaps out to us. Subscription businesses - that’s all an insurance company is, a particular kind of subscription business - are simple beasts really. You have to keep your cost of customer acquisition low, and keep your lifetime customer value high. The lower your acquisition costs and the higher your lifetime value, the more cashflow you have and the more valuable your business, all other things being equal.

If your lifetime value is going down then you have to spend a whole lot more time and money replacing those lost customers, and that’s not the game in subscriptions. The game in subscriptions is, don’t lose subscribers, and get very efficient at winning new ones.

Oops.

Number of subscription pets, up, good.

Monthly average revenue per pet, not much changed since March 2022. Meh.

Average pet acquisition cost, down 1/3ish since March 2022. Good.

Lifetime value of pet, down 43% since March 2022. Not good.

Average monthly retention, unchanged since March 2022. Hunh.

So if churn (retention) is unchanged but the lifetime value of the pet is down a lot, why is that?

We can only think of two reasons.

One, pets at signup are getting older, perhaps because TRUP is offering to insure pets that others won’t. That might be out of the goodness of their hearts or it might be because they aren’t competitive for younger pets or it might be that vets don’t recommend them for younger pets.

And/or two once the pets are signed up, the care that TRUP pays for today is less than it used to be, so pet mortality rates are up ergo lifetime value down.

We don’t know which of these it is, but it kind of has to be one of them.

Either there is more churn than there appears to be, or the lifetime of the pet is shorter due to which pets are signing up, or the lifetime is shorter due to the care provided.

Anyway this most certainly is not a good look.

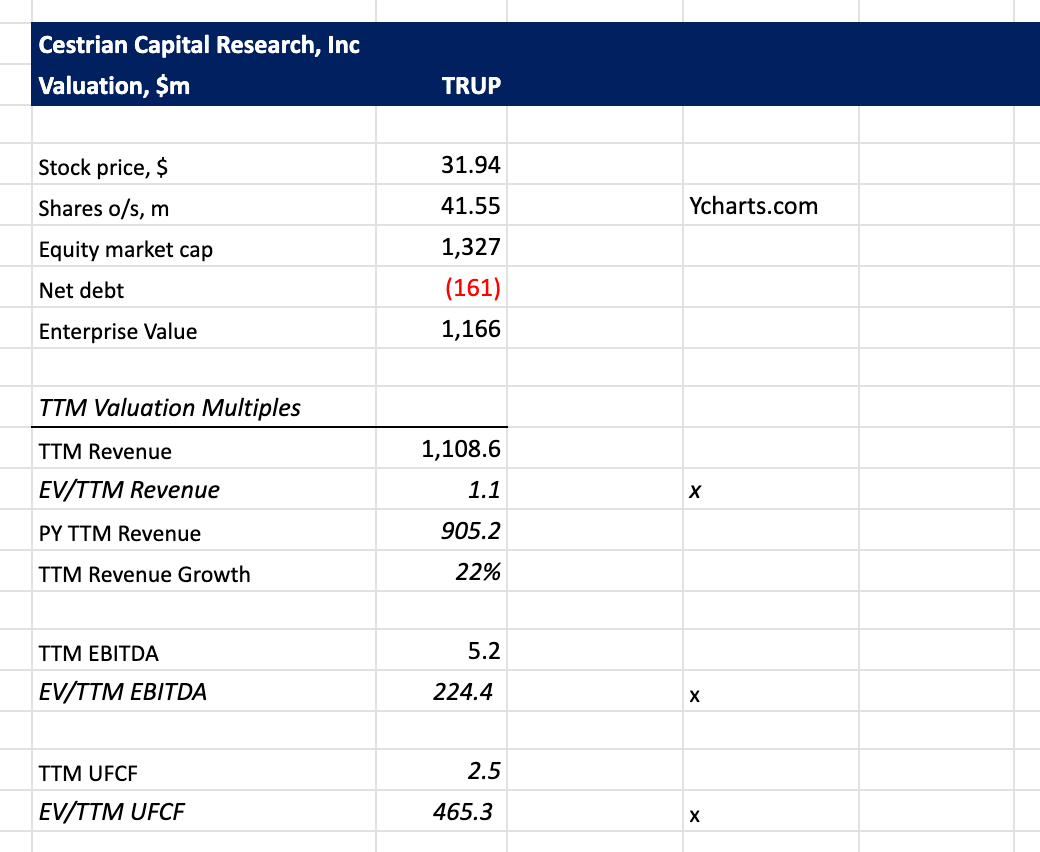

Despite which, you’ll pay 224x TTM EBITDA or 465x TTM unlevered pretax FCF for this name if you buy it right now.

For comparison, is currently for sale at only 80x TTM unlevered pretax FCF. Yes it is. So is nearly 6x more expensive that NVDA on cashflow metrics.

Probably fine.

Here’s the TRUP chart as we see it. You can open a full page version, here.

Sat a little below the 12-month high resistance line after a major run-up into earnings. The stock might break through to the upside, but we can’t think of why that would happen. More likely in our view another drift back down to that 5-year low zone.

We remain short in staff personal accounts.

Cestrian Capital Research, Inc - 16 February 2024.