Apple, Inc - Q2 FY9/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not So Bad Really

Apple is in the business of (1) designing things expensively in the US (2) having them made cheaply in China (3) sending them to the US to be sold expensively. It is in essence one giant labor cost arbitrage business. This of course puts the company squarely in the crosshairs of the new tariff regime.

Now this is a problem not just in the way that it is for any other company with Apple’s manufacture-offshore model. It is a bigger problem because of Apple’s primary product.

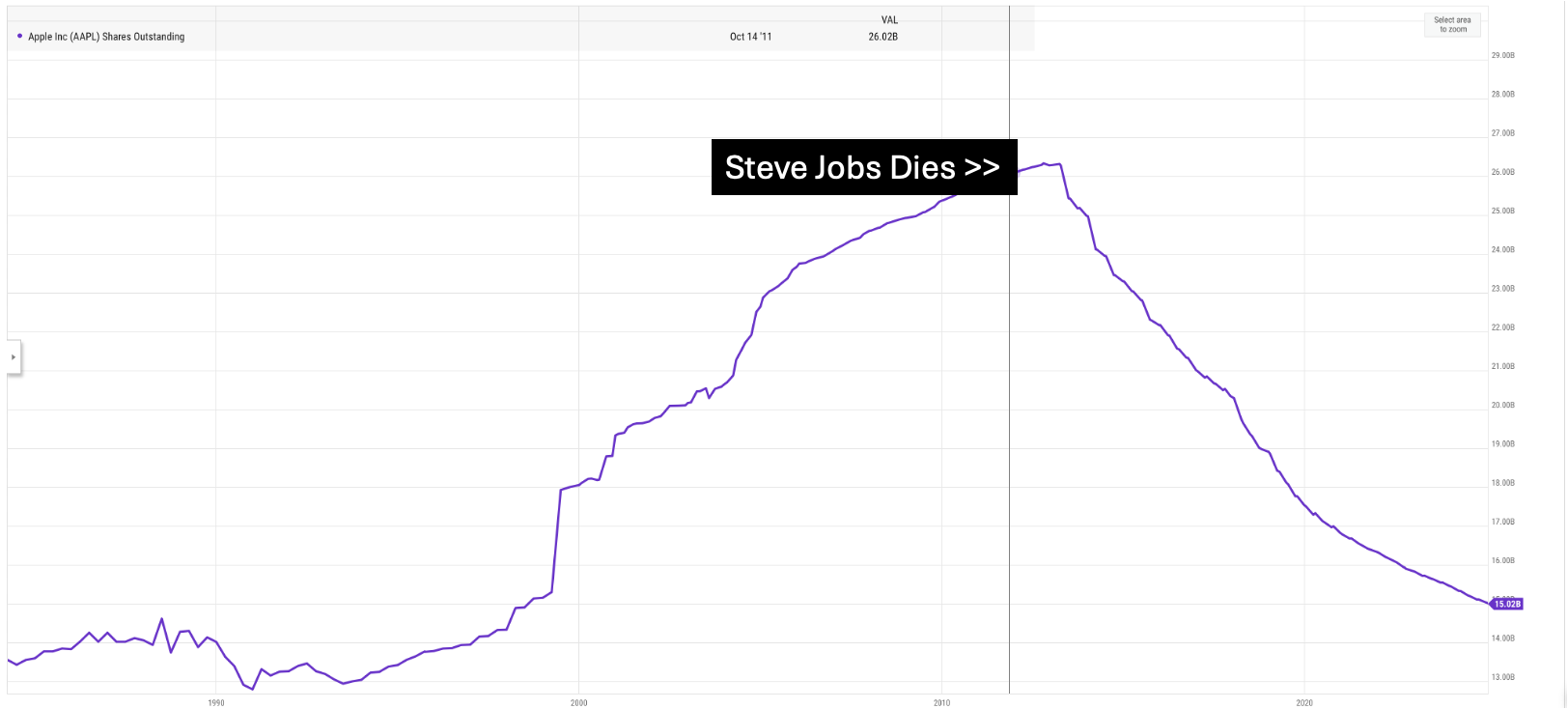

You see, Apple’s notional products are phones and suchlike but in reality its primary product is its stock. The excess profits wrought by its labor arbitrage practice are used to buy its own stock, which in turn helps to support the stock price. In answer to the question “why doesn’t Apple spend more on R&D or innovate more or acquire more startups”, the answer is “because its CEO doesn’t want to”. The Cook era has been the stock-as-the-product era.

So all told, I think the modest drop in AAPL’s stock price after earnings yesterday wasn’t too bad. The company has been one of the few to specify a specific cost assignment to tariffs - $900m in the June quarter, according to the earnings call (and the company said this was flattered by some one-time items, ie. would be worse in future quarters). As with the market at large at present, someone is wrong. Either the proposed tariffs are going to be implemented at or close to the Liberation Day levels (in which case the market is wrong) or else the Administration is going to walk back its ambitions in favor of a less punitive system.

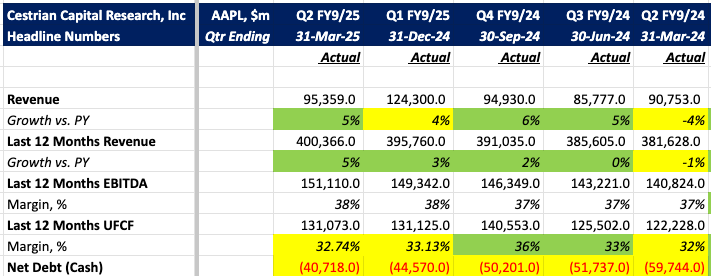

Let’s get into the detail. First the headlines and then the fundamentals, valuation, and the stock chart.