ARM Holdings Q2 FY3/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

When Not If, Probably

By Alex King, CEO, Cestrian Capital Research, Inc.

I’ve noted elsewhere recently that I don’t think the answer to better faster cheaper AI is to keep burning more coal and gas, to keep spinning windmills ever faster, to applaud climate change as a source of cheaper electrons, or even to pile up the “it’s probably safe don’t worry about it” spent nuclear fuel rod arsenal, all in order to power more and more and more and more Nvidia GPUs.

The answer to making cars go faster and be cheaper and safer and better between the 20th century and today wasn’t to add ever more cylinders and displacement capacity. You can buy a W-16 today if you really want to, but the bulk of capital investment and consumer dollars in the combustion engine was rerouted to smaller form factor, fewer moving parts, trickery-enhanced motors with low pressure turbochargers and mild hybrid systems and whatnot. And that’s before we even start talking about EVs.

In semiconductor I don’t think the answer is “before you build your datacenter first commission a new power station”, I think the answer is “use chips that don’t resemble Henry VIII of England in their input / output efficiency”. And curiously I think that probably favors a longstanding chip company that grew out of another seat of medieval power, being Cambridge, UK; that company being ARM Holdings.

ARM cores are low power by design, with 30+ yrs of low power evolution in their DNA. At some point I think someone figures out how to cobble ARM cores together in such a manner that you can get 10x NVDA performance for, if not 1/10 the price, then maybe 1/10 the power requirements which on a TCO basis means a lot less money out the door and a lot more compute cycles down the wire.

If you are the kind of person who invests on this kind of thesis, then $ARM may be one for you. But ARM numbers today aren’t very pretty in my opinion. Formally speaking we rate the stock at “Hold” because the chart looks bullish still, and because I think there’s a good chance semiconductor as a sector surprises folks to the upside; but I don’t own the name personally and I don’t plan to. Specifically the widening gap between accounting profits (EBITDA in our method) and cashflow (unlevered pretax free cashflow for us) isn’t a good look, and neither is the declining amount of deferred revenue.

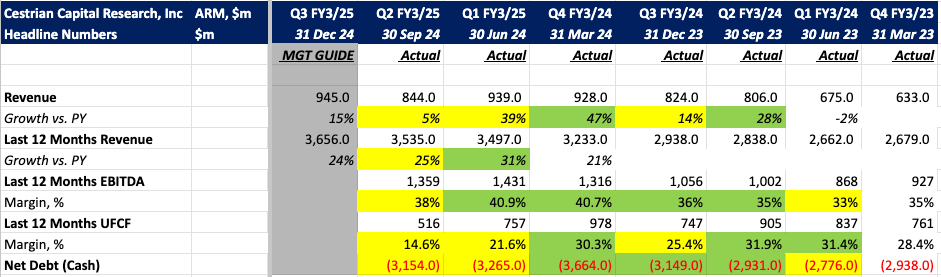

Financial Summary

Here's the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.