Big Money Is Changing. So Must You.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Do Not Get Left Behind.

by Alex King, CEO, Cestrian Capital Research, Inc.

There are two fundamental changes underway in financial markets, and I think the majority of investors are sleeping on both of them.

Before I get to that, since we have had so many new folks join us recently, I want to explain a little bit about how our work at Cestrian - meaning our stock, ETF and crypto analysis - is set up to take advantage of these changes.

Our work, as you will see, is nothing like other research firms; it’s nothing like what you receive from Wall Street sellside analysts; it’s nothing like you will find in anyone’s Substack; nobody on Twitter rolls like us. We consider our work to be buyside analysis of the kind you would expect to see produced internally at a tier-1 fund. It’s just that unlike those funds, we share our work with the outside world as well as using it to invest our own personal capital.

Our work is prepared with Big Money in mind.

Specifically we focus our time and effort on understanding how large, price-setting investors move markets; we use all manner of qualitative and quantitative analysis methods to spot the breadcrumb trail left by these asset managers as they rotate capital through stock after stock, sector after sector, coin after coin.

The output - our market commentary, single-stock analysis, crypto insights - is a function of this Big Money approach. We believe any investor, any trader, can raise their game by reading and thinking about the research and analysis we provide. I’m delighted to say that our testimonials agree.

Fundamental Changes In Financial Markets

- The Institutionalization Of Crypto.

The dichotomy between crypto and traditional securities, DeFi and TradFi, crypto bros and Boomer asset managers has been rendered false by the GENIUS Act. The GENIUS Act enshrines and legitimizes the use of stablecoins as a way for US Dollar value to make its way into the digital domain. The early forms of stablecoins I expect to slowly wither, whilst the newer stablecoins issued by new, audited, quoted providers, backed by solid collateral in the form of US Treasury notes and/or US Dollars I expect to gain share.

Stablecoins are to crypto as chips are to a casino. You can’t play with dollars in the casino, you need dollar-backed chips; you can’t play with dollars on the blockchain, you need cryptocurrencies to do so, and to get cryptocurrency you need stablecoins. A simple on/off ramp from the dollar domain to the digital domain. As crypto continues to take hold in financial markets, the demand for stablecoins will rise and so too, we expect, will demand for US Dollars and US Treasury notes. This is one part of the Federal Government’s attempts to reduce the cost of government borrowing by ramping demand for bonds.

The largest and most risk-averse asset managers on the planet are in the process of adopting cryptocurrency. Specifically, they are ’tokenizing’ (creating fragmented digitized claims on ownership) a wealth of assets from private credit funds to private equity funds, real estate to bonds, in order to access new sources of liquidity. These assets - the tokenized versions thereof - are moving “on chain” which is to say the tokens will be stored and processed on the Ethereum blockchain. To pay for the transaction processing, issuers, investors, traders and brokers in this asset class require Ether, the cryptocurrency. It is likely, therefore, that we are at a significant inflection point in Ether - this is why you see a slew of companies accumualting Ether at present.

And after Ether, with lower demands on blockchain functionality, will come Solana.

To repeat: this is now.

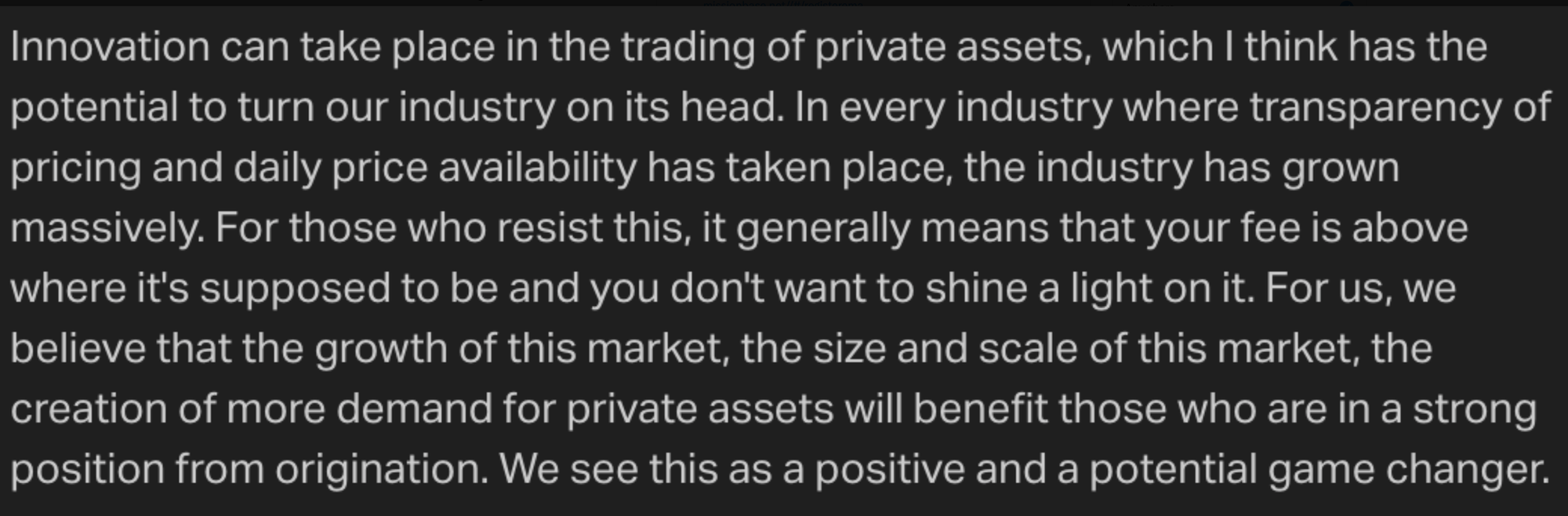

Here’s Marc Rowan of Apollo - about as far from a crypto bro as you can get.

This is now.

Don’t get left behind. All investors and traders need to understand that the old-line asset management industry just embraced, co-opted and captured crypto for its own ends. There is a world of opportunity in this newly legitimized crypto market. We cover this in depth in our Big Money Crypto and Inner Circle services.

- The Quiet Storm: AI Is What Lies Beneath

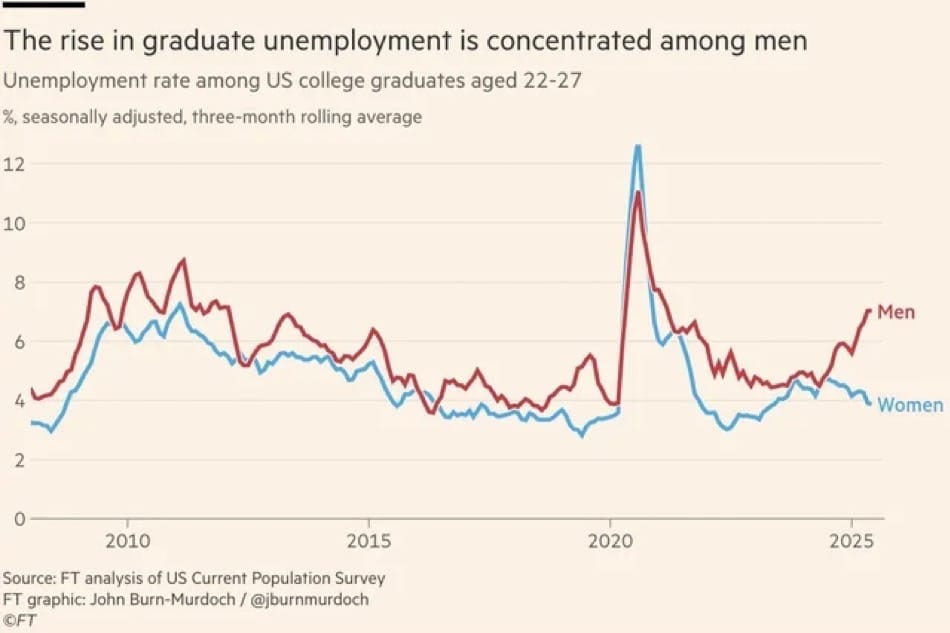

If you think the only use cases for AI is enhanced web search or image creation, you’re already behind. Today, AI is hollowing out professional organizations from within. It is a more brutal, faster, more deflationary and fundamentally more revolutionary change ripping through the economy than even the Internet itself was 30 years ago when the Netscape Moment hit. The hit to junior white-collar jobs of the kind typically taken by young graduate males is already remarkable.

AI is already changing the way large investors run money. In the 1990s and 2000s, there were a handful of pure quantitative analysis funds - most notably Renaissance Technologies but also D. E. Shaw and others - who were successful as a result of (1) novel algorithmic methods to predict securities prices (2) a hugely expensive bench of analysts and software developers needed to create algorithms from the ground up and (3) leverage, lots of it. If you relied upon traditional methods of analysis, you could not keep up with this new class of investor.

Today the methods used to grow Renaissance into a fund of global renown are available to you and I, free or close to it, at any internet terminal. The skills one needs to invest and trade now include, as always, fundamental analysis and technical analysis; but now the quant dimension looms large and if one does not embrace it, one will be rendered obsolete by it.

At Cestrian we use LLMs every single hour of every single working day. We strive to automate as much as we can. And we use AI models in our investing analysis too, as you will see below.

Our services.

We offer a simple palette of services, all available as monthly or (cheaper) annual subscriptions.

Human Authored

- Cestrian Inner Circle is our premium service. It includes human-authored market, sector, single-stock and crypto analysis, and comes with a wonderful chat environment hosting our superb community of investors, traders, engineers, statisticians, data scientists, software developers and so on. Our community is wise indeed. I personally spend much of my day in the Inner Circle chatroom for this reason - I learn a lot! The service includes trade disclosure alerts when Cestrian staff personal accounts place trades in covered instruments; and it includes a live, open-mic weekly webinar.

- Cestrian Big Money Crypto is our crypto-only service. It covers Bitcoin, Ether, Solana, and a curated group of crypto-first stocks like BitMine Immersion Technologies (the Tom Lee / Peter Thiel Ether play), Coinbase, the BlackRock crypto ETFs, and so on. (All this work is included in Inner Circle by the way).

- Jay’s Options is our options service. It is focused on helping you use options the way Big Money uses options. Selling options to capture premium, creating risk-defined trades using multi-leg positions; this is nothing like “buy calls! buy puts!”; it is how market-makers use options, which is why it is such a succesful service. We help you how to think and trade like the “house” and not like the visitors to the casino.

- Trading Gains is a long/short ETF service focused on equities, commodities and bond ETFs. The service can teach you how to fish on both sides of the boat - making money in bull markets and bear markets alike - and it covers a wide range of instruments to ensure that whatever the weather in markets you can find a compelling setup and adjust your risk at entry.

- Trading With Van is a futures service. It is exceptionally easy to use. Van, a full-time futures trader using the NQ e-mini, shares his trades and analysis in real time, and explains his risk control at all times.

- YX Insights is a macro-driven research service that concentrates on the major equity indices, commodities, and the “Mag7” group of market-moving stocks. It includes extensive AI-driven risk on / risk off signals.

Machine Driven

- Big Money Crypto Signals is a simple risk-on / risk-off signal service covering Bitcoin, Ether, Solana, Robinhood ($HOOD) and Coinbase ($COIN). It prints its risk signals daily before the open. Independent investors can read about it here, and professionals here.

- SignalFlow AI is a family of risk signals covering the S&P500, growth sector ETFs, bonds and long/short strategies. You can read all about it here.

- Systematic Signals brings you risk signals covering the S&P500, Nasdaq, Bitcoin, Palantir, Tesla and all Mag7 stocks. Independent investor version here, and investment professional version here.

If you have any questions at all about our method, our work, our services, anything at all, please reach out. You can connect by using this contact form below, or e-mailing us at minerva@cestriancapital.com .

Cestrian Capital Research, Inc - 6 August 2025.