Cloudflare Q1 - Take A Look Below The Waterline

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

RPO, Your Glimpse Into The Future

by Alex King

Summary:

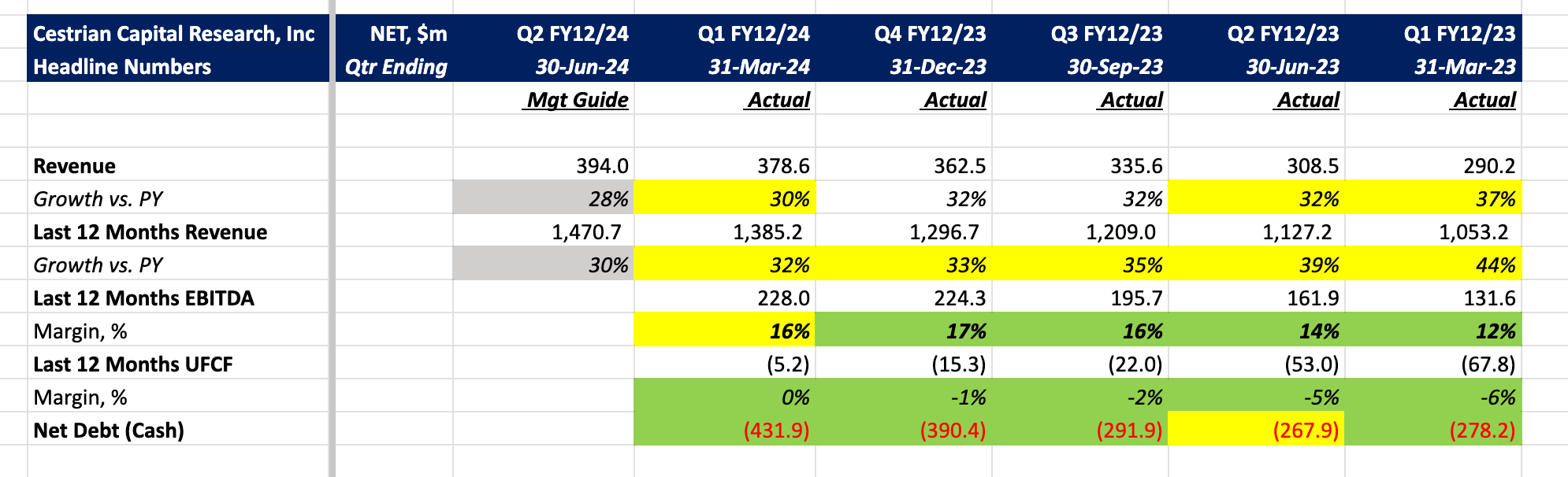

- Cloudflare delivered a slight beat on the revenue line in its Q1, reported yesterday after the close.

- Growth sits at 30% YoY, or 32% on a TTM vs prior year basis. The guide for next quarter is a slowdown to 28% (implying TTM growth of 30%).

- EBITDA margins dipped a point, which is unusual, but on the other hand TTM unlevered pretax FCF hit breakeven for the first time ever.

- The balance sheet remains safe.

- Read on for our ratings, financial and technical analysis, and price targets.

Backgrounder For Normalfolk

Cloudflare, if you don't live and breathe proxy servers, is a business of increasing structural importance to the Internet. The company provides network edge services; this means they buy server hardware and lease telecom capacity, put the hardware at the edge of the public network (physically and topologically close to customers), and use that proximity to (i) serve German Shepherd videos faster than other platforms (ii) allow developers to write and deploy applications near the enterprise for low latency and also (iii) deploy a 'zero-trust' security perimeter around enterprise assets in the manner of ZScaler. This may sound boring to you, but when Cloudflare trips on its own shoelaces, which is not often, your choice of German Shepherd / enterprise application / security hurdle is likely to also hit the deck. Which is unacceptable, clearly. So customers pay Cloudflare a lot of money to keep the lights on. The heavier the compute load in the cloud, the more Cloudflare's services are important. There are competitors, yes - Amazon and Fastly can send those cat videos probably just as fast - and ZScaler likely has better pureplay security tools - but taken as a whole, the success of this company is of increasing importance to a whole lot of customers.

This is perhaps why a relatively small business - enterprise value just shy of $25bn at present - has a stock which increasingly trades very nicely to technicals. When you see key technical levels respected as a stock goes about its business, and in particular when you see the options market behave in a way to swipe money off of folks in a too-perfect manner? That's the hallmark of an institutionally owned and traded stock.

Cloudflare printed perfectly solid numbers yesterday, but the stock dumped pronto. The price held at a key technical level. Let's dive into the implications of that. First, the headline numbers.

Headline Numbers

Fundamental Analysis, Valuation, Rating, Price Targets

Here's the good stuff - after the paywall of course, because capitalism.

If you're yet to sign up to one of the pay tiers here, you can choose the 'Market Insight' level if you want just the earnings and daily market notes; if you'd like the full Inner Circle services - real-time trade alerts, 24/7 access to our charts, price targets, stock ratings, live weekly webinars, top-top-quality investor chat? Then choose the, er, Inner Circle tier. The pay stuff here starts at less than $30/month. We are pretty sure you can find that much value in it!