Crowdstrike (CRWD) stock price popped by >20% post earnings- we ask why...

- CrowdStrike has exhibited weakening financial fundamentals, with falling revenue growth rates and margins.

- The stock's meteoric rise cannot be explained by fundamentals or apparent product positioning.

- Charts and prices in securities markets move ahead of the news, revealing what Big Money is doing.

- And the Big Reveal may just have dropped at CRWD … on the PANW earnings call! Read on.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Why Charts Beat The News Every Time

by Alex King

CrowdStrike ($CRWD) is a cybersecurity software company; specifically it is a leading independent provider of endpoint security in the enterprise. Meaning that compared to most companies not called Microsoft it has a very large installed base of laptops, desktops, those devices used right at the edge of the network (hence the 'endpoint' moniker). The stock has been highly volatile since IPO but very rewarding for anyone with patience and the ability to stomach major drawdowns.

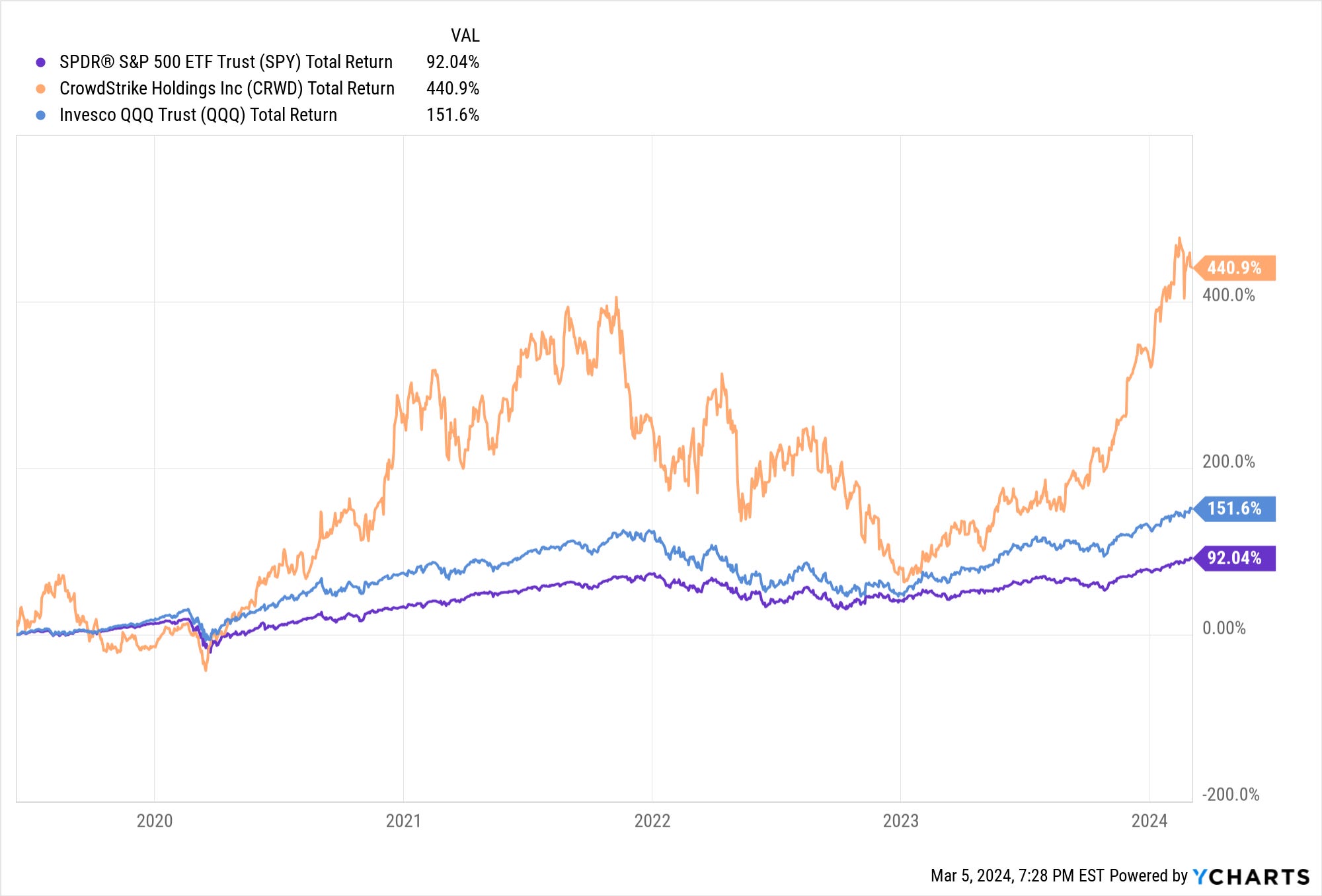

Here's the stock vs. the S&P500 and the Nasdaq-100 - using $SPY and $QQQ index proxies - since the CRWD IPO, both on a total return basis, ie. any dividends produced are re-invested back into buying additional stock. (CRWD pays no dividend, so for CRWD, the price gain = the total return gain).

CRWD has for some time now exhibited weakening financial fundamentals. We've noted many times that both revenue growth rates and margins are falling in concert - that's unusual for enterprise software where, by and large, as companies mature (= grow at slower rates), cashflow margins rise. This is usually a function of an experienced management team knowing when to slow down hiring in sales & marketing, in development, and just ride out the remaining opportunity without spending much to service it. At this point in time, growth is achieved as much by price rises as it is new unit sales; and equity value sustained through the use of dividends, buybacks and other optical matters.

If this were true of CRWD, you would expect the stock to have moved up during 2023-24 with the market, but not to have positively ripped it up the way it has. Nothing in the fundamentals explains CRWD’s meteoric rise. Nothing in the stated product positioning explains it either. And yet here we have a not-small-cap business making like a meme stock. So in the words of that most skilled equity analyst Scooby Doo - huh?

The Grand Reveal

What I absolutely love about securities markets is that prices - charts - move ahead of the news. Anyone who tries to invest off the back of news, good luck to you. This is a fool’s errand in my book. I hate to sound all Marshall McLuhan, but the news is simply what is proffered to you by the handful of organizations with a voice loud enough to reach your screen. The only reality in securities markets is price. The only truth is price. And price tells you what Big Money is doing, not too much longer after the have done it. There is time enough to act and follow in their footsteps, before the news intervenes to sound the dog whistle, heralding late buyers or late sellers, whichever is so desired by Big Money. Very often, having seen a big move in a stock - a run up, a run down, or Big Money’s most favorite move of all, sideways, rangebound, at the highs (distribution) or lows (accumulation) - the news arrives which sheds light on what Big Money knew all along, and a-ha! now you understand the move.

You doubt this? Take a look at the chart of any oil stock, oil itself, wheat or corn futures, in the second half of 2021. Accumulation patterns everywhere. What happened in Q1 2022? Russia invaded Ukraine; energy stocks and commodity prices mooned. Tech stocks? H2 2022. Accumulation. Q2 2023? Moonage. Is this some kind of conspiracy? It is not. It is simply that Big Money is good at its job. That’s why it is Big Money and stays that way. It is Big Money’s job to work out whether forces amassing on a border are to invade, or merely to intimidate; and to invest accordingly. It is Big Money’s job to work out when inflation may start to fall and/or the Fed pause its hiking cycle. This is why the folks in the biggest offices of Big Money spend so much time in the corridors of power - because their job is to read the tealeaves, understand the signs, and to act accordingly.

Well, the grand reveal for Crowdstrike was, funnily enough, the Oh-No moment for Palo Alto Networks ($PANW). PANW’s much-delayed plunge into the abyss - cmon people this is a proprietary systems company, it’s only a matter of time - took place when they said in their earnings print, more or less, oops we are losing Federal market share to young whippersnappers in cybersecurity - yahoos that don’t require you to buy boxes from them. And, after a fashion, it would appear that CRWD is one of these yahoos. CRWD to my eyes appears to be doing more in-network services than it first appeared; and if they are winning share in Federal customers, as are ZS and NET, well, that’s a new leg of growth for them.

Congratulations Big Money!

CRWD is a member of one of the model portfolios in our Inner Circle service, our High Beta Portfolio - we named it there on 17 March 2023 at a closing price of $114. The stock sat at $364 at one point post-earnings call, so, better than a 3x money return in less than a year. Not too shabby.

For more information about Inner circle service and discount links, click on the button below.

TL : DR

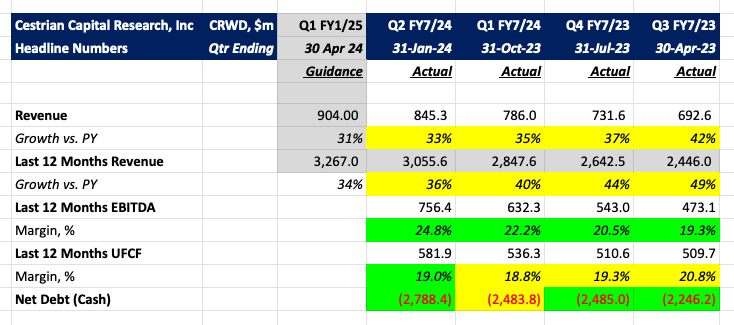

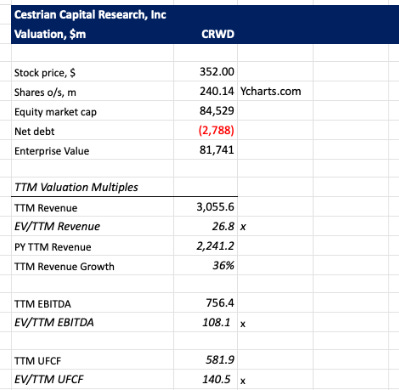

Here’s the headline numbers from CRWD this quarter.

Now let’s move on to consider the stock chart, valuation metrics and our rating.

Read on!

Get our 🎥 content on Youtube, click here and subscribe.

Not a paying member? Subscribe for fundamental and technical analyses, our ratings of 40+ stocks. Hit the button below now!

Technical Analysis

Here's how I see the stock longer term. You can open a full page version of this chart, here.

We rated the stock at Accumulate between $90-135/share, reflecting the institutional accumulation pattern from Q4 2022-Q2 2023 (stock trending sideways in rangebound action at the lows, with high volume nodes on the volume x price indicator - that's the grey bars on the right hand side of the chart).

The stock broke up and out into our Markup Zone in May 2023. I think it can keep rising. The stock popped by over 20% in after-hours trading, breaching the $361 level, which is the 100% Wave 3 extension of the prior Wave 1. It has encountered some resistance at this important technical level. At the time of writing the stock is priced at $337/share.

Going further, in a bull market, I believe that $525/share is possible - that’s the 1.618 Wave 3 extension.

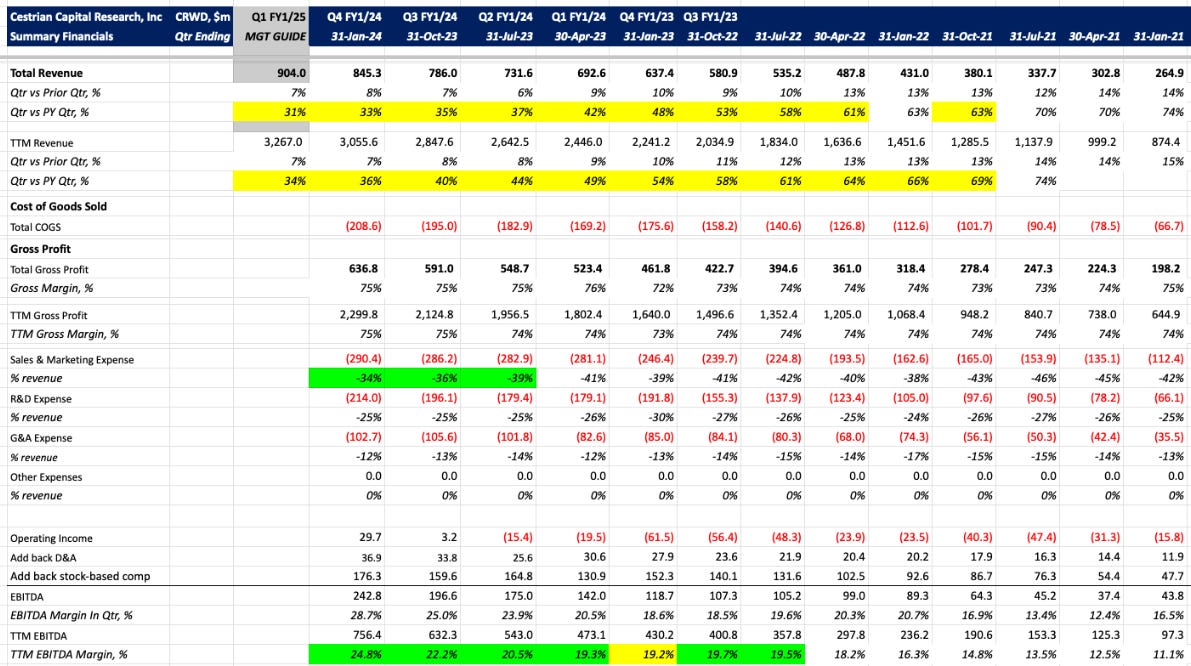

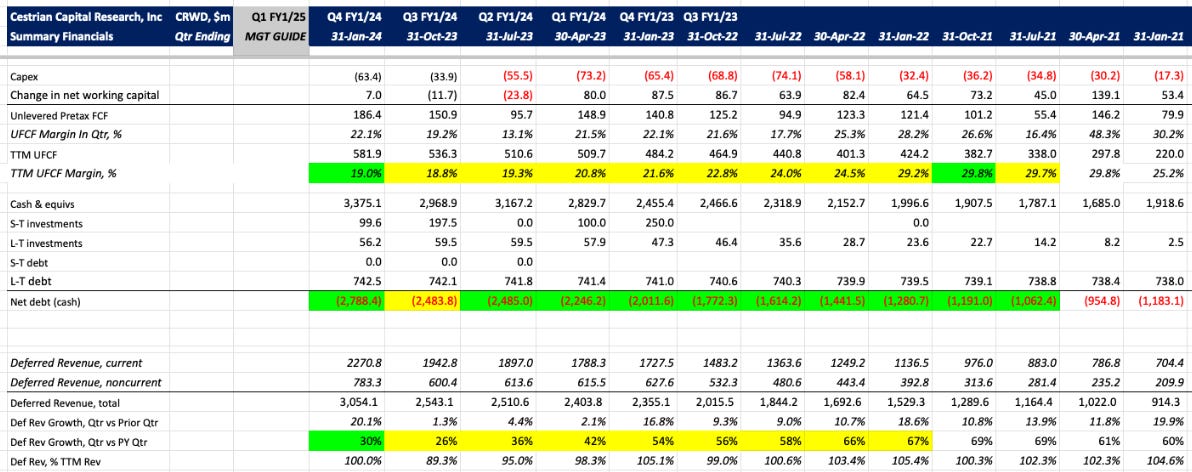

Let’s take a look at the detailed numbers.

Fundamental Analysis

Here's our detailed take on Crowdstrike fundamentals.

The key takeaways for me this quarter were very simple.

- The trend changed. Revenue growth looks like it may flatten out instead of declining - you can see that possibility from the accelerating growth in deferred revenue, up +30% on prior year vs. +26% last quarter.

- Cashflow margins increased - just a touch - but they increased.

- So if revenue growth can bottom out and cashflow margins rise, that’s a whole different story at CRWD, one that doesn’t just say ‘maturing’, but one that says ‘may have found new ways to grow value’.

If you have any questions about the numbers or anything else here, be sure to reach out. Don't suffer in silence!

Valuation Analysis

Expensive on any measure. Doesn’t matter right now.

Stock Rating

We rate CRWD at Hold.

Questions?

If you have questions about any of the numbers, charts, anything, reach out in chat.

Cestrian Capital Research, Inc - 6 Mar 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in ZS.