Evaluating Airbnb's (ABNB) Path Forward- Insights From Q4 FY12/2023 Earnings

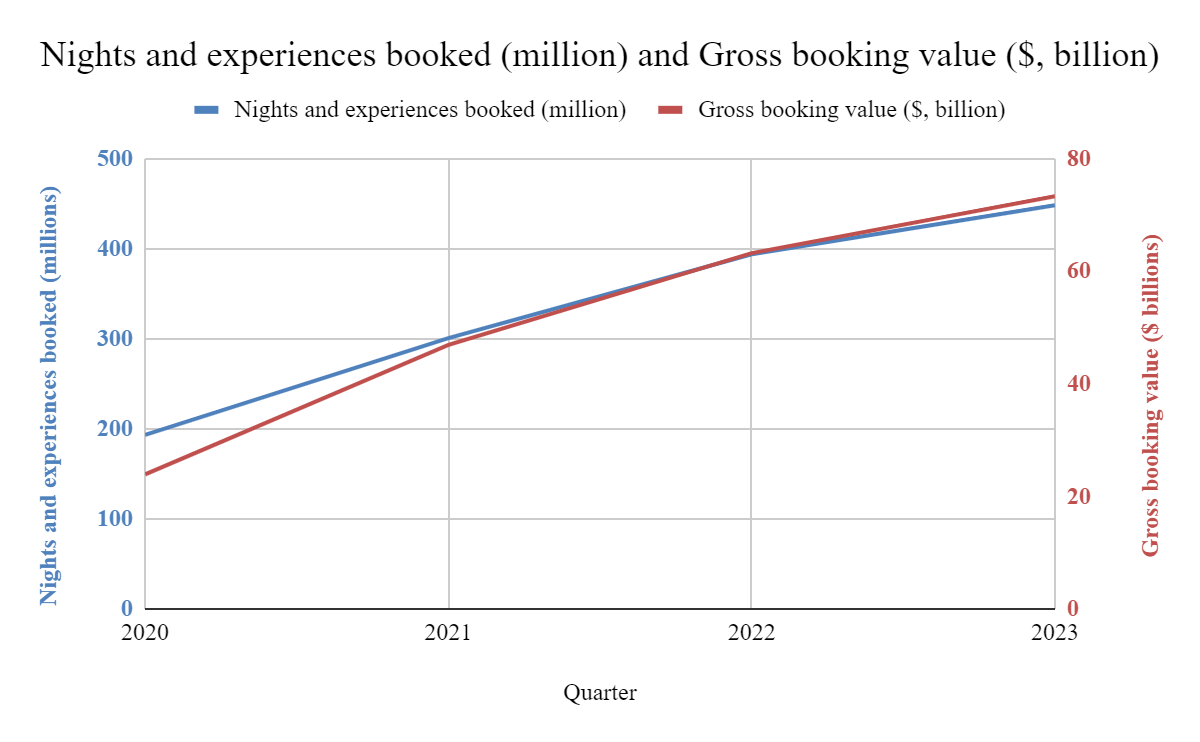

- Airbnb saw a 14% increase in bookings and achieved $73.3 billion in gross booking value in 2023.

- Fourth-quarter revenue reached $2.2 billion, marking a 17% growth compared to the previous year.

- Gross margin remains strong at 83%.

- Supply continues to grow in double digits year over year.

- Challenges lie ahead for Airbnb's growth trajectory.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Tracking Airbnb’s Long-Term Growth Strategy

by Abhishek Singh

Airbnb’s long-term growth rests on three pillars. The company has been working on these for the last three years, having introduced several measures. It would be too boring to detail those measures here; we are more interested in the impact of these changes.

1.) Making hosting mainstream (indicative of how attractive Airbnb is as a platform for hosts)

To have any future whatsoever, Airbnb needs to continuously add more hosts and listings every year. Active listings increased by 18% year-over-year, reaching 7.7 million by the end of 2023. The host community stands strong at 5 million hosts around the globe.

2.) Perfecting host service (indicative of elements which will make Airbnb listings attractive for the customers)

The usual pain points for customers in this pillar were host cancellations, cleaning fees and inflated prices. Airbnb reported a 36% reduction in host cancellations quarter over quarter, and an encouraging trend of two out of three hosts offering discounts on weekly or monthly stays.

Regarding prices, Airbnb claims that the prices of its listings globally are down 2%, whereas hotels are up 7%. Although the data looks positive at face value, I am convinced this is not the whole picture because: one, the data is only for 'one-bedroom apartments'; and two, the price reduction might be due to international expansion in areas where listing prices are low.

3.) Expanding beyond core

This is a crucial pillar for long-term potential of Airbnb and includes expansion into international markets and opening new revenue streams. The company has been actively focusing on expansion into international markets, with growth observed in Germany, Brazil and Korea, and plans to further focus on other countries, including Switzerland, Belgium, and the Netherlands. As in previous earnings call, there were no details about expanding beyond their core business.

Acquisitions

Despite sitting on a pile of cash, Airbnb chose not adopt the growth by acquisition approach for its business until now. Recently, Airbnb acquired AI startup Gameplanner.ai for reportedly just under $200 million. This is ABNB's first acquisition as a public company, and only third valued >$100million. I tried looking up info on Gameplanner.ai but could not find anything of note (looks like a stealth mode start-up to protect intellectual property), except for its founder Adam Cheyer who was also one of the founders of Siri. He now serves as VP AI Experience at Airbnb. This development is a crucial one in my view. Consider this, currently 55% of gross nights booked are on Airbnb app. Any generative AI features resulting in enhanced travel planning and booking experience will result in increased organic traffic for Airbnb, reducing their sales & marketing costs in long run and defend their moat against infringement by the likes of Google travel.

Relevant non-GAAP business performance indicators

- Nights and Experiences Booked: 448.2 million in FY2023 vs 393.7 million in 2022, a 14% increase.

- Gross booking value: GBV is the dollar value of bookings on the Airbnb platform in a period and is inclusive of host earnings, service fees, cleaning fees, and taxes, net of cancellations and alterations that occurred during particular period. GBV was $73.3 billion, a 16% increase from $63.2 billion in 2022.

My take on negative media coverage of Airbnb

Inspired by Munger's quote, we should consider applying the following to Airbnb: 1) our perception of things may not always be the only truth, and 2) never accept any form of media at face value. Now applying these statements to Airbnb:

1.) Airbnb experience of people I know has been extremely positive. My experience with Booking.com has been horrible lately (e.g. they did not let me post a negative review about a booking in a big hotel in a major European tourist city, forget the refund). So, going by my own experience, ABNB might be superior, but is it?

2.) Take all the media coverage (both positive and negative) with a fistful of salt. Airbnb faces a strong hotel lobby worldwide, and any wrong step Airbnb takes WILL BE in spotlight. But hey, Meta was not investable for most part of its existence had people listened to only what media and politicians had to say.

I bought a starter position in Airbnb because I believed that the company was offering something that everyone around me seemed to like (30-35 year olds who love spending money on travel, food, and booze but staying in your Hilton’s or Marriotts is not on top of their list). As I dug deeper into the Airbnb rabbithole, I had this realization that if this company does things right over several years, it will grow into a dominating online travel agency (OTA) platform worldwide. Well, only time will reveal how correct my subjective realization was. But for now, emotions/thoughts/perceptions aside, let us put on our analytical hats and look at the numbers.

Get our 🎥 content, click here and subscribe.

Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Enjoying our work? 🌟 Help us grow by sharing our newsletter with your social network. 🚀

Fundamentals

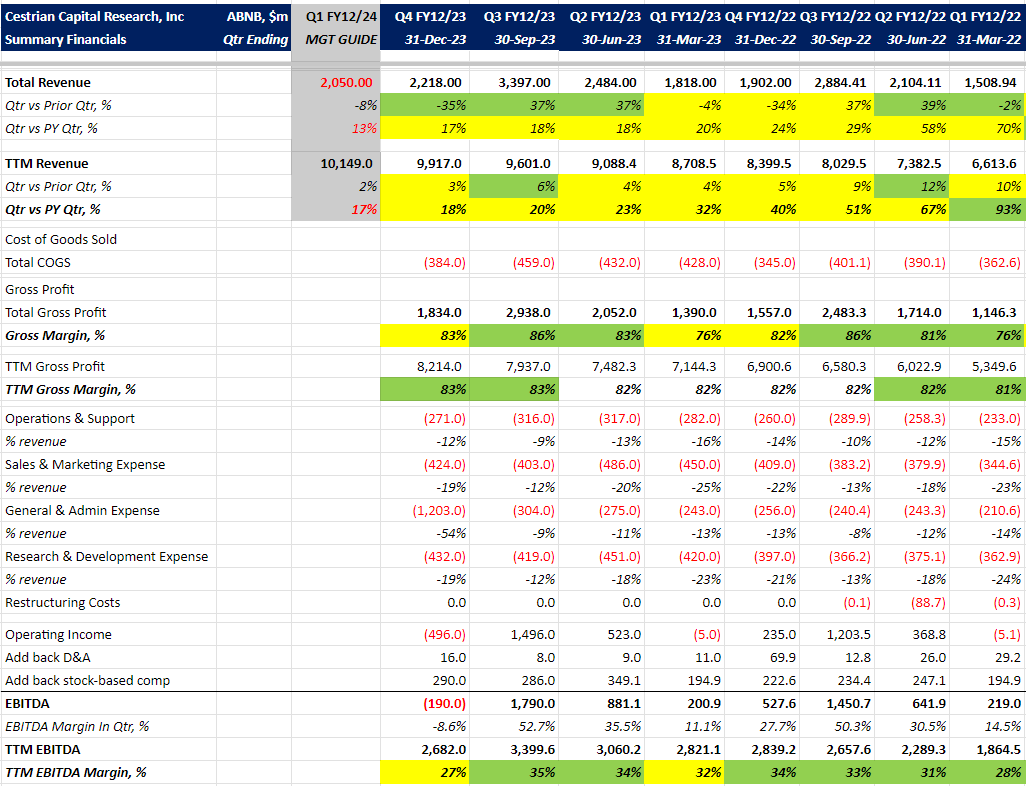

Q4 FY12/2023 numbers were not bad.

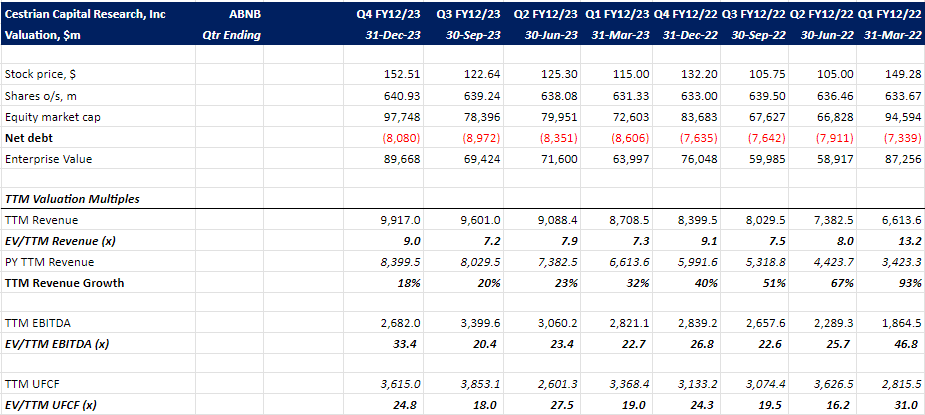

- TTM Revenue of $9.9bn, revenue growth (18% pa) continues to slow down, with management guiding for a further slowdown to 13%.

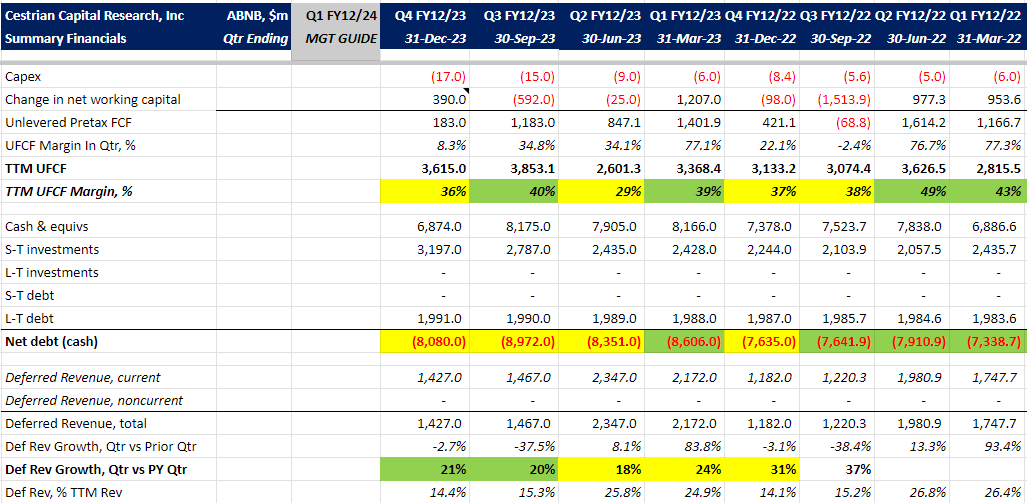

- Unlevered pretax FCF margin, on a TTM basis, dropped to 36%.

- Balance sheet remains strong ($8.08 billion), although on a downward trend since Q2 FY12/23.

- Trading at ~25x EV/TTM UFCF.

Note that negative operating income and EBIDTA for Q4 FY12/23 were caused by very high General and administrative (G&A) costs of 1.2 billion, which was 54% of the quarterly revenue. On a yearly basis, G&A costs increased from $950 million (11% of revenue) to 2.02 billion (20% of the revenue). This increase is primarily due to:

- increase of $991 million related to business and operational taxes, the majority of which is non-recurring

- $93 million increase in payroll related expenses

Valuation

The stock currently trades at EV/TTM revenue multiple of 9 for 18% year over year revenue growth, EV/TTM UFCF multiple of 24.8. This is not prohibitively expensive.

Stock Chart

ABNB's medium-term (M-T) stock chart (Link). Stock is currently in our mark-up zone (>$110/share). It appears to be in Wave 3 subwave impulse within a larger degree Wave 3 impulse. Stock has to materially breach the $153 mark to move upward, where the next resistance level may be at $164. Once that is clear, stock may move further up.

Stop Zone: < $83, Accumulation Zone: $83 - $111, Markup Zone: $111 - $166.

Note : 1.) The dollar limits within the Wyckoff zones serve as guidelines rather than strict rules. They aid in maintaining disciplined buying and selling decisions, removing emotional impulses from the equation. Be like big money and not like chad. 2.) Zone boundaries may change over time, adjusted according to evolving price dynamics, Elliott wave analysis, Fibonacci levels, and volume-by-price data.

ABNB's short-term (S-T) stock chart (Link). After the recent run-up since January 2024, the stock might be on its way to a-b-c correction. Let's monitor how this unfolds.

Rating

Hold since stock is in our mark-up zone. In the long term, I maintain a bullish outlook on this company.

Things to watchout for

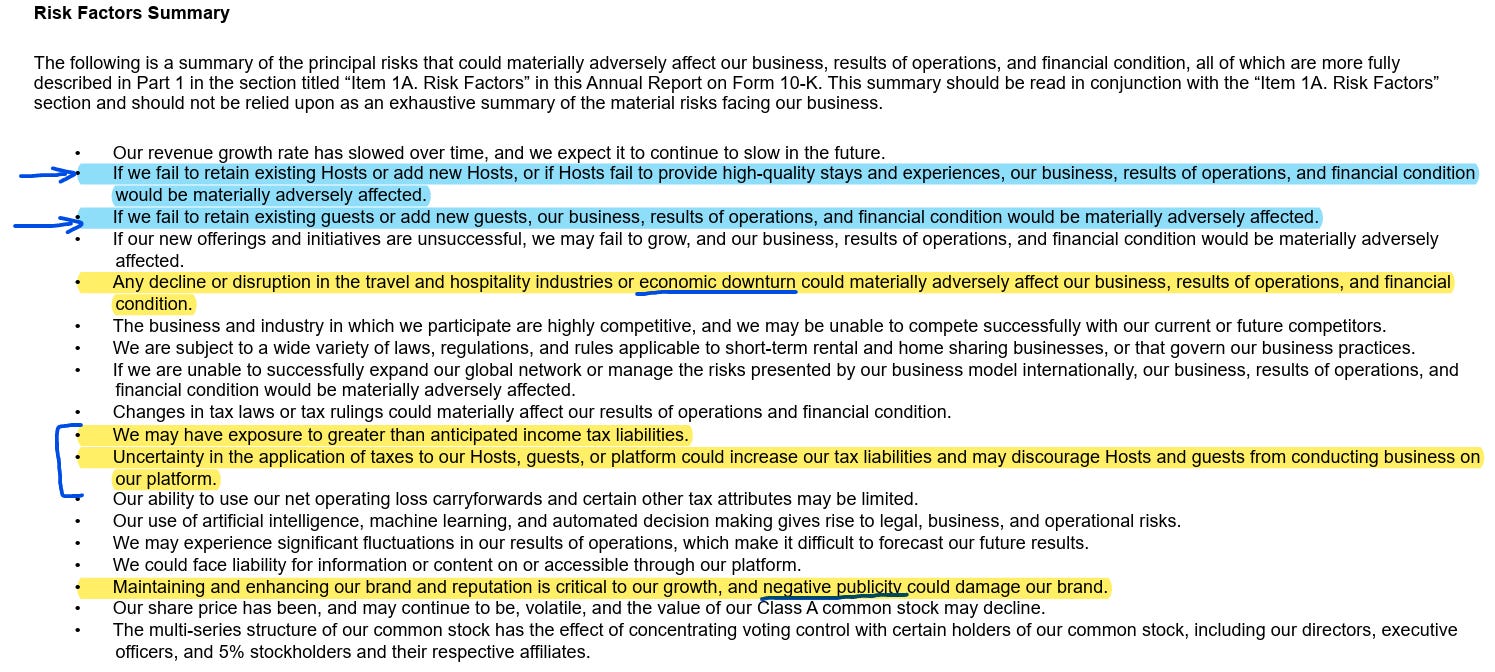

For those considering a long-term buy-and-hold strategy for Airbnb, it's prudent to delve into the risk factors outlined in the latest 10K filing, the ones I find most relevant are highlighted.

We started to track some of these risks on a quarterly basis. Here's an update on those:

1. Continue to capture more of that TAM– the potential is enormous.

- The revenue growth decline has to plateau and should not nosedive. With a recession looming on the horizon, I would not be surprised if the revenue drops going forward.

2. Gross margins will need to remain stable. However, this may not be as straightforward considering the growing competition from Expedia and Booking Holdings.

- Holding stable for now.

3. Open new revenue streams (= innovation, optionality. Provide new travel related services e.g. customer experiences).

- The focus of management has been on perfecting the core business for last 3 years; however, in this earnings call, they sounded more definitive on their ambitions to expand. As always, no details were provided, so take it with a pinch of salt.

4. ABNB's business growth currently relies on the number of properties it lists and the number of customers booking stays through its platform. In the future, we will closely monitor the expansion of property supply, particularly in international markets and host initiatives.

- Listings grew 18% year over year. The company continues to experience greater momentum in the underpenetrated markets. Expansion into international markets can provide a healthy tailwind.

5. Brave the Big ol’ regulatory headwinds (aren’t they everywhere?).

- Since the NYC regulatory development, I have not seen any other city following same suit. I am not too worried about this one for now since no single city represents >2% of revenue (before adjustments for incentives and refunds) as of Dec 31, 2023. This is good.

- However, there is a EU STR regulation which will come into force in April 2024 and EU member states will have 18 months to create necessary infrastructure to enable data collection and sharing related to short-term rental services (STRs). This is “to help shed light on their impact and enable member states to develop and enforce proportionate policy measures”. Now this is something which will take time to play-out, however, something very important to keep an eye on.

Happy to hear any questions, comments, feedback.

Enjoyed this article? Hit the ❤️ button — it'll make us smile! 😊

Cestrian Capital Research, Inc - 18 February 2024.