Everything Is Token

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Ether Joins The Party

by Alex King, CEO, Cestrian Capital Research, Inc

I first started to understand Ether properly when I read Life After Google, by the esteemed George Gilder, in 2019 or 2020. Gilder, a kind of Boomer-In-Chief for technology people like myself, is nobody’s fool and is not often hoodwinked by the thrill of the new. So his celebration of Ether caught my eye; specifically his clear articulation of the “smart contract” functionality offered by the Ethereum blockchain.

I dabbled with $ETHE a little in its early years but then came the 2021 market peak, it all got too difficult, I couldn’t see what real-world applications were springing up outside of Bored Ape Yacht Club et al (which seemed like a good wheeze but probably not one that was going to change the world), and in 2022 I swapped my $ETHE position for a worthwhile chunk of $TQQQ and didn’t look back.

Until now.

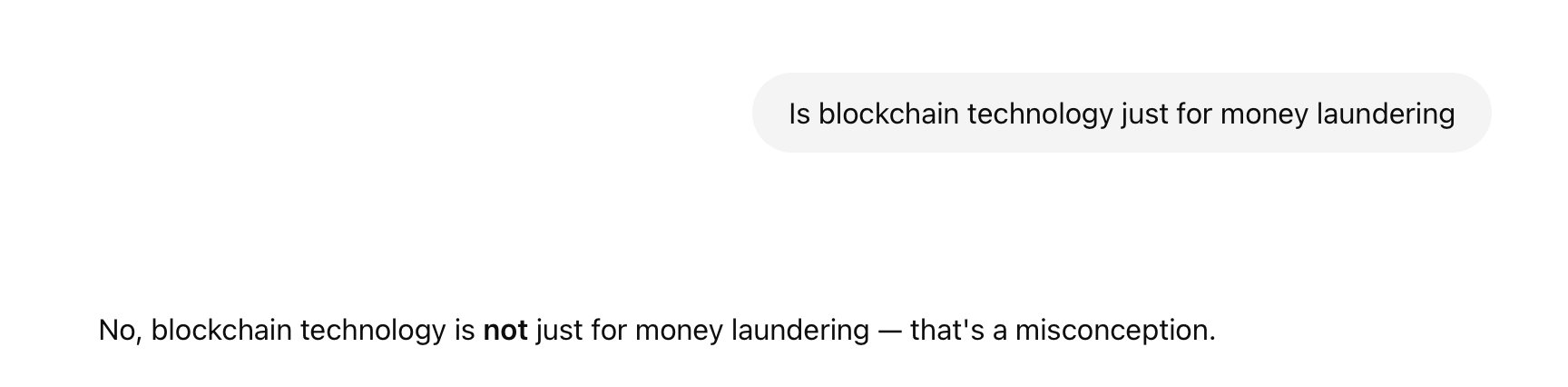

I think the blockchain revolution is moving into its next stage - and if you are an early-adopting blockchain evangelist, don’t choke on your Cap’n Crunch. I know there are tens of thousands of niche use-cases for blockchains over and above just playing host to cryptocurrencies, but the actual encroachment of blockchain into the established fortress of Corporate America has been slow. There are some arguments of real force about why this is, to do with decentralized control (mind-bending for corporations more used to dealing with established financial authorities), cost of operation vs. a big ole Oracle machine in the basement or the cloud somewhere, and so on. But there is also the simple shock of the new. If you are a 40- or 50-something sysadmin, CIO, CTO or indeed any kind of techie in any kind of big shop, you just don’t want the hassle of learning the new new thing which you secretly believe to be just for money-launderers anyway.

“No, there are additional use cases over and above just money laundering”! More reasons why I love ChatGPT.

So what just changed?

TokEncroachment

If you live and breathe technology, as I do, a professional technology investor my entire career, you know that there are two things that each new generation of technology (be that hardware or software) likes to do, and they are:

- Deflate and ruin industries not using technology, and

- Deflate and ruin vendors supplying other industries that already use technology

If you sell database software, your ideal customer is one that currently writes everything down with a, what was it called again, oh yes, a “pen”.

Your second most favorite customer is one that has a flagship Oracle or MongoDB or Microsoft or IBM database system across multiple sites and multiple countries handling mission-critical data. If you get to replace that spaghetti Leviathan? Woot! The dollars and the kudos will surely flow.

What is about to happen in financial services is that tokenization is about to disrupt:

- Industries that have not embraced financial technology in a meaningful way, such as art, classic cars, real estate etc.

- Industries that have been the golden goose for financial technology for 60-70 years or more, such as securities markets.

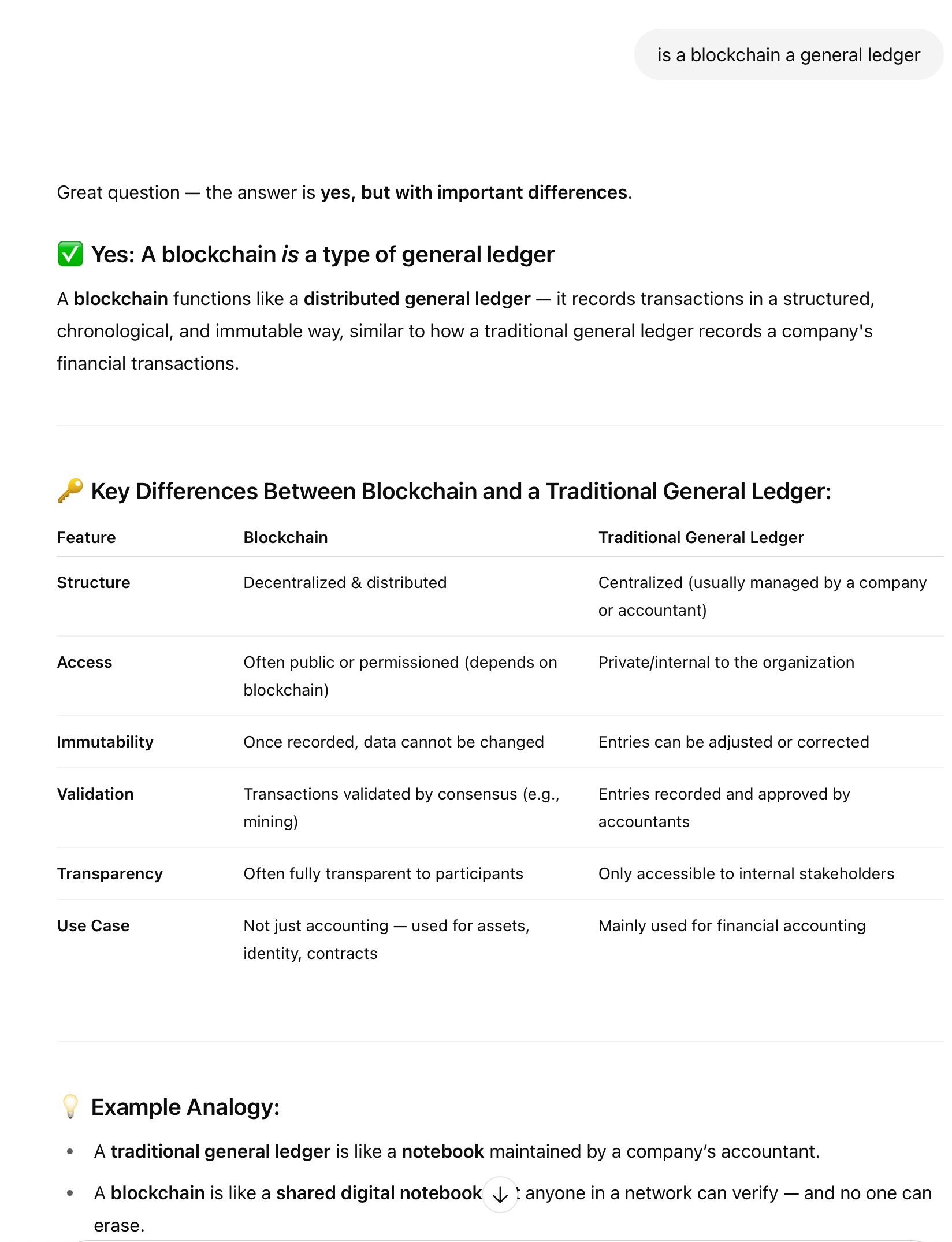

We will get into tokenization in plenty more detail in the future but suffice to say that using blockchain technology to evidence proof of ownership of fractional or entire assets? That’s a general ledger for the globe.

The LLM explains this well.

If you are State Street, Fidelity, BlackRock, the DTCC, or any other esteemed member of the Wall Street Country Club, this is what’s known as a Yikes Cat moment. When the foundation upon which your world is built is starting to crumble. If you don’t need a custodian to confirm you own a security, you don’t need to pay custodian fees, so …. how are the custodian’s C-suite members’ kids going to eat this weekend?

The rapid encroachment of technology into old-line industries in the last 30 years, since the Netscape Moment, has taught the remaining incumbents that you do not fight the trend, you embrace it. You use its momentum to propel you forward, not knock you over. The Netscape Moment in crypto was in 2022, when BlackRock selected Coinbase to provide custody services for its pending Bitcoin ETF.

At this time, $COIN was embroiled in a snark-off with the SEC; in one fell swoop, BlackRock anointed $COIN as legitimate. The stock is up more than 4x since then.

BlackRock continues to lead the way amongst the establishment. Here’s its CEO, Larry Fink, on tokenization:

TL:DR - he’s in favor. Why? Because tokenization can massively extend the size and scale of the securities market. We can argue, and people are arguing, whether tokens are securities or something else, but what tokens most certainly are is tradable and ownable and lendable which are short words all of which spell d-o-l-l-a-r-s to Mr. Fink. And he is right. Can you trade stocks in Jay Leno’s car collection? Not today. But you might be able to trade tokens in it tomorrow. Want to own a piece of the Mona Lisa, or at least own a smart contract that gives you the right to visit the Louvre once per year for free and get one selfie with the Head Curator? Today, art folks will laugh at you. But when they realize the inflow of funds that could arise from the creation and sale of such tokens, you can expect to start hearing about democratization of access to high art aka. yay free money for me!.

In esoteric financial circles in the 1980s, 1990s and 2000s a small group of people got fairly wealthy doing something called securitization, wherein you took a bunch of things that were not securities, like mortgages, putting them into a box, labelling and regulating them, and then selling the package as a security which came with (1) the asset itself ie. a lien on folks’ houses and (2) a stream of cashflows in service of the asset ie. a share of mortgage payments. Yes, it hit some problems for a couple years in the middle there but the securitization of mortgages was a superb financial invention that remains great news for (1) people who want to get a mortgage and (2) people who want to issue mortgages. Markets, liquidity, create wealth for those who know how to use them.

Want to know a major beneficiary of Tokens Eating The World?

The Ethereum blockchain. Remember smart contracts? Now they can give you something other than a free drink at the Bored Ape Bar. Now they can give you a claim on cashflows from a rental estate, or a Night At The Museum in Paris, or endless other things.

This is the Netscape Moment for Ether.

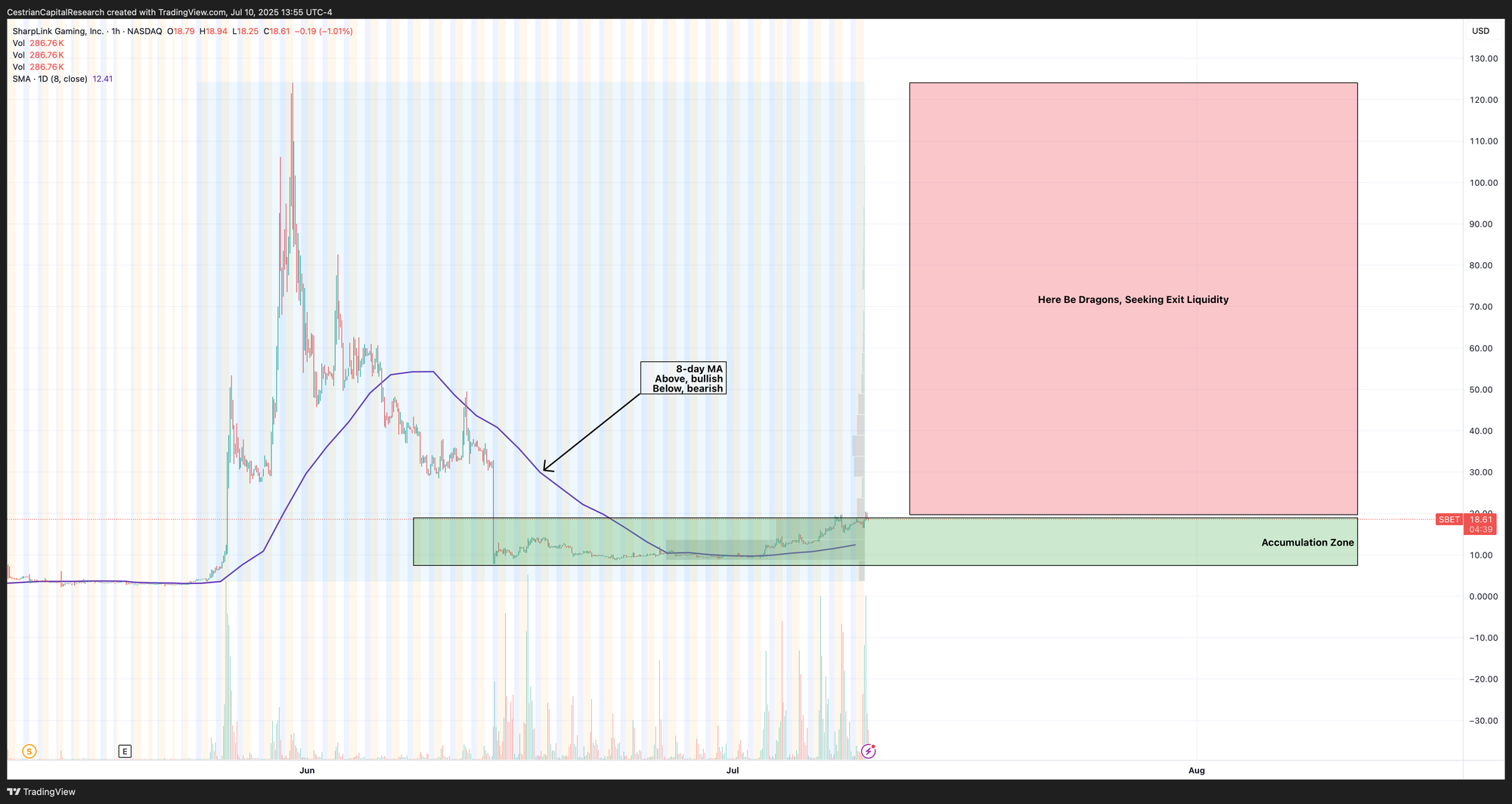

SBET

We’ll be talking a lot about Ether vehicles and the Ethereum blockchain, but let’s just finish off with a note about $SBET, the stock issued by Sharplink Gaming. Sharplink has about as glorious a history pre-Ether as did Microstrategy pre-Bitcoin. That’s no longer relevant. It is one of the first companies to adopt an Ether Treasury model in the manner of the Bitcoin Treasury Model operated by Mr. Saylor and others.

It’s not a difficult concept. If there is demand for Ether, to help operate the Ethereum blockchain, which is used for widespread tokenization of assets, then all things being equal, the price of Ether is likely to rise.

If you reduce the available supply of Ether because you lock it up in the basement of SBET and others, then you likely accelerate the rate of ascent of price.

If you aggressively reduce the supply by issuing SBET stock and debt to fund the purchase of Ether which you then lock up in SBET’s basement, then (1) the price of Ether should rise more quickly and (2) the stock price of SBET, which will become a levered bet on Ether, may also rise. The provisos are (i) Ether has to have value outside of just SBET telling you it has value - just like dollars or land or wheat, a large number of people have to agree it has value; (ii) the crowd has to believe in the integrity of the Colossus aka the eventually creakingly-levered infinite-mirror that the SBET balance sheet will likely become; and (iii) money - actual money, Boomer-money, Powell Dollars - has to be cheap and plentiful.

So will SBET be a good bet? Well, I don’t know, but I think it might be and I own it accordingly. Because I think (i) tokenization is a given (ii) the Ethereum blockchain is going to be a very material part of that (iii) Ether is required to operate the Ethereum blockchain (iv) Tom Lee has hopped on the Ether train and has designs on being Saylor 2.0 and has the credibility and the platform to articulate it too (v) money is in my view going to get cheaper and more plentiful as the Fed eases, which I think it will.

So. You can read all the hoopla about $SBET, here. (You should read the Investor Presentation. Just don’t drink the Kool-Aid. Eyes on the prize.)

Here's my own navigation method. You can open a full page version of this chart, here.

I think SBET can be accumulated between $8-20/share, ish; below $8 look out below and above $20 one has to be careful not be used as exit liquidity for bigs. A slow grind up is good; mad spikes are probably to be sold and the stock re-entered lower. In the absence of trading history longer than a couple months that actually matters, the 8-day moving average isn’t a bad line in the sand. Above, good, below, bad.

Thanks for reading this, our first post about Everything Is Token!

Cestrian Capital Research, Inc - 10 July 2025

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $SBET, $ETHE, $IBIT.