Fastly Q1 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Problem With Small Caps

by Alex King

Summary:

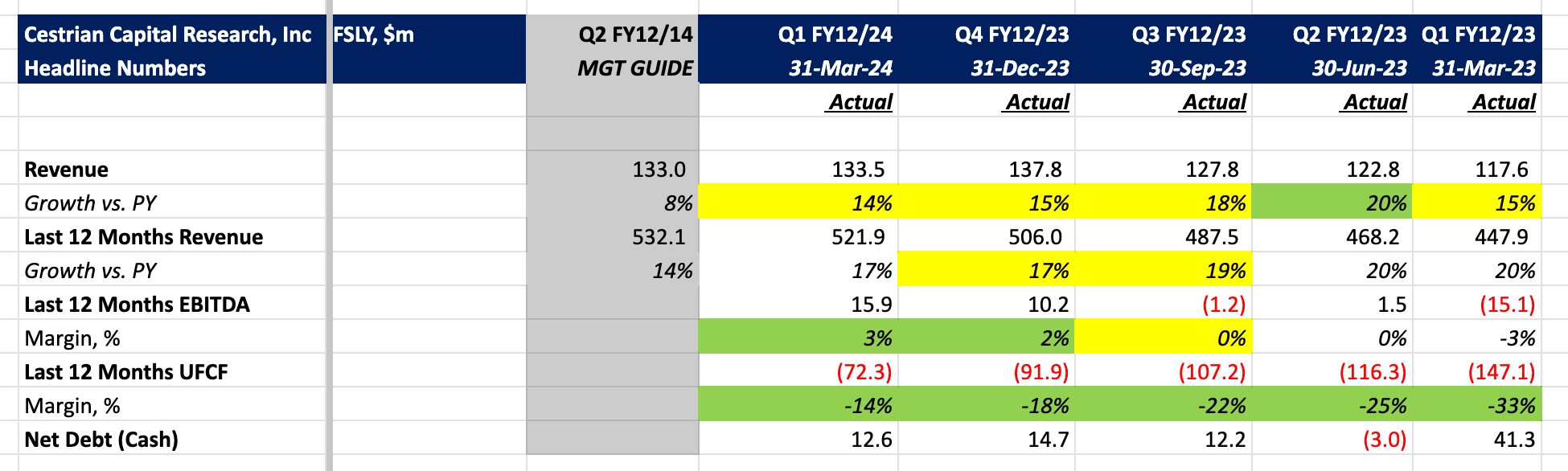

- Fastly reported good progress in accounting earnings and cashflows.

- The quality of business is improving markedly under the new management team; from margins to reporting to capital efficiency.

- BUT the revenue guide is weak, and the stock got crushed by around 30% on the print as a result.

- Companies this size have volatile stocks - the only way to play them safely is either (1) not at all or (2) by controlling position size.

Please, Amazon or Cisco, Put Me Out Of My Misery

This morning we reported on a pandemic survivor, Pinterest (here), whose stock has more than doubled since the 2022 lows. Fastly, on the other hand, just decided to head back to within about 20% of its bear market lows. The new management team at the company is doing sterling work on all fronts save for revenue growth, which is anemic and getting worse. Unfortunately the one thing that small cap tech investors look for is, you guessed it, revenue growth, and preferably accelerating revenue growth. So the price is likely in the doldrums for a while, I think. A smart management team can certainly dial up growth, but it doesn't usually happen in the space of one quarter - usually it's 9-12 months to really get the flywheel speed up.

The best hope for Fastly shareholders (I am one, sadly!) to my mind is that the company is finally sold to one of its multiple potential suitors. Cisco and Amazon are both thought to have run the numbers previously. At around 2x TTM revenue and the company generating operating cashflow - which it did this quarter - this is a cheap product to pick up for any tech major. The cash generation means that the acquisition ought to be EPS accretive very quickly, which matters to bigs.

Anyway, let's get to the numbers.

Headline Numbers