Inner Circle Portfolio Performance, w/e 9 Feb 2024

Another strong week.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Introduction

This Portfolio Performance note is published outside the Inner Circle paywall today and can be read by our paying subscribers and free readers alike. For our paying subscribers, I hope this provides a useful update of the model portfolios we have been running in the Inner Circle service since it began a little over a year ago.

For our free readers, I hope this note gives you a glimpse of the work that our paying subscribers can access 24/7/365. If you’d like to join as a paying member, you can do so right here if you’re looking for an annual or monthly subscription.

If you’re not sure - then sign up for the monthly. It’s $299/mo. If you like the service and want to save money by moving up to an annual or Extended membership, we’ll refund your first month’s payment when you do so.

And if you really don’t like the service? Quit in the first month. You’ll be down just $299, which isn’t nothing, but we truly believe you’ll have learned something from the superb group of investors we have at work in the Inner Circle.

Finally - if you’d like our best value subscription, which is a 6-year term ‘Extended’ option offering a 60% discount vs. the monthly rate, you can sign up for that right here:

Model Portfolio Performance

Here’s how our single-stock baskets are doing as of Friday’s close.

Each of these four model portfolios has five stocks. The portfolio logic has been simple; on the day the portfolio was created, the model assumed all five stocks were purchased in equal proportion on day one, leaving no cash in the portfolio. There has been no rebalancing, no additions of new cash. Any dividends that the stocks have generated have been re-invested, by which we mean the cash produced was used to buy additional shares of the company which paid the dividend. In other words - these models are as simple as could be. They also include no fees, and that’s because we provide them as models for our members to consider investing themselves; we don’t manage client assets so we charge no such fees. Our business is purely investment research - the actual investing is your business.

Each portfolio is benchmarked against the four major US equity indices, being the S&P500, the Nasdaq-100, the Dow Jones 30 and the Russell 2000. We use the total return benchmark which assumes the same dividend re-investment logic that we describe above.

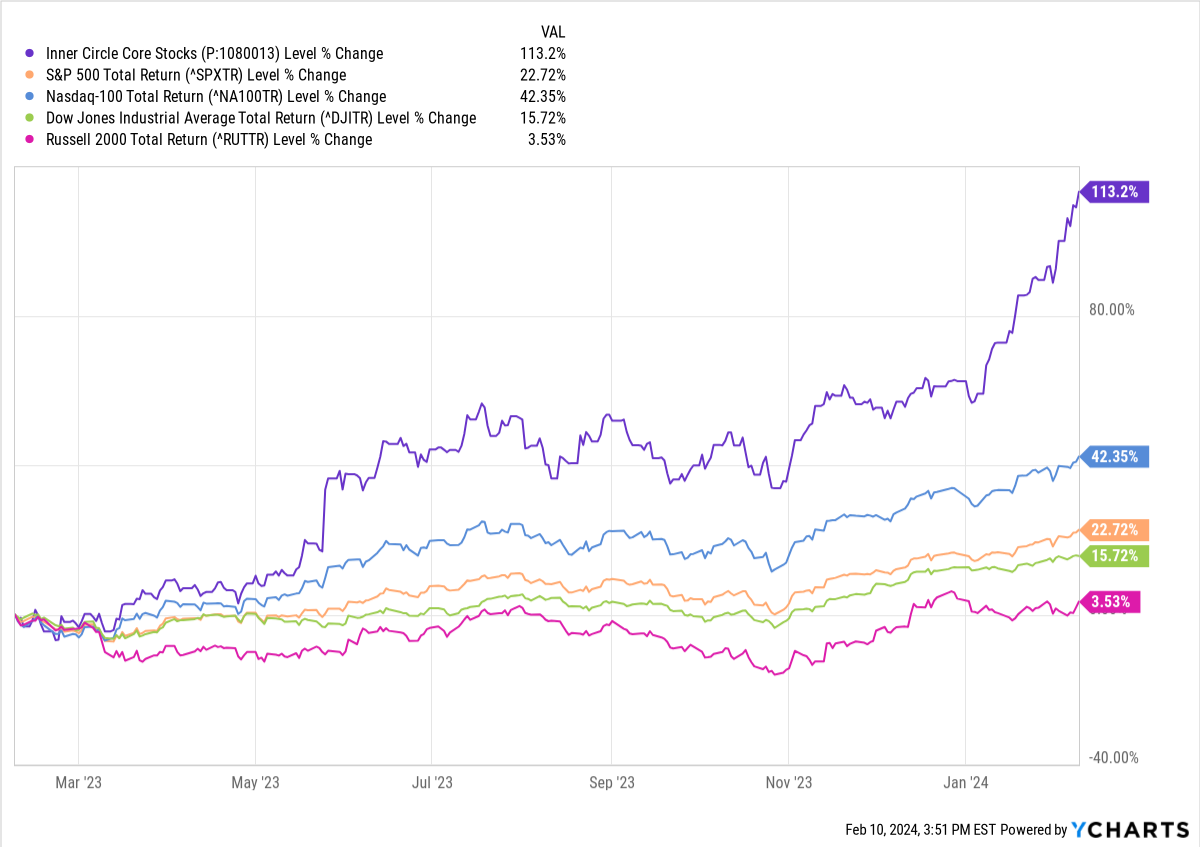

Inner Circle Core Stocks - From Inception (7 February 2023).

Our thesis in February 2023 was that the market had put in a major low in October 2023 and that if we put together a core basket of high quality names spread across growth and value, it could perform well if the market recovered.

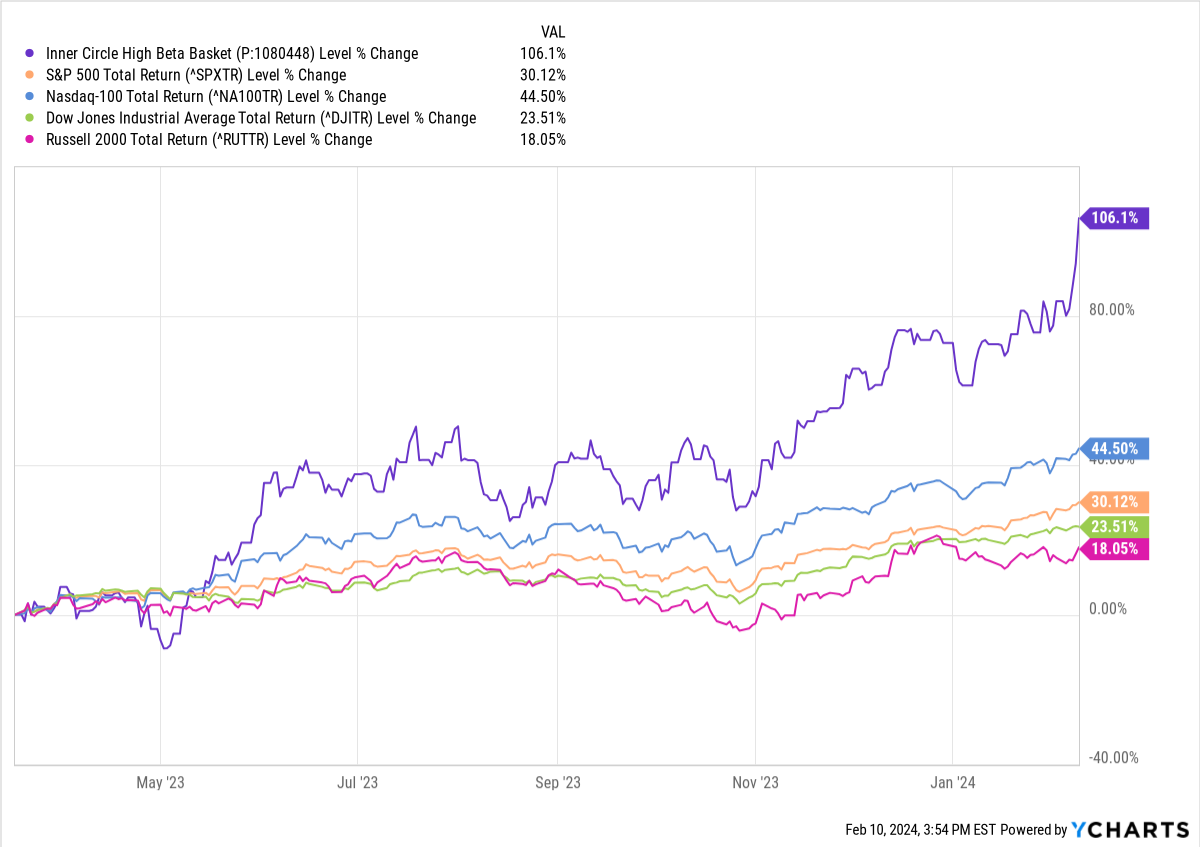

Inner Circle High Beta Stocks - From Inception (17 March 2023)

By March 2023 the initial moves to the upside in major market stocks had been made. The high-beta stocks we cover were lagging and we thought the time was ripe to accumulate such names before they were swept up by the bull tide.

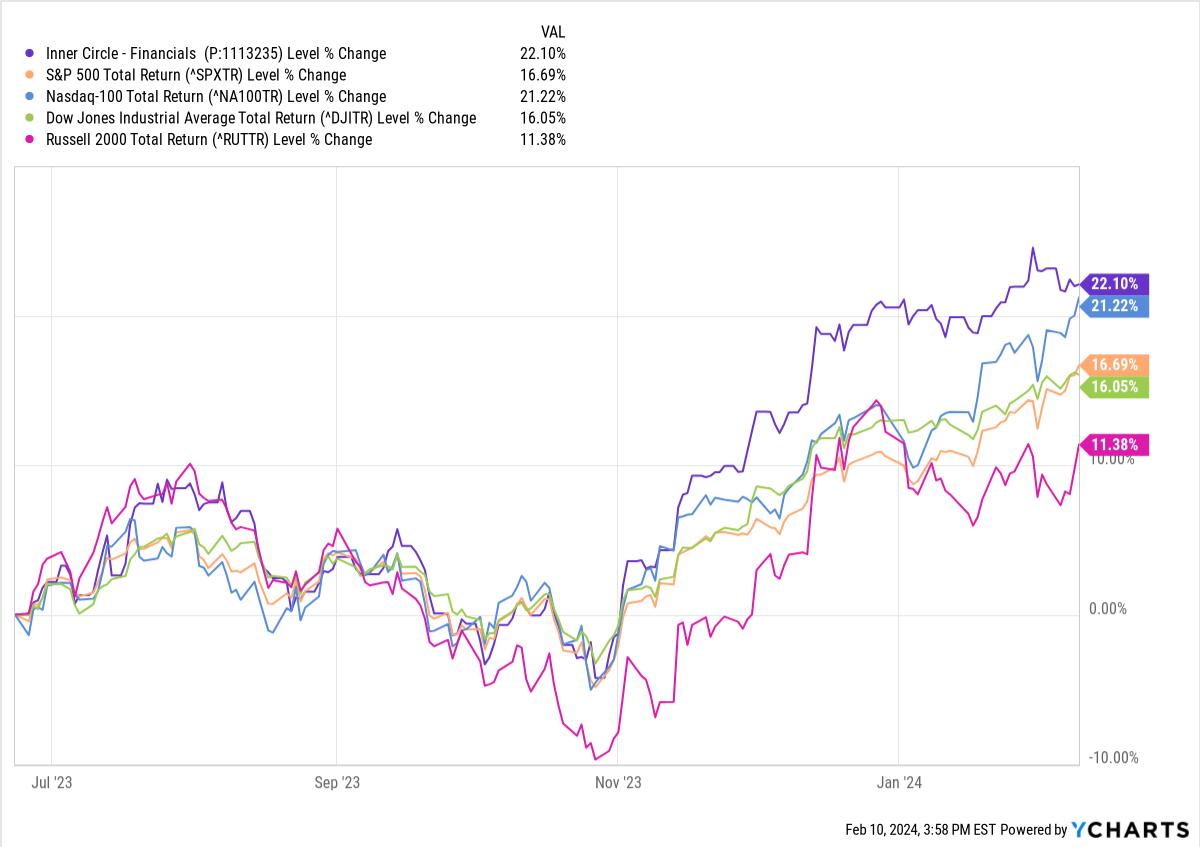

Inner Circle Financial Stocks - From Inception (23 June 2023)

This portfolio was set up in the wake of the regional bank failures that commenced in March 2023. We thought that the financial sector had sold off excessively and that there was an opportunity to buy high quality financial names at an attractive entry point. This was intended to be a way to balance out sector exposure; as it happens it has, to date, also outperformed each of the indices. If the Nasdaq continues its current trajectory it will likely eclipse this basket before too long!

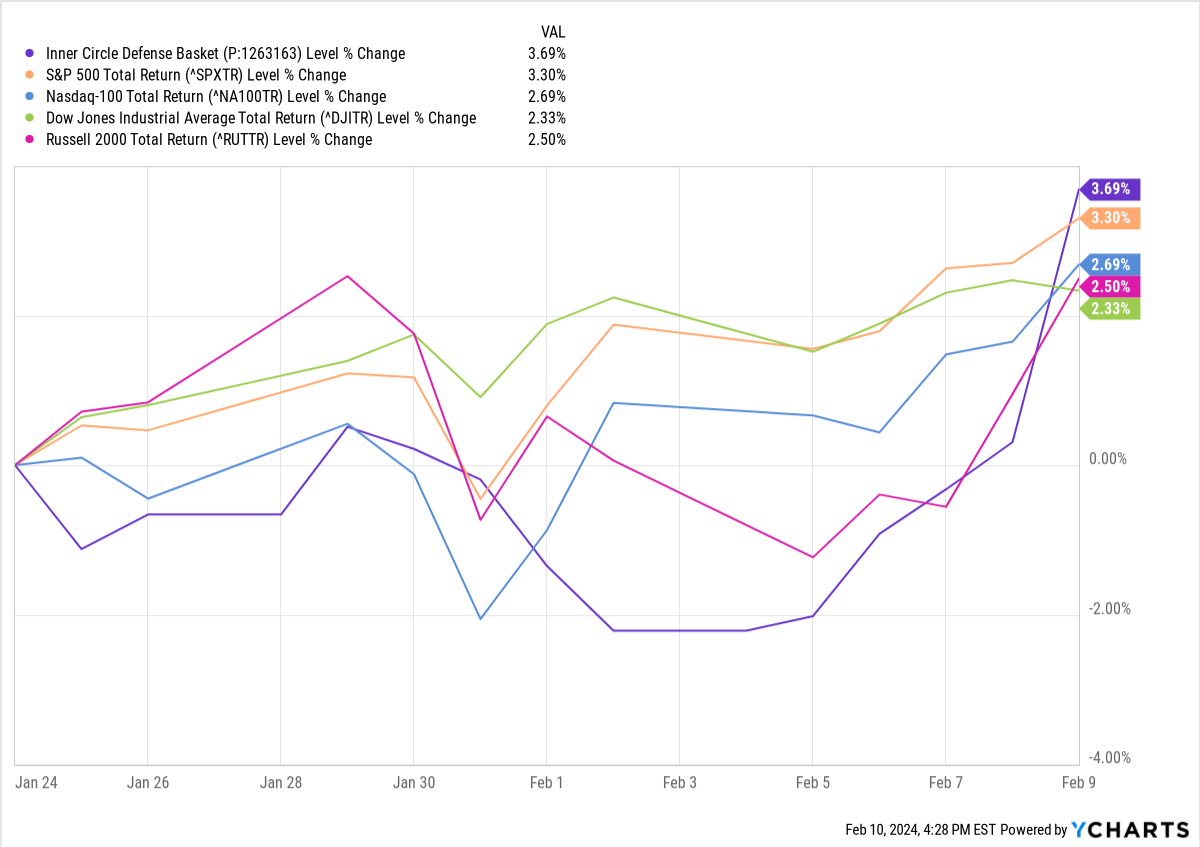

Inner Circle Defense Stocks - From Inception (24 January 2024)

The impetus for this portfolio setup was that many of the defense sector stocks we cover were sat in what appeared to be an institutional accumulation pattern, much as were tech names in H2 2022/Q1 2023, and energy names in H2 2021, in each case prior to their launching into a move up. Sectoral stocks putting in sideways price action at the lows does not mean they will certainly rise thereafter, but it is a common pattern to witness, a hallmark of institutional sector rotation. Kudos to Abhi Singh for spotting this pattern in the defense names.

Now, defense isn’t a sector that typically sets accounts alight; if this is profitable over the medium term we’ll be happy. Think of it as a risk-management method rather than a swing for the fences idea. It’s off to a good start but if this beats the Nasdaq long term than we probably have other worries! Most likely we will close this portfolio out if and when we see institutional distribution in this sector.

Cestrian Capital Research, Inc - 10 Feb 2024.