Intel Q1 FY12/24 Earnings Analysis

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No New News

by Alex King

Summary:

- Intel financials continue to improve, not that you would notice from the stock price.

- The company remains a major beneficiary of Federal chip-sector subsidies.

- Our rating changes to Accumulate - we lay out our Accumulate and Stop price ranges below.

Sometimes Fundamentals Do Matter

To me, Intel is a simple stock to own. This storied anchor tenant of what was once known as The Silicon Valley hit problems a decade or so back as it began to stumble in its manufacturing prowess. The company failed to navigate the shift to 10nm feature size, then repeated the error at the 7nm node. Coupled with its lack of presence in GPU this has hurt the fundamentals and it has hurt the stock. The lows came in late 2022 and ran up very nicely from that point.

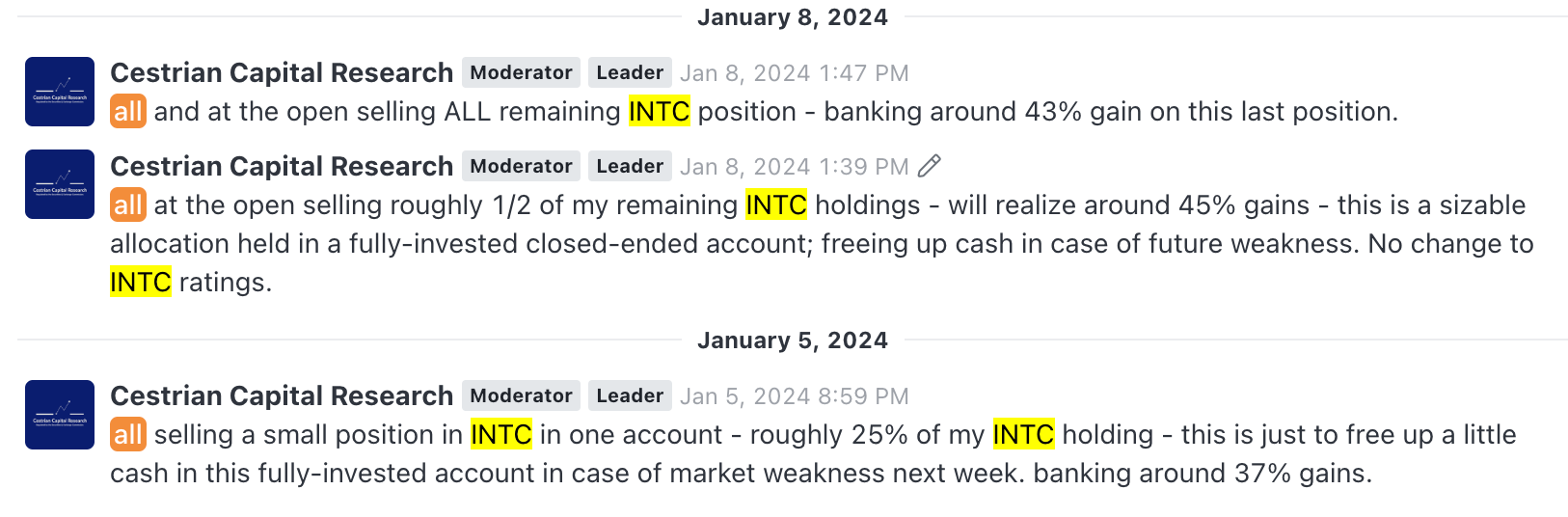

We've had a great run with Intel, that said. We called it as an 'Accumulate' opportunity at the 2022-23 lows and personally I made solid gains selling the name in January this year.

As the stock hit local highs and began to dump once more, I started to accumulate a new position - I added to this today.

The fundamentals are improving and look like they may soon turn an important corner; and the chart looks to be putting in a technical low around here. To my mind the upside opportunity is material from here, and the downside can be protected with a stop not too far away from here. I'll cover what I think are sensible stop-loss levels and price-target ideas below.

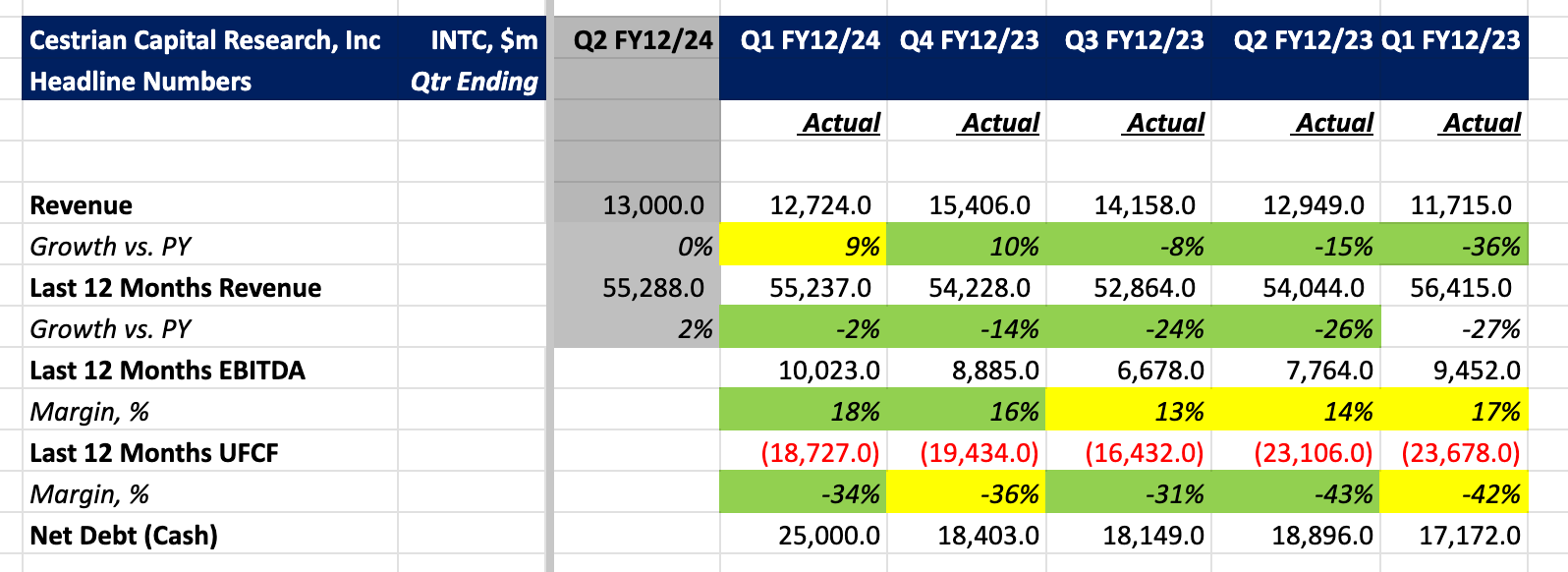

Headline Numbers