Let's Not Talk About The Bad Old Days! (OKTA Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Okta Q1 FY1/25 Earnings Review

Time was we had almost nothing good to say about Okta ($OKTA). Since which time, someone somewhere, be it the board or certain shareholders, has explained the facts of life to the management team. Whereupon everything has started to get better.

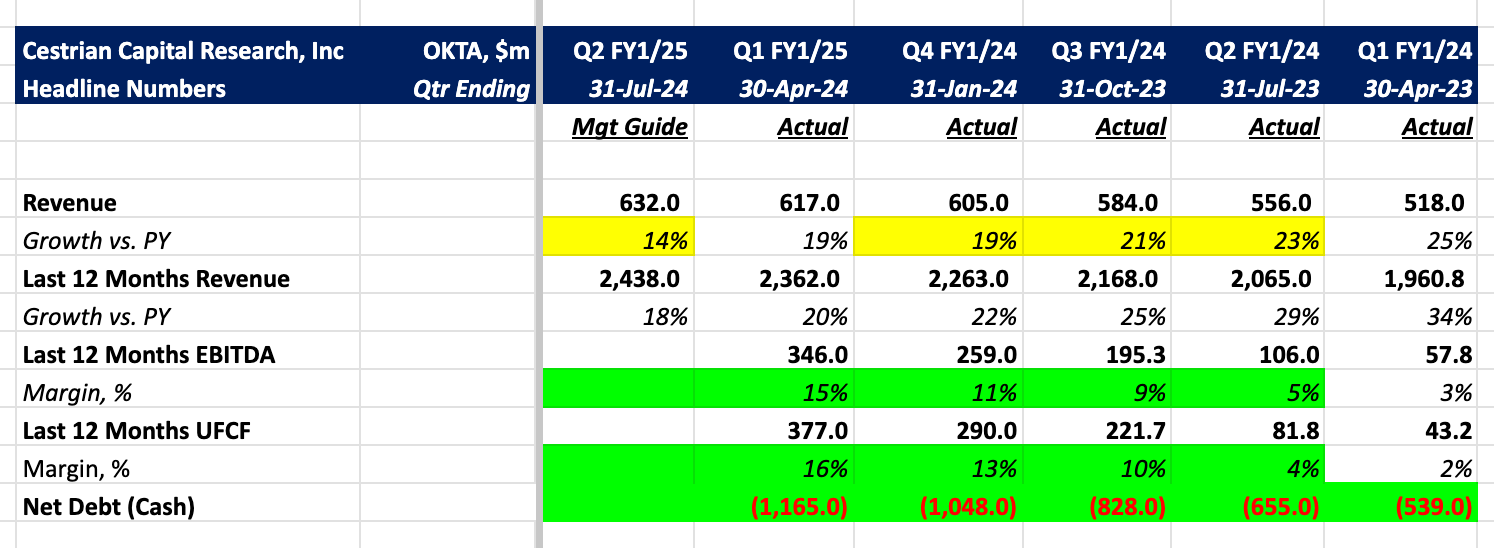

The company just printed another solid quarter. Revenue growth didn't accelerate but it didn't decline either, and that's the first time this has happened in some years. Margins ticked up and cashflow presently exceeds EBITDA, which is a positive indicator of the quality of accounting (it means there is less likely to be over-aggressive revenue recognition). The balance sheet remains sound; and the order book is growing well.

Here's the headlines.

Below we lay out the fundamental financials, valuation metrics, our stock rating and price targets. Read on!