Lockheed Martin Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Charts vs. Reality - Again

by Alex King

I should start by saying I sold a small position in LMT lately for the simple reason that it had generated some gains fairly quickly and this market being what it is, I am a little twitchy with single-name stocks, since they are difficult to hedge, meaning you do actually have to call them correctly if you want to make money! (Whereas the beauty of long index ETFs is that so far if wrong you can just hedge, make money on the short side and then wait for the long to come back into value. Yes I know. Yes you’re right. But I still like this method).

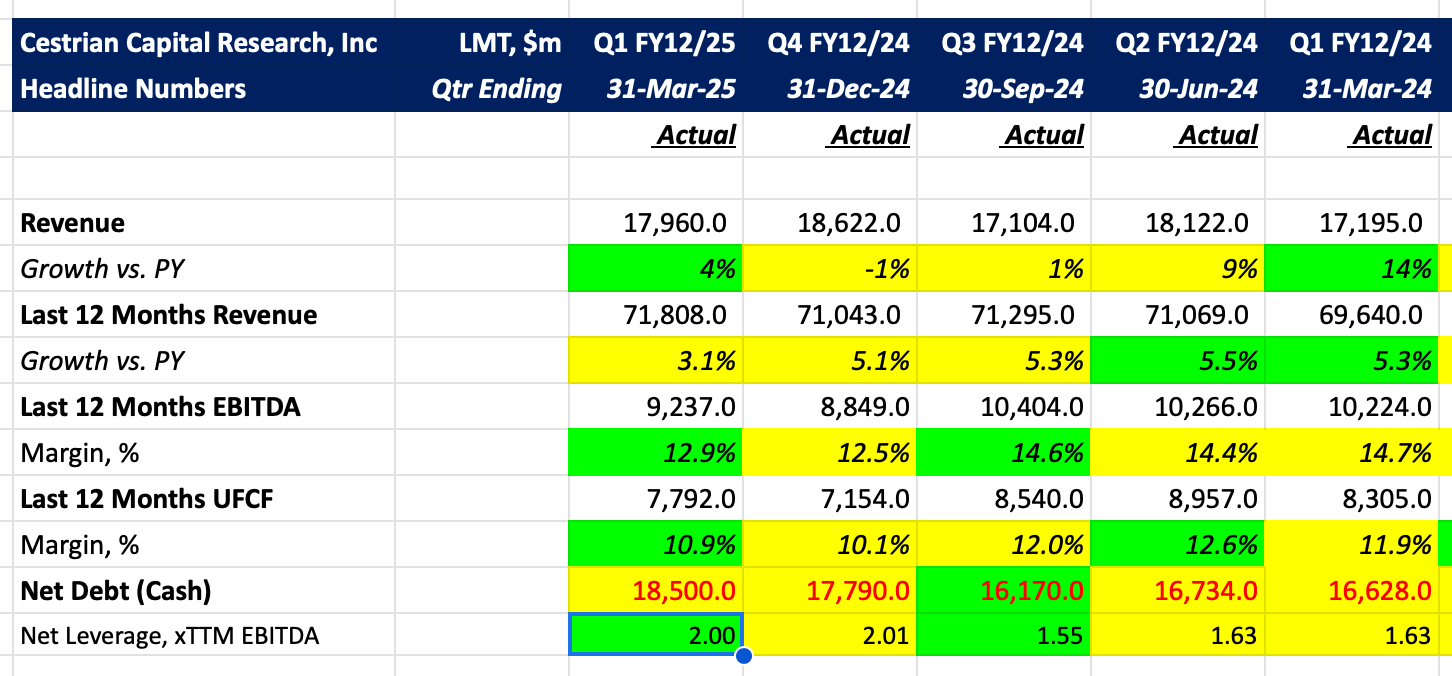

How to think about this name? Well, the quarter was OK. Backlog fell a little but it’s still up 9% on a year ago. Revenue growth accelerated a touch to +4% this qtr vs. same qtr last year but on a TTM basis growth slowed to just 3.1%. Cashflow margins moved up slightly to 11% on a TTM UFCF basis; net leverage fell a touch to 2.00x TTM EBITDA.

The stock chart tells a similarly bullish story.