Market Before The Open - Friday 10 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Rolling Over

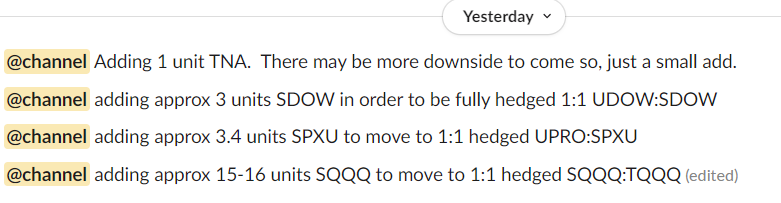

The S&P500, Nasdaq-100 and Dow Jones rolled over late in New York trading hours yesterday. In staff personal accounts we moved to 1:1 hedged in each of those indices, as you will have seen in Slack alerts if you're a paying member here.

Here's what we posted yesterday as markets topped out.

Not yet a paying member? Use the button below.

The Russell continues to dance to the tune in its own head, rather than the music that everyone else is listening to; it commenced its retracement of the November up-move already. On the single stock front, the financial sector and Dow picks we named in this service back in June and July look to have found their footing - even Disney, up 6.5% on the day! - and be putting in some gains. TTD, a High Beta portfolio name here, got hit with a -30% move after hours; we'll report on that over the weekend. This has been an excellent long term investment name and it's likely the reaction is excessive.

Let's turn to our usual charts. But before that, a message from our sponsor.

Price Rises Coming 1 December

If you're a free subscriber here, be aware that our prices rise on 1 December for our annual and monthly subscriptions. Monthly goes up from $249/mo to $299/mo; and Annual from $1999/yr to $2499/yr. Once you sign up, you don't get hit with a price rise. Only new joiners pay more. That way, the sooner you join, the less you pay.

You can sign up for a subscription at the button below. Any difficulties doing so, or if you have any questions whatsoever, you can reach us using this contact form - we'll get it done for you.

Paying members, scroll right down for our latest take on markets. As always we look at the 10-year yield, the S&P500, Nasdaq-100, Dow Jones and the Russell 2000; we consider long-term and short-term outlooks, and we lay out staff personal account trading plans in each of the indices. We add Bitcoin and Ether futures pricing for good measure.

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.